- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

BYD's Gross Margin Slightly Beats Tesla! Delivery Volume Soared in 2024! Who Will Prevail in the Ele

BYD (BYDDF), the electric vehicle giant, has been in the spotlight recently with its delivery volume and sales continuing to rise, firmly establishing itself as a leader in the global electric vehicle industry. However, a recent news has caught the market’s attention: BYD has requested its suppliers to cut costs by 10%. It may sound a bit “alarming”, but there’s no need to worry too much. The report indicates that electric vehicle companies will have to implement strict cost - control measures in the future as the industry is shifting towards low - cost and low - profit electric vehicle options.

And since BYD’s stock is still trading at a very low price - to - sales ratio, I believe the company will remain the top investment choice for electric vehicle investors in 2025 and beyond.

Speaking of competition, the rivalry between BYD and Tesla (NASDAQ: TSLA) has been intensifying recently. BYD has just released its third - quarter financial report, showing that its revenue increased by 24% year - on - year to $28.24 billion, surpassing Tesla’s $25.2 billion. Although Tesla still leads in global sales, BYD’s growth momentum has undoubtedly impressed the market. This “electric vehicle battle” seems never - ending, but BYD, with its high profit margin and strong international expansion capabilities, is gradually narrowing the gap with Tesla.

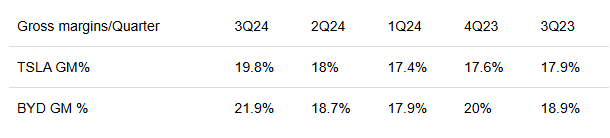

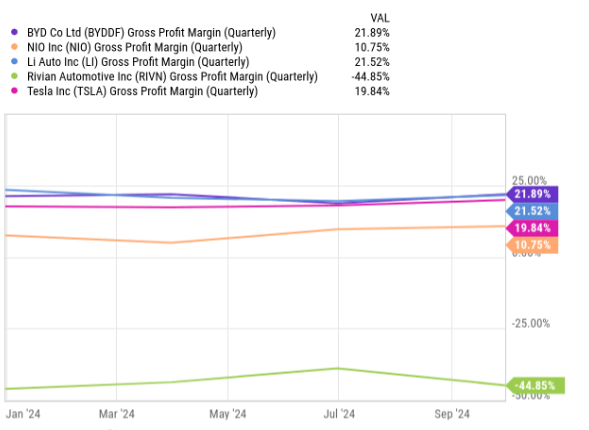

Financial Competition: Slightly Beating Tesla in Gross Margin

BYD’s gross margin appears to surpass Tesla’s, demonstrating stronger profitability.

Tesla’s gross margin has been declining since the first quarter of 2022, reaching a new low especially in the second quarter of 2024, although it rebounded in the third quarter of 2024. Such fluctuations indicate that although Tesla has advantages in price - cutting and market - share expansion, its profitability is under certain pressure.

In comparison, I expect BYD’s profit margin to maintain stable growth, which is consistent with the nature of its business and conducive to cost - reduction and profit - increase, while Tesla’s situation remains uncertain.

In terms of competition in electric vehicle sales, Tesla is still the market leader, especially in the first half of 2024, although BYD’s rise has made the gap smaller. Tesla previously had a 19% share in an important market, but by the first five months of 2024, this share had dropped to 17%. This trend is expected to continue in 2025, putting considerable pressure on Tesla.

BYD’s performance cannot be underestimated. Since 2021, BYD’s market share has increased by 9%. Although its stock price dropped by 1% from 2023 to 2024, during the same period, Tesla’s stock price also declined by 2%. In terms of delivery volume, BYD is almost on par with Tesla, with only 45,000 fewer vehicles delivered. This means that in the global electric vehicle market, the two companies are in a competitive situation with wins and losses on both sides.

BYD’s success lies in its focus on providing more competitively - priced electric vehicles and targeting the needs of different income groups.

This strategy enables BYD to quickly capture more market share, especially in some price - sensitive regions. In contrast, although Tesla has attracted consumers through significant price - cuts, its products are still relatively expensive in some markets, especially in BYD’s domestic market, unable to compete with BYD’s price advantage.

