- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Broadcom's financial report exploded, with a post-market surge of over 15%. Joining hands with Apple

After Broadcom released its Q4 financial report for fiscal year 2024 on Thursday, its stock price surged more than 15% in after-hours trading. In addition, Broadcom announced a partnership with Apple (AAPL) to develop internal server chips specifically designed for AI, which further boosted investor confidence and demonstrated the company’s strong growth potential in the AI field.

Financial report highlights: Broadcom’s performance breaks historical records

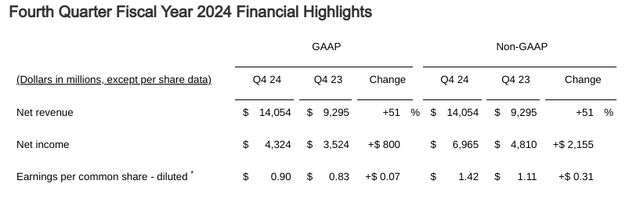

In the fourth quarter of fiscal year 2024, Broadcom achieved adjusted earnings per share (EPS) of $1.42, slightly higher than the market consensus of $1.39. This better-than-expected performance demonstrates the company’s outstanding execution in cost control and revenue growth. The total revenue for the same quarter reached $14.05 billion, almost in line with the market expectation of $14.06 billion, reflecting the company’s stable performance in diversified businesses.

It is worth noting that Broadcom’s quarterly revenue not only met expectations, but also achieved significant growth in multiple key business areas. Especially in the two main sectors of semiconductors and infrastructure software, the company’s performance was particularly outstanding. The semiconductor business continued to be the main engine of revenue growth, while infrastructure software showed strong growth momentum after successfully integrating with VMware.

In terms of full-year performance, Broadcom has reached a new historical high, with total revenue reaching $51.60 billion, a year-on-year increase of 44%. This remarkable growth is mainly due to the following aspects:

Infrastructure software revenue increased to $21.50 billion

Broadcom’s performance in the infrastructure software field is particularly outstanding, with full-year revenue increasing to $21.50 billion. This growth is mainly due to the company’s successful integration of VMware business, which enhances its competitiveness in the Cloud Service and virtualization solution markets. The addition of VMware not only expands Broadcom’s software product line, but also improves the company’s overall profit margin, further consolidating its position in the enterprise market.

Semiconductor revenue reached $30.10 billion

The semiconductor business remains Broadcom’s core driver, with annual revenue reaching $30.10 billion. This achievement is due to the company’s continuous innovation and market expansion in multiple key semiconductor areas. Especially in the fields of high-performance computing and network communication, Broadcom’s product line covers multiple important components from AI accelerators to Ethernet switches, meeting the strong demand for high-performance and high-reliability semiconductor products in the market.

Artificial intelligence (AI) revenue up 220% to $12.20 billion

Broadcom has achieved breakthrough growth in the rapidly developing field of artificial intelligence. In fiscal year 2024, AI-related revenue reached $12.20 billion, a year-on-year increase of up to 220%. This significant growth is mainly due to the company’s leading advantages in AI XPU (Accelerated Processing Unit) and Ethernet network product portfolio. Broadcom’s AI XPU products not only improve data processing speed and efficiency, but also provide customers with more powerful computing capabilities, meeting the demand for high-performance computing resources for AI applications.

Together with Apple and other tech giants: strategic cooperation to promote Broadcom market expansion

After achieving strong financial performance and rapid growth in artificial intelligence business, strategic cooperation and market expansion have become important driving forces for Broadcom to further consolidate and enhance its market position.

Broadcom recently announced a major cooperation agreement with Apple to jointly develop internal server chips designed specifically for artificial intelligence. This cooperation not only demonstrates Broadcom’s technological leadership in the field of AI chips, but also brings significant business growth opportunities to the company. It is expected that through this cooperation, Broadcom can earn an additional $4 billion per year, which is equivalent to about 10% of its current annual revenue. This cooperation not only enhances Broadcom’s market competitiveness, but also further consolidates its leadership position in high-performance computing and AI infrastructure markets.

Working with tech giants like Apple means Broadcom can not only obtain stable orders and revenue, but also further enhance its technological strength and market influence through collaboration with top enterprises. This cooperation demonstrates Broadcom’s excellent execution ability and reliable technological strength, further enhancing investors’ confidence in its future development. In addition, as an important supplier to Apple, Broadcom is expected to further expand its global market share and promote the global layout of the company’s business through this cooperation.

However, Broadcom does not overly rely on a single customer and maintains a high degree of customer diversification. This diversified customer base covers many leading companies in the data center, network communication, storage solutions, and other high-tech industries, such as Meta Platforms and Alphabet. This not only effectively reduces the company’s reliance on a single customer risk, but also enhances its ability to resist risks in different market environments.

The company consolidates its leading position in the global semiconductor industry by expanding new customers and markets, providing diversified products and solutions. Broadcom’s deep cultivation in fields such as data center, network communication, and storage solutions enables it to flexibly respond to market changes, seize growth opportunities, ensure stable growth, and provide investors with stable investment return expectations.

Broadcom actively explores Emerging Markets and high-growth regions, enhancing brand influence and market penetration rate through cooperation with local leading enterprises. The global market layout enables Broadcom to cope with regional economic fluctuations and changes in market demand, ensuring sustained and healthy business development. This diversified strategic layout enables Broadcom to maintain strong growth momentum in the fiercely competitive market.

Dual advantages: financial stability and rich shareholder returns

Broadcom’s financial health and return strategy for shareholders should also be the focus of attention for investors. Broadcom not only performs well in terms of revenue and profitability, but also creates significant value for shareholders through sound cash flow management and generous dividend policies.

