- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Ma Yun embraces AI in a high-profile manner. Can Alibaba take off again after the financial report?

Preface

Good evening, colleagues from Ant Group. I’m glad to celebrate Alipay’s 20th anniversary with you all.

On December 9th Beijing time, Ma Yun attended the 20th anniversary event of Ant Group and delivered a speech. As the godfather of the Internet economy, Ma Yun’s every word and action has attracted much attention.

In his speech, Ma Yun said,

“Twenty years ago, when the Internet just arrived, our generation was lucky enough to seize the opportunity of the Internet age. But looking at it today, the huge changes brought by the AI age in the next 20 years will exceed everyone’s imagination. Because AI will be a greater era, AI will change everything, but that doesn’t mean AI will decide everything. Technology is important, but what really decides the outcome in the future is what we do today for this upcoming era that is truly valuable and unique.”

What we can do today and in the future is still what we have persisted in for the past 20 years, which is to bring happiness and change to every ordinary person’s life through technology. We want AI to empower our emotions, and we also want our emotions to empower our AI.

So how will Alibaba develop in the future? Did the recently released Alibaba financial report reveal any relevant information?

Financial analysis

Recently, Alibaba released its latest financial report. The classification of several sectors is already clear in the annual report chart. We can see the following key indicators in the annual report.

