- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Technical and Fundamental Strengths Combined: Is Now the Best Time to Invest in Microsoft Stock?

Microsoft’s stock price has recently raised doubts among many investors. After hitting an all-time high in July 2024, it has been in a downward correction. Although its financial report data is impressive - with revenue growing by 16% year-on-year and earnings per share exceeding expectations, the market seems to be taking a wait-and-see attitude towards its huge AI investments. It is reported that Microsoft has invested approximately $14 billion in OpenAI since 2019 and also plans to jointly launch an AI infrastructure fund of up to $100 billion with BlackRock. Will these staggering expenditures really bring substantial returns?

Microsoft’s layout in the fields of AI and cloud computing cannot be underestimated. The annualized growth rate of Azure still exceeds 30%. However, in the face of strong competitors like Amazon AWS, the market is also worried about whether it can continue to expand its market share. In other words, Microsoft’s current stock price reflects both its long-term potential and the uncertainty of short-term returns.

So, is now a good opportunity to buy Microsoft on the dip, or just a risky gamble?

The Impact of AI Investments and Capital Expenditures

Microsoft’s moves in the field of artificial intelligence in recent years can be described as “big bets”. Just the approximately $14 billion it has invested in OpenAI since 2019 is already astonishing enough, not to mention that it also plans to team up with BlackRock to launch an AI infrastructure fund of up to $100 billion. Where has all this money been spent? Building data centers, researching and developing chips, and optimizing energy solutions are all to pave the way for its future AI landscape. However, the question that the market cares about the most is: Can these huge investments actually become the driving force for the stock price to rise?

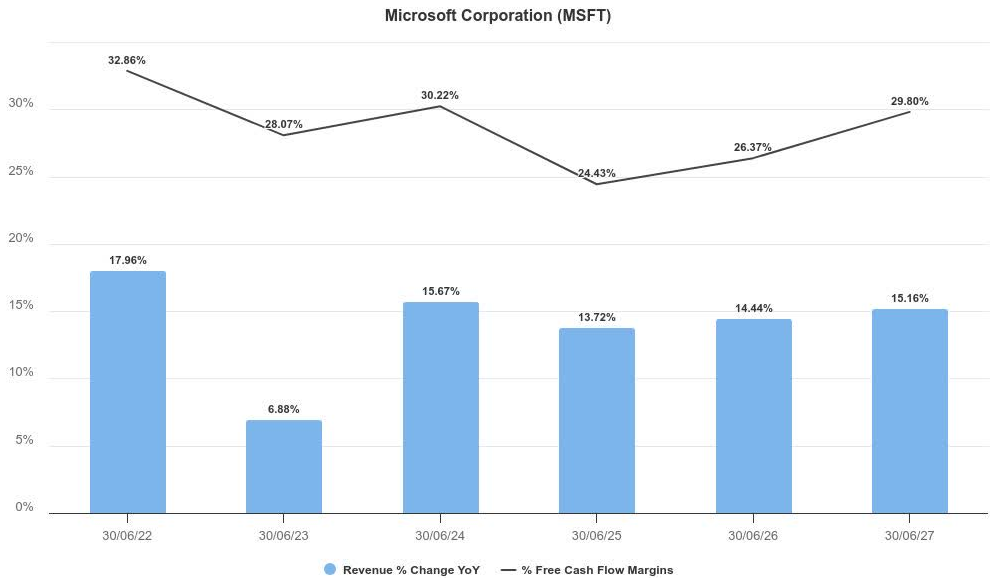

In fact, the pressure of capital expenditures has already begun to show. Microsoft’s free cash flow margin is declining, and this trend may intensify in the short term. Morgan Stanley estimates that by 2025, the total capital expenditures of hyperscale cloud service providers will reach $300 billion, and Microsoft is naturally one of the main forces. It sounds like a huge gamble, but for Microsoft, this kind of bet is a must.