It is worth noting that although international tariff policies have alleviated the price difference between Tesla and BYD, BYD does not rely on exports to Western markets, so its global market strategy is more flexible.

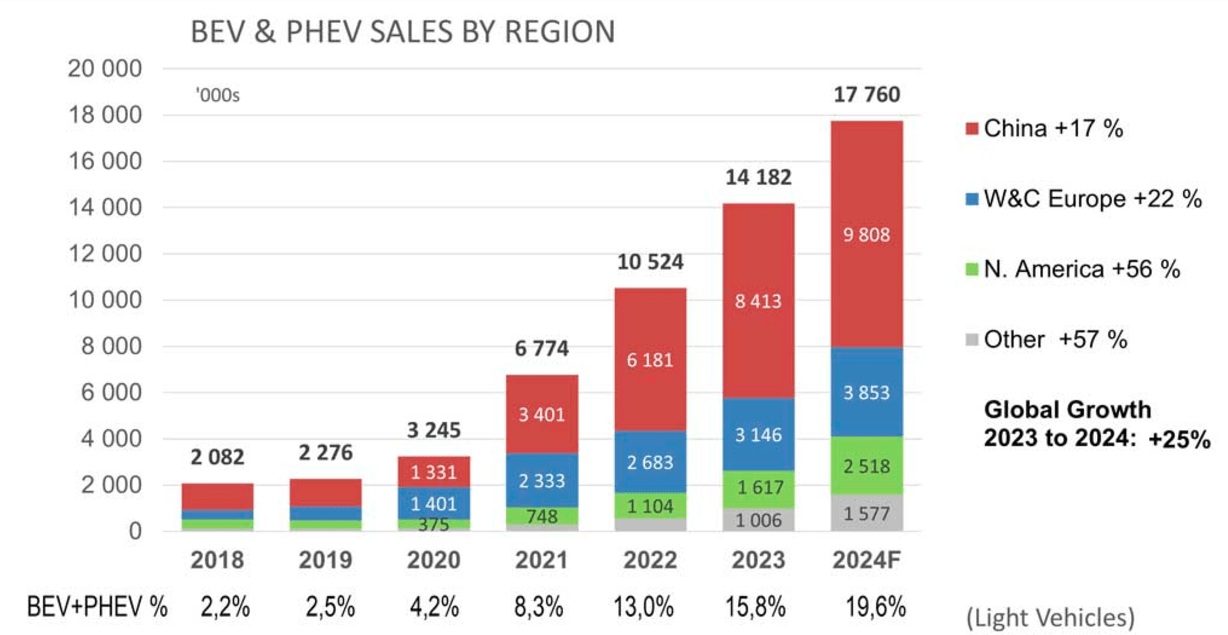

According to 2023 data, global electric vehicle sales reached 14 million, of which 70% were pure electric vehicles. In Asia, the largest market for hybrid and pure electric vehicles, electric vehicle sales accounted for 65% and 59% respectively. This trend is expected to continue in 2024, and as this year is almost over, the prediction seems correct.

The Impact of BYD’s Cost - Reduction

The news that BYD has asked its suppliers to cut costs by 10% next year has attracted investors’ attention.

This news comes from multiple reports, which mention that BYD has notified suppliers via email to reduce prices in all aspects of the electric vehicle production supply chain. Although this practice is not uncommon, the public disclosure of this email has made some people start to worry about the profit pressure BYD may face.

The root of these concerns mainly lies in the fierce competition in the electric vehicle market. Currently, there are a large number of electric vehicle companies competing for market share, and to increase sales and market share, many brands have chosen to launch lower - priced electric vehicles. For example, BYD has launched the Seagull, a small electric vehicle priced at less than $10,000. Moreover, the price war in the electric vehicle industry is intensifying, and the EU has recently started to impose new tariffs, aiming to protect the interests of local electric vehicle manufacturers.

Another company actively launching low - priced models is NIO, whose new electric vehicle brand ONVO, focusing on the low - price market, is an important part of its growth strategy.

