- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Amazon's financial report reveals growth potential, driven by Cloud Service and e-commerce. How can

Amazon, as a global leading tech giant, continues to attract investors’ attention with its strong e-commerce platform and Cloud Service business. The recently released Q3 2024 financial report further consolidates its market leadership position, and its unexpected revenue and profit performance have given investors confidence in its future. Despite facing challenges such as intensified competition and regulatory risks, Amazon still demonstrates strong growth potential with its excellent cash flow management and innovation-driven business model.

Amazon’s third quarter financial report: better-than-expected performance

On October 31, 2024, Amazon released its Q3 financial report, which far exceeded market expectations and further consolidated its position as a leading global technology company. The company performed well in multiple key indicators, demonstrating Amazon’s strong business model and market demand, including revenue growth and profitability.

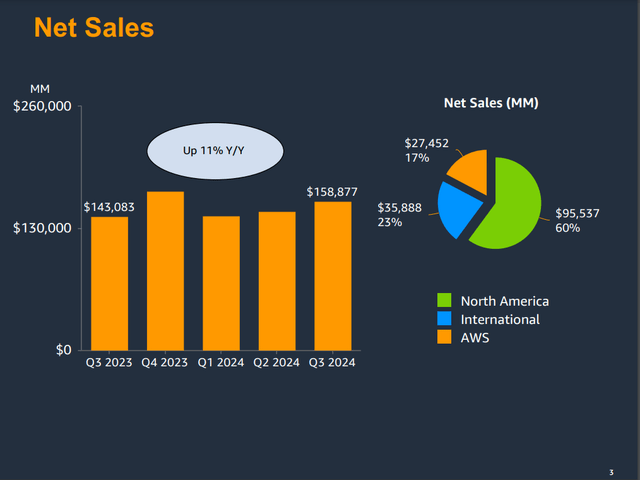

Amazon’s net sales in the third quarter reached $158.90 billion, an increase of 11% year-on-year. This growth exceeded market expectations and demonstrated Amazon’s strong appeal in the global retail and Cloud Service markets. Despite the slowdown in growth, the 11% growth still reflects its competitiveness in various business areas.

In North America, Amazon’s sales increased by 8.7% to $95.50 billion. This increase was driven by an increase in unit sales volume, as well as the company’s continued optimization in pricing, product selection, and customer experience. AWS (Amazon Web Services) remains Amazon’s core growth engine, with sales in the third quarter increasing by 19.1% to $27.50 billion, exceeding market expectations. As more companies expand their Cloud Service business, AWS continues to gain higher market share among enterprise customers.

In addition, Amazon’s international business also performed well, with sales increasing by 11.7% to $35.90 billion. This further proves Amazon’s penetration ability in the global market, especially in Asia Pacific and other emerging markets. With a strong localization strategy and efficient logistics network, Amazon has successfully attracted more consumers.

The most eye-catching thing is the significant growth in earnings per share (EPS). Amazon’s diluted EPS increased by 52.1% YoY to $1.43, far exceeding analysts’ expectations. Behind this growth is the company’s continuous improvement in cost control and Operational Efficiency, especially on the basis of revenue growth. Amazon only increased operating expenses by 7.3%, greatly improving its Net Profit ratio.

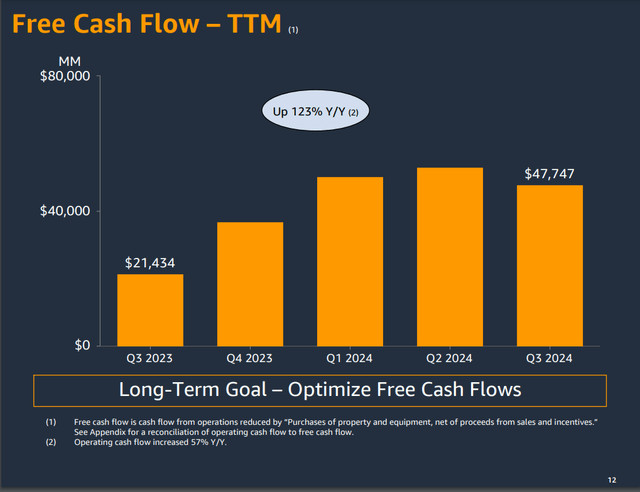

From the current financial report, Amazon’s short-term performance is impressive, but what is more noteworthy is its long-term growth potential. The company’s current strong cash flow, stable balance sheet, and continuously growing AWS business make its future full of possibilities. According to analysts’ expectations, Amazon’s operating cash flow will continue to grow. It is expected that by 2026, the company’s operating cash flow per share (OCF) will further improve, and the growth rate will also remain at a high level.