Microsoft’s diversified business structure is a major advantage - this company doesn’t rely on a single product. Its business segments such as cloud computing, office software, and hardware provide a buffer against aggressive capital expenditures. Meanwhile, Microsoft has also cleverly integrated artificial intelligence functions into existing products like Office 365 through the “bundling sales” method. For example, enterprise users can obtain AI-enhanced functions through subscription services. This strategy not only increases customer loyalty but also creates more possibilities for the monetization of AI technology.

Of course, although the prospects are good, the competition is also becoming fiercer. For example, the confrontation with SaaS field leaders like Salesforce or the direct competition with cloud computing giants like AWS, Microsoft’s “stress tests” in these markets are not easy. In addition, more aggressive capital expenditure requirements may further affect short-term earnings performance. This raises a key question: Can Microsoft find a balance between profitability and expansion ambitions?

From another perspective, this may be exactly where investors should be optimistic. The huge potential of the generative artificial intelligence market and Microsoft’s first-mover advantage in this field make this “big gamble” seem less like a wishful adventure and more like a forward-looking strategic layout.

Ultimately, whether these investments can become the core driving force for the stock price to rise still needs to be tested by the market and time.

So, are Microsoft’s AI investments really worth it? There is indeed short-term earnings pressure, but if it can successfully turn these huge expenditures into growth engines, then the long-term performance of the stock price may make investors applaud in hindsight.

The Growth Code of Microsoft’s Stock Price: AI and Cloud Services

Microsoft’s layout in the field of artificial intelligence is far more than just huge capital expenditures; it is to build a “moat” in future market competition.

Azure, as Microsoft’s core cloud service platform, occupies an important position in the global market. The latest data shows that its annualized growth rate still reaches 33%, but the strong performance of competitors like AWS and Google Cloud makes this market battle even fiercer. So, how can Microsoft find its own growth code in the combination of AI and cloud computing?

From Experiment to Implementation: The Strategy of Azure AI Foundry

At Microsoft’s recent Ignite conference, Satya Nadella and his team made it clear that the short-term challenges in the expansion of artificial intelligence will not undermine their long-term confidence. From the “laboratory model” to “enterprise implementation”, Microsoft is quickly completing the transition by integrating AI technology into enterprise services. This strategy is not just a vision but also a signal to investors: Microsoft has the ability to turn its current AI investments into tangible business growth points.

For example, the launch of Azure AI Foundry is an important attempt. It provides enterprises with more model flexibility, allowing customers to switch AI services on demand to meet diverse business needs. This flexibility significantly expands the application range of Azure, especially in attracting small and medium-sized enterprise customers. Compared with AWS’s customized chip strategy, Azure’s “software-first” strategy is more universal.

However, it is worth noting that as LLM (Large Language Model) is gradually commoditized, will the unique value of Microsoft’s cooperation with OpenAI be weakened? This is still a question that requires continuous observation.

Competition with AWS and Strategic Adjustments

Microsoft has clearly recognized AWS’s leading position in flexibility and adapting to customer needs.

Through Azure AI Foundry, Microsoft is imitating AWS’s strategy while also exploring differentiated competition. Microsoft embeds AI services into the daily work of enterprises through its Office 365 and Dynamics 365 ecosystems, providing customers with one-stop solutions. This deep integration model can not only increase customer loyalty but also further expand the market share.

However, Microsoft also faces practical problems in the competition with AWS. AWS, relying on its managed service Bedrock and higher hardware self-developed capabilities, continues to maintain strong profitability. Microsoft, on the other hand, needs to accelerate the monetization of AI services to achieve the profitable expansion of Azure. This means that Microsoft not only needs to attract more enterprise customers but also needs to make the expansion capabilities of its AI models play a greater role in the revenue structure.

For investors, Microsoft’s AI and cloud service strategies are gradually becoming the core support points for its future stock price. Through the deep integration of Azure AI Foundry and the ecosystem, Microsoft’s attractiveness among enterprise customers continues to increase. However, in the short term, the competitive pressure from AWS and Google Cloud, as well as the challenge of the commoditization of AI models, may have a certain impact on its valuation.

