- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Supermicro Computer's Stock Price Soars by 20%! Audit Results Reveal Crisis Thawing and Investor Con

Supermicro Computer (NASDAQ: SMCI) has been through a series of ups and downs in recent months and has witnessed numerous twists and turns. Previously, the audit issues and governance crisis surrounding it had once plunged investors into a state of extreme pessimism. It was just like the fluctuating emotions in the stock market, making people doubt whether it could survive this ordeal.

However, with the joining of new auditors, a series of internal reforms within the company, and the release of the results of the independent investigation, the market sentiment began to change, and the stock price started to recover.

The findings of the special committee revealed that although there were some minor operational mistakes, no improper conduct by the management or the board of directors was found. This news was like a reassurance pill, which not only relieved investors but also gradually restored market sentiment. Although the company’s financial transparency and compliance still face challenges, the pace of reform and shareholders’ confidence are gradually being restored.

Governance Crisis and the Restoration of Market Confidence

In the past year, SMCI experienced frictions between the management and the auditing institution. The most prominent one was its disagreement with Ernst & Young. In June 2024, Ernst & Young suddenly announced its resignation, citing concerns about the integrity of the company’s financial reports, especially the deficiencies in the internal control processes. This event led to significant fluctuations in SMCI’s stock price. Investors questioned the reliability of the company’s financial data one after another, and the market sentiment dropped sharply.

Ernst & Young’s resignation was not accidental. In fact, this event revealed some potential loopholes in SMCI’s financial audit and corporate governance. With the departure of the external auditor, the biggest problem faced by SMCI was not only how to restore the trust of the public and the market but also how to quickly address the deficiencies in internal governance and prevent such problems from recurring.

Results of the Independent Review

In response to the outside doubts about corporate governance, SMCI took prompt action and established an independent committee to conduct an internal review.

The committee hired external investigation agencies to conduct a detailed review of the company’s past management decisions and financial reports. After the results of the investigation came out, SMCI announced that although there were some mismanagement issues in governance, no malicious or illegal acts by the management or the board of directors were found, especially there was no evidence indicating that the company’s senior management intended to conceal financial problems.

The external legal counsel Cooley LLP and the forensic accounting firm Secretariat Advisors, LLC found that “there was no evidence of improper conduct by the management or the board of directors.”

As a result, the stock price soared immediately:

The results of this review initially restored the company’s trust, especially among those investor groups that had been shaken by financial issues.

In fact, the findings of the independent committee clearly stated that the company did not intentionally conduct financial fraud in its financial reports, which was a positive signal for the market, proving that the company was not in an irreversible crisis.

Reform Measures

To further rebuild market trust, Supermicro Computer, under the leadership of the new management team, began to implement a series of reform measures.

Firstly, the company hired BDO USA as its new auditor. This move marked an important step for SMCI in terms of financial transparency and independence. The addition of the new auditor provided higher confidence for investors and the market, especially since SMCI promised to submit financial reports on time and ensure the accuracy of all disclosed information.

In addition, SMCI conducted a comprehensive review of its internal governance, restructured the senior management team, and appointed a new chief financial officer, chief compliance officer, and general counsel. These new leaders will strengthen the internal control and supervision mechanisms to ensure more transparent and efficient corporate governance.

The implementation of these reform measures quickly alleviated the outside doubts about SMCI’s governance structure and also won back the support and trust of investors for the company. Although the company still faces certain short-term risks, especially those related to the progress of the audit and the compliance of financial reports, through strengthening the governance structure and improving transparency, SMCI is gradually restoring its reputation and trust in the market.

SEC Filing and Nasdaq Compliance Progress

Currently, Supermicro Computer (SMCI) remains listed on the Nasdaq and is dealing with the issue of submitting overdue financial reports.

The company has submitted a compliance plan to the Nasdaq and indicated that it will submit the 10-K annual report for fiscal year 2024 and the 10-Q quarterly report for the first quarter of fiscal year 2025 within the grace period stipulated by the Nasdaq. It is expected that these reports will be submitted in early 2025.

It is worth noting that SMCI has clearly stated that it will not restate the previously issued financial reports. This decision significantly reduces the risk that the company’s financial situation will be significantly affected and also verifies the prudent attitude of the special committee towards the company’s financial health. Nevertheless, SMCI is still in the process of regulatory review. Any delay in report submission or additional investigations may complicate the company’s compliance process.

