- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Broadcom's financial report is about to be released. Can the stock price reach a new high under AI e

Broadcom (NASDAQ: AVGO) continues to strengthen its market position in the field of artificial intelligence. With its comprehensive hardware and software solutions, strategic partnerships, and innovative products, Broadcom has become an important participant in the AI field. Although Broadcom’s AI revenue currently accounts for only about 25% of total sales, this proportion is expected to continue to grow in the coming years, further enhancing the company’s sales and profitability.

As a core player in the AI competition, Broadcom is expected to become a stable investment choice in the medium and long term. Its stock price has been fluctuating in the past few months. On December 12th, the company will release its new quarterly financial report. The market generally expects Broadcom’s new quarterly performance to be higher than expected, and Broadcom’s stock price may continue to rise in the short term.

Broadcom’s core business and strategic layout

Broadcom was founded in 1961 and has now developed into one of the leaders in the global semiconductor industry. The company not only occupies an important position in the semiconductor field, but also specializes in infrastructure software and network solutions, providing technical support for multiple industries such as data centers, enterprise networks, smartphones, and home appliances. Broadcom’s business model is extremely diverse, including customized integrated circuits (ASICs), storage and connectivity solutions, as well as network and security products. These businesses together constitute Broadcom’s powerful technology empire.

Semiconductors and infrastructure software: the core driving force of AI

Broadcom focuses on providing high-performance chip solutions for data centers, communication devices, and consumer electronics products in the semiconductor field. Its most representative products include network switching chips, storage controllers, and wireless communication chips. Broadcom’s technological advantages in these areas have made it irreplaceable in the global market. With the rapid popularization of 5G and Internet of Things (IoT) applications, Broadcom’s semiconductor product demand is growing rapidly, especially in the fields of data centers and Cloud Service services. Broadcom’s hardware products are almost the core components of these infrastructures.

In addition, Broadcom’s expansion in the infrastructure software field cannot be ignored. By acquiring VMware (completed for $6.90 billion in 2022), Broadcom has strengthened its layout in the virtualization and Cloud Service fields. As a global leading virtualization technology company, VMware’s software products help enterprises optimize the operational efficiency of data centers, reduce costs, and improve flexibility. With the increasing demand for Cloud Service solutions, Broadcom’s infrastructure software business has added strong growth momentum to it.

AI strategic layout: seizing future market opportunities

Broadcom’s strategic layout in the AI field is particularly noteworthy. Through customized AI hardware and software solutions, Broadcom has become an important participant in the AI market. Especially with the widespread application of Machine Learning (ML) and Deep Learning (DL) technologies, the surge in demand for AI computing has driven the demand for high-performance chips, and Broadcom is one of the important suppliers in this field. Broadcom’s AI accelerator chips and customized integrated circuits (ASICs) are widely used in various AI applications, especially in the fields of autonomous driving, Cloud Service, and Big data processing.

More importantly, Broadcom has established deep partnerships with top global technology companies such as Google, Amazon, and Microsoft to jointly promote the research and application of AI technology. These strategic collaborations not only help Broadcom expand its market share in the AI field, but also enhance its technological position in the global AI ecosystem.

Broadcom’s AI business growth prospects

Broadcom’s future largely depends on the performance of its AI business, especially with the increasing global demand for AI technology, Broadcom’s development in this field is particularly critical. Through strategic acquisitions and technological innovation, Broadcom has established a competitive advantage in the AI market.

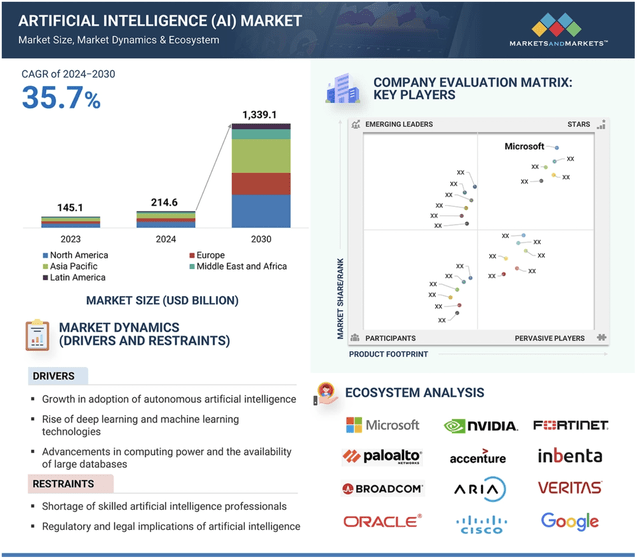

Currently, AI technology is widely used in multiple industries such as automation, Data Analysis, Machine Learning, and image recognition. From autonomous cars to smart home systems, the use of AI is expanding. According to market research, the global market in the AI field is expected to continue to grow at a compound annual growth rate of over 30% per year, indicating huge commercial potential. Broadcom, as a major supplier of AI hardware and solutions, is at the forefront of expanding this market.