In the long run, the growth foundation established by Microsoft through technological innovation and service integration may gradually drive its stock price to strengthen. The current market adjustment may be a good time to re-evaluate and seize opportunities.

Analysis of the Current Situation of Performance and Stock Price

Microsoft’s financial report data shows that the company’s layout in the fields of AI and cloud computing is steadily advancing. Although its performance is stable, its stock price has been consolidating since hitting an all-time high of $468.35 in July 2024. This market reaction is more due to concerns about short-term earnings pressure rather than a negation of Microsoft’s long-term prospects.

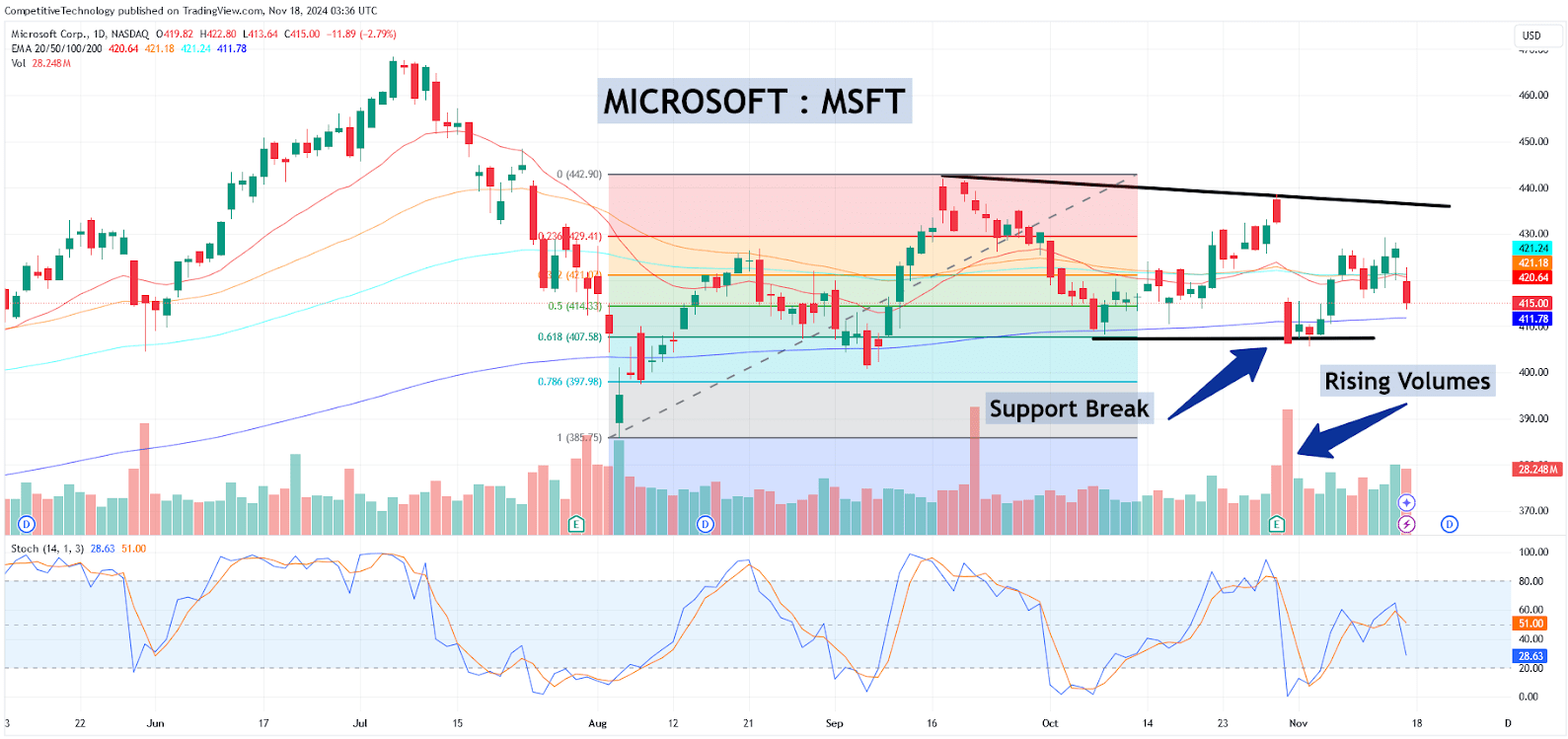

From a technical perspective, Microsoft’s stock price has recently shown a consolidation trend. In particular, the fluctuations at key technical positions reflect the differences between the bulls and the bears.

From the daily chart, it can be seen that since the stock price hit an all-time high in July 2024, Microsoft has experienced a series of declines and formed multiple lower highs. Currently, the stock price has fallen below the 61.8% Fibonacci retracement level of the short-term rebound ($407.60), and the daily closing price has been below this level many times. Along with this process, the trading volume has increased significantly, and these signals further enhance the validity of the downward breakthrough of the stock price.

It is worth noting that the current Stochastic Oscillator has not yet entered the oversold area (currently around 28.63), indicating that the stock price may still have the potential to decline further in the short term and may even touch the support level of $385. If it falls below $385, the market may retest the low of $374.46 in December 2023 and may form a longer period of consolidation.

However, the short-term trend is not completely pessimistic. As the trading volume has significantly increased near the support level (as marked “Rising Volumes” in the figure), it shows that the buying power in the low area of the market has strengthened. Meanwhile, the stochastic indicator is gradually approaching the oversold area, which may provide a certain rebound opportunity for the stock price. If the stock price can rebound above $407, it may gradually test the resistance at $414 and even further challenge $460.

