- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Tesla stock price soars, Musk has 470 billion! Can this rise be stabilized?

Tesla surged 6.14% on Monday to close at $463.02, with a market value exceeding $1.40 trillion, once again setting a new historical high. The stock has risen more than 75% since the beginning of the year. This rise reflects the market’s optimistic expectations for Tesla’s future growth.

This stock price leap not only solidified Tesla’s leading position in the global electric vehicle market, but also caused Musk’s net worth to skyrocket by $19.20 billion overnight. Now his personal wealth has exceeded $470 billion.

The driving factors behind Tesla’s skyrocketing stock price

The strong rise in Tesla’s stock price is not accidental, but the combined effect of multiple factors. In addition to the company’s own growth potential, changes in the macroeconomic environment and market sentiment are also driving Tesla’s stock price higher.

The expectation of a Fed rate cut has boosted US stocks

Recently, the Monetary Policy of the Federal Reserve has become the focus of the market. With the expectation of interest rate cuts heating up, the overall performance of the US stock market is strong, especially in technology stocks. Tesla, as the world’s largest electric vehicle company by market value, is obviously affected by this trend. In the low interest rate environment, investors’ risk appetite has increased, and funds have flowed into technology stocks. Tesla has undoubtedly become the leader of this round of rise. The improvement of stock market sentiment has further increased investors’ expectations for Tesla’s future growth, which is also one of the important factors driving the surge in stock prices.

Policy support from the Trump administration

Musk’s close relationship with the Trump administration undoubtedly provides strong support for its stock price rise. The Trump administration may adopt anti-regulatory policies, especially in the field of autonomous driving technology, which will bring significant benefits to Tesla. With the Trump administration’s relaxation of regulations on autonomous cars, Tesla can accelerate the research and development and launch of its autonomous driving technology, especially in the fierce competition with Waymo.

Tesla’s fully autonomous driving system is under investigation by regulators, but the Trump administration’s deregulation measures have reduced unnecessary regulatory costs for Tesla. This policy change will help Tesla achieve faster progress in the autonomous car field, reduce operating costs, and pave the way for its future market expansion. In addition, the Republican government may cancel the tax credit policy for electric vehicles. Although this measure reduces subsidies for consumers, it may be an advantage for Tesla. Tesla is the only company that has achieved large-scale production and profitability in the electric vehicle field. Therefore, under the policy of canceling the electric vehicle tax credit, Tesla can maintain its market competitiveness, while other traditional automakers may be more affected.

The shift in Wall Street’s perspective

Tesla’s skyrocketing stock price is also inseparable from the changing views of Wall Street investors and analysts. In the past, Tesla’s investors have been worried about whether its profitability and cash flow can support its long-term technological innovation and expansion. However, with the gradual stabilization of Company Finance, especially the better-than-expected financial report for the third quarter of 2024, investor confidence has significantly increased.

Wall Street analysts have begun to re-evaluate Tesla’s future growth potential. Several Financial Institutions have upgraded Tesla’s ratings, believing that the company’s leading position in the electric vehicle market and innovation in multiple fields such as autonomous driving and energy storage will further strengthen its market competitiveness. As more and more institutions raise Tesla’s target stock price, Tesla’s stock price has also seen a strong rise driven by market confidence. Investors’ expectations for Tesla’s future growth have further strengthened, and this optimistic sentiment has driven the continuous rise of the stock price.

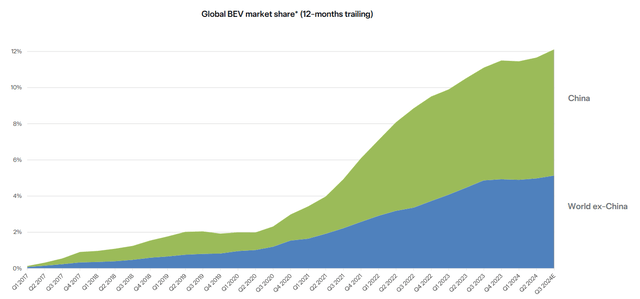

Strong growth in the Chinese market

In addition to the US market, Tesla’s performance in China has also become an important driving force for the rise in stock prices. China is the world’s largest and most promising electric vehicle market, and Tesla’s sales continue to grow in this market, especially driven by popular models such as Model 3 and Model Y, which further expands Tesla’s market share.

The Chinese government has introduced multiple policies to promote the development of the new energy vehicle industry, which provide strong support for Tesla’s business expansion in China. The fiscal and monetary stimulus policies of the Chinese government have continuously improved Tesla’s sales in this important market, further consolidating its leadership position in the global electric vehicle industry. This is not only a short-term factor for Tesla’s stock price increase, but in the long run, Tesla’s performance in the Chinese market will be one of the keys to its future growth.

Strong financial report and future growth expectations

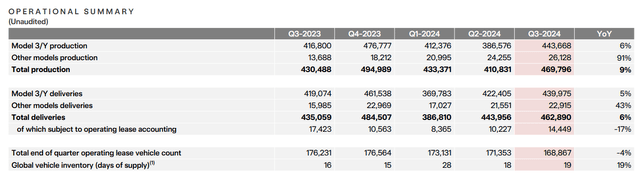

In 2024, Tesla’s financial report exceeded market expectations, especially in the third quarter, where Tesla achieved both revenue and profit growth, further proving its stable financial performance. This financial report not only provides confidence to investors, but also demonstrates Tesla’s competitiveness in the market. More importantly, Tesla’s delivery forecast for 2025 shows that the company will continue to maintain strong growth momentum, with delivery volume expected to increase by 20% -30%.

