- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Trump's Tax Cuts & Deregulation + Rate Cut: Small-Cap Stocks' Year-End Bonanza for 2025 Wealth?

At the end of the year, small-cap stocks have once again become the focus in the investment field. With the continuous interest rate cuts by the Federal Reserve, their market performance has been quite remarkable. Trump’s re-election has added fuel to the development of small-cap stocks. The market generally believes that the tax cuts and deregulation policies implemented by Trump will greatly assist the growth of small enterprises, making small-cap stocks increasingly attractive.

The low-interest-rate environment has significantly reduced the borrowing costs of small enterprises and enhanced their financing capabilities, causing small-cap stocks to soar to historical peaks within just a few weeks.

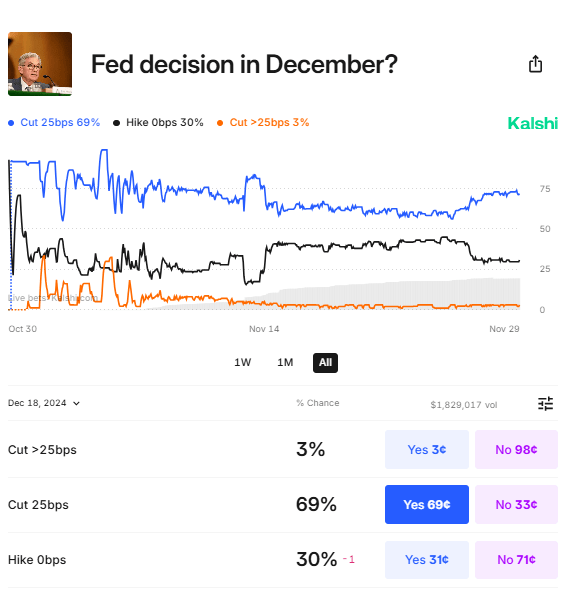

For investors, the most crucial thing at present is whether the Federal Reserve will cut interest rates in December; if it does as expected, small-cap stocks are very likely to ride the upward trend. However, this decision depends to a large extent on the subsequent employment reports and CPI data.

Although there are some short-term fluctuating factors in the current market, the growth potential of small-cap stocks remains strong. For those planning to make investment arrangements in 2025, this is precisely an excellent opportunity to consider and screen small-cap stocks.

Low Interest Rates Bring More Benefits to Small-Cap Stocks:

Lower Borrowing Costs: Small-cap stocks usually have more difficulty obtaining cheap credit than large-cap stocks. When interest rates decline, borrowing costs will decrease, which has a positive impact on the profitability of small companies and improves their fundamentals. Risk Catalyst: When interest rates decline, the yields of fixed-income investments will also decline. This may encourage investors to seek higher returns by switching to riskier assets such as small-cap stocks, thereby pushing up prices. Growth Potential: One of the advantages of small-cap stocks is that they usually have “more room for growth”, which means they are in the early stage and have greater growth capabilities compared to large-cap stocks. Due to lower financing costs, small-cap stocks can more easily raise funds for expansion, potentially accelerating their growth and bringing upside potential for investors.

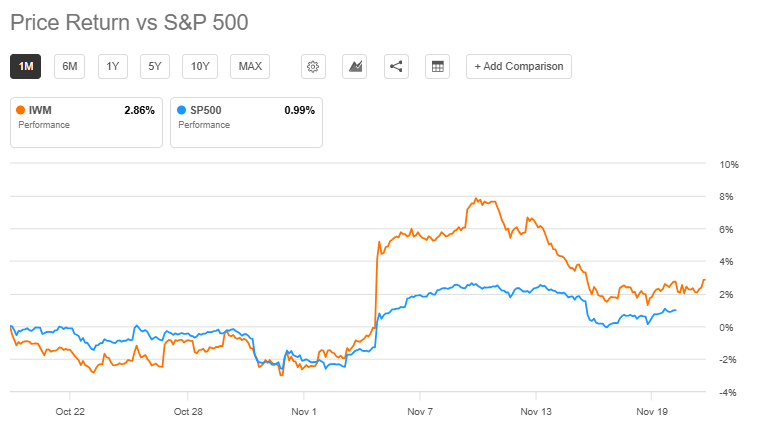

Immediately after the election results were announced, the Russell 2000 Index rose by more than 5%. Although small-cap stocks have given back some of their gains, they still outperformed large-cap stocks in the past month.

