- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Is It the Perfect Time to Enter as Qualcomm's Stock Price Stagnates Amid the ARM Dispute and the Sha

We have paid close attention to Qualcomm (QCOM) on multiple occasions and explored its significant investment potential as a diversified semiconductor stock. Qualcomm’s strong growth prospects in multiple fields such as mobile phones, automobiles, broadband, AR/VR/XR, and AI CPUs based on the ARM architecture have made it a leader in the technology industry. Due to its relatively lower valuation compared to its peers, healthy balance sheet, and strong long-term growth expectations, we have repeatedly reiterated its “Buy” rating.

However, despite Qualcomm’s financial report performance in the fourth fiscal quarter of 2024 exceeding expectations and the company’s management being confident about the long-term prospects in fiscal year 2029, the performance of its stock in the stock market has not been as strong as expected.

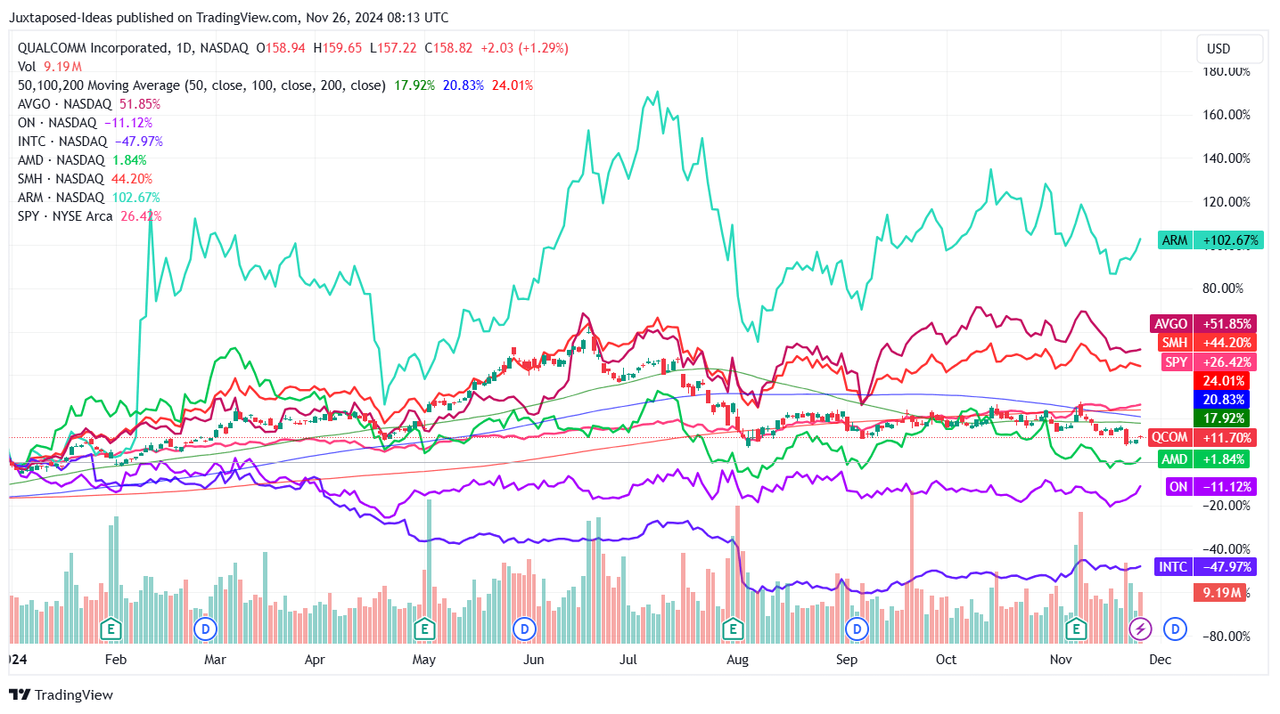

Since then, Qualcomm’s stock price has lagged behind the broader market (the broader market has risen by +7.7%, while Qualcomm’s has fallen by -7.4%) and has underperformed many other diversified semiconductor peers. One of the factors affecting the stock price performance stems from uncertain events including the ARM license dispute and the potential Intel (Intel) acquisition rumors, which have had a significant impact on investor sentiment.

