- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Musk's worth tops $400 billion as Tesla's share price hits a three-year high, nearing Meta in market

In the fierce competition of the global stock market, Tesla (TSLA) is undoubtedly one of the most dazzling stars in recent years. Today, Tesla’s stock price hit a new three-year high, reaching $424.77 and surpassing the record of $409.97 set in November 2021. This breakthrough is not only the market’s recognition of Tesla’s technological innovation and market position but also makes the company the eighth-largest enterprise in the United States by market capitalization.

Even more strikingly, Tesla is currently the eighth-largest US company by market capitalization. If its stock price continues to rise by 15%, its market capitalization will exceed that of Meta Platforms (META) and leap to the seventh place on the market capitalization ranking list. This potential breakthrough means that Tesla is moving towards an even more glorious future.

Meanwhile, Elon Musk, Tesla’s CEO, has also seen his personal wealth exceed $4000 billion, making him the first business leader in history with a net worth exceeding this amount.

The strong bullish sentiment towards Tesla is actually closely related to an important view: with the Trump administration likely to introduce more friendly policies, Tesla is expected to significantly expand its self-driving taxi fleet in the next two years, which provides a powerful growth catalyst for Tesla. Let’s not forget that TSLA is not just a pure car manufacturer. Both the energy sector and the company’s efforts in artificial intelligence are witnessing robust and positive developments.

Although the upside potential is not as great as it was in September due to the new high in stock price, valuation analysis shows that TSLA’s valuation remains attractive. I believe the following reasons are sufficient to support the “strong buy” recommendation.

Fundamental Analysis

I think one of the hottest catalysts next year will be the expected release of a new model - the affordable Model Q. It is a new car with a post-tax credit price below $30,000, and the potential for its expansion into this price range should not be underestimated.

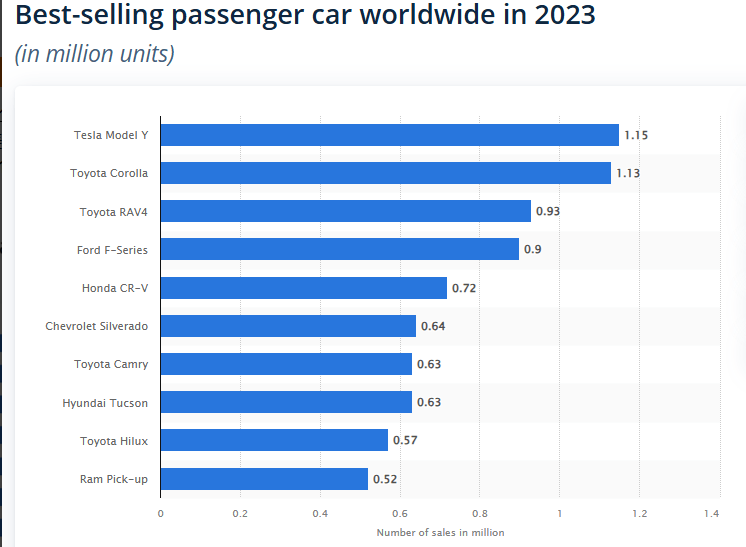

With its high cost-performance ratio, it has the potential to quickly attract a large number of consumers, especially in the middle and low-end markets. The release of this model may not only boost Tesla’s market share but also further expand its global reach, especially when competing with best-selling models like the Toyota Corolla.

Don’t think this can’t be achieved. Let’s turn our attention to Model Y. Tesla’s Model Y has already proven its ability to compete with the Toyota Corolla, and the cheaper Tesla model, the upcoming Model Q, is very likely to take away another part of Toyota’s share in the global market.

As shown in the figure, Model Y has become the world’s best-selling passenger car in 2023. This achievement is significant because the production of Model Y only started in 2020, which enabled it to quickly gain market recognition and demonstrate strong competitiveness. Based on this, we can understand that Model Q will have considerable potential to become one of the world’s best-selling cars in the next few years with its pricing strategy targeting budget-conscious consumer groups.

