- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Has Microsoft's Stock Price Risen for Seven Consecutive Days: Overvalued or with Huge Investment Pot

Microsoft’s (MSFT) recent stock price performance has drawn widespread attention. In particular, the company’s stock has risen for seven consecutive trading days. On Monday, the stock price closed up 0.55% to $446.02.

This tech giant has risen by 4.75% in the past six trading days. So far this year, the stock has climbed more than 17%, while the S&P 500 Index has surged over 27% during the same period. This wave of increases has led many to reexamine Microsoft’s investment value, especially against the backdrop of market turmoil and the general pressure on technology stocks.

Meanwhile, Microsoft’s upcoming important shareholders’ meeting has pushed it further into the spotlight. Shareholders will vote on whether to support a proposal put forward by the conservative think tank NCPPR, which suggests that Microsoft allocate at least 1% of its assets to Bitcoin. This proposal is not only closely related to Microsoft’s future capital allocation and strategic direction but has also sparked discussions about how it can maintain steady growth in the global market.

Although Microsoft’s current valuation already reflects the company’s strong growth potential, in the face of competitive pressure and regulatory challenges, investors still need to make cautious judgments.

Market Reaction to the Shareholders’ Meeting and the Bitcoin Proposal

At Microsoft’s upcoming shareholders’ meeting, a proposal on Bitcoin asset allocation has become a focal issue.

The proposal was initiated by the conservative think tank NCPPR, which advocates that Microsoft should invest at least 1% of its corporate assets in the Bitcoin field. The proponents of the proposal believe that Bitcoin is an extremely effective inflation hedge tool that can open up new revenue channels and create potential returns for Microsoft. Once this proposal was put forward, it caused a stir in the market, triggering extensive discussions among all sectors and also making investors focus on Microsoft’s future strategic layout and development direction.

From the perspective of the proposal’s background and the attitude of Microsoft’s management, the management team of Microsoft has clearly expressed its opposition to this proposal.

They pointed out that rashly investing the company’s funds in high-risk assets like Bitcoin is very likely to trigger a series of unnecessary risks and may even have a serious impact on the company’s capital liquidity and operational stability. However, despite the management’s negative attitude, the proposal has still won the support of some investors and relevant institutions.

Among the external supporters, BlackRock, Microsoft’s largest institutional investor, and Michael Saylor, a well-known figure in the cryptocurrency field, are all sparing no effort to actively promote the passage of this proposal.

BlackRock holds approximately 7% of Microsoft’s shares, and its say and influence at the shareholders’ meeting cannot be underestimated. It is expected to play a key role in the voting process of this proposal. And Michael Saylor has been showing Microsoft’s senior management in various ways the huge potential of Bitcoin, attempting to reverse the opposition stance of Microsoft’s management and create favorable conditions for the smooth passage of the proposal.

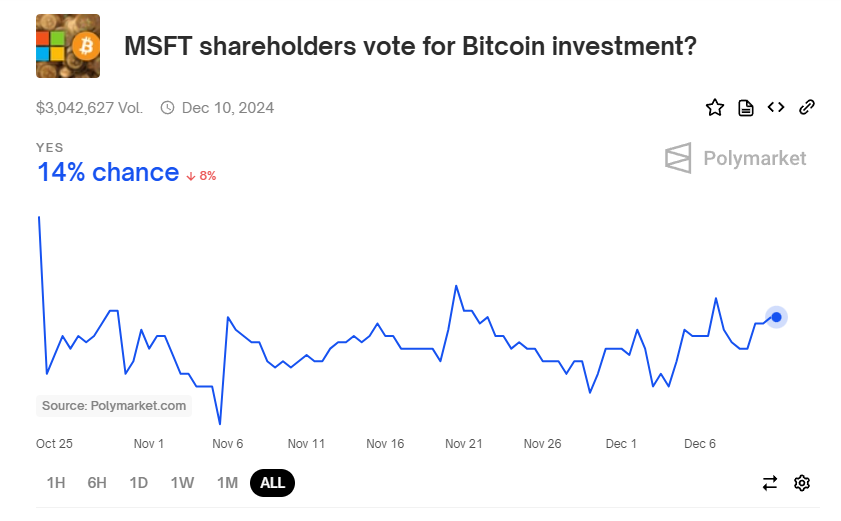

From the perspective of market reaction, according to the data provided by the real-time betting platform Polymarket, the probability of this proposal being passed is currently relatively low, only about 14%.