As the market gradually shifts towards low - priced and low - profit electric vehicle products, companies also have to pay more attention to cost - cutting. In the future, effectively managing operating and raw material costs will be more crucial than simply expanding sales volume. However, despite the pressure of the price war, BYD’s gross margin is still outstanding, reaching 21.9%. This level is higher not only than Tesla’s but also than Li Auto’s - BYD seems to have the highest gross margin in the electric vehicle industry.

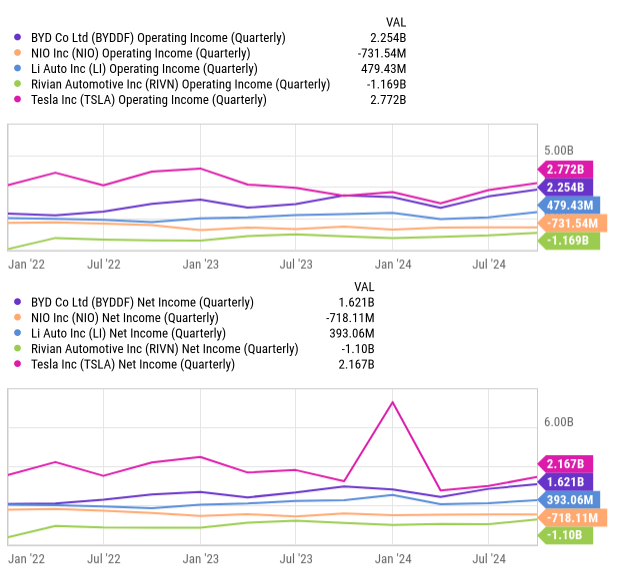

Besides having the industry - leading gross margin, BYD remains profitable in all aspects of its financial statements. Its operating profit in the last quarter was $2.25 billion, ranking second only to Tesla.

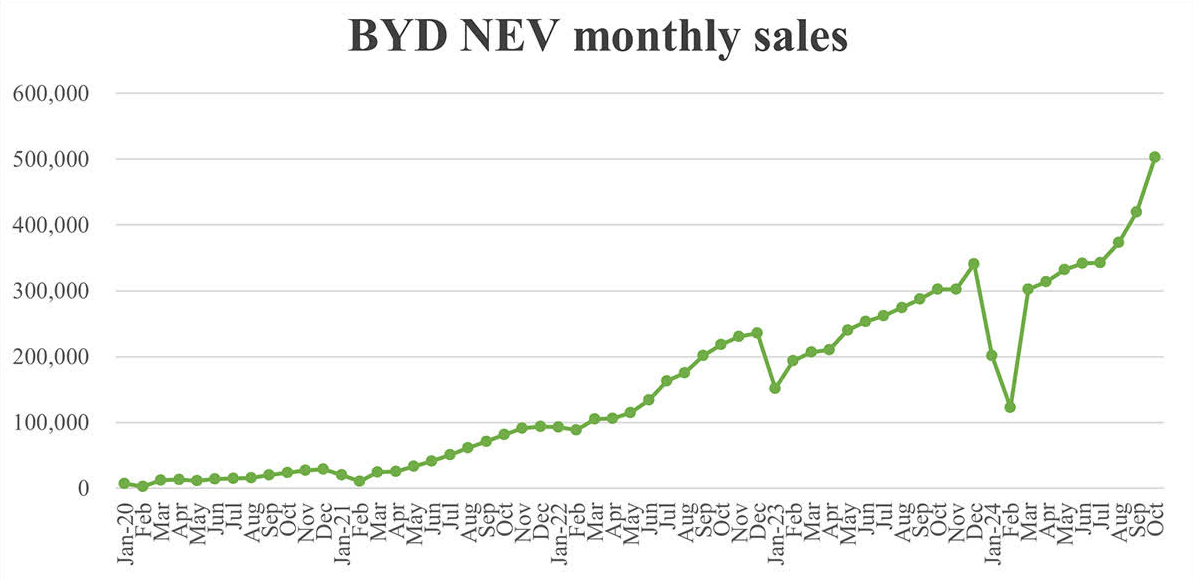

In addition, in October 2024, BYD delivered 502,657 new energy vehicles, which not only set a new company record for monthly delivery but also marked the fifth consecutive month of record - high delivery volume.

