- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

NVIDIA's financial report exceeded expectations. AI and Blackwell are driving the investment potenti

NVIDIA has rapidly grown from a traditional chip manufacturer to one of the world’s most valuable technology companies in recent years, especially in the field of artificial intelligence, which has made its market position more stable. With the rapid development of industries such as data centers and autonomous driving, NVIDIA’s technology products have become the core driving force in these fields. The latest Q3 financial report highlights its dominant position in the field of artificial intelligence, showing strong growth momentum and consolidating its leading position.

NVIDIA’s financial report is impressive: Explosive growth and profitability driven by AI

NVIDIA’s latest Q3 financial report once again confirms the company’s leading position in the technology industry, with revenue reaching a historical high of $35 billion, a year-on-year increase of 94%. This performance exceeded market expectations, especially in the context of global economic uncertainty. NVIDIA’s ability to maintain such strong growth momentum demonstrates its huge advantages in the fields of AI and high-performance computing.

Specifically, the Data center business remains the core driver of growth, with a year-on-year growth of 112%. In addition, the automotive business grew by 72%, while the gaming and professional visualization businesses also showed mid-to-high single-digit growth.

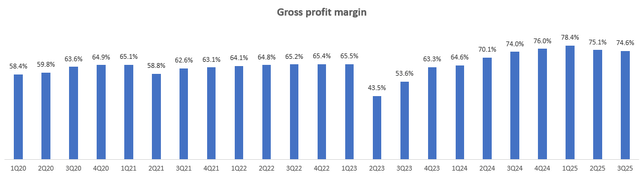

In terms of profitability, NVIDIA has maintained a very high level of profitability. Thanks to strong demand, the company was able to maintain a non-GAAP gross profit margin of about 75%, which is basically the same as last year. At the same time, NVIDIA’s adjusted operating expenses increased by only 50%, making its operating income more than twice that of the same period last year. The company’s reported non-GAAP Net Profit exceeded $20 billion and free cash flow was close to $17 billion, reflecting its strong cash creation and profitability.

In terms of financial position, NVIDIA’s cash and investment balance reached $38.50 billion, and the total debt was about $8.50 billion, which provided the company with great financial flexibility. The company repurchased nearly $11 billion of stock in the third quarter, and the annual repurchase amount is expected to be close to $26 billion. These actions did not affect its cash reserves, but instead further increased its cash balance.

NVIDIA expects quarterly revenue to double from current levels to more than $50 billion by fiscal year 2026, and continued growth momentum and strong technological advantages will enable the company to achieve larger-scale revenue growth in the coming quarters.

NVIDIA’s growth momentum: the dual driving force of technological innovation and market expansion

NVIDIA’s current growth momentum mainly comes from its innovation in multiple technology fields and the outbreak of market demand. Especially in key industries such as artificial intelligence (AI), high-performance computing (HPC), and autonomous driving, NVIDIA is continuously consolidating and expanding its market share through technological innovation. In the next few years, with the release of the new generation architecture and the further penetration of AI applications, NVIDIA’s growth prospects will be even brighter.

NVIDIA’s success is closely related to its continuous technological innovation. The launch of the Hopper architecture has made the company’s technological advantages in AI training and inference more prominent. The architecture has significantly improved processing speed and energy efficiency, further enhancing NVIDIA’s market leadership in deep learning and data computing. At the same time, the upcoming Blackwell architecture is expected to continue to drive NVIDIA’s growth, especially in areas such as autonomous driving, EdgeComputing, and Cloud Services.

NVIDIA’s GPU products are not only widely used in the AI field, but also occupy a dominant position in high-performance computing and data centers. The company expects that with the continuous growth of AI demand, the data center business will become one of the main driving forces for its revenue in the next few years. NVIDIA is also strengthening its cooperation with Cloud Service giants such as Microsoft, Amazon, and Google to further expand its share in the global data center market.

NVIDIA’s leadership position in the GPU field is beyond doubt, especially in the application of AI and Deep learning. As more and more companies integrate AI technology into their business processes, NVIDIA’s product demand will continue to grow. The company not only continuously innovates in technology research and development, but also demonstrates strong capabilities in industry chain integration, further consolidating its dominant position in the global market.

NVIDIA’s technological advantages have made it one of the world’s largest AI hardware suppliers and an irreplaceable position in multiple industries. With the development of AI, autonomous driving, virtual reality, and intelligent manufacturing, NVIDIA will undoubtedly continue to be at the forefront of these trends, driving the company to achieve greater breakthroughs and growth in the coming years.

For investors who are optimistic about NVIDIA’s future, now may be a good time to participate in its growth story. If you want to invest in NVIDIA’s stock, BiyaPay provides a convenient platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience.

With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With the advantages of fast deposit speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

Valuation analysis and investment prospects: what is the potential?