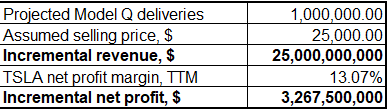

If Tesla can increase the production scale of Model Q as quickly as it did with Model Y, this model will become an important source of the company’s profits. Assuming that Tesla can deliver 1 million Model Qs in the next few years, it will bring about an incremental net income of approximately $3.3 billion. Considering that Tesla’s trailing twelve months (TTM) net income has already reached $12.7 billion, it means that Model Q may drive the company’s overall profit growth to exceed 20% in the next few years.

Of course, besides the potential of Model Q in the low-price market, Tesla’s expansion in other areas also makes us confident about the future.

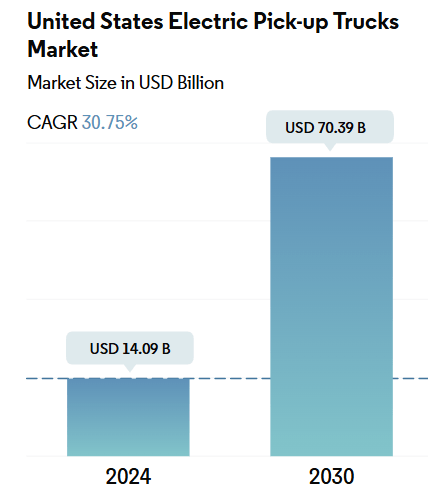

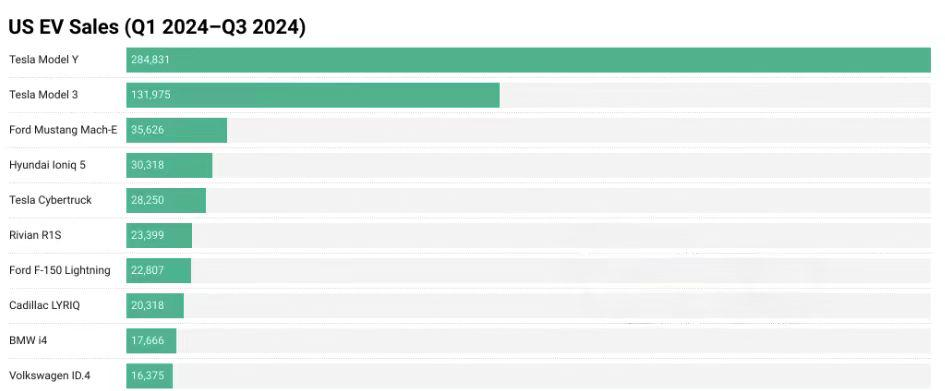

For example, Tesla has successfully entered the pickup truck market that Ford has long dominated and has achieved remarkable results. Although the Cybertruck is a new model, it has already ranked third in the US electric pickup truck sales in the third quarter of 2024. In that quarter, Tesla had already delivered about 17,000 Cybertrucks, surpassing all major competitors, including Ford’s F-150 Lightning, Rivian’s R1T, and Chevrolet’s Silverado EV.

For Tesla’s investors, this is an extremely favorable signal because consolidating its leading position in the electric vehicle pickup truck sales field will surely bring long-term benefits. After all, it is expected that the compound annual growth rate of this industry will reach 30.75% by 2030, and the Cybertruck will undoubtedly become Tesla’s flagship in this emerging “blue ocean”, leading Tesla to explore a broader market territory.

Energy Department

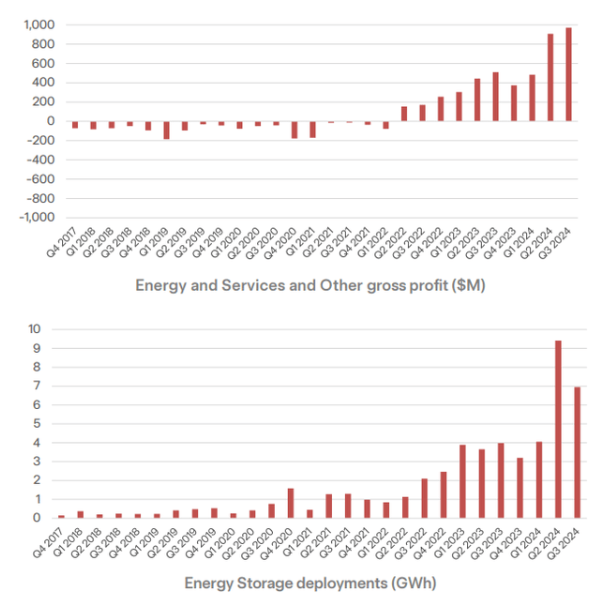

Tesla’s energy department is actually a field full of potential but often overlooked by investors.

