- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Don't Just Focus on Popular Stocks like Apple and Nvidia When Buying US Stocks. Learning Some Strate

Every investor knows that there are always some big companies in the US stock market that can’t be ignored - such as Apple, Tesla, Amazon, etc. They are almost the “standard configuration” in every investment portfolio. These enterprises not only have a strong brand effect and high market recognition but also can bring considerable returns in the long-term holding. However, in this “bustling” market, there are also some stocks that are overlooked. Although these companies are low-key, they are quietly accumulating huge potential.

Less popular stocks are these “small companies” neglected by the market. They don’t have the halo like popular stocks, but often bring rich returns to investors due to being undervalued. Compared with chasing the short-term fluctuations of popular stocks, less popular stocks are more like invisible assets with long-term stable growth. Today, let’s talk about why less popular stocks are worth investing in and how to identify and seize these potential opportunities.

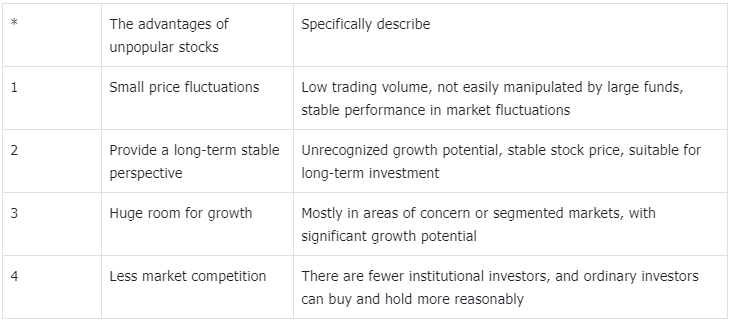

Why Invest in Less Popular Stocks

The charm of less popular stocks lies not only in their undervalued worth but also in some unique advantages that popular stocks can’t provide. Firstly, the price fluctuations of less popular stocks are usually smaller. When market sentiment fluctuates violently, the prices of popular stocks are often manipulated by large amounts of capital and fluctuate sharply in the short term. While less popular stocks, due to their lower trading volumes, are less likely to be manipulated by large amounts of capital. Therefore, they are more stable when the market fluctuates significantly.

This low volatility provides investors with a longer-term perspective. Many excellent less popular stocks have relatively stable stock prices because the market hasn’t fully recognized their growth potential. Once the market notices these companies, their stock prices will often experience a rally. This “low-key wealth accumulation” method is especially suitable for investors who value long-term returns and can endure loneliness.

Another advantage that can’t be ignored is that less popular stocks usually have huge growth space. Many less popular stocks are in industries or market segments that haven’t been widely noticed yet. If investors can identify these potential stocks in advance and make arrangements outside the “vision” of the market, they can obtain considerable returns in the development of the next few years. Popular stocks are often already in a relatively high valuation range, while less popular stocks are usually undervalued, providing more attractive investment opportunities.

Finally, investors in less popular stocks face relatively less market competition. Most less popular stocks have low trading volumes, and institutional investors and large amounts of capital have fewer opportunities to enter. This also means that ordinary investors can buy and hold them more easily within a relatively reasonable price range, thus avoiding price bubbles and excessive competition in popular stocks.

How to Invest in Less Popular Stocks

Investing in less popular stocks is not simply “buying and waiting”. It requires investors to have patience and certain research abilities. The first step in investing in less popular stocks is to deeply understand the fundamentals of these companies. These companies may not show any special highlights in the short term, but in the long run, the fundamentals are the cornerstone of their continuous growth.

The key points that investors need to focus on are usually the sustainability of the company’s profitability, its financial situation, and its future market potential. Different from popular stocks, investing in less popular stocks relies more on the judgment of the company’s future development potential. Moreover, due to the low liquidity of less popular stocks, they are often not affected by short-term market fluctuations. Therefore, when choosing less popular stocks, investors should pay more attention to the company’s long-term competitive advantages rather than just relying on market hotspots or short-term fluctuations.

Meanwhile, investing in less popular stocks is more suitable for long-term holding. Since these companies usually haven’t become the focus of the market yet, their stock prices usually need some time to reflect their potential. Investors shouldn’t expect less popular stocks to bring quick returns in the short term but should be prepared for long-term holding. In this process, short-term market fluctuations or even some negative news often won’t affect the long-term value of less popular stocks.