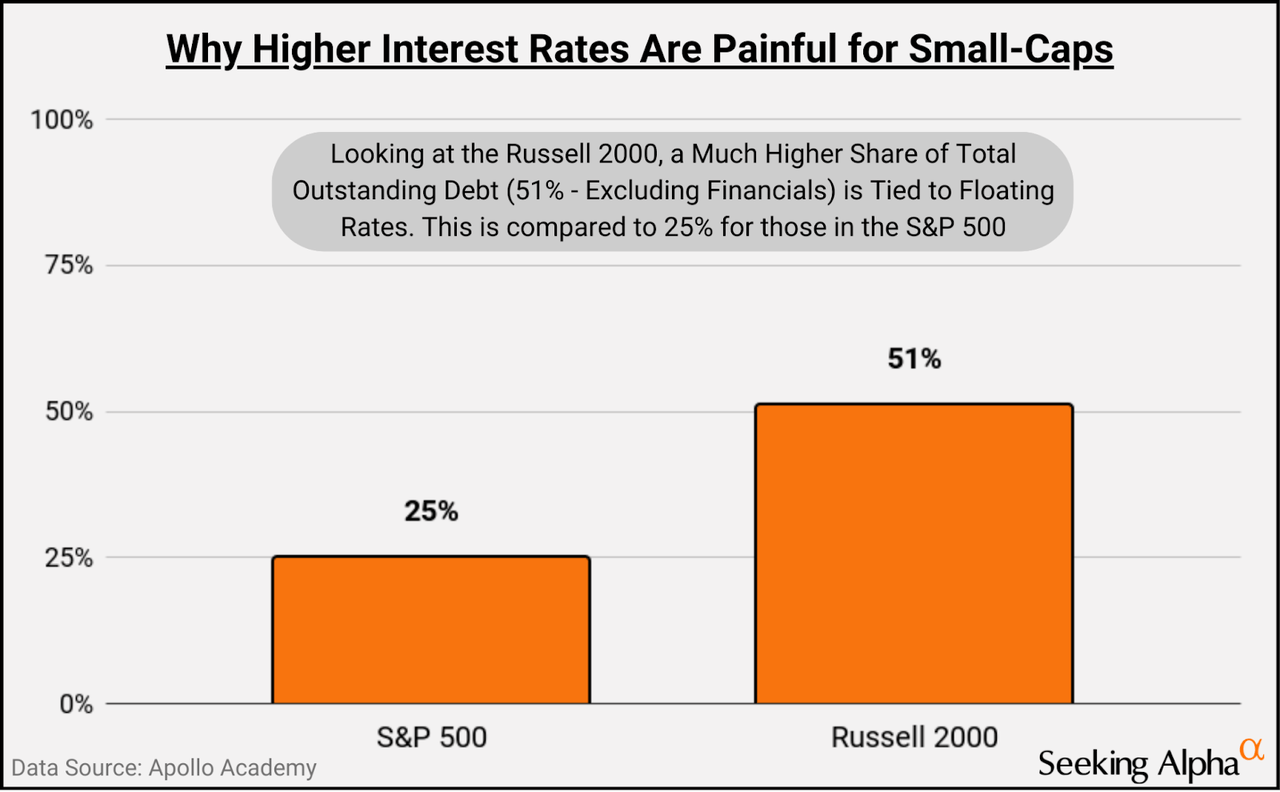

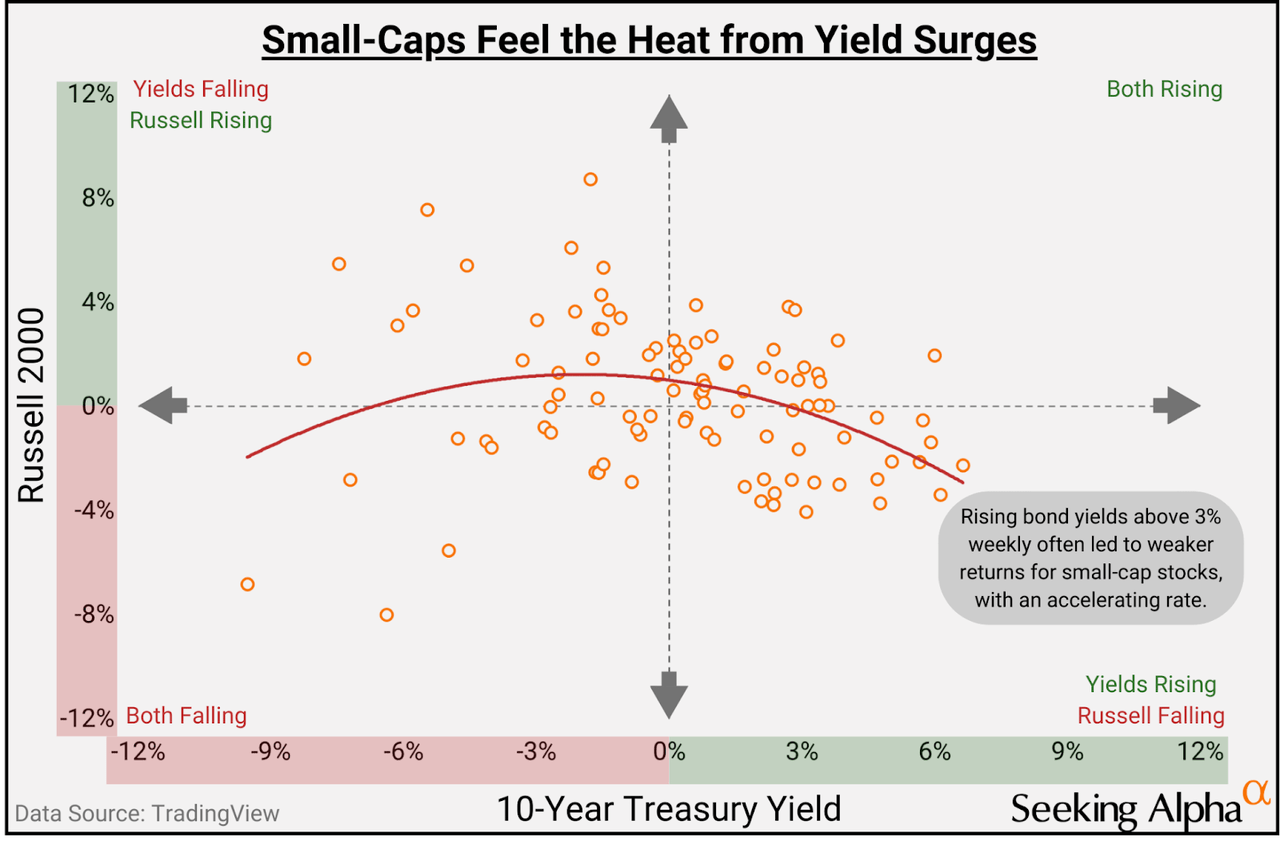

Compared with the S&P 500 Index, a larger proportion of the outstanding debt of small-cap stocks is linked to floating interest rates.

This means that when interest rates change, the burden on small-cap stocks may be heavier than that on large companies, so they are more sensitive to changes in the Federal Reserve’s monetary policy. According to data since 2023, when the yield of 10-year US Treasury bonds rises by at least 3%, the performance of small-cap stocks tends to deteriorate. This also reflects their vulnerability to interest rate changes.

Federal Reserve Chairman Powell is expected to speak at The New York Times DealBook Summit on Wednesday. Although he may not give clear policy guidance before the release of non-farm payroll data and CPI data, once he signals that an interest rate cut is coming, it will have a crucial impact on the market.

The policies of the Federal Reserve and the economic trend will continue to dominate the operation of the market. Currently, the market estimates the probability of an interest rate cut to be 66%.

Regarding small-cap stocks, Federal Reserve Chairman Powell said that the future fiscal policy of the Trump administration has not been taken into account yet, which may provide more room for the market to digest previous hawkish expectations and bring short-term support to small-cap stocks.

Considering that the Trump administration may adopt more relaxed policies and may further cut interest rates, we can expect that small-cap stocks may become a favored direction for investors in 2025. Especially after small-cap stocks have experienced a certain correction recently, it may now provide investors with an opportunity to buy at a low price. With the gradual realization of policy dividends, the long-term upward trend of small-cap stocks is still worth looking forward to.

Recommended Small-Cap Stocks: Long-Term Opportunities of Potential Stocks

After analyzing the market performance and policy-driven factors of small-cap stocks, we will next focus on recommending five small-cap stocks with huge potential. These companies have excellent performance in the current market environment, solid financial conditions, and great growth potential in the future. The following are the five small-cap stocks we have selected. They have the potential for continuous growth and are in line with the market’s expectations of future policy and interest rate changes.

1.OppFi Inc. (OPFI)

Industry: Finance

Market Capitalization: $5.96B

Recommendation Reasons: OppFi is a leading consumer finance company that mainly provides credit services to middle- and low-income groups through an AI-driven lending platform.

The company uses its innovative technology platform and bank cooperation model to reduce regulatory risks and achieved record-high revenue and profits in the third quarter of 2024.

Growth Potential: OppFi’s digital financial service platform has shown strong profitability and has continued to perform well in loan and customer growth.