In terms of Microsoft’s own strategic layout and future development direction, regardless of whether this Bitcoin proposal can be successfully passed in the end, Microsoft’s leading position in its long-term core strategic areas, especially in cloud computing and artificial intelligence, remains rock-solid.

In terms of Microsoft’s strategy and future direction, regardless of whether the Bitcoin proposal is passed or not, Microsoft’s long-term strategy remains solid, especially its leading position in cloud computing and artificial intelligence. Even if it may be affected by the proposal in the short term, Microsoft’s overall investment value is still widely recognized by the market.

Microsoft’s Continued Profit Growth

Microsoft’s financial performance has always been the focus of investors. It has diverse revenue sources and a stable business model. In particular, its continuous expansion in cloud computing and software services has made Microsoft one of the most valuable technology companies in the world.

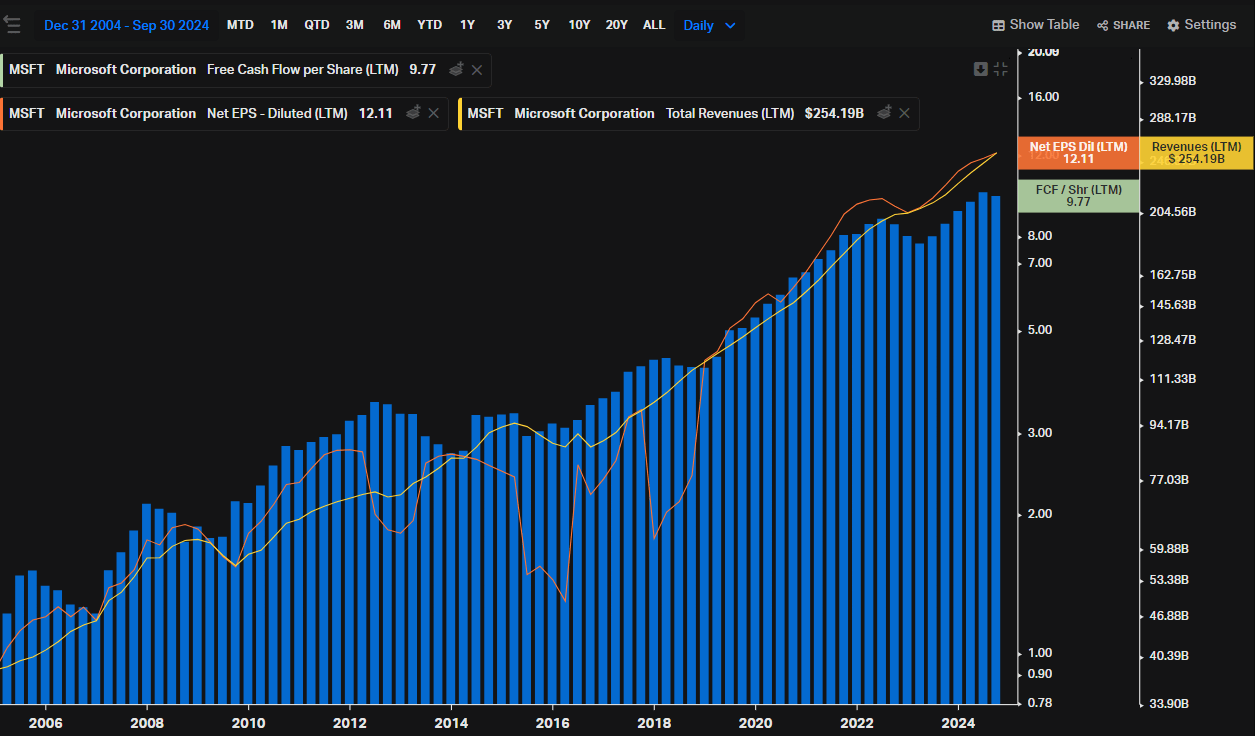

In the past few years, Microsoft has continuously shown strong revenue growth, especially in the intelligent cloud and productivity and business processes segments, which has made Microsoft’s financial foundation extremely solid.

