- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

With the trio of AWS, e-commerce, and advertising, can Amazon embrace the next leap with AI and inno

Amazon (AMZN) is not only the world’s largest online retailer, but also an important leader in the fields of Cloud Services and artificial intelligence (AI). With its strong AWS and growing advertising business, Amazon has shown remarkable financial performance in the third quarter of 2024. With the continuous advancement of technological innovation and strategic layout, Amazon not only remains the leader in the e-commerce industry, but also occupies a key position in the rapid development of Cloud Services and AI.

Next, we will analyze Amazon’s latest financial performance, growth momentum, and latent risks in detail to see its future prospects as an investment target.

Amazon’s financial performance: solid growth and improved profitability

Amazon’s financial performance in Q3 2024 was impressive, demonstrating its strong momentum for continued growth. The company’s total revenue increased by 11% YoY to $159 billion, remaining the leader in the global e-commerce and Cloud Service industries. What’s even more impressive is that Amazon’s operating revenue increased significantly by 55.6% YoY, reflecting significant improvements in cost management and Operational Efficiency. Although Amazon’s e-commerce business is still an important source of revenue, its core profit driver - Amazon Web Service (AWS) and expanding advertising business have become the main pillars of the company’s profit growth.

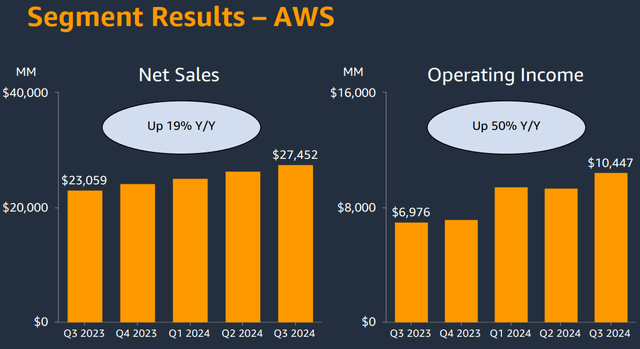

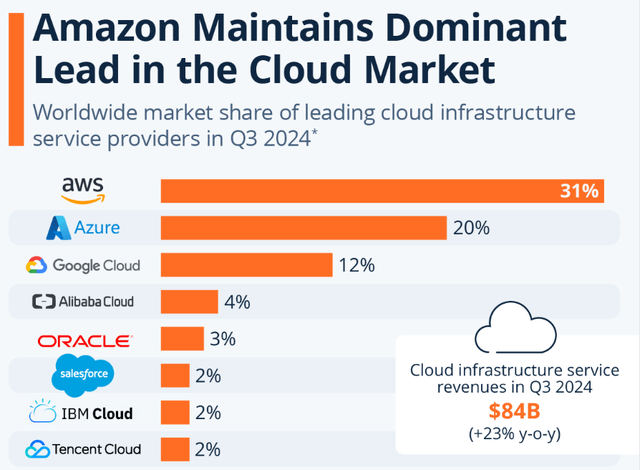

Among them, AWS is still the biggest highlight of Amazon’s financial performance. As the leader in the global Cloud Service market, AWS achieved a revenue growth of 19% in the third quarter, occupying a 31% share of the global cloud market. Due to AWS’s gross profit margin being much higher than Amazon’s overall level, it provides the company with continuous high profit support. The growth of the Cloud Service business, especially the deep cooperation between enterprises and government departments, further consolidates Amazon’s leading position in the global cloud infrastructure field.

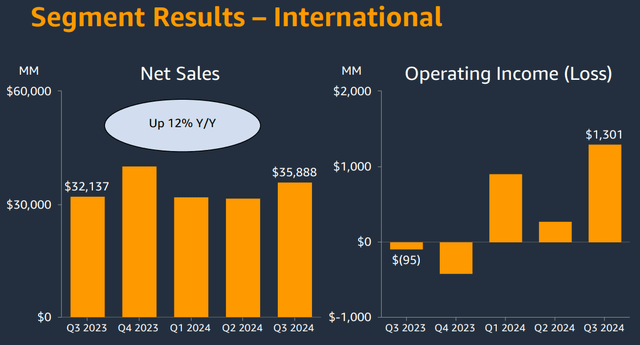

Meanwhile, Amazon’s e-commerce business has not fallen behind. The North American and international e-commerce markets have contributed to stable revenue growth. Especially in the North American market, the third quarter revenue increased by 31% year-on-year, demonstrating strong consumer demand and Operational Efficiency. The international business has gradually recovered profitability and become an important supplement to Amazon’s global layout. Although the gross profit margin of the e-commerce business is relatively low, it is still an important driving force for Amazon’s overall business growth, especially during the holiday sales season.

In addition, Amazon’s digital advertising business also performed outstandingly in the third quarter, with advertising revenue increasing by nearly 19% year-on-year. With the continuous exploration of the data advantages of e-commerce platforms, Amazon’s advertising business is gradually becoming a new growth engine for the company. With accurate user data and advertising delivery capabilities, Amazon’s competitiveness in the digital advertising market is increasing, further enhancing the diversity of its revenue sources.