Financial Highlights: The revenue in the third quarter of 2024 reached $136 million, and the GAAP net profit increased by more than 100% year-on-year.

Valuation: Compared with its peers, OPFI has a very low price-to-earnings ratio. The forward P/E is only 7.9 times, showing significant investment value.

2. Northeast Community Bancorp, Inc. (NECB)

Industry: Finance

MarketCapitalization: $3.46B

Recommendation Reasons: NECB is a regional bank that focuses on providing loans to the construction industry. Despite the high-interest-rate environment, the company’s loan demand remains strong, especially in the construction field.

Growth Potential: NECB has excellent revenue growth performance. The revenue increased by 12% year-on-year in 2024, and the expected earnings per share growth is 21% in the future.

Financial Highlights: The company has a relatively low valuation. The forward price-to-earnings ratio is 8.2 times, and its price-to-book ratio is as low as 0.3 times, showing high investment attractiveness.

Market Positioning: Focusing on the construction industry in high-demand regions gives it a solid market position in the current economic environment.

3. DXP Enterprises, Inc. (DXPE)

Industry: Industry

Market Capitalization: $10.74B

Recommendation Reasons: DXP is an industrial product distributor that mainly provides equipment and maintenance services to energy, industrial, and manufacturing customers. The company continuously expands its business through an acquisition strategy and serves multiple industries, showing a strong growth momentum.

Growth Potential: In 2024, DXP’s EPS increased by 45% year-on-year, showing its strong profitability.

Financial Highlights: The company’s price-to-earnings ratio is 16.8 times, much lower than the industry average of 20.7 times, providing a good valuation opportunity.

Market Positioning: DXP’s strong performance in multiple industrial fields, especially its key role in the oil and gas industry, provides a solid foundation for its future development.

4. Virco Mfg. Corporation (VIRC)

Industry: Industry

Market Capitalization: $2.48B

Recommendation Reasons: Virco is a leading American manufacturer of educational furniture and equipment, mainly providing products to K-12 schools. Benefiting from the recovery of the supply chain after the pandemic, Virco has a competitive advantage in delivery speed compared to international suppliers.

Growth Potential: The company’s annual revenue increased by 9%, and EBITDA increased by 47%, showing strong profitability.

Financial Highlights: Virco’s price-to-earnings ratio is only 8.1 times, significantly lower than the industry average, with high investment value.

Market Positioning: Its deep roots in the education field and strong market demand give Virco the potential for continuous growth.

5. Rapid7, Inc. (RPD)

Industry: Information Technology

Market Capitalization: $24.9B

Recommendation Reasons: Rapid7 is a cybersecurity company that provides vulnerability detection, management, and response services. The company continuously improves its profitability through platform integration and the launch of new products and has shown a strong growth momentum in recent years. Growth Potential: Rapid7 has an annual growth rate of 20% and is expected to continue to grow its annual earnings in the next few years. Financial Highlights: The company increased its operating profit in the third quarter of 2024, and the operating profit margin is expected to reach 19%, an increase of 550 basis points compared to last year. Valuation: The company’s current forward PEG is 0.66, lower than the industry average of 0.94, with a significant valuation advantage.

The performance of small-cap stocks is driven by multiple factors, especially the policy environment and interest rate changes. The recent correction of small-cap stocks has provided an attractive entry opportunity for investors. With the possible further decline in interest rates and the relaxed policies that the Trump administration may adopt, we may see small companies welcome continuous growth opportunities in the next few years.

If you are considering making investment arrangements in small-cap stocks at this stage, the multi-asset wallet BiyaPay provides convenience. BiyaPay supports trading in US and Hong Kong stocks and digital currencies, facilitating users to monitor price trends in real-time and ensuring quick and efficient deposit and withdrawal operations of funds at critical moments. Whether it is foreign currency exchange or withdrawal to a bank account, BiyaPay can provide you with safe and flexible solutions to help you seize investment opportunities.

The five small-cap stocks we recommend - OPFI, NECB, DXPE, VIRC, RPD - all perform outstandingly in different fields and have significant growth potential. They have shown strong momentum in financial foundation, profit growth, market prospects, etc., and have obvious advantages in valuation compared to their peers, providing sufficient opportunities for investors.

In the current economic context, especially small enterprises that are sensitive to interest rates and the policy environment, their performance may be favored by more investors.

For those investors seeking medium- and long-term investment opportunities, the current may be an attractive time to enter the small-cap stock market. Although the market may experience fluctuations in the short term, with the gradual clarification of the macroeconomic environment and the gradual implementation of policy dividends, these high-quality small-cap stocks are expected to achieve sustainable growth in the future.