However, the positive progress made by SMCI in governance reform and the company’s efforts in strengthening internal control and the governance framework have brought more confidence to the market. Given these changes, we can be cautiously optimistic about SMCI’s future. Especially after resolving major governance issues, the improvement in compliance and financial transparency has laid the foundation for the company’s stable growth in the future.

Impact of Audit Reports on Market Sentiment

The latest progress in the audit and compliance work is undoubtedly a positive signal for SMCI’s investors.

The work of the special committee and the new audit team clearly pointed out that the company does not need to restate the financial statements for fiscal year 2024, which means that the previous risks have been greatly reduced, and SMCI has successfully avoided a possible major financial crisis. For the market, such a positive conclusion helps restore confidence in the company’s financial health and brings hope to shareholders.

In the financial market, audited financial reports are usually regarded as the “default state” of a company. That is, the market generally believes that all listed companies’ financial reports comply with corresponding regulations and standards. Therefore, when a company faces the risks of auditor replacement or financial opacity, investors often doubt its future development. However, SMCI has confirmed through independent review that the financial problems are not serious, and the results put forward by the new audit team have further repaired the market sentiment. This has led to the recovery of SMCI’s stock price and restored investors’ confidence in its long-term development.

At this time, the significant undervaluation of SMCI’s stock price brings potential opportunities for investors. Especially with the stock price rebounding, SMCI is expected to experience an upward trend. For investors, seizing this potential opportunity is the key. With the smooth completion of the financial audit and the continuous improvement of the company’s governance structure, more stable shareholder returns may be achieved in the future.

What’s Next for SMCI?

In my opinion, SMCI’s stock price has not yet fully regained the market’s trust. There is a key catalyst in the future that may drive the stock price to rise further - that is, the upcoming SEC reports and Nasdaq compliance progress. It is expected that we may see significant progress in these aspects by the end of this year or before the end of January. Therefore, the current positive sentiment in the market for SMCI is actually just in its infancy.

Once these catalysts take effect, it is very likely that banks will revise their valuations of SMCI. It is worth noting that some banks have already canceled their price targets for SMCI, which is due to certain uncertainties, especially those related to the former auditor (as far as I know, Argus Research has made such a decision).

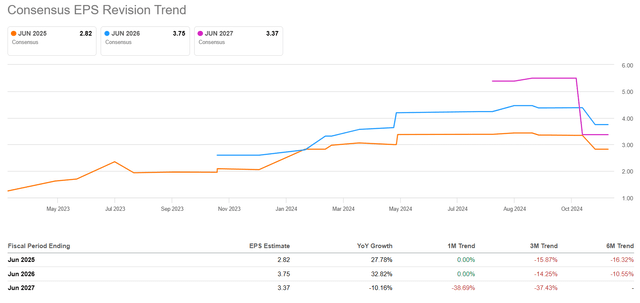

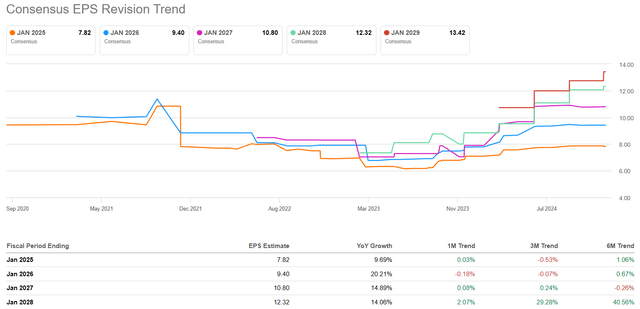

In the past 3 - 6 months, the earnings per share (EPS) expectations of SMCI have dropped significantly, which means that the company is currently in a relatively undervalued state, and the market’s expectation for its growth recovery is also relatively low. In other words, our current “base” is very low, providing fertile ground for future growth.

The reason why I am hopeful for a positive revision of the EPS data is that if you look at peer companies with a similar market positioning to SMCI, you will find that similar situations have occurred before. For example, Dell Technologies (DELL) has already achieved growth in its EPS expectations, although the initial expectations were not high. This situation tells us that SMCI may also experience a similar rebound in the future.