Excellent Finances but Unresponsive Stock Price

In the fourth fiscal quarter of 2024, Qualcomm’s financial report brought quite a surprise, performing even better than the market had expected. However, despite its outstanding performance, the stock price has not received the due rewards and has been affected by some adverse factors.

Financial Performance

Looking at the situation in the fourth fiscal quarter ending on September 29, 2024, Qualcomm’s revenue reached $10.244 billion, growing by 19% compared to the same period last year. This growth rate is quite impressive. Moreover, its net profit was $2.920 billion, and earnings per share were $2.69, which increased by a staggering 96% compared to the same period last year. Such achievements are already remarkable.

Furthermore, each business segment has also performed quite outstandingly. Take mobile phone chips, for example. Its sales increased by 12% to reach $6.1 billion, indicating that Qualcomm still has significant influence in the mobile phone chip market.

The automotive business saw even faster revenue growth, reaching $899 million with an 86% growth rate, and it has maintained growth for five consecutive quarters. The revenue of the Internet of Things business was $1.68 billion, with a year-on-year growth of 22%.

However, despite such excellent performance, Qualcomm’s stock price has not risen as expected. Since the beginning of 2024, Qualcomm’s stock price has fallen by 7.4%, significantly lagging behind the broader market and other diversified semiconductor peers.

Management’s Optimistic Expectations

Qualcomm remains optimistic about the first quarter of fiscal year 2025. It is expected that the revenue in this quarter will be around $10.9 billion, with a sequential growth of 6.4% and a year-on-year growth of 9.8%. Earnings per share (EPS) are expected to be $2.95, with a sequential growth of 9.6% and a year-on-year growth of 7.2%. This expectation is based on the strong performance in fiscal year 2024 and reflects the management’s confidence in the future. It is expected that in fiscal year 2025, revenue growth and profit growth will be 8.6% and 21.2% respectively.

This indicates that Qualcomm’s management is optimistic about the outcome of the ARM license dispute and is full of confidence in the company’s future development.

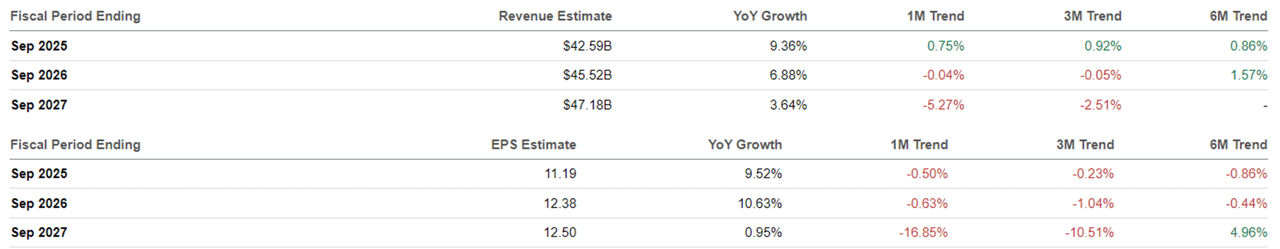

Now we think that the market’s expectations for Qualcomm are somewhat conservative. By fiscal year 2027, QCOM’s revenue and profit growth rates may far exceed the current expectations, and the compound annual growth rates are expected to reach 6.6% and 6.9%. In particular, Qualcomm’s management is confident about the growth prospects in the next five years and expects to achieve breakthroughs in multiple key areas.

The management expects that by fiscal year 2029, automotive-related revenue will reach $8 billion, growing at a compound annual growth rate (CAGR) of 22.4% from $2.91 billion in fiscal year 2024.

By fiscal year 2029, the revenue of the Internet of Things is expected to reach $14 billion, including $4 billion in personal computer revenue, $2 billion in mixed reality revenue, $4 billion in industrial revenue, and $4 billion in other areas of the Internet of Things (compared to $5.42 billion in fiscal year 2024, with a compound annual growth rate of 20.9%).

