- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

US stocks hit a new historical high, with an expected 11% increase next year! How to seize the oppor

Last Friday, the S & P 500 and Dow Jones Industrial Average in the US stock market set new closing records. As of now, the year-to-date gains of the three major US stock indexes - Dow Jones, Nasdaq, and S & P 500 - are 19.16%, 28.02%, and 26.47%, respectively. These impressive data not only demonstrate the strong performance of the US stock market, but also make investors wonder if the future trend of the US stock market will still be strong?

Recently, Goldman Sachs also released the 2025 US stock market outlook and investment strategy report. Today, we will review the key information in this report, including the 2025 US stock market performance forecast, investment directions worth paying attention to, and stock list, covering hot topics such as the overall market index, the seven giants of the US stock market, and the AI field. Let’s see how it helps our investment decisions.

How will the US stock market perform in the future?

First, let’s take a look at the question we are most concerned about: how will the US stock market perform in 2025?

Analysis shows that the current valuation of the US stock market is already relatively high, so they believe that the driving force for the rise of the US stock market in 2025 will not come from the expansion of valuation, but from the improvement of corporate profits.

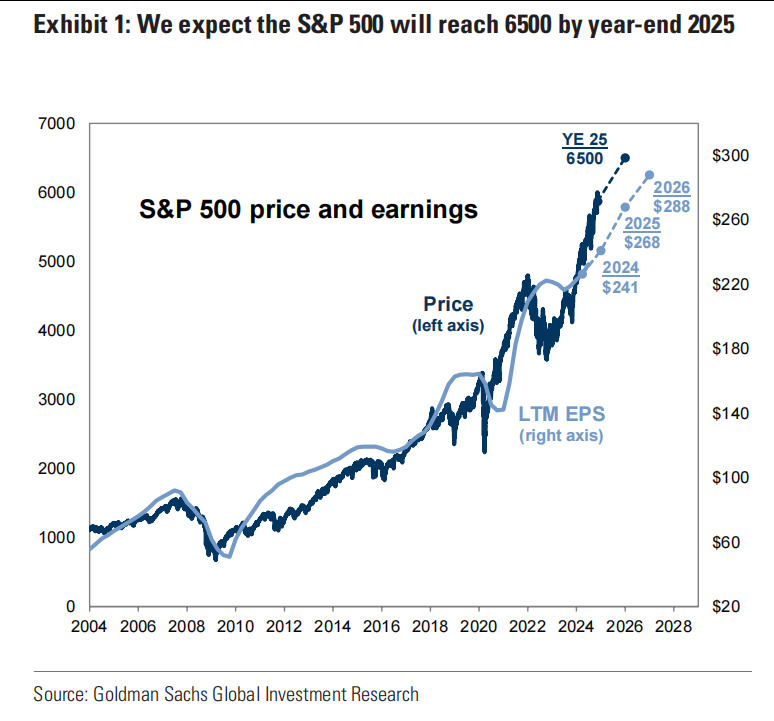

It is expected that the S & P 500 index will rise to 6,500 points by the end of 2025, with a yield of 11%. In terms of corporate profits, Goldman Sachs’ predictions in the past two years have been relatively accurate. This time, Goldman Sachs believes that the net profit of the S & P 500 index in the US stock market in 2025 and 2026 will increase to $268 and $288 per share, respectively, an increase of 11% and 7%.

As for valuation, Goldman Sachs estimates that the dynamic Price-To-Earnings Ratio by the end of 2025 will be 21.5 times, slightly lower than the current 21.7 times. It should be noted that the Price-To-Earnings Ratio of 21.7 times is considered a high of 93% percentiles in the history of the US stock market. Therefore, it is very normal for the US stock market to experience a pullback during the process. Goldman Sachs also suggests that investors should seize the opportunity to layout during low market volatility or hedging the downside risk of the stock market through options.

Can the seven giants continue to exert their strength?

After talking about the stock market, let’s take a look at Goldman Sachs’ judgment on the seven giants.

Starting from the end of 2022, the return rate of the seven giants in the US stock market has reached 148%. If we exclude the seven giants from the S & P 500 index (which we call S & P 493), the return rate of S & P 493 during the same period is only 35%. The seven giants in the US stock market have contributed 57% of the increase in the S & P 500 index in the past two years.

However, it can also be seen that in the past two years, the excess return rate of the seven giants compared to the S & P 493 has become lower and lower, and the yield gap since the beginning of 2024 has narrowed to 22%. Goldman Sachs believes that the seven giants will still outperform the S & P 493 in 2025, but the yield gap will further narrow to 7%.

The reason for making this judgment is that the profit growth rate of the seven giants is slowing down, and the rapid growth of profits is the core driving force behind the rapid rise of the seven giants’ stock prices in the past two years. As can be seen from the chart, the profit growth rate gap between the seven giants and S & P 493 is gradually narrowing, which also means lower excess returns.