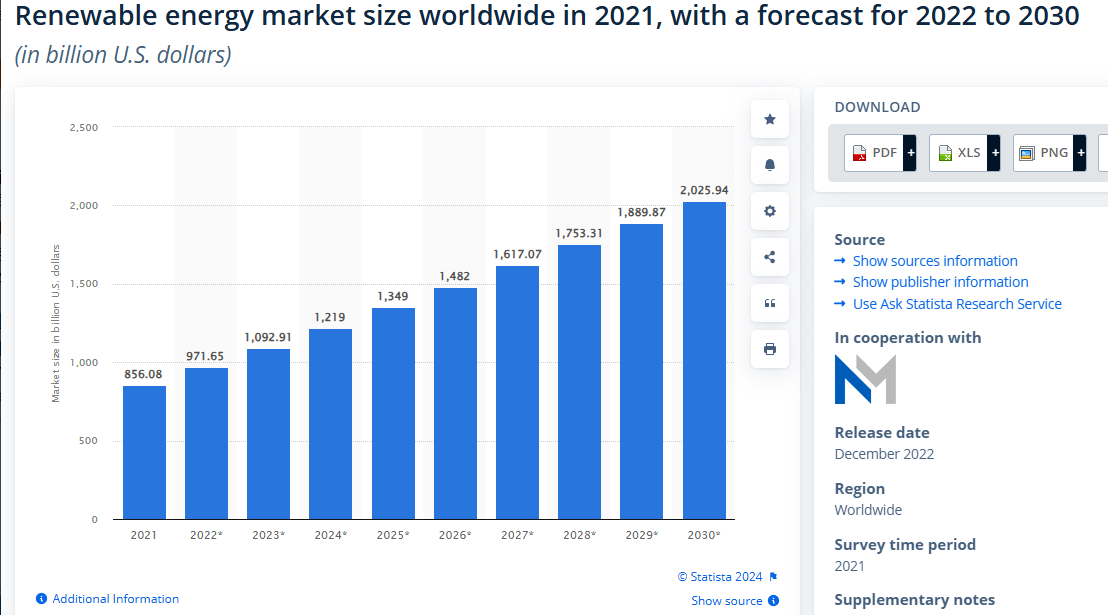

The company’s energy production and storage solutions (including solar panels, solar roofs, and Powerwall) are becoming increasingly popular in the residential and commercial markets. Moreover, according to Tesla’s latest third-quarter financial report, its Shanghai Gigafactory plans to start shipping Megapacks in the first quarter of 2025, which will bring a new and more stable source of revenue growth for the company.

Therefore, although the renewable energy industry is relatively young and may experience certain fluctuations in the short term, its prospects are quite optimistic in the long run. Data shows that the value of the renewable energy market is expected to double from 2024 to 2030, which is undoubtedly a tailwind for Tesla’s future growth.

Although the business scale of the energy department is currently smaller compared to the automotive business, it has already achieved profitability, and its gross profit shows a significant growth trend. As Tesla further expands its sales volume in the energy field, its profitability is expected to continue to improve, creating more value for shareholders.

The Continued Development of FSD

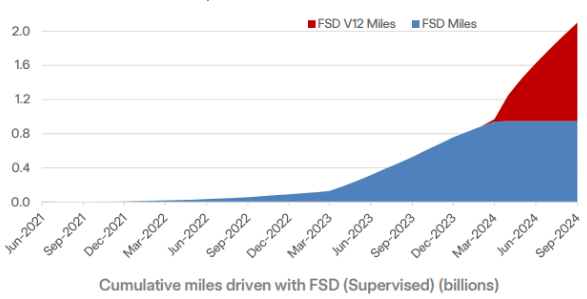

Finally, let’s take a look at the progress of FSD, which Elon Musk has been investing in. The Full Self-Driving (FSD) function has always been one of the core aspects of Tesla’s technological strategy, and there is no doubt about its promising prospects.