The management expects that by 2030, the overall target market size will grow to $900 billion, which means that Qualcomm will have huge growth potential in the next few years and further consolidate its market leadership position.

ARM Legal Dispute and Acquisition Rumors

The license dispute between Qualcomm and ARM originated from the process of technological integration after Qualcomm’s acquisition of Nuvia. This acquisition has led to profound changes in Qualcomm’s technological layout in the field of chip design.

As a high-performance processor company, Nuvia’s designs may conflict with ARM’s existing license terms. Therefore, when Qualcomm integrates Nuvia’s technology, it may need to re-evaluate its long-term license agreement with ARM.

The core issue of this dispute lies in ARM’s request for Qualcomm to re-evaluate the existing license agreement and even the possibility of canceling the existing agreement. This controversy has brought uncertainty to the market. Especially when it is about to enter the trial in the Federal District Court of Delaware in December 2024, the market’s attention to this legal process has risen sharply. The uncertainty of the legal outcome has made investors have doubts about Qualcomm’s future growth, thus affecting its stock price performance.

However, Qualcomm has successfully dealt with similar legal challenges in history. The most representative one is the patent litigation with Apple (AAPL).

In 2019, Apple and Qualcomm had a fierce dispute over patent fees, but in the end, Qualcomm won the lawsuit against Apple, ensuring the protection of its intellectual property rights. The victory in this case has provided valuable experience for Qualcomm in dealing with the current case.

Therefore, although the ARM dispute poses a short-term challenge to Qualcomm, judging from historical experience, Qualcomm has demonstrated strong capabilities in dealing with similar legal litigations, and the market may need to be patient with this dispute.

Based on the stock price performance in the past few months, Qualcomm’s stock price has underperformed compared to the increase in the broader market. Part of the reason is that the market is overly sensitive to the uncertainty of this legal issue.

The outcome of this dispute will directly affect Qualcomm’s future technological development strategy, especially in the application of Nuvia’s technology and the adjustment of the ARM license agreement. If Qualcomm can reach a favorable agreement with ARM or win the lawsuit in court, its technological advantages will be further consolidated, and its stock price may resume growth in the future.

Intel Acquisition Rumors

Regarding the rumors about Qualcomm’s acquisition of Intel (Intel), although this news has attracted widespread attention in the market, we think the possibility of a full acquisition is relatively low.

Firstly, considering that the US government has implemented strict anti-monopoly reviews on many transactions in recent years, any similar acquisition cases may face huge regulatory resistance. In particular, in 2023, Intel’s acquisition of Tower Semiconductor (TSEM) fell through because it failed to obtain relevant regulatory approval. More importantly, in 2018, Qualcomm’s failure to successfully acquire NXP Semiconductor (NXPI) was also due to opposition from regulatory authorities.

These examples show that similar large-scale acquisition cases often face numerous regulatory challenges worldwide. Therefore, the possibility of a full acquisition of Intel is relatively low.

However, although Qualcomm may not carry out a full acquisition, there is still a possibility of certain asset divestitures or strategic cooperation between the two companies. It is reported that currently, Qualcomm has shown a strong interest in Intel’s PC design business, especially on the basis of its existing ARM-based PC products, which will help Qualcomm further expand the PC market and strengthen its technological advantages in the mobile and PC fields.

However, under the current circumstances, Intel does not seem to be in a hurry to have in-depth discussions with Qualcomm. Given the strict anti-monopoly reviews and the complexity of the political environment, especially the uncertain political situation after the recent US presidential election, Intel may postpone or reject any formal contact with Qualcomm.

Therefore, although the rumors about Qualcomm’s acquisition of Intel have attracted a lot of attention, we think that the possibility of this acquisition being realized in the short term is relatively small, and it is more likely to achieve technological synergy and market layout between the two companies through strategic cooperation or asset divestiture.