Amazon’s financial performance not only reflects its strong growth in multiple fields such as e-commerce, Cloud Services, and advertising, but also demonstrates its continuous progress in cost control and operational optimization. With the continuous iteration of technological innovation and business models, Amazon’s future growth potential still deserves high attention from investors. BiyaPay’s multi-asset wallet provides convenience for seizing its growth opportunities.

BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currency. Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to their personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help investors seize market opportunities in a timely manner at critical moments, ensuring fund safety and liquidity needs.

Amazon’s Technological Innovation: The Future of Cloud Services and AI

Amazon has always regarded technological innovation as the core of its competitive advantage, especially in the fields of Cloud Services and artificial intelligence (AI). The strong growth of AWS is not only due to the continuous increase in market demand, but also inseparable from Amazon’s continuous investment in technology. According to the financial report for the third quarter of 2024, Amazon’s capital expenditure increased by 88% year-on-year, reaching $21.30 billion, mainly used to build new data centers and technology infrastructure. This huge investment will further enhance its leading position in the global Cloud Service market and lay a solid foundation for future AI development.

Cloud Service, as Amazon’s profit pillar, has entered a stage of rapid development, especially driven by generative AI. With the breakthrough of AI technology, Amazon has accelerated its layout in this field. AWS has not only expanded its cooperation with industry giants, but also launched a series of new tools for developers and enterprises to meet the growing demand for AI. For example, Amazon has reached strategic cooperation with companies such as Lumen Technologies, Box, and Smarsh, and the addition of these partners has brought more AI solutions and Cloud as a Service demand to AWS.

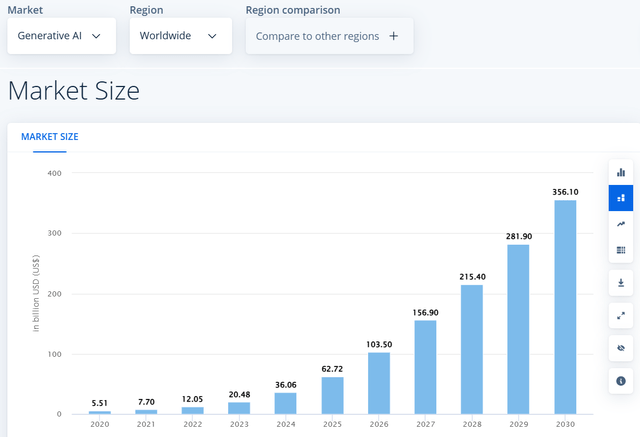

In addition, Amazon’s investment in hardware and data center construction is also providing support for its technological innovation. In the third quarter of 2024, Amazon announced that it will build a new data center worth about $2 billion in Sunbury, Ohio, US. This project will further enhance AWS’s infrastructure coverage in the global market and provide stronger computing power support for generative AI and big data analysis. With the AI industry expected to achieve a compound annual growth rate of 46.5% by 2030, Amazon’s increased technology investment at this time undoubtedly provides strong growth momentum for its long-term development.

Amazon’s investment in AI is not only reflected in the expansion of AWS, but also applied in its e-commerce and advertising businesses. For example, Amazon’s Shopping Recommender system and advertising precision delivery technology rely on powerful AI algorithms to improve User Experience and advertising effectiveness. This technology-driven innovation enables Amazon to benefit from multiple business areas at the same time and lays a solid foundation for future growth.

Amazon’s technology innovation strategy revolves around Cloud Services and AI. The increase in investment and technological breakthroughs provide strong support for the company’s future growth. With the rapid development of generative AI, Amazon is expected to further consolidate its leading position in the global technology industry.

Amazon’s e-commerce and advertising business: dual engines of stable growth

Although AWS is Amazon’s core profit engine, its e-commerce and advertising businesses also provide strong support for the company. Especially in a fiercely competitive market environment, Amazon still maintains a leading position in the industry with its strong infrastructure and innovative model.

E-commerce business: global layout and sustained growth

Amazon’s e-commerce business is still its largest source of revenue, especially in North America, where e-commerce revenue increased by 31% year-on-year in the third quarter. This growth rate is due to the recovery of consumer demand and Amazon’s continuously optimized logistics system. Amazon invests in new distribution centers worldwide, especially the next-generation distribution center opened in Louisiana in 2024, using AI and robotics technology to improve Operational Efficiency. Despite its low gross profit margin, Amazon occupies an important position in the global e-commerce field, especially in the US market, where it is still the preferred platform for consumers.

Advertising business: a rapidly growing new source of profit

Amazon’s advertising business has grown rapidly in recent years and has become an important part of its revenue. In the third quarter of 2024, advertising revenue increased by nearly 19% year-on-year, far exceeding the industry average. With its huge e-commerce platform and accurate data, Amazon provides Personalized Ad solutions, attracting a large number of advertisers. With the enhancement of ad platform user stickiness and platform effects, it is expected that Amazon will further expand its market share in the fields of mobile advertising and video advertising.