Currently, the company has launched a brand-new FSD V13.2 version, which is being tested by a group of users. As the cumulative mileage of FSD grows exponentially, its algorithm is constantly being optimized. It is believed that Tesla will be able to provide customers with a safe and advanced self-driving experience in the future.

More importantly, the favorable industry trend will also continue to boost the development of this field - it is predicted that the global self-driving market will achieve a compound annual growth rate of 33% in the next ten years.

Meanwhile, Tesla’s Model 3 and Model Y, as the company’s current core products, have already become veritable “cash cows”. Although they are still relatively young models, their market performance is extremely impressive. In the first nine months of 2023, these two models firmly occupied the top position among the best-selling electric vehicles in the United States, and their sales far exceeded those of the second and third-ranked competitors.

This dominant position has not only consolidated Tesla’s leading position in the US market but also enabled the company to account for 17.5% of the global electric vehicle market, making it an industry leader in selling pure electric vehicles. However, in the face of Tesla’s stock price hitting a new high, many investors may feel that the risk of entering the market now is relatively high. In this case, it may be a wiser choice to keep an eye on it and wait for a better buying opportunity.

Valuation Analysis

To sum up, since Tesla is involved in multiple high-growth industries, this not only guarantees extraordinary growth potential but also explains why the market is willing to give it a high valuation. As a leading enterprise in the electric vehicle field, Tesla, with its strong execution and technological innovation capabilities, is expected to fulfill its bold growth commitments. For this reason, Tesla’s valuation has always been growth-oriented.

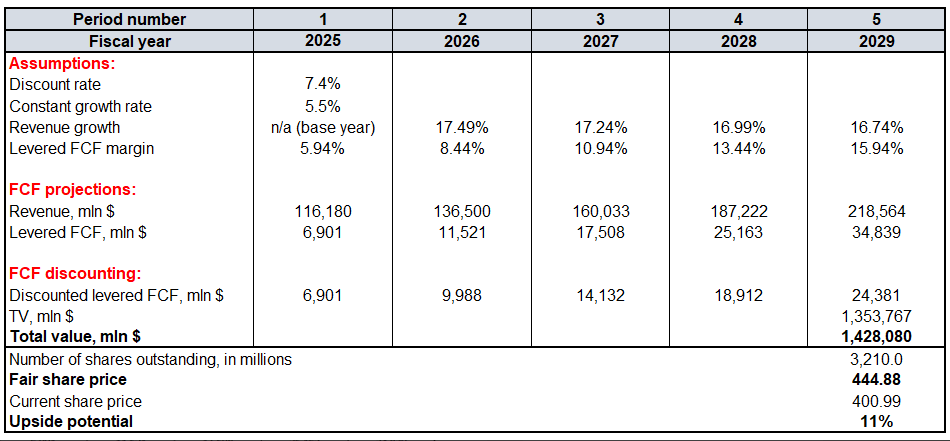

When evaluating Tesla’s value, the Discounted Cash Flow (DCF) model is a more suitable method.

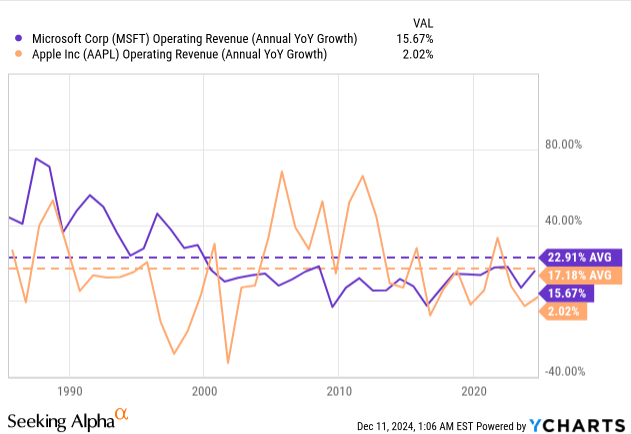

According to calculations, Tesla’s Weighted Average Cost of Capital (WACC) is 7.4%. The revenue forecasts for 2025 - 2026 are based on the consensus of more than 30 Wall Street analysts, which provides a relatively reliable basis for the model. After 2026, I predict that Tesla’s revenue growth will gradually slow down by about 25 basis points per year.