Broadcom has significantly enhanced its position in the enterprise AI solution market by acquiring VMware. VMware’s technology enables Broadcom to provide more comprehensive cloud infrastructure and AI solutions, which are crucial for developing complex AI applications and services. The latest financial report shows that VMware’s revenue increased by 41% year-on-year, clearly indicating the direct benefits brought by this strategic acquisition.

With the continuous expansion of AI business, Broadcom’s revenue structure is also gradually changing. Currently, AI-related businesses account for about 25% of Broadcom’s total revenue, but this proportion is expected to increase significantly in the next few years. Analysts predict that by 2026, Broadcom’s AI business revenue may increase to more than 30% of the company’s total revenue, which will greatly promote the company’s overall growth and profitability.

Broadcom’s financial performance and stock valuation

Broadcom has shown strong financial performance in the past few years, and its continuously growing revenue and profitability have made it the focus of investors’ attention. Especially in 2023 and 2024, Broadcom’s revenue and earnings per share (EPS) have performed well, receiving positive market response. With the continuous advancement of AI business and VMware integration, Broadcom’s financial situation is expected to further improve, bringing higher returns to shareholders.

Revenue and earnings growth: Continuously exceeding expectations

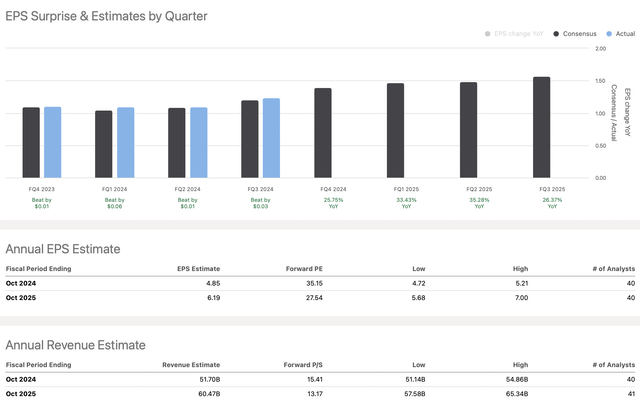

Broadcom has repeatedly exceeded market expectations in its financial reports, especially in Q2 2024, where its total revenue reached $23.10 billion, a year-on-year increase of 14%. Among them, AI and Cloud Service businesses have grown the most rapidly, becoming the core drivers of the company’s growth. Driven by these key areas, Broadcom’s gross profit margin and Net Profit ratio have performed well. Broadcom expects that by 2025, the company’s total revenue will exceed $28 billion, with an annual growth rate of over 10%. Considering the rapid expansion of the AI field, Broadcom’s revenue growth in the coming quarters may further accelerate.

In addition, Broadcom has only missed profit expectations once in the past five years, and its strong profitability has provided stable returns for investors.

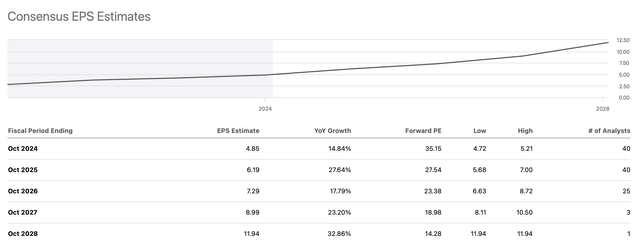

Broadcom’s earnings per share (EPS) reached $6.30 in 2023, an 18% increase from 2022, and is expected to exceed $7.00 in 2024, continuing to maintain strong growth. Analysts predict that Broadcom’s EPS will reach around $7.50 in 2026, with an annual growth rate of about 8-10%.

Stock price valuation: undervalued or overvalued?

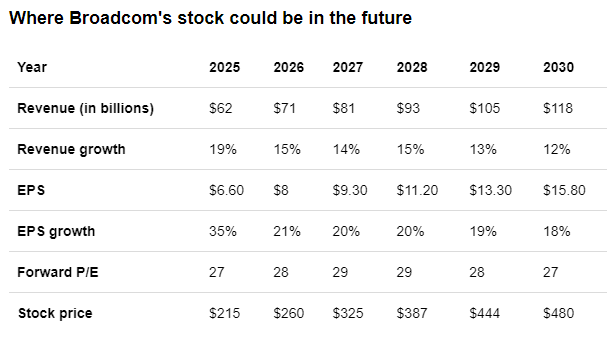

Broadcom’s current stock price is relatively stable in the market, with a stock price of about $170 in 2024. Based on Broadcom’s profit expectations and future growth potential, many analysts believe that the current stock price is relatively cheap. According to Bank of America’s valuation model, Broadcom’s target stock price is $215, an increase of about 27% from the current price. Depending on different growth scenarios, some more optimistic analysts believe that Broadcom’s stock price is expected to exceed $350 by 2027, and the long-term stock price may approach $450-500, mainly driven by the continuous growth of its AI business.