From the perspective of valuation, whether it is the seven giants or the S & P 493, the dynamic Price-To-Earnings Ratio is at a historically high level. In absolute terms, the seven giants are obviously higher. However, as we mentioned earlier, this high valuation is more due to high profit expectations. Therefore, in the case where valuation is difficult to continue to expand, US stock investment in 2025 should return to its roots and focus on the profitability of enterprises.

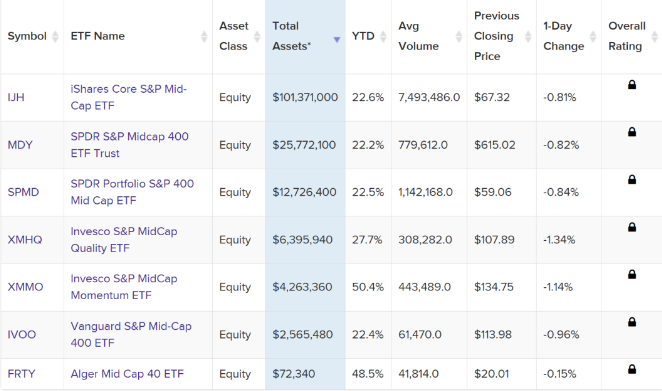

In addition, the report shows that the valuation of the S & P 400 Mid-Cap Stock is significantly lower than that of the S & P 493, and it is more likely to benefit from the stable expansion of the US economy in 2025.

Speaking of ETFs that track the SP400 mid-cap stock index, IJH is worth paying attention to. It has a large scale, strong liquidity, and low fees, making it a good investment choice.

Besides IJH, there are also some other related ETFs to choose from, which have been compiled into the following table for your reference.

How to choose AI investment

Next, let’s take a look at Goldman Sachs’ judgments on AI investment in the US stock market in 2025, and what we can refer to and learn from.

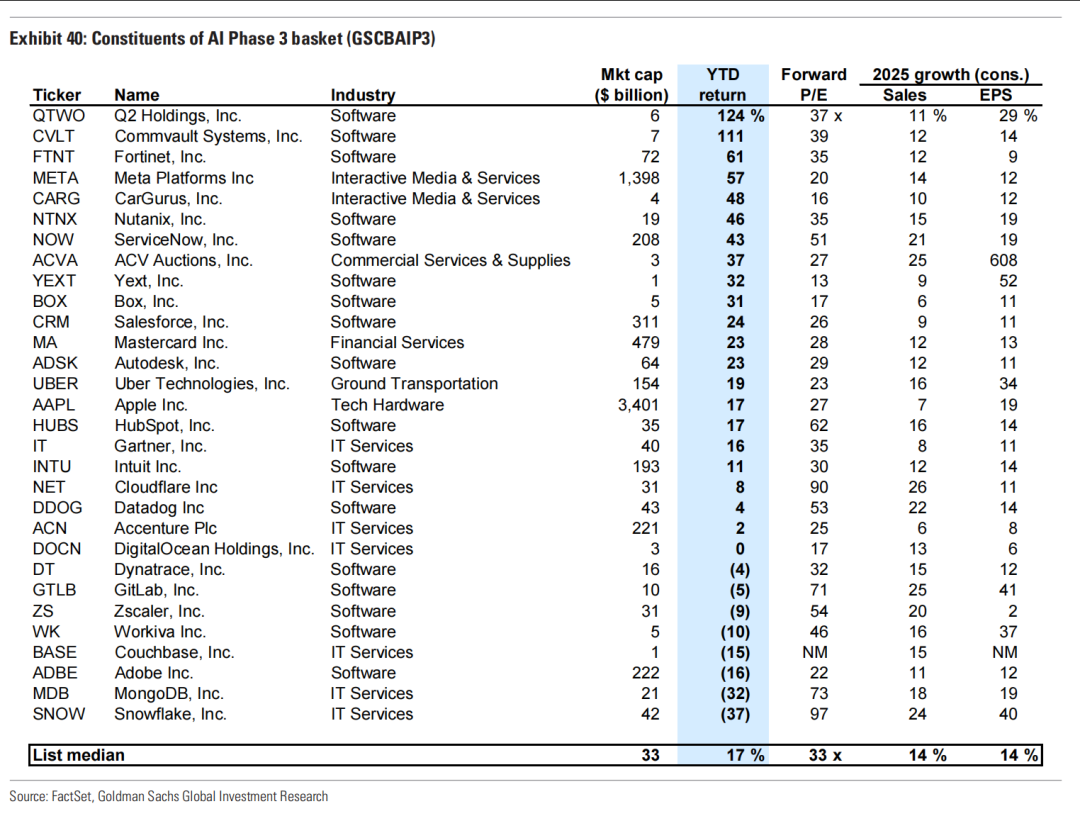

Goldman Sachs divides AI investment into four stages: the first stage is companies like NVIDIA, which are the most obvious companies that can immediately benefit from AI; the second stage is mainly companies with artificial intelligence infrastructure, such as semiconductor companies, Cloud as a Service providers, Data center REITS, hardware and equipment companies, etc.; the third stage should focus on companies that can monetize AI and create more revenue for the company; the fourth stage includes companies that can fully utilize AI technology to increase productivity and revenue after its widespread application.