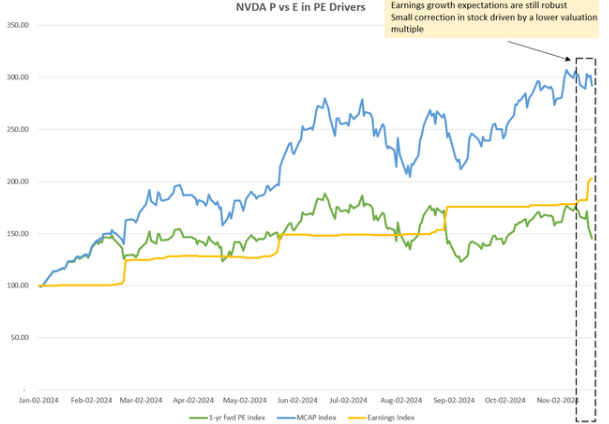

NVIDIA’s market value has surpassed $3 trillion, making it one of the most valuable companies in the world. However, despite its historically high valuation, investors remain optimistic about its future growth potential. Currently, NVIDIA’s 12-month future Price-To-Earnings Ratio is 36 times, down from around 45 times. This change does not represent a problem with the company’s fundamentals, but rather a normal adjustment of market expectations for its future growth.

Analysts generally believe that as NVIDIA continues to expand its market share and achieve sustained growth in revenue and profits, future valuation levels will gradually be recognized by the market.

In particular, the explosive growth in demand for NVIDIA’s GPU and AI hardware in the coming years will bring sustainable cash flow and profit growth, thereby enhancing its valuation space. The company expects quarterly revenue to double to over $50 billion by fiscal year 2026, driving further market value growth. Despite the current high stock price, its steadily growing profitability and technological leadership provide investors with solid long-term investment logic.

Latent risks and challenges: the test of market adjustment and technological progress

Despite NVIDIA’s impressive performance in the AI and data center fields, potential risks and challenges are gradually emerging as the company’s market value continues to soar. Investors need to be aware that although NVIDIA has broad growth prospects, the market volatility, competitive pressure, and uncertainty of technological progress it faces may have a certain impact on the company’s future performance. Understanding these latent risks helps to more comprehensively evaluate NVIDIA’s investment value.

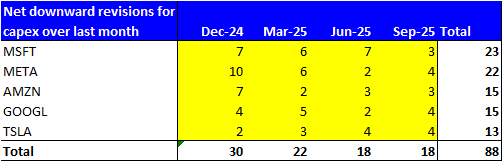

Market demand fluctuations and capital expenditure adjustments

Despite NVIDIA’s strong earnings growth, some key customers (such as Microsoft, Meta, Amazon, etc.) have lowered their capital expenditure expectations.

With the increasing uncertainty of the global economy, these companies may postpone or reduce their investments in AI hardware and data center equipment, which will affect NVIDIA’s revenue growth in the coming quarters. Especially after the short-term peak period of AI demand, there may be a market adjustment, leading to a slowdown in revenue growth. Therefore, investors need to pay attention to NVIDIA’s customer spending trends to determine whether it will put pressure on the company’s future financial performance.

Technology competition and product lifecycle

Against the backdrop of continuous technological development, NVIDIA is facing increasing competitive pressure. With the increasingly fierce competition in the GPU market, especially in the fields of AI and high-performance computing, NVIDIA needs to maintain its leading position in technological innovation to prevent being surpassed by other competitors. Although the company is consolidating its market share by continuously launching new generation architectures (such as Hopper and the upcoming Blackwell architecture), the speed of technological updates and the research and development progress of competitors are still risks that cannot be ignored. As the market demand for new technologies continues to escalate, NVIDIA needs to remain highly sensitive and responsive in product innovation and technological iteration.

Gross Margin Pressure and Internal Distribution Trends

NVIDIA’s current gross profit margin has been stable at around 70%, but with changes in customer demand structure, especially the increase in internal distribution trends, future gross profit margins may face certain downward pressure.

More and more companies are starting to build their own data centers or seek their own chip solutions to reduce their dependence on external GPU suppliers. This trend may have an impact on NVIDIA’s pricing power and gross profit margin, especially as the production of Blackwell architecture gradually increases, which may face pressure from price competition and market share. Therefore, NVIDIA needs to continue to strengthen strategic cooperation with major customers and continuously optimize its cost structure to cope with the potential downside risk of gross profit margin in the future.

In summary, NVIDIA has shown strong growth momentum with its technological advantages in AI, data center, and high-performance computing, and is expected to continue expanding its market share in the coming years. Despite the company’s current high valuation, its profit growth prospects are still strong, and the market is optimistic about its value-added potential. However, investors also need to be vigilant about potential risk factors, such as market demand fluctuations, customer capital expenditure adjustments, and technology competition, which may affect short-term performance. Overall, NVIDIA is a high-quality technology stock suitable for long-term investment, and everyone can pay attention to investment opportunities.