Of course, investing in less popular stocks is not without risks. To reduce risks, diversification of investment is a very important aspect. Although less popular stocks have great potential, their volatility and uncertainty are relatively high. Therefore, investors should avoid concentrating all their funds on one or two less popular stocks. By diversifying investments in multiple less popular stocks, the risks brought by a single stock can be effectively reduced, ensuring the stability of the investment portfolio.

Finally, and also very importantly, when investing in US stocks, you must choose a suitable investment platform. The choice of the investment platform directly affects the security of funds, the convenience of investment operations, and the diversified management of assets. Global well-known brokerage firms like Charles Schwab are the choice of many investors. By opening an account with Charles Schwab, investors can not only get a bank account with the same name but also deposit digital currencies (such as USDT) into the multi-asset trading wallet BiyaPay and then withdraw funds to Charles Schwab Securities for US stock investment.

In addition, as a multi-asset trading wallet, BiyaPay also provides convenient options for investors. Users can directly search for US stock codes on BiyaPay and recharge USDT to make purchases.

How to Identify Whether Less Popular Stocks Are Worth Investing In

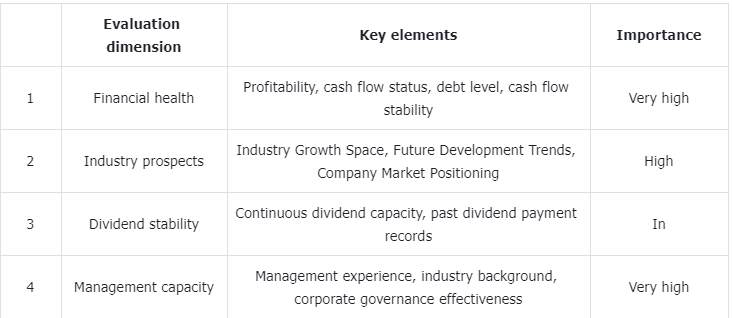

The key to identifying whether less popular stocks are worth investing in lies in in-depth research on the company and forward-looking judgments on the industry. Firstly, financial health is the basis for judging whether less popular stocks are worth investing in. Investors should pay attention to the company’s profitability, cash flow status, debt level, and the stability of cash flow. A continuously profitable company means its advantage in market competition, and this is also the manifestation of its long-term growth potential.

Besides the financial situation, the industry prospects are also a must-consider factor. Less popular stocks are often concentrated in some industries or segments that haven’t been fully recognized by the market yet, and these industries usually have large growth space. For example, emerging technologies, green energy, artificial intelligence, and other fields, although they are still in the initial stage at present, their potential should not be underestimated. Investors need to analyze the future development trends of these industries and judge the company’s market positioning and development potential in them.

The stability of dividends is also an important investment indicator. Many less popular stock companies will provide stable dividend returns, which is especially important for investors seeking stable cash flow. By checking the company’s dividend payment records in the past few years, investors can judge whether the company has the ability to pay dividends continuously and ensure that they can obtain stable investment returns from it.

Finally, the ability and reputation of the management are also very critical. Less popular stock companies are often small in scale, and the decisions of the management directly determine the company’s future direction. An excellent management team can lead the company through the troughs of the market and seize future opportunities. Therefore, investors need to pay attention to the company’s senior management and analyze their experience in the industry and the effectiveness of corporate governance.

Summary

As an investment strategy, less popular stocks offer unique opportunities different from those of popular stocks. They are usually undervalued due to being overlooked by the market, but it is precisely this undervaluation that makes less popular stocks a potential investment choice with huge potential. By deeply researching the fundamentals of companies, paying attention to industry prospects, understanding the stability of dividends, and observing the performance of the management, investors can dig out sustainable returns from less popular stocks.

Investing in less popular stocks requires patience and a long-term vision. In the short term, there may not be obvious gains, but in the long run, they can often bring unexpected returns. If you hope to find more stable and growth-potential investment targets in the US stock market, less popular stocks are undoubtedly an area worth trying.

In addition, multi-asset trading wallets like Charles Schwab and BiyaPay provide convenient trading channels for US stock investment for investors. Among them, through its efficient and safe fund deposit and withdrawal operations, BiyaPay enables investors to manage and allocate funds more flexibly and ensure that the fund needs are met at critical moments.