- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Low Valuation but Strong Earnings: Is Amazon a Bargain Now?

Amazon’s newly released financial report for the third quarter of 2024 once again demonstrated with impressive figures that this tech giant still has the confidence of a “leader”. Its revenue grew by 11% year-on-year, reaching $158.9 billion, and its net profit soared by 55%, shooting up directly to $15.3 billion! What’s the level like? It’s like making a lot of money while also being cost-effective, with all its businesses thriving, be it e-commerce, advertising, or AWS cloud computing, each being more stable than the other.

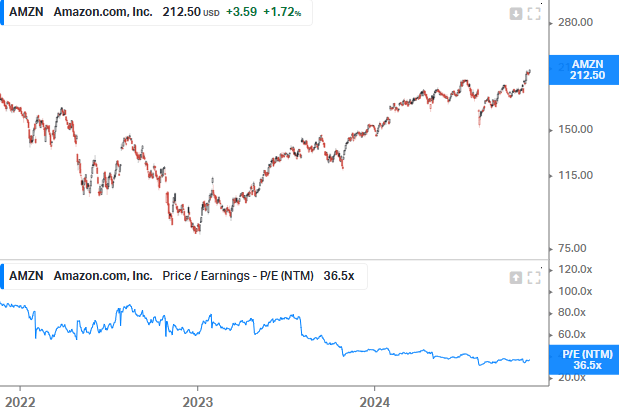

Moreover, have you noticed an abnormal phenomenon? Amazon’s price-to-earnings ratio (P/E ratio) is only 36 times, dropping to a low point in the past three years. In the past, valuations of 60 times or even 90 times now seem incredibly cheap. But the question is, does such a “depression” really mean an investment opportunity or is it just an illusion caused by market sentiment?

What’s more interesting is that Amazon is quietly doubling down on AI. The new version of Alexa, AI advertising technology, and AWS’s AI cooperation with Nvidia all seem to indicate that it’s a “leader in the future of technology”. If AI really becomes the key to triggering the next round of growth, then Amazon may be even more “powerful” than we think.

How Do AI and AWS Empower Amazon?

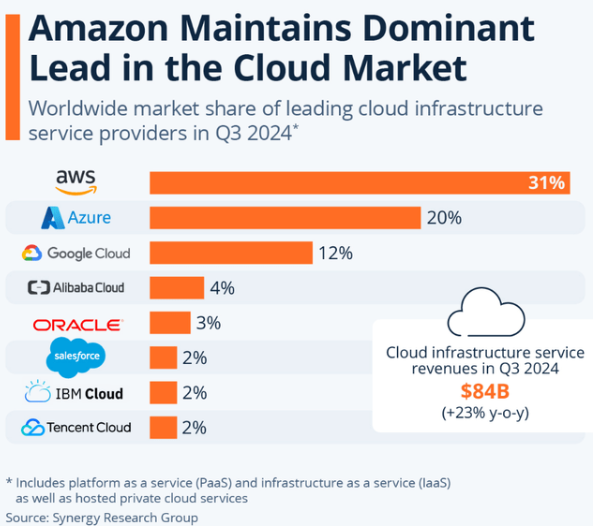

AWS remains Amazon’s “ace player”. In the just-concluded third quarter, AWS achieved a year-on-year revenue growth of 19%, reaching an annualized operating rate of $110 billion, with an operating profit margin as high as 38.1%. Compared with its peers, Google Cloud’s earnings before interest and tax (EBIT) margin is only 17%. Although Microsoft Azure’s data hasn’t been made public, AWS’s scale and profitability have enabled it to firmly remain in the first tier.

Although its growth rate is slightly slower, in the “long-distance race track” of cloud computing, AWS is obviously running more steadily thanks to its powerful ecosystem and technological advantages.

Even more interestingly, AWS has already set its sights on the new frontier of generative AI. For example, its cooperation with Nvidia enables AWS to provide customers with more efficient AI training and inference capabilities. Just think about it. In the future, cloud computing may not just be about storing files but could become the “brain” of generative AI. The global cloud computing market is expected to maintain a compound annual growth rate of 19.5% in the next few years. Standing at the forefront of the trend, AWS has a high probability of continuing to lead the pack.