Revenue

Unit: 100 million yuan

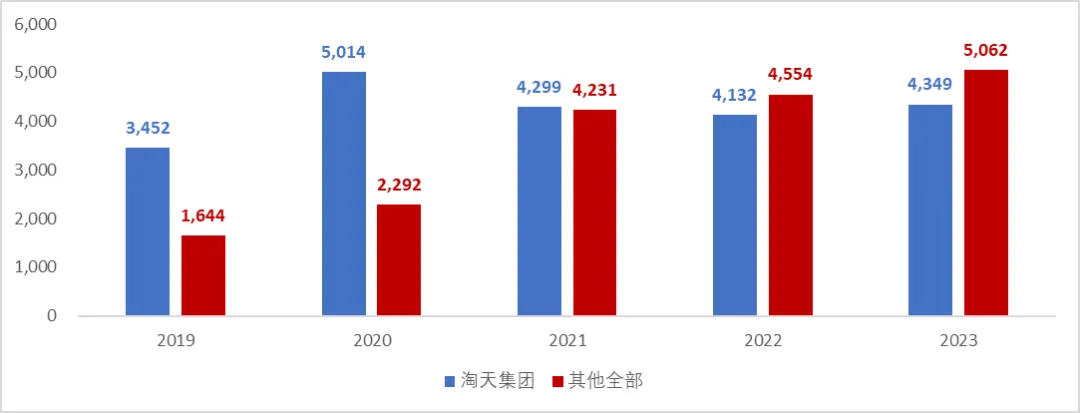

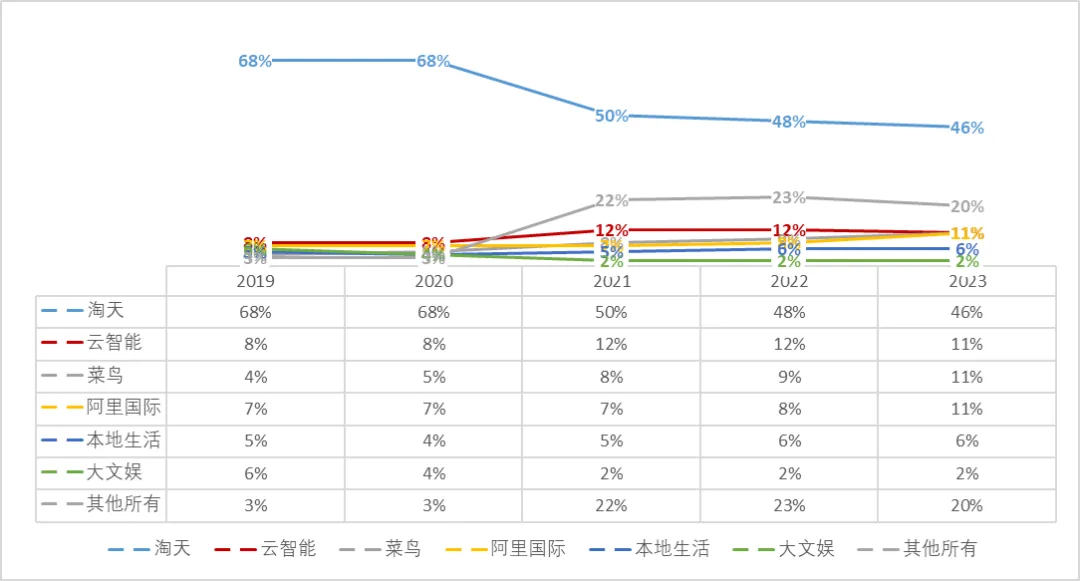

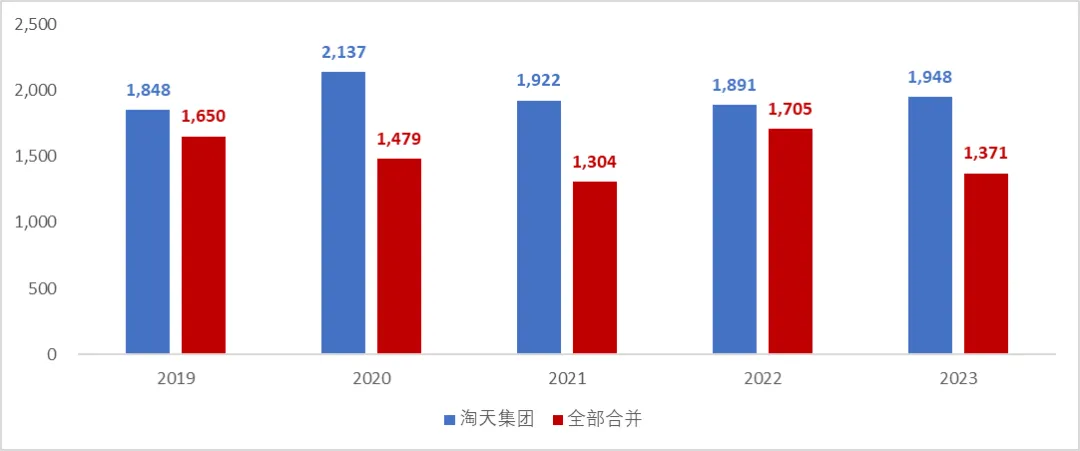

In 2023, Alibaba’s Taobao Group contributed almost all of Alibaba’s Operating Profit with nearly 50% of its revenue.

