- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Google Faces Antitrust Pressure, but Market Concerns May Be Overblown. Can the Stock Price Find New

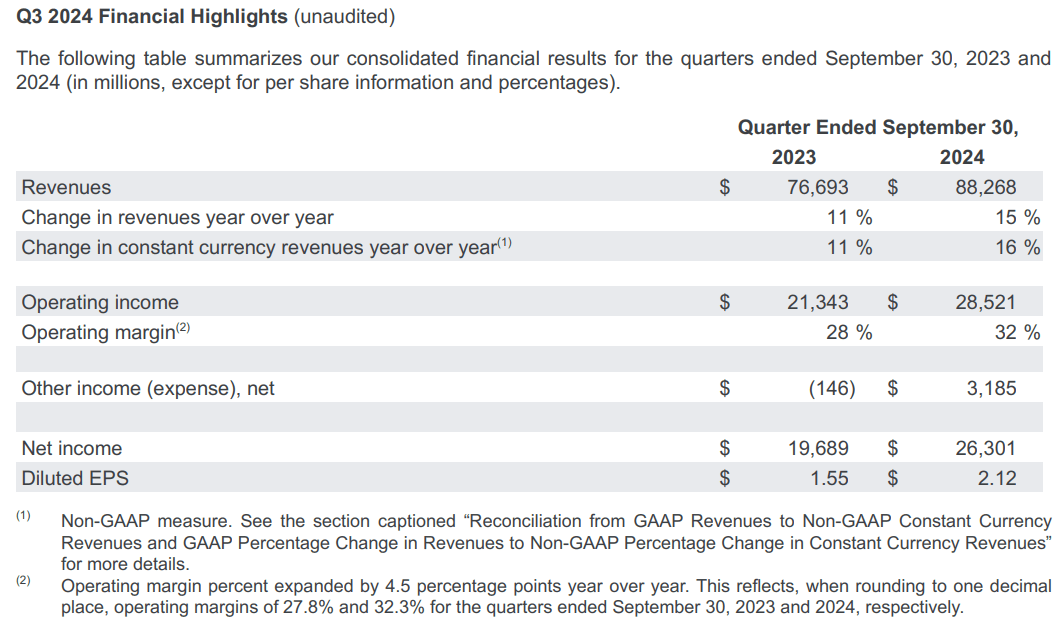

Google (GOOGL), as a global tech giant, has recently shown impressive performance that has excited many investors. Especially in the third-quarter earnings report, it not only delivered remarkable revenue growth but also demonstrated strong profitability.

Since September, the stock has performed well and outperformed the S&P 500 Index until mid-November. However, there are still some doubts in the market about Google’s future development and stock price potential. The news about the possible divestiture of Chrome, especially the discussions about antitrust lawsuits and whether Chrome will be split, has led to a decline of about 5% in the stock price since November 20.

Even so, Google’s fundamentals remain solid. Diversified businesses such as advertising, cloud computing, and artificial intelligence still provide strong growth momentum. So, in the face of these uncertainties, can Google continue to bring investment opportunities in the future?

Google’s Financial Performance and Growth Drivers

Google (GOOGL), as a leading global tech giant, has continued to show strong growth momentum in its latest financial performance. In the third quarter of 2024, Google’s revenue increased by 15.1% year-on-year to $883 billion, exceeding analysts’ expectations. This growth was mainly due to the steady expansion of the company’s various business segments, especially the outstanding performance in Google Cloud and YouTube advertising revenue.

Strong Growth in Core Business

Google’s advertising business remains the main driver of the company’s revenue.

In the third quarter of 2024, the revenue of Google Search and its related businesses reached $494 billion, with a year-on-year growth of 12.2%. This growth was due to the company’s increased application of artificial intelligence technology in advertising placement, which improved advertising efficiency and cost per click. In addition, the increase in advertisers’ spending and the growth of search queries have promoted the increase in paid clicks.

The YouTube advertising business also performed well, with a revenue growth of 12.2% year-on-year to $89 billion in this quarter. The growth of Google’s brand advertising and direct response advertising products reflects the trend of continuous increase in advertising spending. The success of YouTube provides strong support for Google’s future revenue growth.

Cloud Computing and Subscription Business

The revenue of Google Cloud increased by 35% in the third quarter to $114 billion, further consolidating Google’s position in the cloud computing market. Although Amazon AWS and Microsoft Azure lead in market share, Google Cloud is gradually attracting more customers and increasing product usage with its technological advantages and efficient operations.

According to CEO Sundar Pichai, Google Cloud is attracting new customers and driving a 30% growth in product adoption rate among existing customers, and the operating profit margin of this segment is also constantly increasing.

