- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Among all the stocks owned by Buffett, which ones does Buffett favor the most? Can they be bought an

Professional investors are not quite like professional athletes, among whom the top players are often household names, though there are occasional exceptions. Perhaps the biggest exception is Warren Buffett, who could be called “the most famous investor in the investment world today” or even “the Sage of Stocks”.

Many people far from Wall Street know Buffett’s name, and this is no coincidence. After all, his success attracts many investors who constantly follow and even try to emulate his investment strategy to replicate his returns and achieve financial freedom.

Although this may not be the best choice for all investors, seeking guidance from the Omaha Oracle (Buffett) is certainly not wrong.

We all know that Buffett adheres to the principles of value investing, the core of which is to uncover undervalued companies and obtain long-term stable investment returns through a buy-and-hold investment strategy.

The foremost investment principle is to never lose money, by establishing a diversified investment portfolio consisting of enterprises, stocks, bonds, and cash to hedge against any potential market fluctuations. Although these two blue-chip stocks have grown slowly recently, they are very stable long-term investments. If you are looking for stocks to buy and hold worthy of holding forever, then the following two Buffett stocks are safe to hold forever.

Coca-Cola (KO)

Coca-Cola is one of the longest-held stocks in the Berkshire Hathaway portfolio and its fourth-largest holding, accounting for over 6% of its stock portfolio.

Investors should not expect Coca-Cola to yield the income or profit growth of growth stocks, but the company has maintained steady growth over the years. Coca-Cola’s revenue in 2023 was $45.8 billion, a 6% increase year-on-year. Its revenue growth outpaced its global sales volume (a 2% increase year-on-year), indicating the company’s pricing power.

Coca-Cola’s brand is unparalleled in the beverage industry, and the company has done well in leveraging its brand during stagnation periods. It operates only in the beverage industry, ensuring that Coca-Cola does not spread itself too thin and can focus on operating as efficiently as possible. This is why Coca-Cola’s net income often exceeds that of PepsiCo, even though its revenue is far less than that of the snack and beverage company.

The main reason for always holding Coca-Cola stock, in the editor’s opinion, is its dividend. The company is a dividend king, having increased its annual dividend for 62 consecutive years with no signs of stopping. Only a few companies have a longer history of dividend increases.

Coca-Cola’s quarterly dividend is $0.485, with a yield of about 3.2% over the past 12 months. This is more than double the average level of the S&P 500 index, which is enough to enhance the total return of investors if the stock price is in a stagnation period.

Apple (AAPL)

To date, Apple Inc. is the largest stock held by Berkshire Hathaway, accounting for nearly 43% of its stock portfolio. Over the years, the heavy concentration of Apple stock has worked wonders for Berkshire Hathaway, but this year has not been the best for the iPhone maker. So far this year, Apple’s stock price has fallen by nearly 5%.

The main reason for the decline in Apple’s stock price is investors’ concerns about the company’s recent lack of growth. In the first quarter of the 2024 fiscal year (ending December 30, 2023), Apple’s revenue was $119.6 billion, but only increased by 2% year-on-year. This is also a concerning trend.

Despite this trend, I believe some concerns about Apple, although reasonable, are somewhat exaggerated. iPhones account for a large portion of Apple’s revenue (over 58%), and the slowdown in smartphone sales in recent years has caused losses. In October 2023, global smartphone sales increased by 5% year-on-year, the first positive growth in the previous 27 months. Investors should not overlook this.

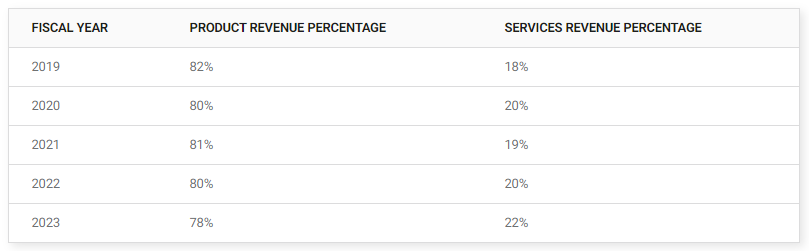

Setting aside slow revenue growth, the growth of the company’s services sector is an optimistic sign. Here is a comparison of Apple’s product and service revenues over the past five fiscal years:

Services are a higher-margin business than products and can provide more reliable revenue for Apple through subscriptions. Apple is smart enough to focus on building its own service ecosystem to complement its hardware.

Apple certainly has some issues to address, but it has consistently demonstrated that it is one of the greatest companies in the world for a reason. Buffett once said a famous quote: “Be fearful when others are greedy, and greedy when others are fearful.” Now seems to be the time when investors are afraid of Apple. For long-term investors, now seems to be a good time to buy Apple stock.

How to hold these two stocks?

First is the US stock account.

The simplest way is to choose a broker online to open an account, which can be done successfully within minutes, and then you can transfer funds and buy stocks.

However, for many US stock investors, there are a series of problems such as difficulties in transferring funds in and out and troublesome broker account opening. Here, I recommend a professional tool that can trade both US and Hong Kong stocks and facilitate the entry and exit of funds for US and Hong Kong stocks—BiyaPay, which is also the tool I have always used.

Let me briefly introduce the advantages of using BiyaPay: online registration, no need for an overseas bank account, and support for real-time online trading of US and Hong Kong stocks. If you have a brokerage account and an overseas bank account, you can use BiyaPay as a tool for entering and exiting funds for US and Hong Kong stocks. By recharging digital currency (such as USDT) and converting it into US dollars or Hong Kong dollars, you can withdraw funds to your personal bank account and then inject funds into your brokerage account. This method can be described as fast, with no limit on the amount, and no trouble with fund transfers, and you can also keep an eye on the market dynamics of your favorite stocks at any time.

Finally, Buffett has already set a precedent, and it is yet to be seen if there will be any successors. After all, times make heroes, let us look forward to the next upward cycle together.