- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

As soon as Google's Willow chip was released, the stock price surged by 5%. Musk even liked it. Shou

On Monday, Google’s parent company Alphabet (NASDAQ: GOOGL) released its latest Quantum Computing chip, Willow. This breakthrough not only brings new hope to the Quantum Computing field, but also injects vitality into Google’s stock price. After announcing the Willow chip, Google’s stock price rose 5.32% in just two days, from about $177 per share to $186.53. This increase reflects the market’s positive view of Google’s technological innovation and future potential.

In addition, Google’s announcement has also won praise from many well-known figures in the technology industry, including Musk and OpenAI CEO Sam Altman, on social media, further highlighting the innovation and industry influence of this technology.

Google’s Willow chip brings technological breakthroughs

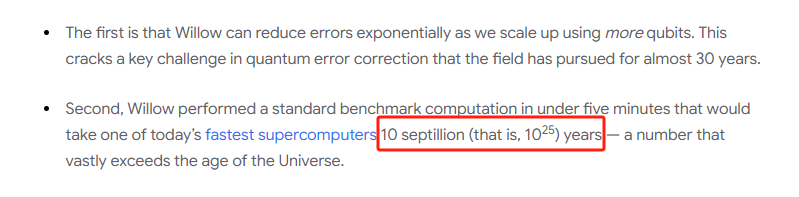

Google’s Willow chip is known in the industry as a major breakthrough in the field of Quantum Computing, bringing far-reaching technical impacts. Specifically, one of the highlights of the Willow chip is its demonstrated Quantum Computing capability. In recent tests, Willow successfully completed a task that traditional supercomputers would take 10 ^ 25 years to complete, all in just 5 minutes! If this number shocks you, it is not an exaggeration: 10 ^ 25 years, even longer than the history of the universe. Google’s chip has achieved an unprecedented leap in speed and efficiency in Quantum Computing.

In the core technology of Quantum Computing, Willow has also demonstrated unprecedented progress. Firstly, the “qubit” of Quantum Computing is the key difference between it and traditional computers. Ordinary computers use “bits”, while Quantum Computer processes information through qubits. Unlike traditional computers, qubits can be in both “0” and “1” states at the same time, which means they can process more information at the same time, greatly improving computing power.

However, the processing of quantum bits is not without challenges. One technical challenge is that quantum bits are highly susceptible to external environmental interference, leading to calculation errors. As the number of quantum bits increases, the error rate will also increase, limiting the practical application of Quantum Computing. Google’s Willow chip has made an important breakthrough in this regard. By optimizing quantum error correction technology, Willow can successfully reduce calculation errors while increasing the number of quantum bits. This innovation means that Quantum Computing can not only demonstrate strong potential in theory, but also maintain high reliability in practical applications.

In addition, Google has taken an important step in the scalability of Quantum Computing. Traditionally, as the number of qubits increases, the complexity and error rate of the system will also increase. However, Willow chips have achieved more efficient quantum bit manipulation and error correction through innovative design. This enables the scale of Quantum Computing systems to be further expanded, providing support for more computing tasks.

These technological breakthroughs not only mark Google’s significant progress in the field of Quantum Computing, but also bring people closer to the large-scale application of Quantum Computing technology. As the technology continues to mature, the potential of Willow chips will undoubtedly be released in the next few years, which will not only promote Google’s leadership position in the field of Quantum Computing, but may also have a disruptive impact on other industries.