In addition, Google’s subscription and device business also showed strong growth, reaching $107 billion, with a year-on-year growth of 27.8%. This growth was due to the increase in YouTube paid subscribers and the growth in Pixel device sales, showing Google’s gradual expansion in the hardware and paid service fields.

Earnings per Share

Google’s diluted earnings per share (EPS) increased by 36.8% year-on-year to $2.12 in the third quarter of 2024, exceeding analysts’ expectations. This growth was attributed to the company’s excellent performance in cost control: the operating expenses in this quarter only increased by 7.9%, making Google’s net profit margin significantly increase to 29.8%. This excellent profit performance shows Google’s strong profitability and management efficiency.

With the improvement of the company’s revenue and operating efficiency, Google’s profitability is expected to continue to grow in the next few years. It is expected that Google’s earnings per share will continue to grow by 11.5% in 2025 and is expected to achieve a growth rate of 14.9% in 2026. These data not only prove Google’s strong financial performance but also further enhance investors’ confidence in the company’s long-term growth potential.

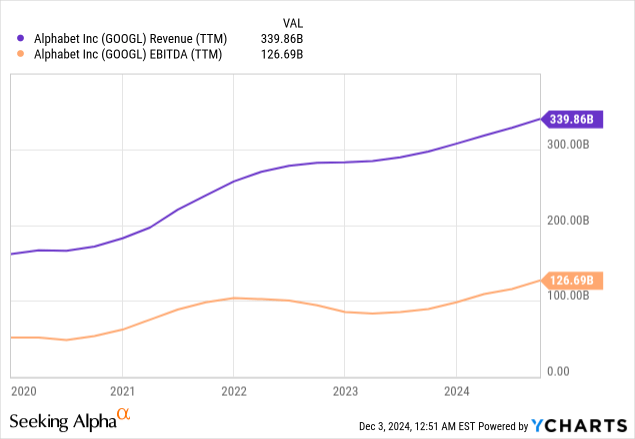

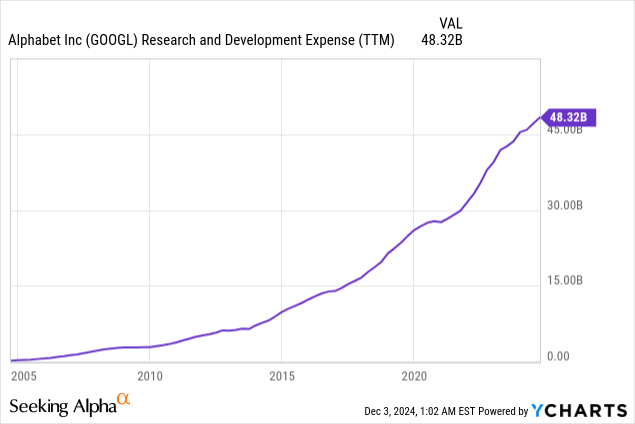

Google still has huge growth potential in the next few years. With the continuous progress of artificial intelligence technology, the integration of Google’s AI assistant Gemini and other AI tools will further promote the company’s business development, especially in the advertising and cloud computing fields. It is expected that these technological innovations will bring new growth momentum to Google and enhance its market competitiveness in the next few years.

In addition, Google’s dividend growth prospects are also worthy of attention. Although Google’s current dividend yield is low, the company is expected to significantly increase the dividend level in the next few years. It is expected that Google’s dividend will grow by 15% to 20% annually by 2025, which will bring rich returns to long-term investors.

The Risk of Divestiture Is Exaggerated

When conducting relevant analysis, I think we should first focus on the most critical and thorny issue of the potential divestiture of Google assets. In fact, the concerns caused by this issue are likely to be overblown.

On the one hand, this is not new news. As early as 2019, there were rumors that the Department of Justice wanted to split large tech companies. Now, as we are about to enter 2025, the Department of Justice has still not made substantial progress in this regard.

Moreover, Google is just one of the many tech giants in the US. Apple dominates the headphone industry, Meta and Amazon dominate the social network and e-commerce fields respectively, and Nvidia controls 88% of the GPU market. If these giants are forced to divest or split, it will set a dangerous precedent for the entire industry and may lead to an irreversible panic in the US stock market. This should not be the result expected by Trump’s “Make America Great Again” plan.

At the same time, Google has abundant funds and the ability to hire top-notch legal teams to defend its existing structure. Its long-term dominant position in the industry has made it face strict regulatory scrutiny, and its legal team must have accumulated rich experience in dealing with antitrust risks.