Not only that, Tesla also expects to achieve a high per-unit gross profit margin in 2025, especially with the promotion of Model 3 and Model Y, the overall sales growth will be even stronger. Tesla’s future growth potential has attracted a lot of attention from investors, causing its stock price to further rise. These factors work together to make Tesla’s stock price rise more than market expectations in just a few months.

2025 Investment Outlook: Tesla remains attractive

With Tesla’s recent strong performance, investors are increasingly optimistic about the outlook for 2025. Wall Street analysts have begun to adjust their predictions for Tesla, especially in the context of global market expansion, technological innovation, and continuous competitiveness. Tesla remains the most attractive investment target in the eyes of many investors.

Strong financial performance

In 2024, Tesla’s financial report exceeded market expectations. In the third quarter, Tesla produced 469,796 electric vehicles, mainly Model 3/Y, and delivered 462,890 to customers. As a result, Tesla’s total delivery volume increased by 6.4% year-on-year, and there may be more momentum in the fourth quarter.

The company expects to continue to maintain a delivery growth of 20% -30% in 2025, further expanding its global market share. Despite the increasingly fierce competition in the global electric vehicle industry, Tesla is still able to dominate the competition with its strong capacity and technological leadership.

Tesla’s financial health is also one of the key factors for investor confidence. In 2024, Tesla not only exceeded market expectations in revenue and profit, but also had a fairly stable cash flow performance. In the future, Tesla will have sufficient funds to support its technology research and development, production expansion, and market expansion, especially in areas such as autonomous driving technology and energy storage. This means that Tesla can not only maintain its current market position, but also continue to promote innovation and maintain its industry-leading advantage.

Tesla’s unique advantages

Tesla’s unique advantage lies in being the only company in the world with large-scale economic benefits in the production of electric vehicles. This enables Tesla to reduce unit costs through large-scale production and improve profitability. This advantage is not only reflected in the production of electric vehicles, but also in its energy storage and solar energy business areas. By optimizing the production process and continuously reducing costs, Tesla has strong market competitiveness in pricing and can provide consumers with more attractive prices.

In addition, Tesla is far ahead in technological innovation in autonomous driving technology and energy storage. Whether it is in the intelligent system of vehicles or in home energy storage solutions, Tesla is constantly advancing technological breakthroughs. With the continuous maturity of technology, Tesla will occupy a leading position in multiple Emerging Markets and vertical industries, which gives the company strong long-term growth potential.

Potential long-term returns

Although Tesla faces challenges from other electric vehicle manufacturers, traditional car companies, and policy risks, its investment value is still relatively high in the long run. With its technological accumulation in cutting-edge fields such as electric vehicles, autonomous driving, and energy storage, Tesla has become one of the most profitable companies in the world.

With the increasing global attention to environmental protection and sustainable energy, Tesla, as the world’s largest electric vehicle manufacturer, will benefit from both policy support and market demand in the future. Especially in regions with high penetration rates of electric vehicles such as China and Europe, Tesla has huge growth potential. In addition, as the scale of the electric vehicle market continues to expand, Tesla may become a leader in global energy transformation. Its layout in multiple fields such as automobiles, energy storage, and smart grids undoubtedly lays a solid foundation for future growth.

Therefore, Tesla’s investment prospects in 2025 are still very strong. Although there is some uncertainty and competitive pressure in the market, Tesla is still a high-quality target worth long-term investment due to its unique advantages in technological innovation, capacity, and global market layout.

For investors who want to seize this long-term growth potential, BiyaPay’s multi-asset wallet provides convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supports US and Hong Kong stocks and digital currency transactions. Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw funds to their personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer limits, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Investors should be wary of latent risks

Although Tesla holds a leading position in electric vehicles and technological innovation, it also faces multiple risks and challenges. Investors must pay attention to the following main risk factors when considering its future prospects.

Firstly, there is competitive pressure. Tesla’s leading position in the electric vehicle market is facing fierce competition from traditional automakers (such as General Motors and Ford) and emerging electric vehicle companies (such as NIO and Xiaopeng). Although Tesla still dominates the market, other companies are also accelerating the research and development of electric vehicles and autonomous driving technology, gradually narrowing the gap.

Secondly, there is uncertainty in policies and regulations. Although the Trump administration may relax regulatory policies to benefit Tesla, policy changes are still latent risks. The Regulatory Scrutiny of autonomous driving technology may intensify, and any policy changes will affect Tesla’s development speed. In addition, government subsidy policies for electric vehicles may also change with government changes, affecting Tesla’s competitiveness in certain markets.

Finally, there is market sentiment and stock price fluctuations. Tesla’s stock price has always been volatile, and the impact of investor sentiment on the stock price cannot be ignored. High valuation may lead to stock price adjustments, especially during profit taking or market adjustments. For example, in 2022, when the market corrected, Tesla’s stock price fell sharply. Investors need to be vigilant about changes in market sentiment and avoid blindly following the trend.

Overall, Tesla still has significant investment appeal due to its strong financial performance, leading technological advantages, and continuously expanding market share. However, factors such as competitive pressure, policy uncertainty, and market mood swings also pose challenges for future development. While investors are optimistic about its long-term potential, they also need to be vigilant about potential risks and carefully grasp investment opportunities.