Overall, Amazon’s Q3 financial report not only demonstrates its strong competitiveness in the global e-commerce and Cloud Service markets, but also further proves the Sustainability and profitability of its business model. As the global retail e-commerce and Cloud Service markets continue to expand, Amazon’s future growth is still worth looking forward to.

If you are also optimistic about Amazon’s growth potential and want to invest in its stocks, BiyaPay provides a convenient platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience.

With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With the advantages of fast deposit speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

Strong cash flow and financial position: Amazon’s capital advantage

Amazon’s strong cash flow and sound financial position provide a solid guarantee for its future development. In the past 12 months, Amazon’s operating cash flow has increased by 57.3%, reaching $112.70 billion, demonstrating the company’s efficient management in expansion and capital expenditures. Despite increasing capital expenditures, Amazon still successfully achieved $47.70 billion in free cash flow growth, indicating the company’s ability to maintain strong financial performance while making large investments.

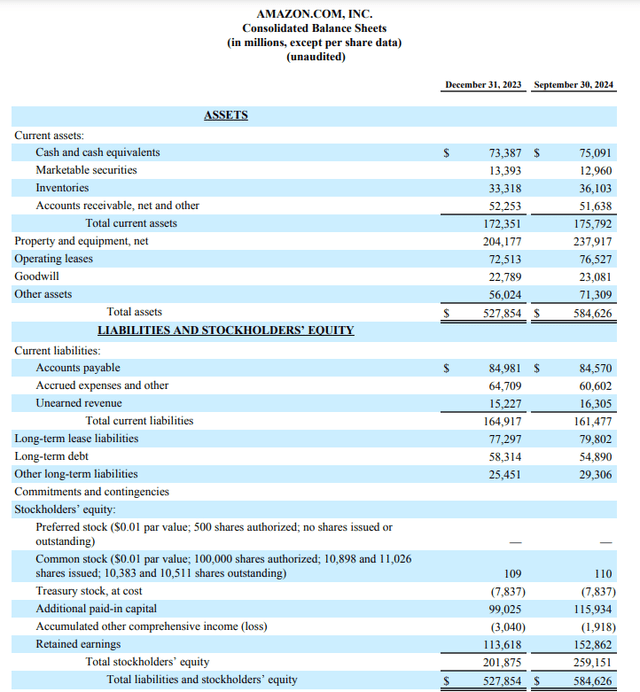

As of September 30, 2024, Amazon’s cash and market securities balance was $33.20 billion, and the Balance Sheet was very healthy. The company’s debt structure is reasonable, and the net debt burden is light enough to cope with possible future market fluctuations. Thanks to this strong financial foundation, Amazon’s credit rating has been rated AA by Standard & Poor, with a stable outlook, which enables Amazon to continue its global expansion and innovation strategy with low-cost financing.

Meanwhile, Amazon’s fund management efficiency is constantly improving. By optimizing its capital structure, the company is able to provide higher returns to its shareholders, including through stock buybacks, which further enhances investors’ confidence in Amazon.

Future Growth Potential: E-commerce and Cloud Services Driven by Two Wheels

Amazon’s future growth potential is equally exciting. With its leadership position in e-commerce and Cloud Services, the company still has huge development potential. The global retail e-commerce market continues to expand, and it is expected that global e-commerce sales will increase from $4.40 trillion in 2023 to $6.80 trillion by 2028. As a leader in global e-commerce, Amazon will continue to benefit from this trend with its strong user base, global logistics network, and innovative customer experience. Amazon’s Prime membership system and additional services, such as Whole Foods’ delivery service, not only enhance user stickiness, but also bring stable revenue streams to the company.

Meanwhile, Amazon’s Cloud Service business, AWS, remains one of the core drivers of the company’s growth. With global IT spending gradually shifting towards Cloud Services, AWS is expected to continue expanding with its technological advantages and leading market share. The growing demand for Cloud as a Service by enterprises has made AWS’s profit model more stable. Through long-term customer contracts and growing customer usage, AWS will continue to provide Amazon with considerable revenue and profits.

In addition, Amazon’s advertising business has achieved significant growth in recent years and has become an important part of the company’s revenue. With its huge consumer data and precise advertising delivery capabilities, Amazon’s ad platform provides merchants with efficient marketing channels. Against the backdrop of the rapid development of the digital advertising market, Amazon is expected to further increase its market share in the advertising field, which will promote a more diversified revenue structure for the company.