Therefore, overall, although the proposal of the Department of Justice seems to have a significant impact, the possibility of full implementation is low. So, more attention should be paid to Google’s solid fundamental situation.

From Google’s third-quarter press release, we know that its total revenue increased by 16.4% year-on-year to $883 billion, and most business lines grew steadily, demonstrating the strong strength of the business portfolio. What is more worth mentioning is that the operating income surged by 34% year-on-year, with a growth rate far exceeding that of revenue, and the operating profit margin increased by 450 basis points year-on-year, reflecting the management’s firm commitment to maintaining high cost efficiency.

In addition, Google’s core business - Google Search and other related businesses achieved a year-on-year growth of 12%, with an optimistic outlook. Thanks to the improvement of artificial intelligence capabilities, the digital advertising industry has accelerated growth from 2023 to 2024, improving advertising placement efficiency. According to the current trend, this growth is expected to remain strong in the next few years. Using artificial intelligence to provide digital advertising services has become an important competitive advantage of Google. The management also plans to continue to actively invest in R&D and capital expenditure in 2025. Therefore, Google’s core business is likely to thrive in the next few years. Artificial intelligence will help it move forward, and the management is also ready for innovation and expansion.

Not only that, Google’s revenue structure is becoming more and more diversified. Google Cloud accounted for 13% of the total revenue in the third quarter of 2024, an increase of 200 basis points compared with the same period last year, and the business grew by 35% year-on-year, far exceeding its main competitors. Although Google Cloud currently ranks third in the industry, after Amazon’s AWS and Microsoft’s Azure, its market share is expanding quarter by quarter.

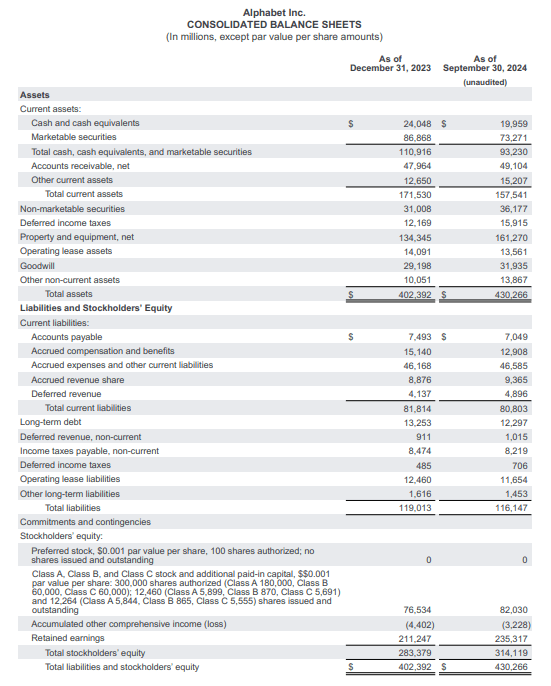

Finally, Google has obvious advantages in terms of finance compared with its main cloud computing competitors. It not only has the most abundant cash reserves among the three giants but also has a very low leverage ratio (relative to its market value). If we look at the net asset situation after deducting total debt, Google’s advantage is more prominent. Such a good financial situation has brought it a strong competitive advantage.

Fair Value Has Nearly 30% Upside

Since the last analysis of Google’s stock price, the total return of Google’s stock has reached 10%, on a par with the performance of the S&P 500 Index. Nevertheless, I believe that Google’s stock price still has significant upside potential.

Based on the latest financial data and expected earnings growth, my fair value estimate has risen from the previous level, which makes me believe that even though the current stock price has increased, Google is still an attractive investment opportunity.

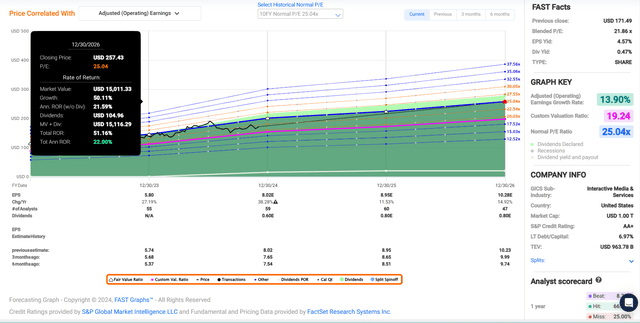

Google’s current P/E ratio is only 19.2, far below the average P/E ratio of 25 in the past decade. According to the data of FAST Graphs, Google’s annual compound growth rate (CAGR) of earnings per share in the past decade was 18.9%. In addition, FactSet’s long-term average annual growth rate is also around 18%, which further proves that Google has strong growth potential. In this case, a P/E ratio of around 25 is still a reasonable fair value level for Google.

