- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Turmoil of the Department of Justice's Split Proposal, Google's Stock Price Plummets! Would You

Google (GOOG) has got into trouble again recently. This time, it has caught the attention of the U.S. Department of Justice. The antitrust lawsuit proposing to split Google’s search, Chrome, and Android businesses has directly led to a 5% drop in its stock price. Indeed, just seeing the word “split”, investors are bound to feel nervous. However, after all, Google is Google. Its dominant position in the fields of digital advertising and cloud computing is not something that can be easily split up.

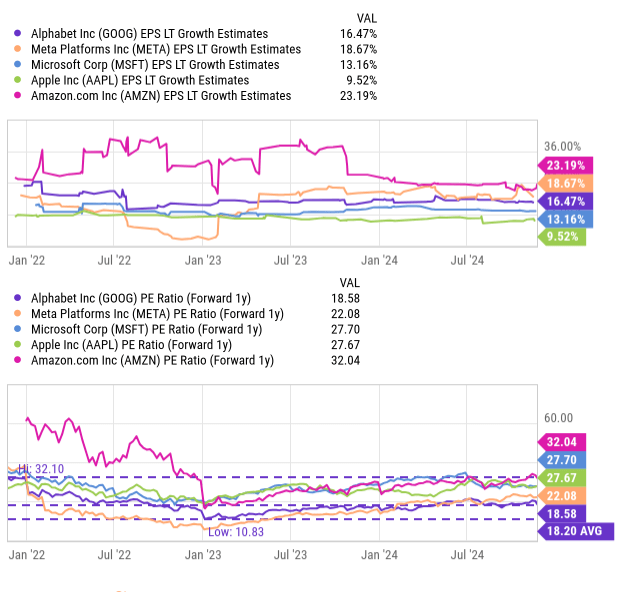

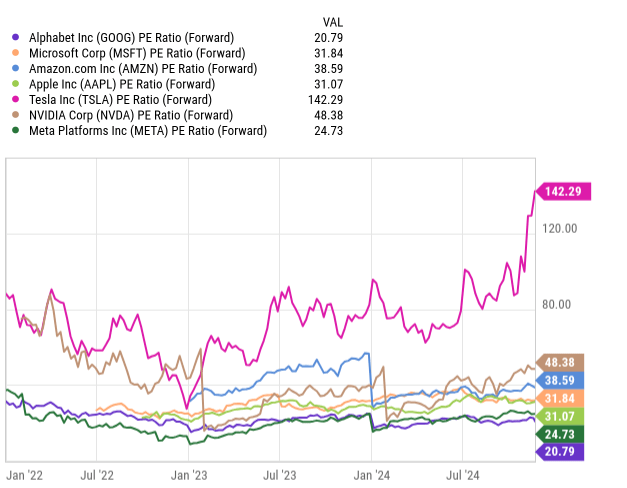

You should know that Google’s search business accounts for 56% of the company’s total revenue, and its cloud computing division is growing vigorously with an annualized growth rate of 35%. Looking at the valuation, its current price-to-earnings ratio is only 18.6 times, the cheapest among the MAG-7 tech giants, much lower than the industry average of 25.6 times. Given this cost-performance ratio, it’s no wonder that some people say it’s an “undervalued gold mine”.

Certainly, the Department of Justice’s move will make the market sentiment a bit uneasy. But on careful thought, Google’s fundamental business hasn’t been shaken. On the contrary, after the valuation correction, there may be greater room for an upward trend. So, should one sell in panic or buy at a low price? Let’s take a good look at whether Google is worth investing in at present.

The Short-Term Impact of the Antitrust Turmoil

Google seems to have been constantly troubled by antitrust issues in recent years. Recently, the U.S. Department of Justice took action again, proposing to split Google’s search business, Chrome browser, and Android operating system. This proposal immediately attracted widespread attention in the market, causing Google’s stock price to plunge by about 5% within a week. Such fluctuations in the stock market have made many investors doubtful and worried that this antitrust lawsuit might affect Google’s core businesses.

First of all, let’s take a look at the specific content of this antitrust turmoil.

The U.S. Department of Justice believes that by controlling search engines, browsers, and mobile operating systems, Google has formed a monopoly in the entire digital advertising market and gained an unfair advantage in competition. Especially in the search business, Google has almost monopolized the U.S. market.

To change this situation, the Department of Justice has put forward a plan to split Google, requiring it to divest some of its businesses, especially the search and browser businesses, to increase market competition. With the release of such news, it’s natural for the market to be in a panic, and the decline in the stock price is not unexpected.

However, this reaction may actually be overly pessimistic.

Although antitrust investigations and legal proceedings are undoubtedly major challenges for Google, judging from historical experience, such cases usually don’t easily lead to the forced dissolution or splitting of enterprises. Take Microsoft as an example. In the late 1990s, it also encountered similar antitrust lawsuits. Although Microsoft was finally required to make some business adjustments, its core competitiveness remained solid and it didn’t experience a “split” as many market participants predicted. So there’s a high possibility that Google can reach a settlement with the government through legal means and avoid being forcibly split.

