- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

AMD's Stock Price Is Undervalued, Optimistic about the Counter-Trend Growth of the Data Center, and

From 2023 to 2024, the semiconductor industry was once a powerful engine for the market’s rebound. However, after the summer, the industry’s popularity took a sharp downturn. Nowadays, except for Nvidia (NVDA), which still maintains a strong momentum, the stock prices of most semiconductor companies have dropped significantly, and AMD is no exception.

Although AMD’s financial report released in the third quarter of 2024 showed that it faced challenges in the gaming and embedded markets, there were still remarkable aspects in its core business. Especially in the data center field, with the rising demand for EPYC CPUs and Instinct GPUs, it successfully compensated for the weakness of other sectors and drove the growth of overall revenue. The improvement in gross profit margin has also laid a solid foundation for future growth potential.

Nevertheless, in the face of short-term fluctuations in the stock price, investors inevitably have doubts in their minds: Is AMD’s stock price undervalued? Can the strong performance of the data center business help the stock price rebound? In my view, AMD is highly likely to hold on to its recent lows, and with the comprehensive improvement of its fundamentals next year, the stock price is expected to rise substantially.

The Rise of the Data Center and Counter-Trend Growth in Performance

On the business stage in the third quarter of 2024, AMD made a grand appearance with an outstanding financial report. Although it encountered some “chilly winds” in the gaming and embedded fields, its core businesses - the data center and client departments - not only strongly boosted the overall revenue but also made the company’s position in the market map more solid.

The Brilliant Achievements of the Data Center and Client Businesses

The financial report data reveals that in this quarter, AMD’s total revenue soared to $6.8 billion like a rocket. Compared with the same period last year, the growth rate was as high as 18%, and it exceeded the market expectation by approximately $104 million. Among them, the data center business can be regarded as the “super engine” for revenue growth, achieving $3.55 billion, accounting for half of the total revenue with a proportion as high as 52%, and the year-on-year increase was an astonishing 122%. Such brilliant achievements are mainly due to the strong demand for EPYC CPUs and Instinct GPUs, which is like surging waves.

The demand for EPYC CPUs has risen like a rocket, playing a significant role in the broad fields of high-performance computing and cloud services, and firmly occupying a key position among enterprise customers and hyperscale data centers. And as the core hardware for AI and machine learning tasks, the Instinct GPU created an income achievement of over $1.5 billion in this quarter, winning the title of the single product with the fastest growth in AMD’s history.

Meanwhile, the client business was also not to be outdone, with its revenue reaching $1.88 billion and a year-on-year growth rate of 29%. The hero behind this excellent achievement is the Ryzen CPU, especially the desktop Ryzen 9000 series based on the Zen 5 architecture and the laptop Ryzen AI 3000 series. Their strong market demand has burned out brilliant performance like a raging fire.

In this quarter, AMD’s gross profit margin climbed to 53.6%, an increase of 250 basis points compared with the same period last year. Behind this significant improvement, on the one hand, the sales mix of high-margin data center and client products has been carefully optimized, and on the other hand, it also demonstrates the company’s outstanding ability in improving operational efficiency and controlling production costs.

Although the data center and client businesses are in the limelight, AMD has encountered a “cold current” in the gaming and embedded markets. The revenue of the gaming business dropped sharply by 69% year-on-year, only reaching $462 million.

Both the gaming and embedded revenues (and profits) are in a poor state, but the problems in these two aspects are relatively small, so that AMD can easily overcome this weakness through its strong data center and client departments. We will mention this point in the subsequent fundamental analysis.

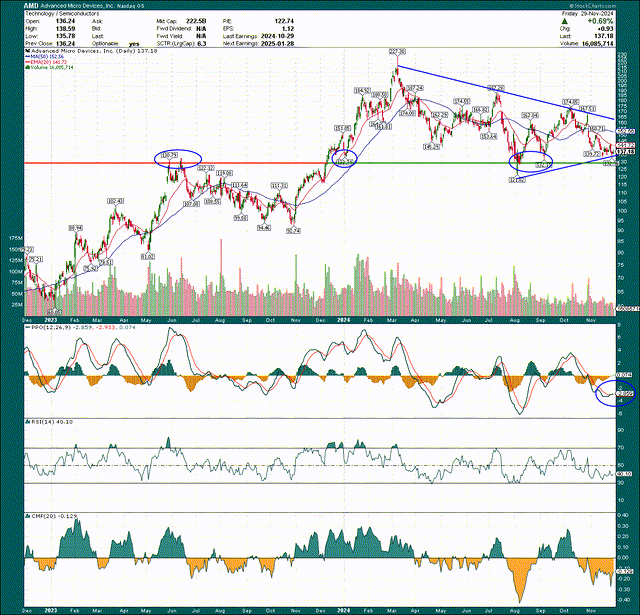

Integration Completed? Technical Analysis

Now, there is a very crucial problem presented on the daily chart. After the astonishing rebound from $92 to $227, AMD’s stock price gradually formed a sequence of lower highs in 2024. However, we can also see multiple higher lows, forming a symmetrical triangle marked in blue.