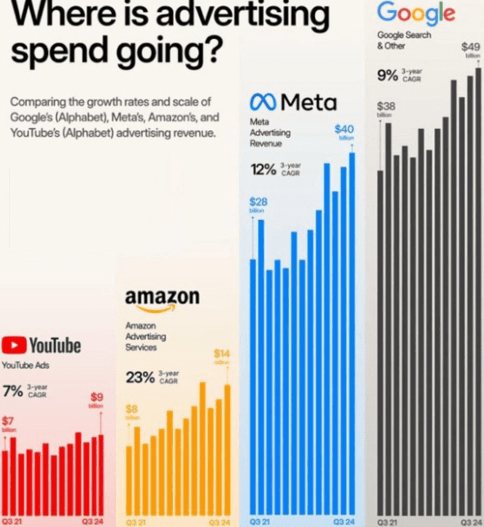

If AWS is Amazon’s technological pioneer, then its advertising business is its “cash cow”. The quarterly advertising revenue grew by 19% year-on-year, reaching $14.3 billion. Advertisers clearly have confidence in Amazon’s precise ad placement. And behind this growth, AI technology has played an indispensable role. For example, generative AI tools allow brands to generate customized advertisements more efficiently, which not only saves time but also catches people’s attention.

More importantly, Amazon’s advertising business is not limited to e-commerce but has gradually expanded into the fields of long-form video and advertising technology. It’s like telling the market: “I can not only sell products but also help you tell good brand stories.” For advertisers, the attractiveness brought by this integrated ecosystem is almost irreplaceable.

AI Empowers Logistics and Consumer Experience

Amazon’s investment in AI is not only reflected in cloud computing and advertising businesses. Logistics and consumer experience are also areas where AI can play a role.

For example, Amazon is expected to invest $75 billion in infrastructure and technological innovation in 2024, and a considerable part of it will support AI-related projects. The new version of Alexa is a good example. This voice assistant driven by generative AI is redefining smart homes through a more natural conversation experience.

In logistics, AI technology is also showing its prowess. More efficient inventory management and faster delivery speeds - these seemingly insignificant improvements actually directly enhance the user experience. For consumers, it means getting the things they want faster, and for Amazon, it means higher customer satisfaction and lower costs.

From AWS’s absolute advantage in the cloud computing market, to the AI-driven advertising business, and then to the comprehensive upgrade of logistics and consumer experience, Amazon’s technological layout has undoubtedly injected strong momentum into its future growth. These innovations not only enable the company to continue to occupy a leading position in the industry but also provide solid support for its valuation. After seeing all this, don’t you also think it’s already powerful enough? But don’t forget that what really makes these layouts shine is its interaction with the current low valuation.

Does the Valuation Depression Mean a Good Buying Opportunity?

In a market environment where tech stocks are generally overvalued, Amazon unexpectedly lies at a low point.

The price-to-earnings ratio (PE) has slipped from an average of 60 times in the past three years to 36 times, almost approaching the bottom of the undervalued range. For a tech giant with continuously increasing profitability, does such a valuation mean an opportunity?

Amazon’s Current Valuation at a Historical Low

Amazon’s current P/E ratio is 36 times, which is a relatively low level in the past three years. Historically, Amazon’s P/E ratio has reached as high as 90 times, but changes in the interest rate environment and short-term market sentiment have clearly compressed its valuation. In comparison, the average P/E ratio in the past three years was 60 times, which means the current valuation level may be a “depression”.