Unit: 100 million yuan

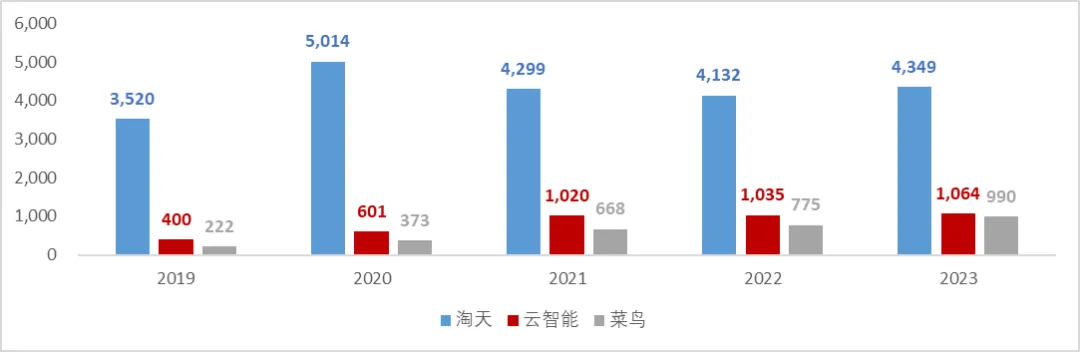

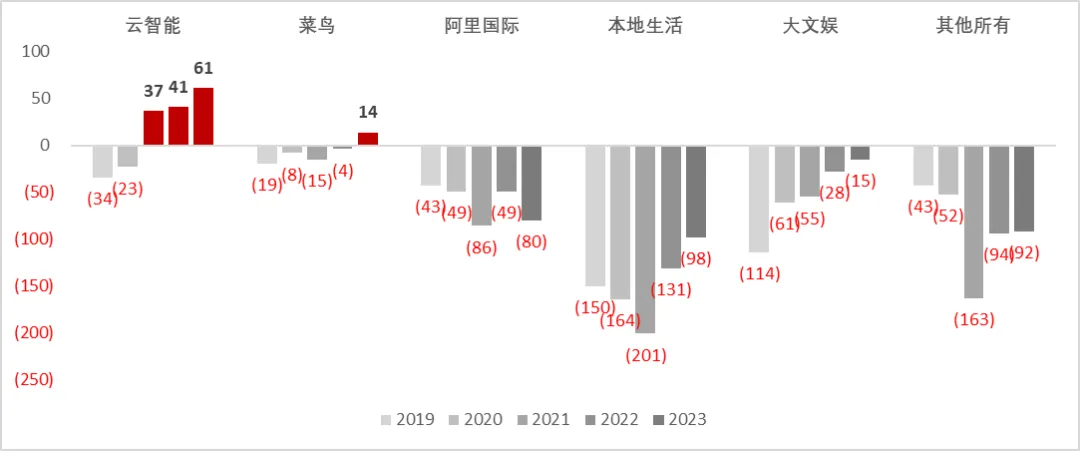

The revenue growth of Taotian Group has stagnated after experiencing the epidemic period. It is obvious that the revenue of all other sectors is increasing. Next, we will divide it into three categories of revenue. The first category is profitable, the second category is still losing money, and the third category is big integration. The profitable category includes Taotian Group , Cloud Intelligence and Cainiao .

Cainiao’s expected revenue growth this year is definitely not as impressive as it was when it submitted its prospectus. If profits continue to rise, it will definitely go public in the future. Cainiao disclosed in its prospectus that The financing cost for the last round was 7.45 yuan/share , which is already valued at 115 billion yuan, so it cannot be lower than this after going public. The expected valuation given by the market at that time was 185 billion, corresponding to a stock price of 11.7 yuan per share After going public, the stock price will rise by at least 57%. With profits coming out this year, the valuation for the next listing will inevitably be higher. As for Taotai Group, the revenue data for the past five years is the above number.

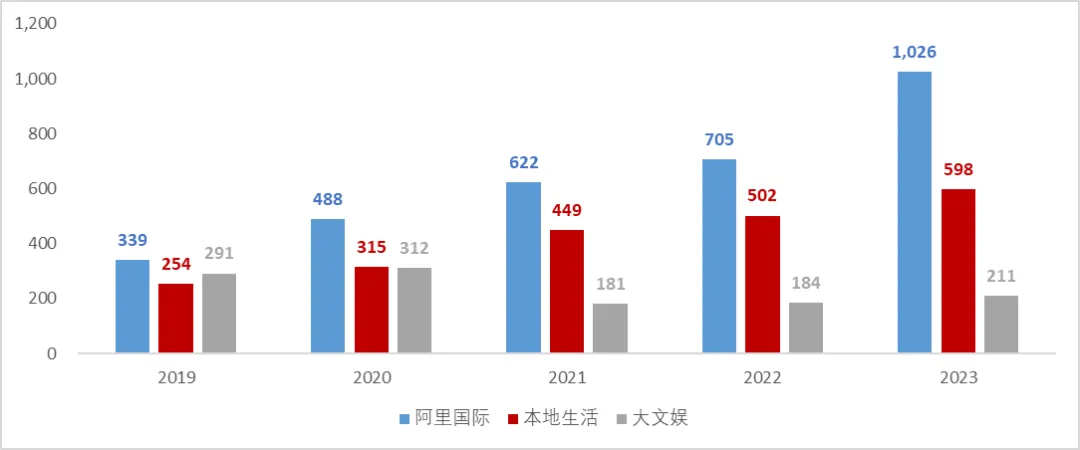

After the three main sources of revenue, the second wave is all businesses that are still losing money, including Alibaba International, Local Life, and Grand Entertainment.

Alibaba’s international expansion speed is indeed very fast, and it is a perfect combination with Cainiao’s cross-border logistics. However, the speed of narrowing losses will slow down for a few years. Let’s look at the profit numbers below in a moment.

The third wave is the great integration. Starting from 2021, Alibaba has put Hema, Gaoxin Retail, Ali Health, DingTalk, UC, Lingxi Interactive Entertainment Social, Quark, etc. under one category called “All Others”. The revenue figures are as follows.

Finally, put all the revenue figures in the annual report together and sort them in percentage order.

Starting from the revenue of Alibaba Group Holding Company, we have seen a 5% increase in revenue compared to a year ago. This is not a super fast growth rate, but considering the following factors, it is a solid result.