With the strong demand in the domestic market and the continuous penetration of overseas markets such as Europe, Asia, and the Americas, BYD’s competitiveness in the global electric vehicle market is becoming more and more significant. It is expected that BYD will soon replace the German auto giant Volkswagen, which shares the market with its joint - venture partners.

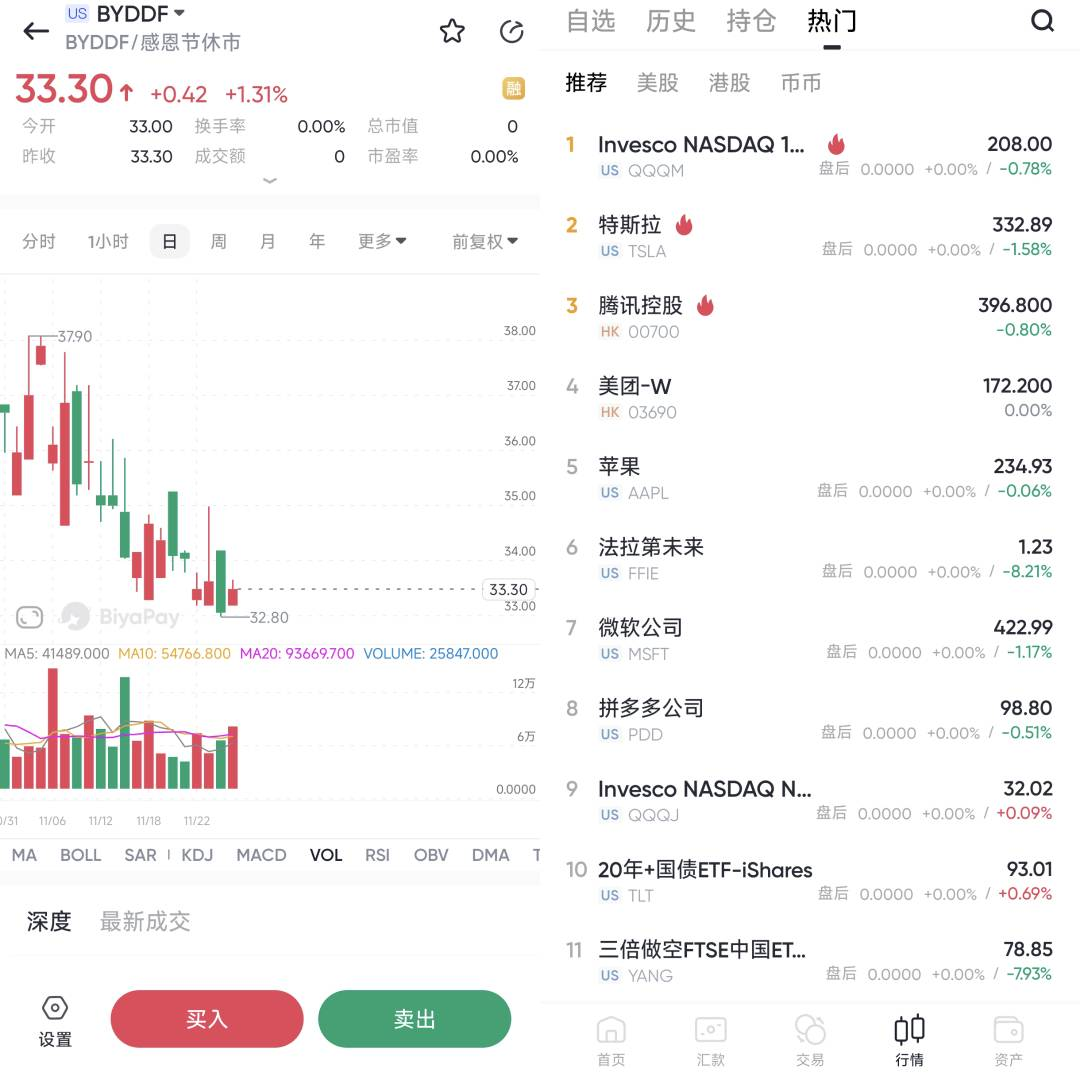

Overall, although the news that BYD has asked suppliers to cut prices has made the market a little nervous, considering its strong gross margin, steadily increasing delivery volume, and continuously expanding international market share, BYD is still in an advantageous position, and there is no need to worry too much about short - term supply - chain cost pressure. Currently, its profitability and delivery volume are clearly not fully reflected in the stock price. I recommend you to use the multi - asset wallet BiyaPay to make investments in the current stock price range and look forward to future growth dividends. BiyaPay also supports trading of US and Hong Kong stocks and digital currencies, facilitating users to check price trends regularly and complete deposit and withdrawal operations quickly at critical moments.

If you encounter problems with fund transfers, BiyaPay provides efficient, safe, and non - frozen - card solutions. Whether it is recharging digital currencies and converting them into US dollars or Hong Kong dollars, or withdrawing funds to a bank account, it can quickly and flexibly meet fund requirements, ensuring that investors do not miss any market opportunities.