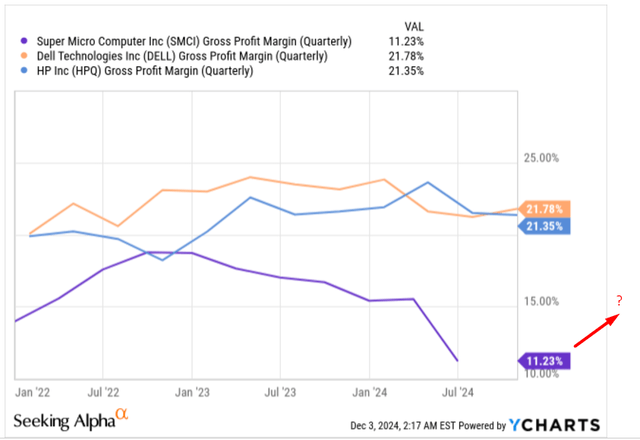

In addition, the appointment of SMCI’s “new CEO” will have a positive impact on the company’s operational processes and help improve the profit margin.

After all, SMCI’s current gross profit margin is much lower than that of Dell or Hewlett-Packard (HPQ). This was not a big problem two or three years ago, but it has become a problem that must be solved now. Although the financial guidance given by SMCI in early November seemed a bit weak, I still think that with a lower comparison base and the lag in market expectations, SMCI has an opportunity to make certain progress in terms of the gross profit margin.

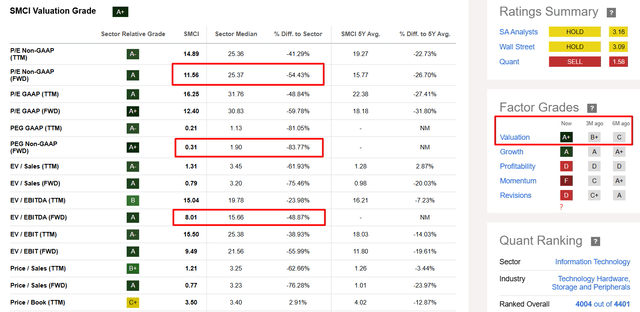

The continued undervaluation of SMCI remains a significant highlight. Although the stock price rose by nearly 27% in yesterday’s trading day, from a valuation perspective, SMCI still looks very cheap. According to SA’s quantitative system, SMCI’s valuation grade has been upgraded from “B+” three months ago to “A+”. This means that SMCI is now one of the most attractive stocks in the industry, and its trading price is 50 - 80% lower than its valuation multiple for next year.

Overall, I think SMCI is still worth “buying”. Its road to recovery has not ended but has just begun. If you make an investment at this moment, you are likely to experience a strong growth in the future.

Risks Faced

Firstly, the market’s investment confidence is based on the premise that the recent independent review and governance reform can fully restore market trust. If the U.S. Securities and Exchange Commission (SEC) or the Nasdaq discovers new compliance issues or if the company delays the submission of financial reports again, the stock price may come under pressure.

Moreover, although the new leadership is in place, it may take some time to see substantial operational improvements. If the company fails to implement governance reforms or improve the profit margin as planned, the market’s trust in its long-term prospects may also be shaken.

In addition, the competitive environment in which SMCI operates is also worth attention. Although the company’s current valuation is relatively attractive, its gross profit margin still lags behind that of Dell and Hewlett-Packard. If SMCI fails to bridge this gap, its recovery may encounter obstacles.

Overall, although the outlook is optimistic, these risk factors may limit SMCI’s stock market performance.

Overall, SMCI’s prospects are gradually showing potential in the process of governance reform and the restoration of financial transparency. Although the market’s confidence in it has been severely tested in the past few months, as audit and compliance issues are gradually resolved, the company is expected to embrace a more stable future. Especially when the financial statements are not required to be restated, the significant undervaluation of SMCI’s stock price provides potential opportunities for investors. With the new leadership in place and the gradual improvement in operational efficiency, shareholder returns are expected to achieve stable growth.

However, all of this depends on whether the company can continuously implement its governance reforms and solve the profit margin problem. If the company makes breakthroughs in these aspects, the recovery of SMCI’s stock price will be further accelerated. But if it encounters new compliance issues or the reform effect is slow, the restoration of market confidence will also face challenges.

Therefore, although the outlook is promising, investors still need to be vigilant about potential risks. The current low valuation provides a relatively attractive investment window, but the key to success lies in whether the company can fulfill its commitments and effectively respond to market competition.