Microsoft’s revenue has been rising steadily, especially in cloud computing. This is mainly due to its continuous heavy investment in Azure. Azure is so powerful that it has enabled Microsoft to gain a foothold in the cloud market and has also driven up the company’s overall profits. Taking the first quarter of fiscal year 2025 as an example, Microsoft’s intelligent cloud business grew by 20%, and its productivity and business processes business also grew by 12%. The growth rate is higher than that of many peers.

In addition, Microsoft is quite proficient in capital allocation. The company is very precise in capital expenditures and excellent in cash flow management. So when it comes to technological innovation and market expansion, it never has to worry about lacking funds. In the past decade, the compound annual growth rate of free cash flow has reached 10.47%, which has laid an extremely solid foundation for shareholder returns. The growth of both free cash flow per share and earnings per share fully reflects Microsoft’s profitability and its position in the market.

Therefore, Microsoft has always had excellent performance and a particularly solid “moat”. The moat ensures the stability of revenue, enabling Microsoft to gradually increase product prices without affecting demand. The company has also adopted a series of strategies to expand revenue sources. The layout of artificial intelligence is particularly important. Microsoft has launched new products such as Copilot, Microsoft Security Copilot, and Copilot + PC. Although it is difficult to accurately quantify how much growth these innovations can bring, Microsoft will definitely continue to be a major player in the AI field. By integrating products and improving efficiency, Microsoft can further benefit from the development of artificial intelligence.

Microsoft has a good financial situation and strong cash flow, and shareholders have earned a lot. In the past 10 years, 7 years, 5 years, and 3 years, the compound annual growth rate of Microsoft’s dividend per share is approximately 10%. This stable growth indicates that the company will continue to increase dividends and share repurchases in the future, further enhancing shareholder value.

Therefore, Microsoft is not only a stable growth stock but also a high-quality stock worthy of long-term holding.