Valuation Analysis: BYD Is More Attractive

In the electric vehicle field, the valuation gap between Tesla and BYD is quite significant.

Tesla’s market capitalization currently reaches $1.09 trillion, far exceeding BYD’s approximately $105.5 billion. In the past year, Tesla’s stock price has risen by more than 43.8%, showing high market enthusiasm, but its volatility is also large, with a beta coefficient of 2.29, meaning its price volatility is higher than the overall market level. In comparison, BYD’s stock price has risen relatively little, only by 13.6%, and its beta coefficient is 0.42, indicating that the stock’s volatility is lower than the market average and the risk is relatively low.

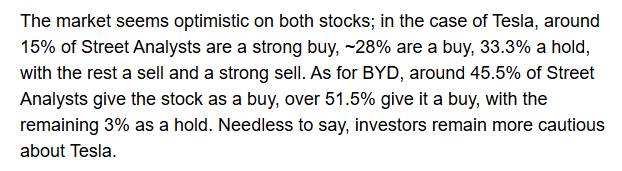

Analysts’ recommendations for the two companies’ stocks are relatively optimistic:

Nevertheless, investors’ cautious attitude towards Tesla is still significantly higher than their optimistic expectations for BYD.

From a valuation perspective, BYD appears to be more cost - effective. BYD’s current price - to - earnings ratio is 20.1, and the expected price - to - earnings ratio is 16.2, far lower than Tesla’s 92.8 and 110. At the same time, BYD’s enterprise - value - to - sales ratio (EV/Sales) is only 1.06, while Tesla’s is as high as 10.98. Combining its strong earnings performance with lower valuation, BYD is undoubtedly more attractive compared to Tesla.