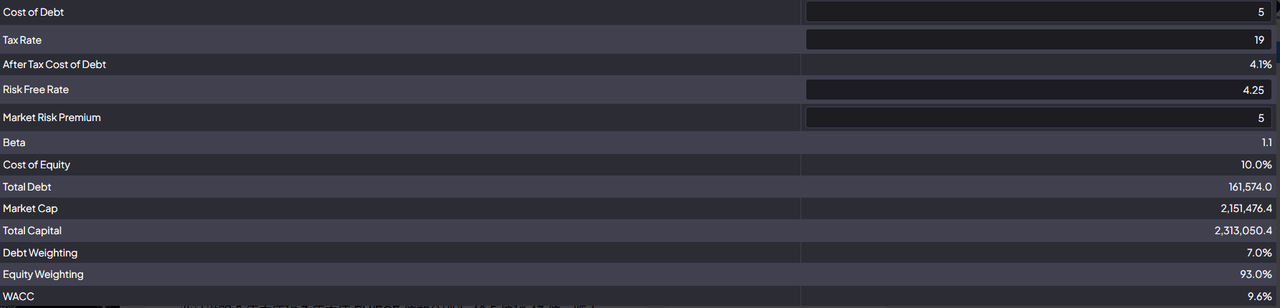

Even more interestingly, according to the Amazon DCF (discounted cash flow) model I set up, the current stock price is underestimated by 21.7%. Based on the expected revenue growth in the next few years, even with a conservative estimate, Amazon’s free cash flow (FCF) margin and operational efficiency are sufficient to support a higher valuation.

Profitability Supports Valuation Attractiveness

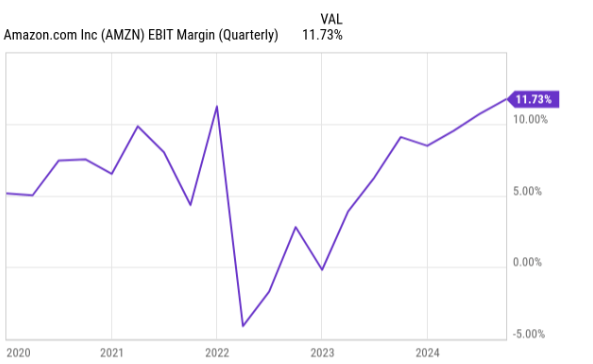

In the latest financial report, Amazon demonstrated extremely strong profitability: Earnings per share (EPS): Reached $1.43, exceeding market expectations by $0.29. Operating revenue: Grew by 56% year-on-year, reaching $17.4 billion, with the EBIT margin hitting a historical high. Free cash flow: Has been positive for six consecutive quarters, reaching $8.4 billion in this quarter. International e-commerce performance is outstanding: Revenue grew by 12%, showing the stability of the global market.

These data indicate that Amazon not only leads in revenue scale but has also significantly enhanced its profitability through strict cost control. This growth resilience provides strong support for the current low valuation.

Why Is the P/E Ratio Compressed?

Although Amazon’s profitability has been continuously increasing, why is its P/E ratio still at a low point? Has the market made a mistake somewhere, or is there some other hidden logic? To understand this issue, we first need to look at the overall performance of the market and the industry.

Firstly, although Amazon’s revenue has performed well in recent quarters, it hasn’t always exceeded market expectations. For investors, this undoubtedly reduces their confidence. To put it bluntly, the market always likes “pleasant surprises”, while Amazon’s growth is more like steady progress, which obviously can’t make everyone “exclaim” in astonishment. In addition, the impact of interest rates cannot be ignored. Compared with 2022, the current interest rate level has risen significantly. High interest rates are like a “heavy weight” on the valuations of tech stocks, naturally making the P/E ratio seem a bit powerless.

Secondly, don’t think that only Amazon’s P/E ratio has been compressed. Its major retail competitors are also experiencing similar situations.

For example, MercadoLibre (MELI), Alibaba (BABA), and Sea (SE) are also facing valuation declines. The reasons behind this are not only the rise in interest rates but also reflect that it’s becoming increasingly difficult for the entire industry to maintain high growth. After all, there aren’t that many companies that can always “exceed expectations”.

Compared with these competitors, Amazon’s profitability is continuously increasing. Its three major businesses, cloud computing, advertising, and e-commerce, are steadily driving growth. Even if the market’s sentiment towards it is a bit cold in the short term, it can’t conceal its long-term value.