Microsoft’s Valuation Cost

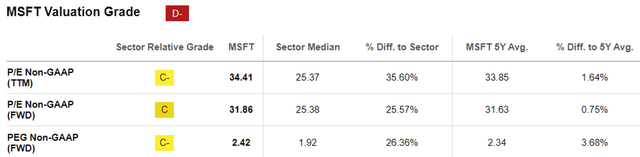

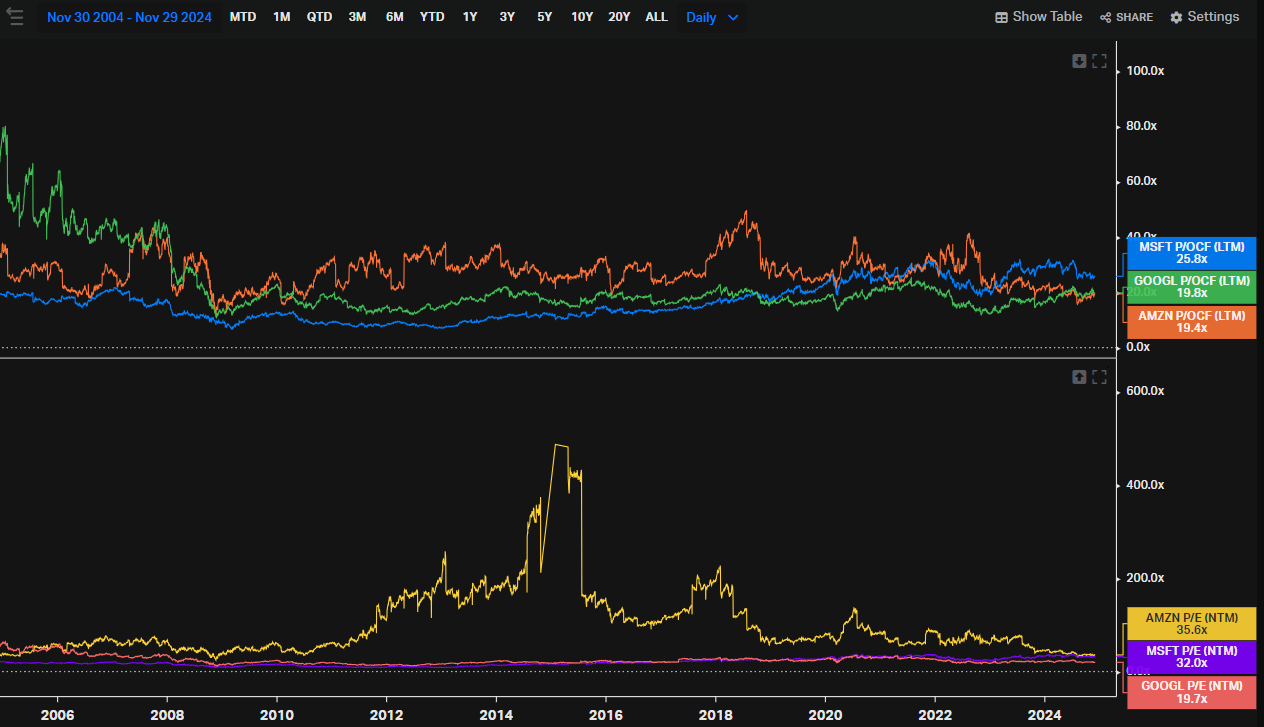

From the perspective of basic valuation, Microsoft’s FWD P/E (Forward Price-to-Earnings Ratio) remains at 31.86 times, which is basically consistent with its average of 33.27 times in the past year and 31.63 times in the past five years, indicating that the stock’s valuation is in a reasonable range. However, on the other hand, when we put the FWD PEG (Forward Price-to-Earnings-to-Growth Ratio) non-GAAP ratio at 2.42 times, compared with 1.63 times in the past year and 2.34 times in the past five years, Microsoft’s stock is trading at a slightly premium price.

Even when comparing Microsoft (MSFT) with its seven major peers, such as Amazon (AMZN) (1.66 times), Google (GOOG) (1.26 times), Meta (1.32 times), and NVIDIA (NVDA) (1.28 times), it is obvious that, except for Tesla (TSLA) (17.26 times) and Apple (AAPL) (3.26 times), Microsoft’s stock price is relatively high.

Perhaps part of the premium in Microsoft’s stock price stems from its highly strategic investment in OpenAI. This investment is estimated to be $137.5 billion, while OpenAI’s recently announced valuation has reached $1570 billion.

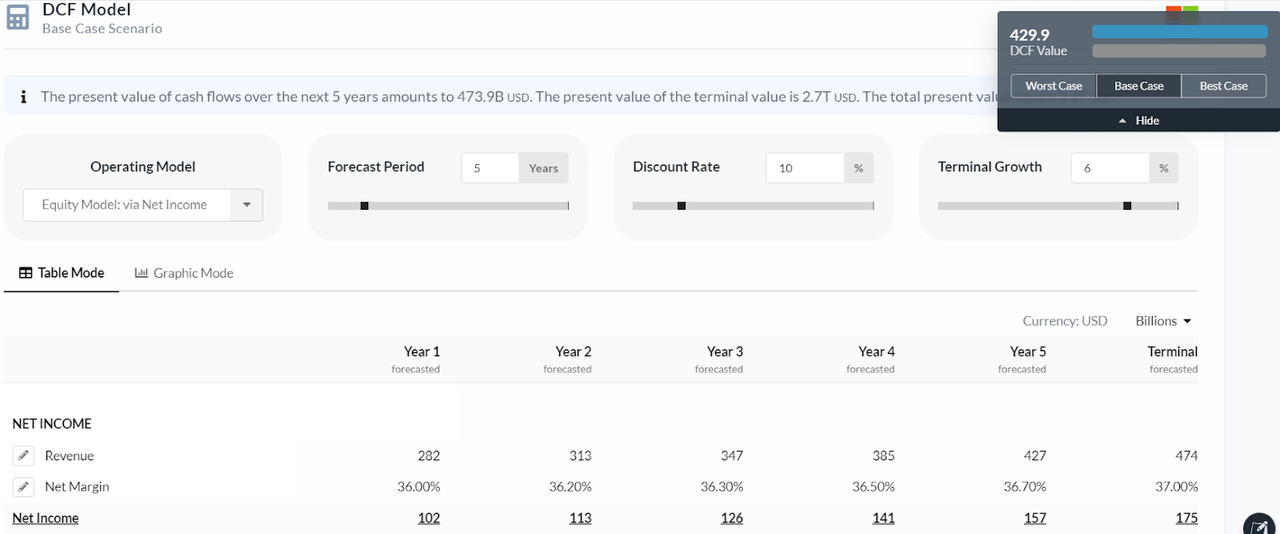

As mentioned earlier, Microsoft’s stock has a relatively small margin of safety. According to the stock price model, the reasonable stock price of Microsoft calculated using the following assumptions is $429, slightly higher than the current stock price:

The compound annual growth rate of revenue in the next few years is about 11%;

The net profit margin gradually expands to 37%;

The discount rate is 10%;

The terminal growth rate is 6%.