Although the impact of the antitrust lawsuit has depressed Google’s stock price in the short term, considering Google’s leading position in digital advertising, cloud computing, and the global market, it can be considered that all this is more of a fluctuation in market sentiment.

Valuation Analysis and Google’s Long-Term Value

In the current tech stock market, Google’s valuation is relatively low, which provides an attractive opportunity for investors. Google’s price-to-earnings ratio (PE Ratio) is currently 18.6 times, significantly lower than that of other tech giants in the same industry. Microsoft’s price-to-earnings ratio is 31.8 times, and Apple’s is 29.4 times. Google is regarded as an “undervalued” member. Even among the entire MAG-7 (including Apple, Microsoft, Google, Amazon, Meta, Tesla, and Nvidia), Google has the cheapest valuation.

So, why is Google’s valuation so low?

Firstly, the antitrust issue has obviously affected market sentiment. After seeing the split proposal put forward by the Department of Justice, investors have concerns about the company’s future uncertainties. Such concerns have made investors doubtful about Google’s future profitability and thus affected the stock price. However, Google’s fundamentals remain strong, especially with the continuous growth in the two major fields of digital advertising and cloud computing.

Google’s current price-to-earnings ratio is much lower than the industry average level, especially considering its strong market position and future growth potential.

This low valuation provides a “margin of safety” for investors. That is to say, even facing antitrust pressure, Google still has sufficient profitability to support its current valuation and return to a more reasonable level in the future. Historically, similar undervaluation situations often mean that once market sentiment warms up, the stock price may rebound significantly.

Upside Potential for Valuation

Assuming that Google’s price-to-earnings ratio rebounds to the industry average level of 25.6 times, its stock price may rise by more than 30%. This valuation recovery doesn’t rely on drastic changes in Google in the short term but is based on the restoration of the market’s confidence in the company’s future development. For example, as the antitrust lawsuit is gradually resolved, the market’s long-term expectations for Google will gradually recover, and the stock price may also rebound accordingly.

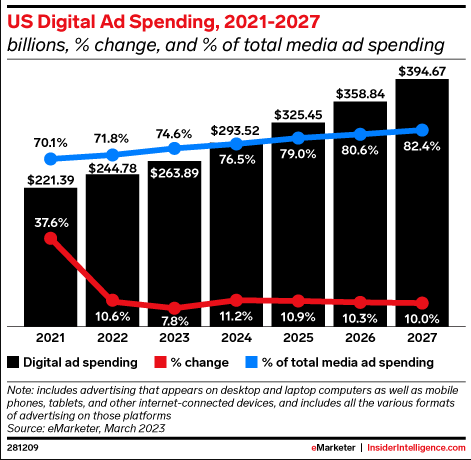

Moreover, Google’s advertising business accounts for about 30% of the global market share, which enables Google to remain competitive in the digital advertising field by virtue of its huge data and traffic advantages even when facing split pressure. According to the financial report for the third quarter of 2024, Google’s search department generated $494 billion in revenue in that quarter, accounting for 56% of the company’s total revenue. Although the annualized growth rate of the advertising department is 10.39%, lower than that of the previous quarter, the search business remains Google’s core revenue source and is still growing steadily with an annualized growth rate of 12.3%.

More importantly, Google’s cloud computing business and hardware business are also expanding steadily, becoming new growth points for the company’s revenue. In the third quarter of 2024, Google Cloud’s revenue was $113.5 billion, with a year-on-year growth rate of 34.96%, which exceeded that of Microsoft and Amazon, showing Google’s strong growth momentum in the cloud computing field. In addition, Google’s hardware businesses, such as Pixel mobile phones and Nest home products, are also gradually diversifying the company’s revenue. The growth rates of these emerging businesses provide more guarantees for Google’s future profitability and further support its potential for valuation upside.

Therefore, although Google’s stock price is currently dragged down by the antitrust lawsuit, considering its strong performance in advertising, cloud computing, and hardware and other fields, Google still has huge room for valuation repair. In the long run, the current low valuation provides a rare entry opportunity for investors.