If this pattern breaks upward - breaks through the blue line of the downward trend - AMD’s stock price may reach new highs. The previous high was $227, which means there is significant upside potential.

The key support line is approximately at $130. This level was reached last summer and has been repeatedly tested in December 2023, August 2024, and September 2024. If this support level breaks down, AMD is likely to enter a more significant downward trend. However, from the perspective of risk/reward, the current situation is very attractive because the downside risk is only about 3%, while the upside potential is much greater than this figure.

The PPO indicator has just formed a bullish crossover, although it is still in the negative region. The RSI remains at 40, which has shown a significant improvement compared with previous lows. The Chaikin Money Flow Index has also risen significantly, although it, like the PPO, is still in the negative region. Although the momentum indicators have not strongly suggested that we buy yet, their improving trend combined with the performance of the chart makes me think that the current situation is quite favorable.

Although the chart performance is good, let’s conduct an in-depth analysis of the fundamentals to see if there is enough momentum to support a strong rally in 2025.

Fundamental Analysis

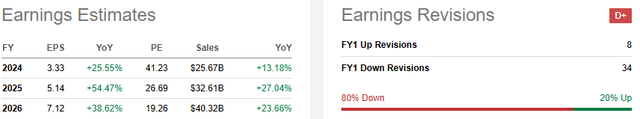

The simple fact is that AMD has recently experienced a rather unpleasant revision cycle, and its stock price has fluctuated as a result.

However, the prospects for 2025 and 2026 are quite promising. It is expected that during that time, sales will soar at a growth rate of about 25%, which will not only directly increase revenue but also further enhance earnings by controlling costs such as research and development, sales, and administrative expenses. From the perspective of operating leverage, the growth rate of earnings may even exceed that of revenue - which is also the reason why we will usher in a bull market.

For example, in the third quarter, AMD’s sales increased by 17.5% year-on-year, while the operating profit reached twice this growth rate. This is where the charm of operating leverage lies. Therefore, sales growth is particularly crucial, and investors also need to closely monitor this indicator.

What’s more worth mentioning is that AMD’s gross profit margin is continuously rising. Although cost reduction has played a significant role, it is not entirely relying on cutting expenses. The main driving force for growth comes from the data center business, which is the company’s largest and fastest-growing sector. Its revenue has already doubled year-on-year, and the operating profit margin is also not far behind.

New products, such as the Instinct MI325X accelerator, are also driving a new round of cooperation, especially in the field of artificial intelligence computing. Although there are many competitors in this market with broad prospects, AMD’s growth momentum cannot be underestimated.

However, there are also some “weaknesses”. The performance in the gaming and embedded fields is not satisfactory, with both revenues and profits declining. The revenue of the gaming business dropped sharply by 69% year-on-year, only reaching $462 million. Fortunately, the market size of these two sectors is relatively small, and AMD can make up for this deficiency through the strong performance of its data center and client departments. Although there is certain pressure in these areas, resulting in a decline in overall growth and profit margins, the overall performance is still good at present.

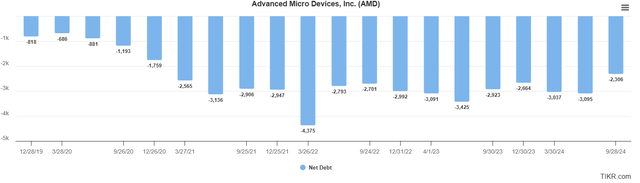

AMD has maintained strong profitability and cash flow for many years, which has also ensured the health of its balance sheet. The net debt is -$2.3 billion, meaning that the company has ample room for acquisitions and investment in research and development. This provides solid support for the long-term bullish expectation.

Valuation Analysis

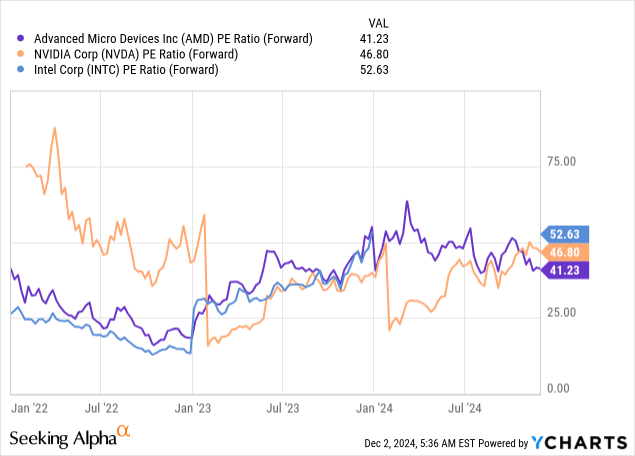

Considering various possible favorable factors in the future, I think the market’s reaction to AMD’s recent financial and operational updates seems overly pessimistic. As mentioned at the beginning of the article, the decline in the stock price seems to lack sufficient reasons and is too negative. In fact, compared with the trading prices 3 - 6 months ago or even longer ago, AMD’s stock price already appears somewhat undervalued.