This means that the market has already fully reflected Microsoft’s revenue growth and net profit margin, and the pricing level is within a reasonable range. In this basic scenario (although the assumptions are somewhat optimistic, considering Microsoft’s long-term performance, these assumptions are reasonable), investors can still expect an annual return of about 10%.

I think the current valuation is still reasonable because there is still room for upward movement in the revenue and profit expectations in the assumptions. In particular, the cloud computing market is expected to grow at an annual rate of about 20%, and Microsoft has huge growth potential in this area, and its revenue may exceed expectations. In addition, the net profit margin may also break through 37%, which has been verified in some quarters. Moreover, as the market’s recognition of Microsoft increases, the discount rate may be reduced from 10% to 8% or 9%, further enhancing Microsoft’s valuation level.

Risks and Opportunity Costs

In the previously mentioned “cautious buy” strategy, the risk brought by the low margin of safety is a key factor. Although Microsoft has broad growth prospects and diversified businesses, the realization of all these still depends on cloud computing, and the competition in this market is extremely fierce. Companies like Amazon (AMZN) and Google (GOOGL) are all strong competitors.

The growth of Microsoft’s capital expenditures may also put pressure on free cash flow in the short term, thus affecting the distribution of shareholder returns.

In addition, as demonstrated by Google’s case, the antitrust regulatory risk cannot be ignored. Microsoft may face similar regulatory challenges, especially accusations of major acquisitions or monopolistic behavior, which may have an adverse impact on its prospects.

Another important risk is the execution risk, especially in the AI field. Although Microsoft has launched AI tools including Copilot, these products also face fierce competition from companies such as Apple (AAPL) and Google (GOOGL). In particular, Apple has enhanced the intelligence of its devices through Apple Intelligence, and Google has launched new technologies such as Gemini.

These risks will not make Microsoft lose its attractiveness, but their existence illustrates uncertainties. Even for a high-quality company like Microsoft, corresponding equity risk premiums need to be considered in the stock price model. Therefore, I tend to use a higher discount rate for valuation.

Apart from the above risks, opportunity cost is also a factor that needs to be considered.

Although Microsoft is currently one of the most eye-catching technology companies, especially among the seven major technology companies, its growth is clear and diversified, but this does not mean that it is the most attractive investment option. In contrast, Google and Amazon show greater uncertainty in their future return potential, but they also have higher investment return potential. If their strategies are effectively implemented, they may bring greater value increases.

Amazon not only has strong potential in cloud computing but also has a large number of opportunities in fields such as robotics, artificial intelligence, and international expansion. Its price-to-operating-cash-flow ratio (P/OCF) is 19.4 times, much lower than that of Microsoft. Although its price-to-earnings ratio is relatively high due to high depreciation and stock-based compensation (SBC).

Google also has a growth prospect in cloud computing, but its diversified growth in areas such as YouTube, artificial intelligence, and search, especially its strong momentum in the cloudification process, makes its price-to-earnings ratio of 19.7 times seem quite reasonable, while Microsoft’s price-to-earnings ratio is 32 times.

Therefore, it is crucial to weigh these factors because these three companies are all good companies and should bring good returns, but they have different risks and thus can form different investment portfolios to meet the needs of different investors.

Microsoft, with its powerful moat, extensive product portfolio, and profound accumulation in cloud computing and artificial intelligence, shows solid growth potential. In particular, its strategic investment in the AI field may bring substantial returns in the future. However, Microsoft’s stock price has already reflected high growth expectations, and its valuation is relatively high with a small margin of safety, which limits the room for its stock price to rise.

Although Microsoft has a certain attraction among tech giants, it also faces multiple uncertainties such as competition, capital expenditure, and regulatory risks. Compared with companies like Google and Amazon, Microsoft’s investment returns may be more stable, but it lacks the same high return potential.

In conclusion, Microsoft’s prospects are still bright, especially driven by its core businesses such as cloud computing and AI. However, considering the current valuation and potential risks, investors should be cautious and make reasonable investment allocations to balance risks and returns.