- Alibaba’s valuation is very low. Therefore, the company did not price high growth rates at all

- Over the years, Alibaba has become a huge company, and it has become increasingly difficult to maintain a high relative growth rate as the company has grown. Many other companies, including Apple Inc. (AAPL), have found that growth inevitably slows down over time - AAPL’s growth rate in the most recent quarter is very similar to BABA’s, at 6%.

Considering these factors, I found that Alibaba Group’s 5% revenue growth is not a bad result in absolute terms. The growth rate is also higher than the previous three quarters, indicating that BABA’s current momentum is favorable. This does not guarantee that revenue growth will accelerate this quarter and beyond, but I believe that this situation is very likely to happen. The revenue growth of different business units of Alibaba is not balanced, and the growth rate of Cloud Service business is higher than the average level of 7% in the same period last year. Although it is not very strong compared to Amazon.com , Inc. (AMZN), Alphabet Inc. (GOOG), (GOOGL), etc., there are also some positive aspects.

Management said the public cloud grew at double-digit rates in the most recent quarter, so as this segment grows, we are likely to see an acceleration in overall Cloud Service growth.

In addition, artificial intelligence-related products grew at a triple-digit rate in the most recent quarter. Although Alibaba is not considered a major player in artificial intelligence by many, this data shows that the company can still benefit from the ongoing trend of artificial intelligence. If the current growth rate is maintained, this may become the main source of future revenue and profit growth for the company. Recalling today’s speech by Ma Yun, perhaps the road to Alibaba’s AI led by Ma Yun has begun.

Alibaba’s international digital commerce business also grew faster than the company-wide average, achieving 29% revenue growth, albeit from a modest base. Revenue for the quarter was around $4.50 billion, equivalent to just over 10% of total revenue. As the business continues to grow, its growing importance to Alibaba and its growing revenue contribution, both on an absolute and relative basis, will help boost overall business growth over the next few years. Management sees investments in parts of Europe and the Middle East as one of the growth drivers for this period, and I expect these investments to continue, hopefully continuing to drive impressive growth rates for BABA’s IDC business.

US stock: Alibaba (stock code BABA)

Operating Profit

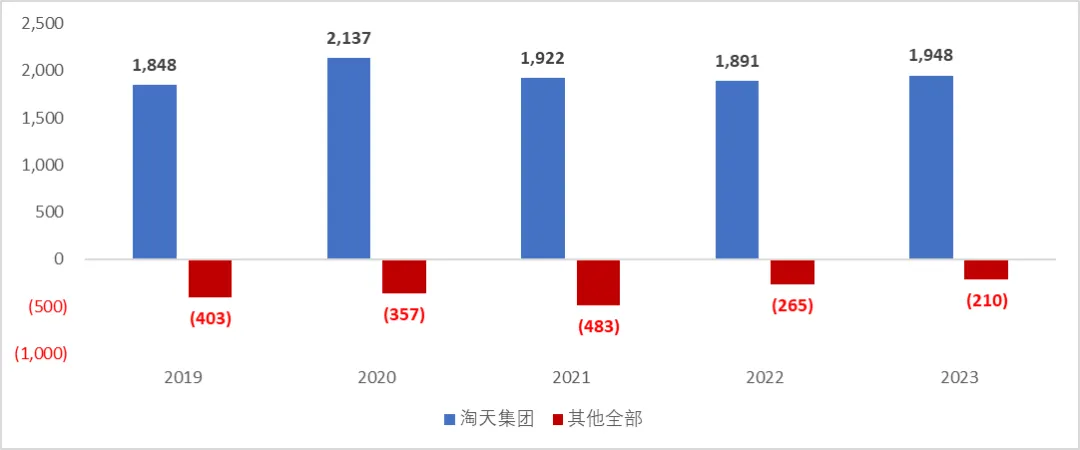

In terms of the adjusted EBITDA operating profit figure, Taotai Group is equivalent to all of Alibaba, because the others are either just starting to make profits or are all losing money.

Extended reading:

EBITDA is the abbreviation for Earnings Before Interest, Taxes, Depreciation and Amortization, which refers to the profit before interest, taxes, depreciation and amortization. EBITDA is widely used by private capital companies to calculate their operating performance.