Amazon Stock Potential: Intrinsic Value and Future Return Forecast

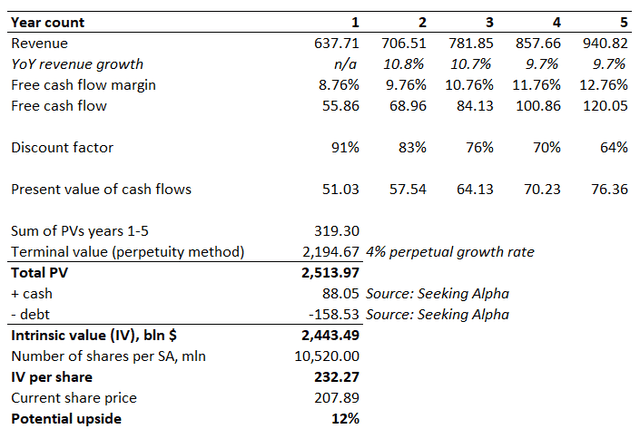

In order to evaluate the investment value of Amazon, we estimated its intrinsic value based on the discounted cash flow model (DCF), combined with growth assumptions and Technical Fundamental analysis, and gave a target price and upward potential.

DCF Model Analysis: Estimation of Intrinsic Value

The Discounted Cash Flow Model (DCF) relies on predicting future cash flows and setting Universal Discount Rates. Amazon’s cost of equity is 9.47%, which reflects its relatively stable market risk.

In terms of revenue assumptions, we expect Amazon to maintain stable growth in the coming years. The strong performance of businesses such as Cloud Services, AI, and e-commerce supports this assumption. According to the Q3 2024 financial report, Amazon’s free cash flow (FCF) profit margin is 8.76%, and the company is expected to have sufficient room for further expansion. We assume that the company’s revenue will grow by 1% annually and set a long-term growth rate of 4%.

Based on these assumptions, our DCF model estimates Amazon’s intrinsic value at $232 per share. Considering the current relatively low stock price, we believe that Amazon’s stock still has a 12% upside potential.

Growth assumptions and market expansion

Amazon’s growth mainly comes from the following aspects:

- Cloud Services (AWS): Continued to expand market share, especially for large enterprise and government customers.

- E-commerce business: Despite facing competition, Amazon’s e-commerce revenue will continue to grow with its strong brand and logistics system.

- Advertising business: The rapid growth of Amazon advertising will become an important driving force for performance in the coming years.

These factors support our expectation of 4% annual growth for the company in the future.

Technical Fundamental Analysis: Stock Price Buy Signals

From a Technical Fundamental perspective, Amazon’s RSI index is currently below 60, far below the high point of the stock price in 2024, indicating that there is still room for the stock price to rise. At the same time, Wall Street analysts have positive expectations for Amazon, generally optimistic about the potential for an increase of about 13%.

Amazon risks and challenges: external pressures and the competition landscape

Although Amazon has shown strong growth in multiple areas, it still faces macroeconomic, competitive, and internal operational risks in the future investment process.

Macroeconomic pressures: a strong dollar and a global slowdown

Amazon, as a global enterprise, is under dual pressure from the strong US dollar and the global economic slowdown. In Q3 2024, the US dollar index rose nearly 5%, and the strong US dollar may compress Amazon’s revenue in the international market, especially in Europe and Asia. The slowdown in global economic growth and the decrease in consumer spending may also affect the e-commerce business. Although Amazon has diversified its business through Risk Diversification, short-term growth may still be affected.

Competitive Pressure: The Challenge between Microsoft and Google

In the field of Cloud Services, Amazon faces fierce competition from Microsoft and Google. Microsoft Azure and Google Cloud continue to expand their market share, especially in enterprise customers and government departments. Microsoft’s strong technology ecosystem and financial advantages have intensified the competitive pressure on AWS. Google Cloud’s advantages in Data Analysis and AI have also made the market pattern more complex, and Amazon may need to increase strategic investment to meet the challenges.

Internal challenges: logistics and cost management

Amazon has always been in a leading position in e-commerce and logistics, but with business expansion, logistics management and cost control are facing pressure. Although it continues to invest in new distribution centers and warehousing facilities to improve efficiency, it also brings capital expenditure pressure. In addition, changes in consumer demand require Amazon to continuously optimize platform technology and services, otherwise it may face the risk of slowing growth.

In summary, Amazon has maintained steady growth with strong innovation capabilities and diversified businesses, but still faces macroeconomic pressure, fierce competition landscape, and internal operational challenges. The strong US dollar, global economic slowdown, and competition from Microsoft and Google may affect its financial performance in the short term. At the same time, the pressure of logistics and cost management also requires the company to make more strategic adjustments in expansion and efficiency improvement. Nevertheless, with its leading position in e-commerce and Cloud Services, as well as continuous investment in innovation, Amazon still has strong long-term growth potential and is worth investors’ attention.