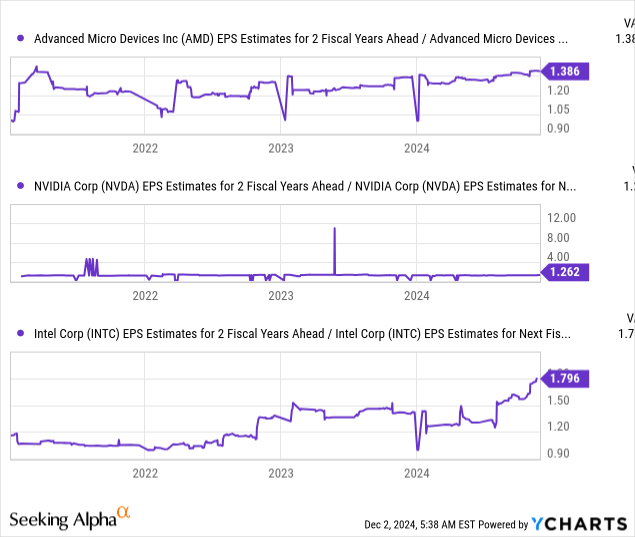

Interestingly, at the beginning of 2024, the valuation gap between AMD and Nvidia almost disappeared. Among the three major CPU and GPU manufacturers, AMD now has the lowest price-to-earnings ratio:

Meanwhile, according to the growth forecast of earnings per share (EPS) in the next two years, AMD’s performance is second only to Intel. However, considering the current operational challenges faced by Intel, there is still uncertainty as to whether this growth can be achieved.

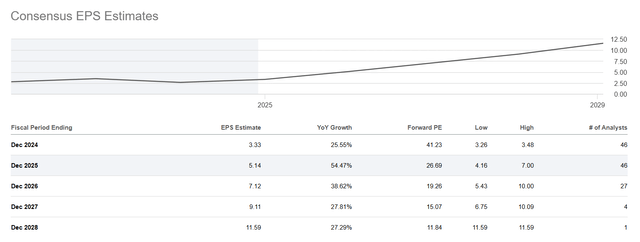

According to the data from Seeking Alpha, AMD’s earnings per share are expected to grow from $3.33 in fiscal year 2024 to $11.59 in fiscal year 2028, meaning that the compound annual growth rate will reach 28.33%. Against such a strong growth prospect, the current price-to-earnings ratio of 41 times seems a bit “inappropriate”.

I think it is too simplistic to evaluate the growth potential of a stock, especially a stock like AMD with an astonishing growth trajectory, solely by traditional multiples such as the price-to-earnings ratio. This method cannot fully reflect its future potential. Therefore, we might as well use the PEG (Price/Earnings to Growth ratio) to further evaluate AMD’s value.

Even assuming that Wall Street’s current earnings per share forecast is accurate, I think AMD’s reasonable PEG multiple should be slightly lower than 1 (according to the data from Seeking Alpha, the current Forward PEG is 0.98). In other words, assuming that the EPS growth rate is roughly the same as or even slightly lower than the price-to-earnings ratio, according to the standard of a PEG value of 1, AMD’s price-to-earnings ratio in fiscal year 2025 should be approximately 43.6 times. If calculated based on the expected earnings per share ($5.14), then the mid-term target price is approximately $224.1 per share, which is 63.5% higher than the current stock price.

Although I predicted AMD’s stock price target two years later in my last analysis, today’s prediction is based on one-year data, so the target price is slightly lower. But in any case, considering the current undervaluation, AMD is still worth buying, especially when the stock price may continue to decline.

Overall, compared with the current downside risk, AMD has huge upside potential. Asymmetric risk opportunities in the market often bring higher returns, and AMD currently represents such an opportunity.

Of course, this optimistic prediction is not without risks. The biggest risk lies in the possibility that AMD may lose market share or that its revenue growth may not meet expectations. After all, the premise of profit growth is the continuous growth of revenue. If revenue growth slows down, it may affect the expected operating profit margin. This is also the main risk point of my optimistic prediction.

However, considering the negative revision cycle that AMD has recently experienced, I think the current valuation has already taken these risks into account. The chart shows that AMD’s current expected price-to-earnings ratio is at the lowest level in the past 12 months, lower than the three-year average. In this context, the lower valuation actually provides favorable support for the risk/reward ratio.

Wouldn’t you be more willing to reduce risks and increase your odds if you could buy at an expected price-to-earnings ratio of 30 times instead of 40 or 45 times? As long as AMD remains around $130, I think its stock price will witness a significant increase by 2025. Unless the risk factors I mentioned are largely realized, the bullish possibility is relatively high. Based on this, my rating for AMD remains a Strong Buy.