Calculation formula for EBITDA:

Net Profit + Net Interest Expense + Corporate Tax + Depreciation and Amortization = EBITDA

Adjusted EBITDA (adjusted earnings before interest, tax, depreciation and amortization)

Total Operating Income + Total Operating Profit - Total Operating Expenses - Total Net Non-Operating Expenses Hidden in Operating Profit - ESO Employee Stock Option Expenses + Goodwill Amortization + Depreciation and Amortization (Cash Flow) = Adjusted EBITDA

Adjusted EBITDA and EBITA are a more accurate and comparable way to calculate a company’s pre-tax cash profit.

Of course, business growth alone does not translate into strong returns, profits are more important. In this regard, BABA’s performance does not look very strong, as adjusted earnings have slightly decreased compared to a year ago, and adjusted EBITDA has decreased by 4% year-on-year.

Cloud Intelligence and Cainiao have turned losses into profits. Local life and entertainment have narrowed significantly; Alibaba International is still expanding, and the narrowing of losses may need to be slowed down; the remaining losses have narrowed to some extent.

The management believes that this is due to an increase in growth investment - we will see if these investments will pay off in the coming quarters. Looking at the report’s results, Alibaba achieved a reasonable 5% revenue growth based on unadjusted data.

The difference between the strong GAAP growth rate and the weak adjusted growth rate can be explained by lower stock compensation expenses. These are excluded from the adjusted results, which are included in the GAAP indicator, so the decrease in expenses will lead to an increase in profits, everything else being equal. After adjustment, BABA’s net income per share (technically ADS) was $2.15, a slight decrease from the same period last year.

After looking at the revenue and adjusted EBITDA, the conclusion is that Taotai Group contributed almost all of Alibaba’s Operating Profit with 46% of its revenue.

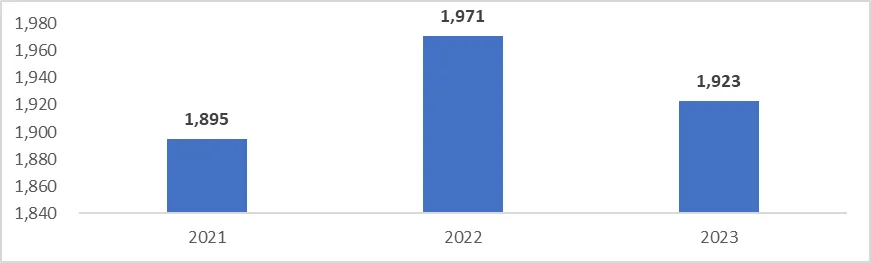

Active buyback

However, the decline in earnings per share is lower than the decline in net profit for the entire company, due to Alibaba’s stock buybacks significantly reducing the company’s stock count in the past year. Overall, Alibaba’s buybacks last year brought a 5% benefit to earnings per share, which is quite good - for example, AAPL’s famous buyback only reduced stock by about 3% per year. In the most recent quarter, Alibaba continued to actively repurchase stocks and spent another $4.10 billion to repurchase stocks, accounting for about 2% of the company’s market value. I like BABA’s enthusiasm in buybacks because there is no good reason to hold billions of dollars in cash on Balance Sheet without using these funds to create shareholder value.

Unfortunately, the cash flow situation is not very good: the total operating cash for the quarter was $4.50 billion, equivalent to an annual rate of $18 billion. Although this is a strong number, in absolute terms and relative to the company’s market value of about $200 billion, this number is lower than the same period last year. Management believes that this is due to increased investment in international digital commerce and artificial intelligence cloud products. If this is true, this is a temporary pullback and there is no reason to worry, but we hope to see this indicator improve again in the coming quarters.

Summary

Hong Kong Stock: Alibaba-W (Stock Code 09988)

The above results exceeded analysts’ expectations for revenue and profit. Although cash generation in this quarter was below average, Alibaba continued to reward shareholders handsomely through buybacks. In the past few weeks, Alibaba’s stock price has fallen, which is why Alibaba has become very cheap again.

So how can investors invest in Alibaba’s stocks? BiyaPay provides a platform for trading US and Hong Kong stocks at the same time. As a compliance trading platform, it can trade US and Hong Kong stocks and digital currencies, and solve the problem of fund inflow and outflow with one click. Moreover, there is no need to worry about funds being frozen. Transfers are fast and secure, and market opportunities can be seized in minutes. You no longer have to miss the opportunity to get rich because of “funds stuck on the deposit and outflow road”.