Google’s Quantum Computing Market and Competitive Advantage

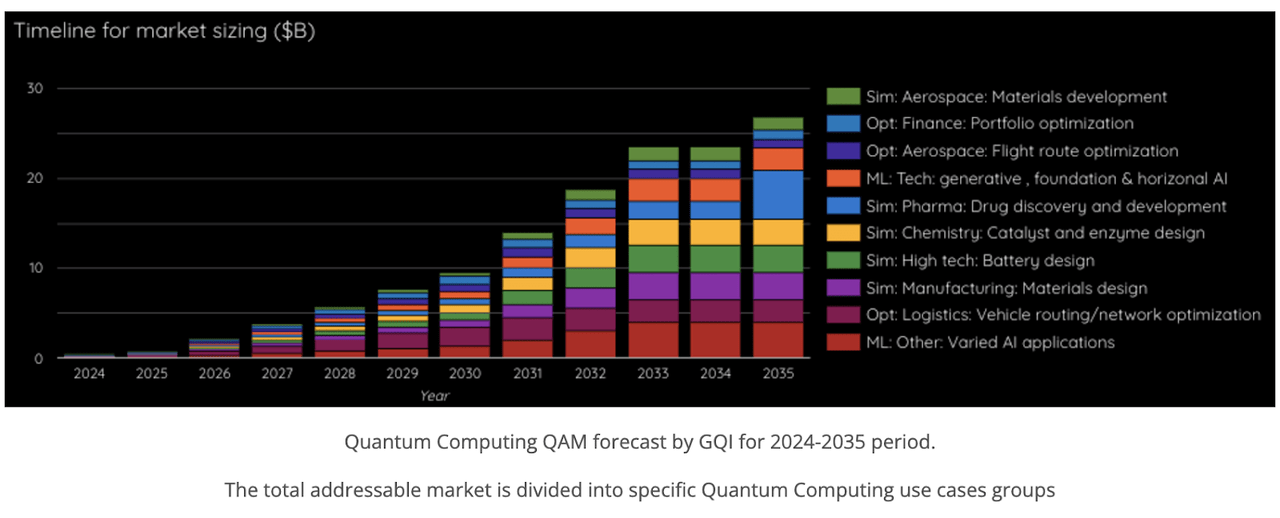

Quantum Computing technology is rapidly developing and attracting global attention. Although monetization applications are still in their infancy, with the release of Google’s Willow chip, Quantum Computing has entered a new stage of development, bringing unprecedented growth opportunities to the market. It is expected that by 2035, the market size of Quantum Computing will approach $30 billion, becoming an important driving force for multiple industries.

Quantum Computing has huge market potential, especially in the fields of healthcare, artificial intelligence (AI), energy, and finance. For example, Quantum Computing can accelerate drug development, shorten R & D cycles and save costs by optimizing molecular simulations. In the field of AI, Quantum Computing can handle more complex datasets, improving the accuracy and efficiency of AI training. In addition, Quantum Computing also has extensive applications in the fields of energy and finance, optimizing power grid management, improving the efficiency of Renewable Energy, and helping the financial industry improve the accuracy of Risk Analysis. As the technology gradually matures, Quantum Computing will promote innovation and development in these industries.

Google’s technological advantage in Quantum Computing cannot be underestimated. With strong research and development capabilities and financial support, Google has made breakthroughs in Quantum Computing hardware and algorithms through the Willow chip, further consolidating its market position. Compared with competitors such as IBM and Microsoft, Google is in a leading position in Quantum Computing research and application with its powerful computing platform and resources.

In addition, Google’s diversified business layout also provides strong support for Quantum Computing strategy. As the world’s largest search engine company, Google has not only achieved great success in the advertising field, but also performed well in its Cloud Service and AI businesses. Google Cloud is the third largest Cloud Service platform in the world, second only to AWS and Azure. Quantum Computing technology will further enhance Google Cloud’s computing capabilities and enhance its competitiveness in data processing and big data analysis. At the same time, Google’s accumulation in the AI field makes the combination of Quantum Computing and AI an important development direction in the future, and the synergy effect of the two will bring broader innovation opportunities to Google.

With the maturity of Quantum Computing technology, Google is expected to take a leading position in this Emerging Market. If Google can gain a dominant position in the Quantum Computing field, it may bring considerable revenue growth in the next few years. Google’s Quantum Computing platform is expected to become an important partner for global technology companies and research institutions, further expanding revenue sources.

In short, Google’s layout in the field of Quantum Computing has laid a solid foundation for its future Market Positioning. With the development of technology, Quantum Computing will bring significant growth opportunities to Google while driving innovation in multiple industries.

For investors, Google’s Quantum Computing strategy is undoubtedly a long-term investment opportunity worth paying attention to. It will gradually release its growth potential in the future. BiyaPay’s multi-asset wallet provides convenience for investing in Google. BiyaPay provides efficient and secure deposit and withdrawal services, supports US and Hong Kong stocks and digital currency transactions. Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw funds to their personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer amount, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

What is Google’s investment outlook?

With Google making breakthrough progress in the field of Quantum Computing, investors’ expectations for its future are also increasing. As a revolutionary technology, Quantum Computing may bring profound changes to multiple industries and bring new growth drivers to Google. However, despite Google’s outstanding innovation performance in multiple technology fields, the market has not fully recognized its valuation.