Meanwhile, referring to the data of the past five years, the average Free Cash Flow (FCF) margin of Tesla is 5.94%. Due to Tesla’s extremely strong profitability when expanding its business, I expect this margin to increase by 250 basis points per year from 2025 to 2029.

Although the sustainable growth rate in the future is 5.5%, this figure may seem bold, but industry giants like Apple and Microsoft have proven that maintaining long-term high growth is not impossible. Judging from Tesla’s current growth momentum and market position, this prediction has a realistic basis. According to data from Seeking Alpha, the number of Tesla’s outstanding shares is 3.2 billion.

Based on these assumptions and the analysis of the DCF model, Tesla’s reasonable stock price is estimated to be $445. Although the stock price has experienced a strong rally in the past few weeks, compared with this valuation, there is still a discount of about 11%. For a company that has a profound influence in multiple high-growth fields and firmly dominates the electric vehicle market, this discount is undoubtedly a “golden buying opportunity” that attracts investors.

In addition, investors should also be aware that the “Fear of Missing Out” (FOMO effect) in the market may drive the stock price to exceed the reasonable valuation level, further boosting Tesla’s investment value.

Risk Factors

Even the grandest epic is not without obstacles. Although the current economic situation in the United States is relatively strong, the tightening of monetary policy poses certain challenges for Tesla.

Jerome Powell, the chairman of the Federal Reserve, recently stated that the Federal Reserve may adopt a more cautious attitude towards future interest rate cuts. In a high-interest-rate environment, consumers tend to be more conservative when purchasing high-priced goods, and most car transactions in the United States are usually completed through leasing or loans.

Therefore, high interest rates will have a certain inhibitory effect on the demand for new cars, especially for models like Tesla that are relatively high-priced. As the leader of the US electric vehicle market, Tesla will inevitably be affected by this environment. However, this pressure may be temporary. As interest rates gradually decline, the demand for new cars is expected to resume growth.

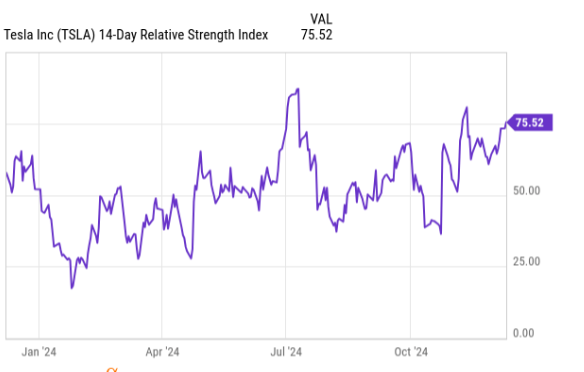

In addition, from a technical indicator perspective, Tesla’s Relative Strength Index (RSI) has reached 75, indicating that its stock price is in an overbought state. When the stock price rises sharply in the short term, there is usually a relatively high risk of a pullback.

Although Tesla has a strong fundamental and multiple positive growth catalysts, this does not mean that the stock price will necessarily rise further in the short term. Investors need to be vigilant against fluctuations caused by market sentiment and reasonably assess investment risks.

Overall, Tesla’s long-term growth potential in the electric vehicle market cannot be ignored, and its diversified layout provides a solid foundation for its sustainable development. At the current valuation level, Tesla remains a long-term investment target worthy of attention, especially for investors who are optimistic about the new energy and autonomous driving industries. However, since the stock price has just hit a new high recently, now may not be a good time to enter the market. Rational investors should comprehensively consider its potential upside and short-term risks to formulate an investment strategy that suits them.