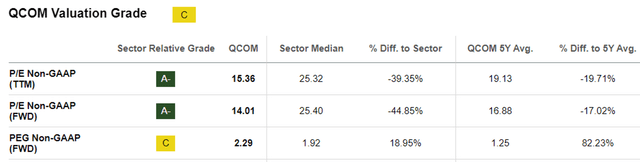

QCOM Valuation Analysis

Qualcomm’s current forward price-to-earnings ratio (FWD P/E) is 14.01 times, significantly lower than its 1-year average (15 times), 5-year average (16.88 times), and 10-year average (15.40 times), indicating that its valuation is at a relatively low level.

Compared to the median price-to-earnings ratio (25.4 times) in the semiconductor industry and its peers in the connectivity and CPU semiconductor fields, such as Broadcom (AVGO) with 33.84 times, ON Semiconductor (ON) with 17.4 times, Intel (INTC) with 34.87 times, and Advanced Micro Devices (AMD) with 41.56 times, Qualcomm’s valuation is clearly underestimated.

Combined with the company’s expected compound annual growth rate (CAGR) of revenue and adjusted earnings per share (EPS) in the next five years being 10.4% (based on Qualcomm’s management guidance for fiscal year 2029, including the expected 7% growth in the smartphone market size by 2029), we think that Qualcomm’s current stock price is still attractive. Based on this growth expectation, Qualcomm’s forward price-to-earnings growth ratio (FWD PEG) is 1.34 times.

Even compared to peer companies, for example, Broadcom’s FWD PEG is 1.71 times, ON Semiconductor’s is 2.26 times, and Advanced Micro Devices’ is 0.98 times, we still think that Qualcomm’s valuation is relatively reasonable, and the current stock price provides a good margin of safety for potential investors.

Investment Recommendations

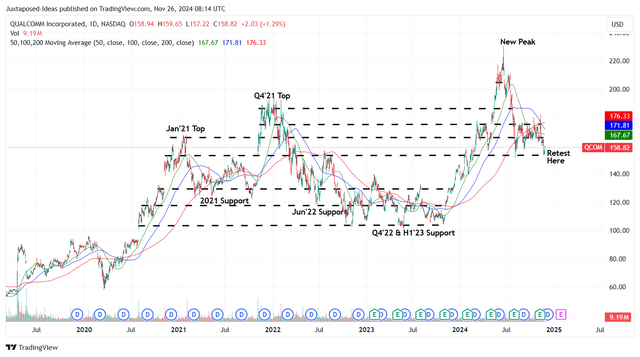

Currently, Qualcomm’s stock (QCOM) has underperformed expectations. In particular, when its stock price fell below the 50-day, 100-day, and 200-day moving averages, its gains in 2024 were significantly retraced.

However, this is not necessarily a bad thing. Instead, this sell-off has provided an attractive entry point for investors who wish to enter the market.

Based on the adjusted earnings per share (EPS) in fiscal year 2024, which is expected to be $10.22 with a year-on-year growth of 21.2%, and the current stock price relative to the average price-to-earnings ratio (P/E) of 15 times for one year, the current trading price of this stock is quite attractive, close to our estimated fair value of $153.30.

According to the general market expectations, the adjusted earnings per share in fiscal year 2026 are expected to be increased from $12.43 to $12.50. This means that for our long-term target price of $187.50, QCOM still has an upside potential of approximately 18%.

More importantly, we maintain our previous view that QCOM is worthy of being re-evaluated and aligned with the valuation levels of its peers in the connectivity and CPU semiconductor fields. This means that in a bull market, the long-term target price may reach $275, and based on the non-GAAP valuation of the forward price-to-earnings ratio (FWD P/E), it may eventually be raised to about 22 times the industry median.

In addition, the management continues to create value by relying on stable free cash flow, providing returns for long-term shareholders through a stable forward dividend yield of 2.17% and the last dividend increase of 6.25% (higher than the 5-year average growth of 5.88%).

Considering the current risk/return ratio and the support level of $150 established in 2024, we think that QCOM’s stock is still worth buying.