Goldman Sachs believes that investors who are optimistic about the development prospects of the AI industry can lay out stocks in the third stage of AI investment in advance. Although stocks in the second stage of AI investment may still perform well, the valuation is already high, and the capital expenditure growth rate of large Cloud as a Service providers is gradually slowing down. Therefore, the profit growth rate of these companies may not be as fast as before.

In contrast, the current risk-return ratio of stocks in the third stage is obviously more attractive, and the market’s expectations for them are not so high at present.

These third-stage AI stocks have gradually attracted market attention. Since early October, their returns have been 12%, higher than the 0% of second-stage stocks and 2% of the equal-weighted S & P 500 index.

Goldman Sachs’ third-stage AI investment targets mainly include software and service companies. Below is a summary table for your reference.

Which industries are worth paying attention to?

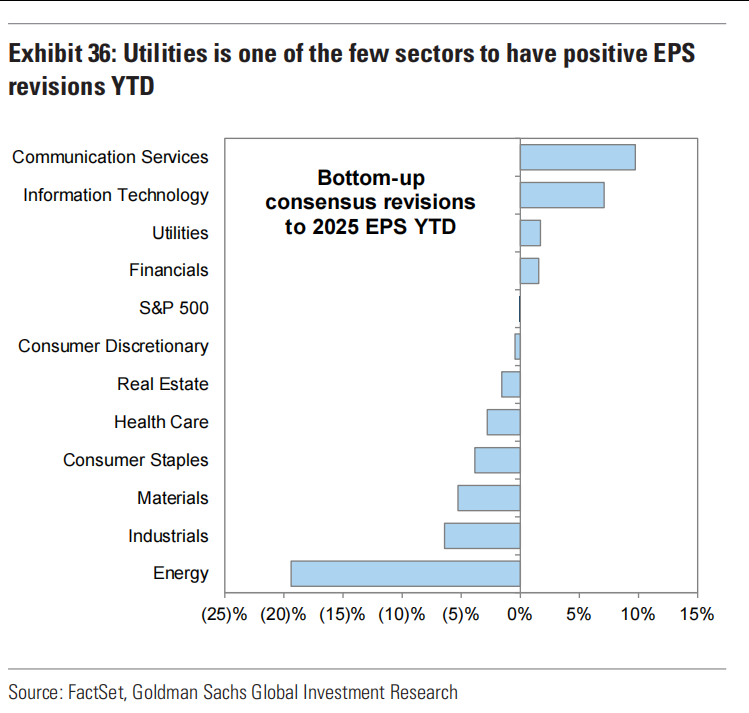

Finally, let’s take a look at the reference for industry allocation in 2025 . Goldman Sachs believes that the market has already taken into account many expectations that the US economy will continue to maintain strong growth next year, and suggests overmatching the software and services, materials, and utilities industries.

The software and service industries mainly benefit from the development of AI. We have already provided a more detailed introduction earlier, so we will not repeat it here.

The logic of the materials industry is more inclined towards a reversal of difficulties. In this round of cyclical rebound, materials stocks have clearly underperformed, but Goldman Sachs believes that this undervaluation is unsustainable. Excessive pessimism pricing has increased the possibility of a rebound in the materials industry in the next 12 months.

As for the logic of the public utility industry, it is due to its strong defensive properties, which can better hedging risks. Moreover, this industry is one of the few industries that has experienced an EPS increase since the beginning of the year. As can be seen from the chart, the top two industries with an EPS increase are all growth industries related to AI, and the third place is public utilities.

How investors can seize the opportunity

Combining with the previous introduction, we mentioned some related ETFs and US stock investment targets that are worth everyone’s attention. We should lay out in advance and seize investment opportunities. Speaking of investment, what kind of investment platform should we choose to avoid possible risks?

It is recommended to use the global multi-asset trading wallet BiyaPay for trading, which provides a convenient channel for quick asset allocation. For investors who are also optimistic about the aforementioned options, BiyaPay not only allows you to directly purchase these stocks, but also helps you capture the best buying opportunities through its efficient market monitoring tool. If you are worried about short-term volatility risks, you can also track and analyze stock price dynamics in real-time on the platform to find opportunities.

In addition, BiyaPay also plays the role of a deposit and withdrawal tool for US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, and then quickly withdraw it to your bank account or transfer it to another brokerage account for stock purchases. The fast arrival and unlimited characteristics of this platform can ensure that you will not miss any investment opportunities in the dynamic and changing market.

Overall, although the overall valuation of the US stock market is high, the future rise depends more on the growth of corporate profits rather than valuation expansion. Especially in the context of the slowdown in the profit growth rate of the seven giants, investors should pay attention to companies with sustained profit growth. Goldman Sachs suggests investing in AI in stages, especially in stocks in the third stage, because their risk-return ratio is relatively more attractive. In addition, industries such as software and services, materials, and utilities are worth paying attention to, benefiting from the development of AI or economic rebound. Overall, future investment strategies should focus on profit growth and industry potential, while using platforms such as BiyaPay for market monitoring to seize the best investment opportunities.