Technical Analysis Support

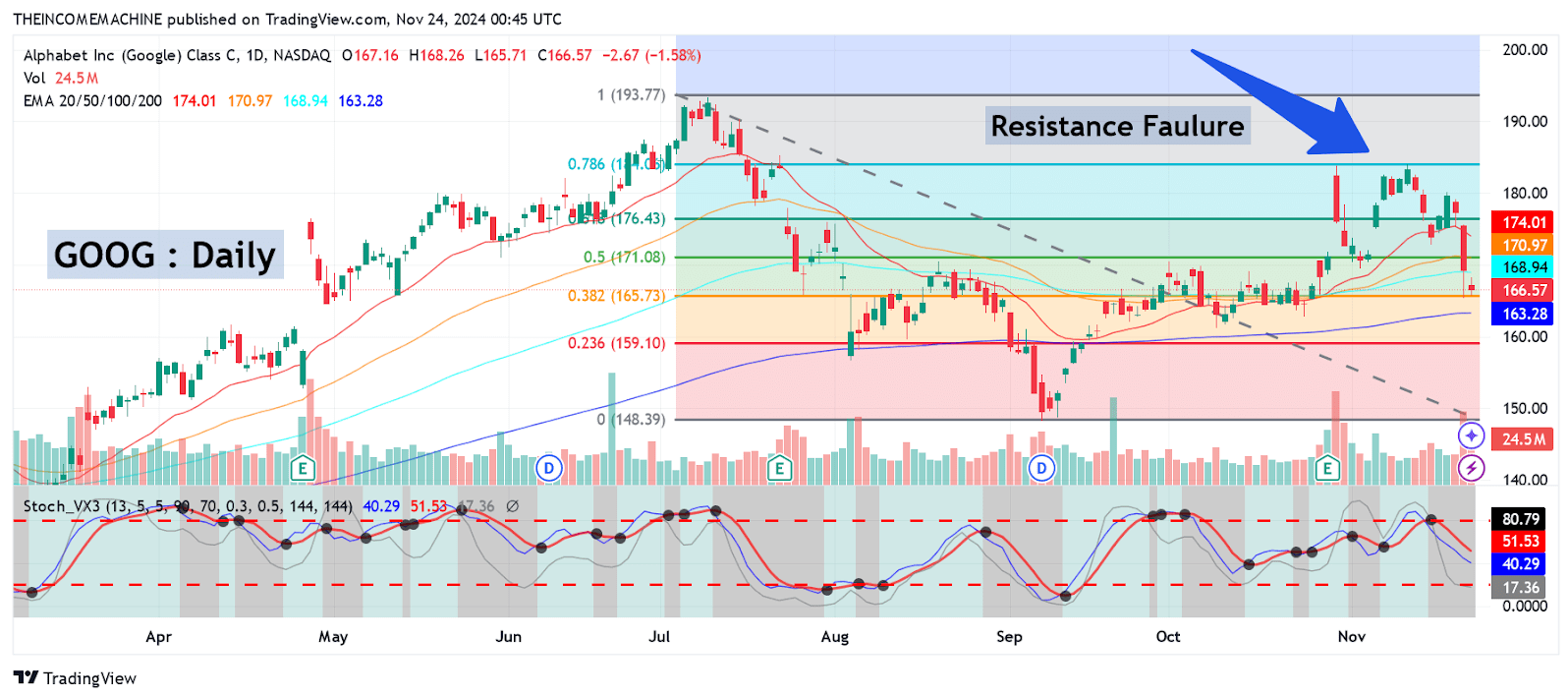

For the reasons mentioned above, I still think that Alphabet’s stock is in a very advantageous position among the broader MAG-7 group. However, all investors know that the stock market rebound won’t last forever. After hitting a historical high, a correction is inevitable. Judging from the stock price trend we discussed earlier, I think Alphabet’s stock is currently in a typical correction process.

Looking back at Alphabet’s historical high of $193.31 and connecting it with the low of $148.20 on September 9, 2024, it can be clearly seen that the stock price encountered strong resistance when approaching the 78.6% Fibonacci retracement level (about $184.05). At this time, the stock price failed to break through this key price level, and the daily stochastic indicator (RSI) also fell back from the overbought area, and the bearish trading volume increased significantly, exceeding the recent average level.

This price trend has formed an obvious double-top resistance area near $184, further limiting the upward space of the stock price. To further adjust my view and downgrade the rating from “Buy” to “Sell”, I will pay attention to whether the stock price falls below the low of $148.20 on September 9. If this happens, it may accelerate the downward pressure and lead the stock price to the next major support area, that is, the low of $131.55 on March 4, 2024.

Unless this situation really occurs, I will maintain my current long position and lower the overall outlook to a simple “Buy” rating, because I believe that the recent historical correction is just part of the stock price adjustment. In the long run, Alphabet still has strong fundamental support.

Entry Timing: Wait or Act Immediately?

For investors, the key question is: Should one enter the market now or wait for further corrections?

Although the stock price may be continuously affected by the antitrust lawsuit in the short term, in the long run, Google still has strong market competitiveness and growth potential. Combining with Google’s relatively low valuation at present, especially when compared with companies in the same industry, Google’s price-to-earnings ratio is relatively low, bringing a relatively safe entry opportunity for investors.

More importantly, with the possible changes in the regulatory environment after the change of government, the pressure of the antitrust lawsuit may be alleviated, thus laying the foundation for the long-term rise of the stock price.

To sum up, although Google is facing pressure from the U.S. Department of Justice, the short-term fluctuations in its stock price can’t change its fundamental for long-term growth. From the advertising business to cloud computing and the cutting-edge layout in artificial intelligence, Google’s leading position in multiple fields has laid a solid foundation for its future development. Its share in the global advertising market, the continuously expanding cloud computing business, and the constantly advancing artificial intelligence technology all provide it with huge growth potential.

Although the current stock price fluctuations provide short-term investment opportunities, investors should pay attention to the natural corrections in the stock market and possible technical rebounds. Therefore, for long-term investors, the current stock price level may be a relatively appropriate entry timing. In the short term, if the stock price continues to decline, it may provide a more favorable price point for future rebounds.