Cash flow and profit margin: a sound financial foundation

Broadcom’s financial performance in fiscal year 2024 is not only reflected in significant revenue growth, but also in its strong cash flow and high profit margin. The company’s annual free cash flow reached $5.50 billion, a year-on-year increase of 15%, accounting for 39% of total revenue. This high proportion of free cash flow demonstrates Broadcom’s outstanding ability in Operational Efficiency and Fund Management, enabling it to maintain sufficient liquidity while continuously expanding its business.

The growth of free cash flow is an important indicator of Broadcom’s financial health. In fiscal year 2024, Broadcom achieved a free cash flow of $5.50 billion, a year-on-year increase of 15%. This not only reflects the company’s effective management in revenue growth and cost control, but also demonstrates its cautious attitude towards capital expenditures. Abundant free cash flow provides Broadcom with flexible capital usage options, including further research and development investment, strategic mergers and acquisitions, and feedback to shareholders.

Broadcom’s gross profit margin remains at around 77%, reflecting its strong profitability and efficient operational management. The high gross profit margin not only indicates the company’s advantages in product pricing and cost control, but also reflects its deep accumulation in high value-added products. Especially in high-growth areas such as artificial intelligence and infrastructure software, Broadcom has further improved its overall gross profit margin by providing leading technology solutions. The sustained high gross profit margin has brought stable profit sources to the company and enhanced its ability to withstand pressure in market competition.

Dividend policy: Generous return to shareowners

Broadcom has also performed well in terms of shareowner returns, demonstrating its generous return policy. The company announced an 11% increase in quarterly dividends to $0.59 per share and set a target annual dividend of $2.36 for fiscal year 2025. This is the 14th consecutive increase in annual dividends since fiscal year 2011, reflecting the company’s continued commitment to shareowner returns. The dividend growth not only improves the cash return of shareowners, but also conveys the company’s confidence in performance growth.

Broadcom’s dividend growth demonstrates its strong cash flow and profitability, which can support business development while generously giving back to shareholders. This dual guarantee provides investors with stable income expectations and enhances confidence in the company’s long-term investment value. The target annual dividend set for fiscal year 2025 has reached a historic high, demonstrating Broadcom’s consistent strategy and firm commitment to shareholder returns.

Despite Broadcom’s continuous increase in dividends, its dividend payout ratio remains at a low level. In fiscal year 2024, free cash flow reached $5.50 billion, accounting for 39% of total revenue, and the increase in dividends did not significantly affect free cash flow. The low dividend payout ratio ensures the sustainability of dividends, allowing the company to maintain or even increase dividends while keeping funds for business expansion and innovative investments. This strategy ensures the stability of Company Finance and provides long-term return guarantees for shareholders.

Broadcom’s future investment potential

Broadcom has demonstrated outstanding investment value with its strong financial performance, leading technological advantages, strategic market layout, and stable shareholder return policy. With the continuous growth of demand for artificial intelligence and high-performance computing, Broadcom is expected to continue to achieve steady revenue and profit growth in the next few years, bringing substantial returns to investors. Despite certain market uncertainties, Broadcom has good risk resistance with its diversified business structure and stable financial condition, making it a high-quality target worth paying attention to and holding for long-term investors.

For investors who want to seize this long-term growth potential, BiyaPay’s multi-asset wallet provides convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supports US and Hong Kong stocks and digital currency transactions. Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw funds to personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer limits, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Latent risks and challenges: factors Broadcom needs to address with caution

Despite Broadcom’s strong growth momentum and solid financial performance, it still faces multiple latent risks and challenges in the rapidly changing technology industry. When evaluating Broadcom’s investment value, investors need to consider the following key factors comprehensively.

Firstly, the instability of the global supply chain is a major challenge that Broadcom needs to face. In recent years, the semiconductor industry has been frequently affected by factors such as geopolitical tensions, natural disasters, and global epidemics, leading to supply chain interruptions and rising production costs. Broadcom needs to have a high degree of supply chain management capabilities to ensure production continuity and cost controllability. At the same time, fluctuations in raw material prices may also have adverse effects on the company’s profitability.

In addition, the rapid iteration of technology and the constantly changing market demand require Broadcom to continue to invest heavily in research and development. Although Broadcom has made significant progress in the fields of artificial intelligence and high-performance computing, maintaining technological leadership requires continuous investment of funds and resources. The increase in research and development investment may put some pressure on the company’s profits in the short term, but in the long run, these investments are crucial for maintaining the company’s competitive advantage and promoting innovation.

Changes in regulatory environments are another important factor that Broadcom needs to pay attention to. With increasingly strict regulations on data privacy, Anti-Trust, and environmental protection, Broadcom needs to ensure that its business operations comply with various regulatory requirements. This not only involves compliance in product design and production processes, but also legal risk management in cross-border operations. Failure to respond to regulatory changes in a timely manner may lead to legal proceedings, fines, and even business restrictions, which in turn may affect the company’s reputation and financial condition.

Finally, the uncertainty of the macroeconomic environment may also have an impact on Broadcom’s business. Fluctuations in the global economy, changes in trade policies, and currency exchange rates will directly or indirectly affect Broadcom’s international business and financial performance. Especially in the current context of many challenges facing the global economy, Broadcom needs to have flexible response strategies to mitigate potential economic shocks.

Broadcom has demonstrated significant investment value with its outstanding financial performance, strong growth in the field of artificial intelligence, strategic cooperation with tech giants such as Apple, and stable shareowner return policy. Its diversified customer base and continuous technological innovation have enabled it to maintain its leading position in the fiercely competitive semiconductor industry. Despite facing latent risks, Broadcom still demonstrates strong risk resistance and potential for sustained growth. Overall, Broadcom is a high-quality stock worth holding for the long term, suitable for investors seeking stable returns and growth opportunities.