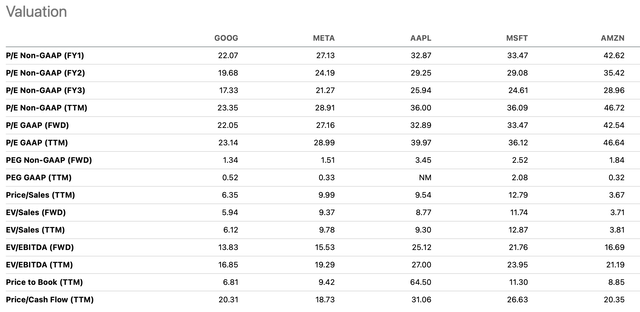

Compared with other tech giants such as Meta, Apple, Microsoft, and Amazon, Google’s Price-To-Earnings Ratio (P/E) and Enterprise Value/Earnings Before Interest, Tax, Depreciation and Amortization (EV/EBITDA) ratios are significantly lower, reflecting the market’s conservative expectations for its future growth.

Despite Google’s significant performance growth in the past few years, especially its investment in emerging fields such as Quantum Computing and artificial intelligence, the market has not fully reflected its long-term potential. This undervaluation phenomenon is related to the diversification and stability of Google’s business, which has prevented its stock price from obtaining a premium like some companies that focus on a single high-growth field.

However, it is this undervaluation that provides investors with a huge margin of safety. According to the discounted cash flow (DCF) model, the reasonable value of Google’s stock price is between $200 and $210, and the current stock price is about below this level. More importantly, as Quantum Computing technology gradually moves towards practical applications, Google’s stock price may experience greater gains. It is expected that by 2025, its stock price may rise to the range of $230 to $240. Although Quantum Computing is still in its early stages, as the technology matures, especially in industries such as healthcare and artificial intelligence, Google’s revenue and profit growth are expected to further accelerate.

Therefore, the combination of Google’s low valuation and strong growth potential makes it one of the most attractive investment opportunities in the market. Quantum Computing technology is expected to become a new engine for Google’s future growth, and investors should pay attention to how the company can push this technology from the laboratory to monetization and obtain considerable returns from it. As the technology further develops, Google will continue to maintain its leadership position in the global technology field, bringing strong profit growth to investors.

What challenges will future development face?

Although Google has shown strong growth potential in Quantum Computing and other technology fields, investors still need to be cautious about a series of risk factors that may affect the company’s future performance. These risks include technological challenges, regulatory pressures, market competition, and macroeconomic environment.

Technical risk: The practical application of Quantum Computing still needs time

Although the Willow chip represents a breakthrough in the field of Quantum Computing, the maturity and widespread application of Quantum Computing technology still face many technical challenges. The monetization process of Quantum Computing may be much slower than expected, and technical issues such as the stability of quantum bits and the control of error rates have not been fully resolved. Although Google has made significant progress in this field, the process of “from laboratory to market” of Quantum Computing may face many uncertainties. Therefore, investors should pay attention to the technical bottlenecks and development cycles that Google may encounter when applying Quantum Computing technology.

Regulatory risk: global policy uncertainty

Google, as a global tech giant, faces strict regulatory requirements from different countries and regions. Especially in the US and Europe, governments are increasingly strict in regulating large companies in areas such as data privacy, Anti-Trust, and market competition. In 2024, Google also faced some litigation challenges related to Anti-Trust, which may affect its operating model and profitability. Although Google has a strong legal team to deal with these challenges, the outcome of these lawsuits is still uncertain and may have an impact on the company’s reputation and stock price.

In addition, with the rapid development of Quantum Computing technology, countries around the world may introduce more regulatory policies related to technology security, data privacy protection, and international technology competition. These policy changes may affect Google’s operations and market expansion globally.

Market competition: challenges for industry giants

Although Google is in a leading position in the field of Quantum Computing, it is not the only competitor. Companies such as Microsoft, IBM, and Amazon are also actively promoting the development of Quantum Computing technology, and all have strong technical reserves and financial support. For example, Microsoft’s Quantum Computing project has important layouts in both software and hardware fields, while Amazon has increased its investment in Quantum Computing through its AWS Cloud Computing Platform. The competition among these companies in technology innovation, talent introduction, and market expansion may affect Google’s market share and profit prospects.

Overall, Google has shown great long-term investment potential with its innovative breakthroughs in Quantum Computing, as well as its strong technological foundation and financial position. Despite facing multiple risks such as technology, regulation, and market competition, Google’s undervaluation and strong growth make it still an attractive investment opportunity. As Quantum Computing technology gradually moves towards monetization, investors should closely monitor how Google responds to these challenges and continues to drive innovation and growth in the coming years.