Broadcom’s Price-To-Earnings Ratio (P/E) is relatively low, with a current P/E of about 21 times, which is relatively cheap in the same industry. For a technology-leading company that occupies an important position in the AI and semiconductor fields, such a valuation appears relatively undervalued. If Broadcom’s AI business grows as expected and gross profit margin and profitability continue to improve, the future P/E may expand to 25-30 times, which will further push Broadcom’s stock price higher.

Future stock price trend: the possibility of breaking through $200

With Broadcom’s continued expansion in the AI field and VMware’s continued contribution, Broadcom’s stock price is expected to break through $200 in 2025 and may achieve a greater breakthrough in 2027. Depending on the company’s future financial performance, the stock price may approach $250 or even higher. If the growth of AI and Cloud Service businesses meets expectations, Broadcom’s stock price reaching $450-500 in 2030 is not impossible. This means that investors who hold Broadcom for the long term are expected to receive substantial returns.

Meanwhile, Broadcom’s high dividend return is also one of the important factors for investors to choose this stock. Broadcom has maintained a stable dividend policy, and it is expected that by 2025, Broadcom’s dividend will further increase, with a return rate of around 2-3%, which is attractive to investors seeking stable cash flow.

For investors who want to invest in Broadcom, BiyaPay’s multi-asset wallet provides convenience for seizing the opportunity of its rise. BiyaPay provides efficient and secure deposit and withdrawal services, supports US and Hong Kong stocks and digital currency transactions. Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to their personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Broadcom’s risks and challenges

Although Broadcom has shown strong growth potential in AI and semiconductors, investors still need to pay attention to some potential risk factors that may affect the company’s future financial performance and stock price trends.

Risk of high customer concentration

Broadcom’s revenue comes from a high proportion of sales from several major customers, especially companies like Apple, Huawei, and Microsoft. Fluctuations in demand from these major customers or changes in purchasing decisions for Broadcom products may have a significant impact on the company’s revenue. If any of these important customers reduce their purchasing volume or turn to competitors, it will directly impact Broadcom’s sales. Although Broadcom has taken measures to diversify its customer base, this customer concentration is still a risk point that needs attention.

Technological competition and market changes

Broadcom is in an industry with extremely fierce technological competition, especially in the fields of AI and semiconductors. Although Broadcom has leading advantages in multiple technology fields, competitors in the industry, especially companies such as NVIDIA and Intel, may launch competitive products in the next few years, weakening Broadcom’s market share. For example, NVIDIA’s leadership position in the AI accelerator field may pose challenges for Broadcom in some AI application areas.

In addition, with the continuous development of AI technology, changes in industry standards and customer needs may also bring challenges. Broadcom needs to continuously increase its R & D investment to maintain its competitiveness in technological innovation.

Acquisition integration risk

Broadcom’s acquisition of VMware is widely regarded as a successful strategic move, but the post-acquisition integration process remains challenging. VMware may encounter difficulties in integrating with Broadcom’s culture and operating model, affecting the realization of the synergy effect. If the integration process is not smooth, it may lead to delayed expected revenue growth or increased costs. In addition, Broadcom plans to conduct more mergers and acquisitions, and risks such as improper acquisition pricing and poor integration may have a negative impact on the company’s long-term development.

Broadcom Investment Prospects

Overall, Broadcom’s investment prospects for the next few years are very optimistic. With its leading position in the AI and semiconductor fields, especially the growth momentum brought by the acquisition of VMware, Broadcom is expected to maintain strong revenue and profit growth in the coming years. The rapid expansion of AI business will drive the overall growth of the company, and it is expected that by 2028, AI-related revenue may reach more than $35 billion.

Currently, Broadcom’s stock price valuation is relatively attractive. With the continuous development of the AI industry, Broadcom’s stock price is expected to rise significantly in the next few years. It is expected that the stock price may exceed $350 by 2027 and may approach $450-500 by 2030.

Therefore, for long-term investors, Broadcom is an attractive investment choice, especially with its strong growth potential. Investors can focus on the upcoming financial report information, seize short-term volatility opportunities, and find the right time to get on board.