Therefore, the current stock price is still significantly undervalued relative to the company’s future growth expectations.

As 2024 is coming to an end, about 8% of the remaining time and 92% of 2025 have not been reflected yet, which provides an expected growth of about $8.88 in diluted earnings per share (EPS) for Google in the next 12 months.

Based on this expectation, my fair value multiple model calculates a fair value of $222 per share, which is about 23% higher than the current stock price of $172. This means that Google’s stock price is currently at a discount of about 23% of the fair value.

If Google can maintain its current growth momentum and return to the fair value in the future, it is expected that the cumulative return of Google’s stock will reach 51% by 2026. This undoubtedly provides investors with a relatively rich return potential.

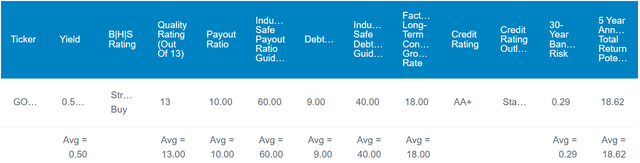

Not only that, Google also has a long dividend growth period in the future.

Although Google’s current dividend yield is only 0.5%, which may not attract those investors who prefer immediate passive income, for long-term investors like me, this is not a concern. I pay more attention to Google’s future dividend growth potential rather than short-term dividend returns.

Google’s current dividend yield seems low, and the expected dividend payout ratio of diluted earnings per share in 2025 is only 9%. This is far below the dividend payout targets of many rating agencies and peers (about 60%). However, precisely because of Google’s stable revenue and cash flow situation, I believe that the company will gradually increase the dividend level to attract long-term investors.

From the perspective of free cash flow, Google’s dividend payment ability is also reassuring. It is expected that Google’s free cash flow dividend payout ratio will be less than 11% by 2025, indicating that the company has sufficient cash flow to support shareholder dividends. In addition, according to the data of FAST Graphs, Google’s free cash flow per share is expected to grow by 19.2% to $7.34. Such growth can not only support the existing dividend payment but also provide room for future dividend increases.

In this case, I predict that Google may increase the quarterly dividend per share by 15% to 20% next year, which means that the dividend may reach $0.23 or $0.24. This dividend growth rate will greatly reward long-term shareholders while maintaining the stability of the company’s dividend payout ratio. Such healthy dividend growth is exactly what I expect to see in a high-quality company like Google, which can provide sustainable returns for long-term holders.

Risk Factors

In addition to antitrust risks, other challenges faced by Google are also worth noting. Although Google’s financial situation is more robust than that of Microsoft and Amazon, it still lags significantly behind in cloud computing market share. According to Statista, AWS accounts for 31% of the market share, and Azure has 20%. These two leaders not only have a far leading market share but also have strong investment in R&D and capital expenditure, and the competition is fierce. Therefore, it may be difficult for Google to surpass them in the short term in this field, and it may be a realistic situation to maintain the third position in the long term.

In addition, although Google’s global business has brought it broader market opportunities, it also exposes it to increasingly complex macroeconomic and geopolitical risks. About half of its revenue comes from outside the US, which means that political and economic uncertainties around the world have a significant impact on Google. For example, global market instability, trade frictions, or other geopolitical risks may affect Google’s revenue growth and operating costs.

Finally, in the field of generative artificial intelligence, although Google is in a leading position in technology research and development, it faces extremely fierce competition. Although its Gemini chatbot has received high attention, its market share has declined significantly since January 2024 compared with other competitors in the market.

However, the generative artificial intelligence industry is still in its infancy and has not been fully monetized. Therefore, Google still has sufficient time to adjust its strategy and catch up in this field.

Google is undoubtedly a true blue-chip stock. Its solid financial performance and continuous growth ability make it an excellent choice for long-term investment. The stable double-digit annual growth plus a low dividend payout ratio provides huge space for future dividend and stock price growth. In addition, Google’s excellent balance sheet provides a solid financial foundation for the company and ensures its competitiveness in the future.

Although market concerns about the possible divestiture of Chrome have caused panic and led to a short-term correction in the stock price, this also provides a more attractive buying opportunity for investors. Considering Google’s strong fundamentals and the market’s overreaction to these concerns, the current stock price still has about 32% upside potential compared with its intrinsic value.

Therefore, despite some short-term risks and market fluctuations, Google’s long-term investment value remains solid. For those investors seeking long-term stable returns, the current stock price is undoubtedly an opportunity worthy of attention.