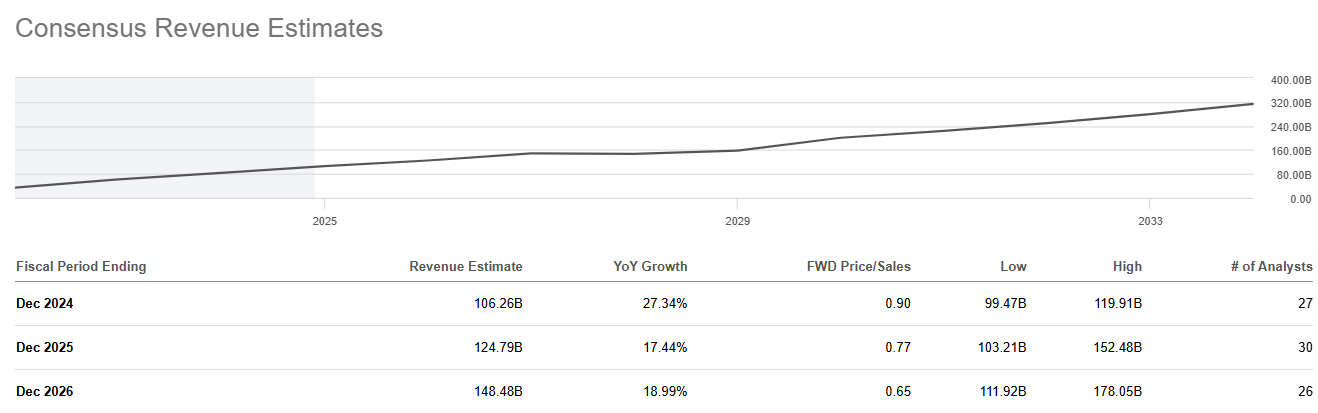

It is even more notable that BYD’s price - to - earnings ratio is significantly lower than that of its Chinese peers such as Li Auto (LI) and NIO (NIO), whose price - to - sales ratios are 0.8 and 0.7 respectively. These figures also reflect that the market’s expectations for BYD’s future growth are still relatively conservative, while the company has already proven its strong profitability and market performance.

From a fundamental perspective, BYD’s valuation appears particularly low. BYD’s price - to - earnings ratio is only 0.8 times (based on expected earnings for the 2025 fiscal year), and its profitability and delivery volume (expected to deliver more than 4 million vehicles this year) are clearly not fully reflected in the stock price. Therefore, I believe that BYD’s current valuation is obviously lower than it should be.

Overall, BYD’s valuation is relatively more reasonable and attractive, especially considering its strong performance in gross margin, profitability, and delivery volume. In comparison, although Tesla’s high valuation reflects the market’s expectations for its future growth, its higher risk and volatility also make some investors cautious.

Therefore, from an investment perspective, BYD clearly offers more potential value, especially in the context of the increasingly fierce competition in the current electric vehicle market.

The Next Step

BYD has great potential in the electric vehicle field and even has the opportunity to surpass the current industry leader - Tesla.

In fact, as early as the fourth quarter of 2023, BYD’s electric vehicle sales once exceeded Tesla’s, but then Tesla regained the market - leading position. Nevertheless, BYD’s fourth - quarter performance hit a new high in the company’s history, which also laid a solid foundation for its short - term future performance. I expect this performance will have a positive impact on the further rise of BYD’s stock price.

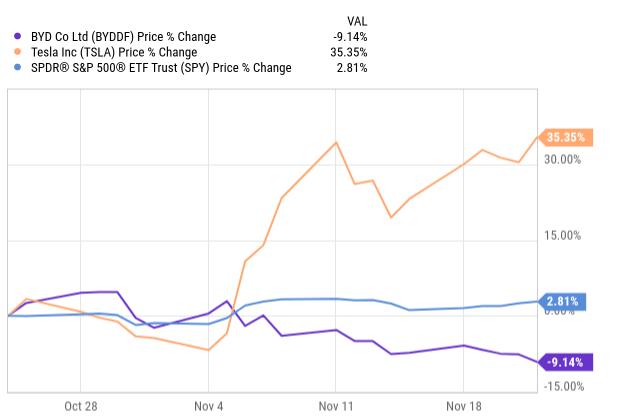

From a long - term development perspective, I am more optimistic about BYD’s profit margin. However, in terms of stock price performance in the last month, Tesla is clearly ahead of BYD, which is not surprising. As shown in the figure below, BYD’s stock price has dropped by about 9% in the past month, while Tesla’s stock price has risen by about 35%, and the S&P 500 index has risen by 2.8%. But to be honest, the rise in Tesla’s stock price is mainly affected by Elon Musk’s relationship with American political leaders (such as Donald Trump), and I think the market has digested this factor to some extent.

Therefore, although Tesla has performed strongly recently, with the better - than - expected third - quarter results and the favorable election results, there is limited room for Tesla’s stock price to rise further.

From BYD’s perspective, I think the market has not fully recognized the company’s huge potential in the battery field and international expansion. Relatively speaking, investors are currently more on the sidelines, worried about whether BYD can withstand the risks brought by tariffs. But in fact, the only risk concern is that about 90% of BYD’s sales come from the domestic market. Therefore, although tariffs may bring some challenges, their impact on BYD is relatively limited.

Overall, although Tesla has stronger political and market support in the United States, BYD’s local position and its expansion potential in the global market make its growth space broader in the next few years. Therefore, whether in the short - term or long - term, from an investment perspective, BYD is worthy of our close attention.