Amazon’s international market expansion also provides strong support for its future growth. Although the company’s market share in North America and Europe is already very large, Amazon still has huge expansion potential in emerging markets such as the Asia-Pacific region and Latin America. With the rise of the middle class and the popularity of the Internet in these regions, Amazon’s e-commerce and Cloud Service businesses are expected to usher in new growth opportunities. Especially in markets such as India and South East Asia, Amazon can further increase its market share and expand its influence in the global e-commerce industry with its global network and advanced technology platform.

Overall, Amazon’s continuous innovation and expansion in multiple fields such as e-commerce, Cloud Services, advertising, and international markets have laid a solid foundation for its future growth. Combined with analysts’ expectations, Amazon is expected to achieve an annualized return of 36% in the next few years, continuing to bring considerable long-term returns to investors. This makes Amazon still an attractive investment target with great growth potential.

Valuation analysis: Amazon is still significantly undervalued

Although Amazon’s stock price has risen by 18% in the past few months, from a valuation perspective, Amazon is still significantly undervalued. Currently, Amazon’s Price-To-Earnings Ratio (P/E) and Operating Cash Flow Ratio (P/OCF) are still far below their historical averages. Specifically, Amazon’s P/OCF ratio is currently 14.6, while the average level of the past 10 years is 25.3. This gap indicates that the market may underestimate Amazon’s growth potential.

According to the latest financial report data, Amazon’s operating cash flow has maintained strong growth, and future growth expectations are also very optimistic. With the continuous expansion of multiple business areas such as e-commerce, Cloud Services, and advertising, Amazon will still benefit from the trend of digital transformation and Consumption Upgrade globally. Therefore, even though the stock price has risen, based on Amazon’s leading position in multiple high-growth industries, the current stock price still has significant upward space.

According to estimates, combining current operating cash flow and growth expectations for the next few years, Amazon’s fair value is approximately $315 per share. Compared to the current stock price of about $206, this means that there is still about 35% room for the stock price to rise. If Amazon can continue to maintain its cash flow and profit growth momentum as expected by analysts, it is very likely that the stock price will return to fair value and achieve this increase.

Based on the above valuation analysis, it is expected that Amazon will be able to achieve an average annual total return rate of 36% in the next three years. This expectation is not based on short-term market fluctuations, but on Amazon’s long-term development potential in multiple fields such as retail, e-commerce, and Cloud Services. As the company continues to occupy a leading position in the global e-commerce and Cloud Service markets, further stock price increases are quite likely.

Risk factors: challenges to focus on

While Amazon has demonstrated strong growth potential and solid financial fundamentals across multiple segments, there are still some risk factors that investors need to watch.

Firstly, as a leading global e-commerce and Cloud Service platform, Amazon has a large amount of customer data, which makes it a potential target for cyber attacks and data breaches. Any data security incident could cause serious damage to the company’s brand, thereby affecting stock price performance. With increasingly strict global data privacy regulations, Amazon needs to continuously increase its investment in data protection to cope with regulatory pressure.

Secondly, competitive pressure is another major challenge facing Amazon. Although the company holds a leading position in the e-commerce and Cloud Service fields, emerging competitors such as Temu and Shein are attracting a large number of consumers through low-price strategies, which poses a threat to Amazon’s market share. Especially in the low-price market and price-sensitive customer groups, Amazon needs to maintain its competitive advantage. In addition, AWS’s leading position in the Cloud Service market also faces strong competition from Microsoft Azure and Google Cloud. Although AWS has a deep technical accumulation and customer base, fierce market competition may still affect its growth rate.

Finally, the increasingly strict regulations and Anti-Trust reviews worldwide may pose potential risks to Amazon. The newly introduced regulatory policies may limit its Operational Efficiency or increase compliance costs. Although Amazon has taken corresponding measures, future regulatory changes may still have adverse effects on the company. Investors need to fully consider these potential risks when making decisions and avoid excessive reliance on short-term market performance.

Overall, Amazon remains a company with strong growth potential and a solid financial foundation, especially with its market leadership in Cloud Services and e-commerce providing sustainable growth momentum. Despite facing challenges such as data security, competitive pressure, and regulatory risks, Amazon still has the attractiveness of long-term investment with its strong cash flow, stable balance sheet, and constantly innovative business model. With the current undervalued stock price, the potential for returning to fair value in the future is huge. Therefore, for investors pursuing steady growth, Amazon is still a high-quality target worth up the ante.