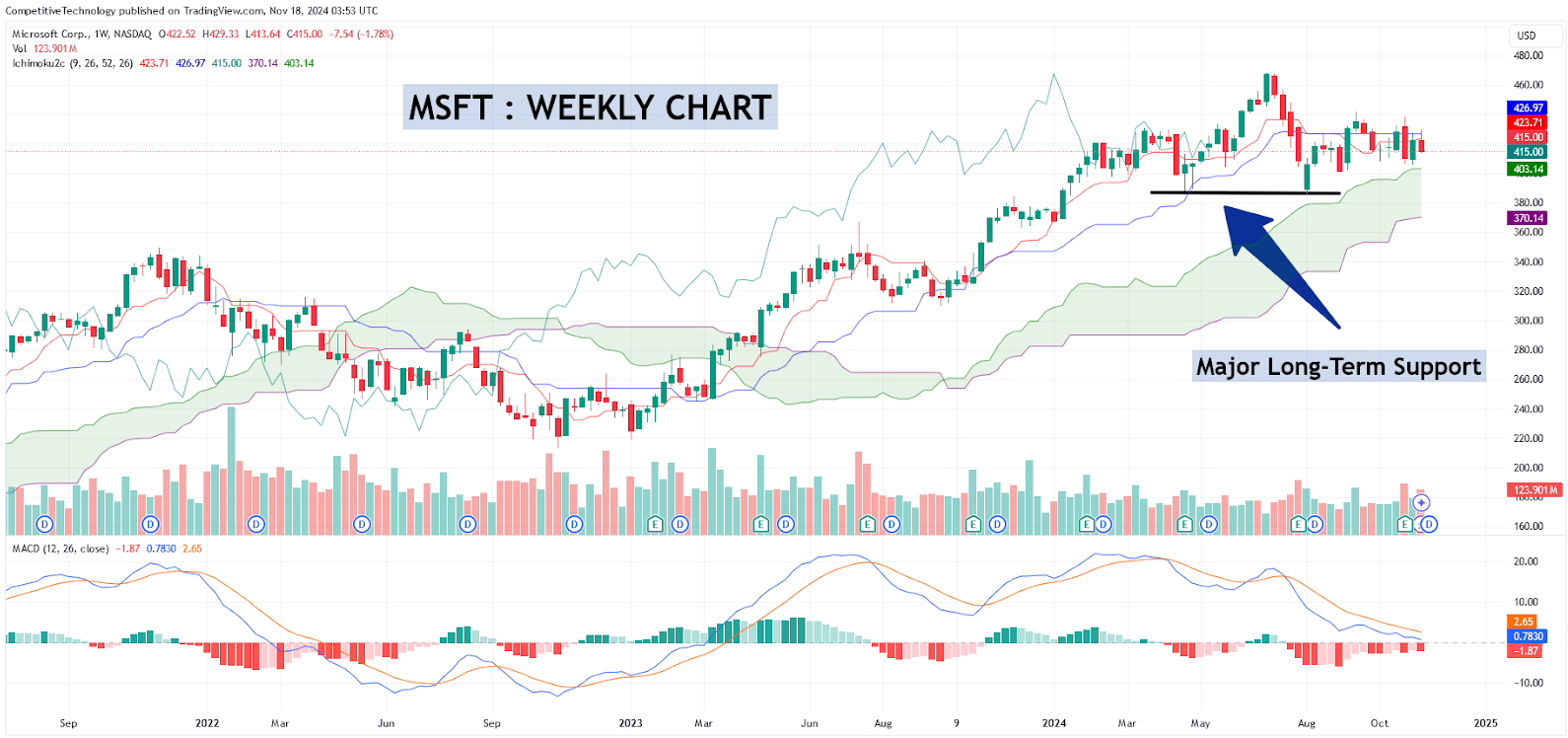

From a long-term trend perspective, Microsoft’s price structure remains strong. The weekly chart shows that the stock price has formed a relatively solid support area, which is located between $385 and $370 and forms a double-bottom pattern composed of the low on April 22, 2024, and the low on August 5, 2024. As long as this support area can hold, the long-term price trend will remain healthy.

The Ichimoku Cloud further supports this view. The stock price is currently running above the “cloud”, with the top of the cloud at approximately $403 and the bottom at approximately $370. This interval is not only a long-term key support area but also has an important guiding role for the current market sentiment. If the stock price falls below the bottom of the cloud at $370, it may trigger a larger adjustment; conversely, as long as the support is effective, the stock price is expected to gradually resume its upward trend.

The MACD indicator also provides some positive signals. Although the fast line is still below the zero axis at present, it is close to crossing the signal line, indicating that the downward momentum may gradually weaken. If the fast line breaks through the zero axis, it will further confirm the resumption of the long-term upward trend. If Microsoft’s stock price can hold at $385 and complete the construction of the consolidation base, it may challenge the all-time high of $460 again when entering 2025.

Microsoft’s stock price has been consolidating since September 2024, but there has been no worrying downward reversal. On the contrary, the current price is still higher than the callback range in August 2024. Does this signal make you think that the bulls are already accumulating strength? Indeed, from a technical perspective, the support level is solid and the long-term trend is still intact. These signs indicate that Microsoft’s upward potential has not been ignored by the market but is waiting for the next catalyst.

Microsoft’s growth premium indeed requires stronger performance in the second half of the year to support it. But precisely because of this, the current stock price adjustment provides an opportunity for investors - if you missed the opportunity to enter the market in August and September, you may now rethink: Is this a good time to enter the market?

Overall, whether from the technical, valuation, or business growth potential perspectives, Microsoft has proven its robustness as a classic technology giant. Although short-term execution risks and market fluctuations still need attention, in the long run, Microsoft is steadily expanding its growth space through the combination of AI and cloud computing. So, for investors, this adjustment is not only a risk but also an opportunity. After holding key support levels, Microsoft may move towards a higher target price. The rating remains “Buy”, and it’s time to prepare for future increases.