Therefore, this compression of the P/E ratio can actually be seen as a rare opportunity. Instead of saying it’s undervalued, it’s more like opening a buying window for investors.

Market sentiment may fluctuate, but Amazon’s underlying logic remains unchanged, which is precisely the reason why it’s worth being optimistic about.

Why Has the Market Undervalued Amazon?

Although Amazon’s performance is impressive, the market’s pricing of it seems a bit too conservative. This phenomenon of “undervaluation” mainly stems from the following reasons:

Short-term sentiment impact: The market has overly magnified concerns about the slowdown in AWS’s growth, ignoring its high profit margin advantage. Interest rate increase: The global interest rate environment has caused the valuations of tech stocks to generally come under pressure, and Amazon is no exception. Increasing competition: The fierce competition between Google Cloud and Microsoft Azure in the cloud computing market has made investors cautious about AWS’s future growth rate.

In fact, Amazon’s advantage in the cloud computing field is still obvious. AWS not only has the largest market share but also leads by a wide margin in terms of profit margin and technological layout. In addition, the advertising business is expanding rapidly at a three-year compound annual growth rate of 23%, further strengthening its diversified profit structure.

The current low valuation point may be a short-term reaction of the market, while Amazon’s fundamentals show its long-term investment value. From free cash flow to profitability, Amazon’s data supports a clear conclusion: In such a “valuation depression”, its risk-return ratio is very attractive.

Competition and Risks

Although Amazon’s valuation and growth potential seem extremely attractive, as a tech giant with a market capitalization of over $2 trillion, it’s not without challenges.

Although AWS is the “big brother” in the cloud computing market, its competitors won’t show it any mercy. Google Cloud’s growth rate in this quarter reached 35%, much higher than AWS’s 19%, with a significant growth rate advantage. And Microsoft Azure, relying on its huge enterprise customer base and complete solutions, is competing with AWS for high-value customers. Just think about it. Every time it loses a cloud service order from a large enterprise, AWS needs to work harder to stabilize its market share.

The advertising business also faces similar challenges. Although Amazon’s advertising revenue is growing rapidly, its scale still lags far behind that of Meta and Google. For Amazon, how to continuously expand its scale in the advertising field and confront these “established players” head-on is definitely not an easy task.

Uncertainty of AI and Technology Investments

Amazon’s investment in AI and technological infrastructure in recent years has been quite substantial, but does high investment necessarily mean high returns? This is probably still a question mark. According to surveys, only 26% of enterprises have successfully transformed AI technology into actual business results. Even for a giant like Amazon, it has to face various complex challenges in technology implementation, such as delays in technology rollout or lower-than-expected market demand.

In addition, Amazon expects its capital expenditure on AI and cloud infrastructure to reach $75 billion in 2024. This sounds astonishing, but whether this money can bring stable long-term growth still needs time to verify. Also, although the new version of Alexa and generative AI tools look attractive, will consumers really buy them? This is another unknown worth paying attention to.

Amazon, as a “versatile player” spanning e-commerce, cloud computing, and advertising, its performance in the third quarter of 2024 seems to tell us a simple fact once again: This giant is still strong. International e-commerce is growing, AWS has an enviably high profit margin, and the advertising business is constantly expanding. The compression of the P/E ratio is actually more the result of the superposition of short-term sentiment and the deterioration of the overall industry situation rather than a problem with Amazon’s fundamentals. On the contrary, such a “depression” may be a rare opportunity for investors. After all, Amazon’s technological layout in cloud computing and AI is quietly building a new stage for future growth.

Of course, we can’t ignore the challenges it faces. Competitors are catching up, the return on technology investment is still somewhat uncertain, and internal management also needs to be more refined. But if we look back at Amazon’s history, you’ll find that it has repeatedly proved its resilience with practical actions. Short-term fluctuations, in the context of its long-term development curve, seem to be just a footnote.

So, the question is: Are you brave enough to seize the current valuation depression? Amazon is not only the current industry benchmark but also expected to continue to lead the market in the future technological wave. And as an investor, perhaps now is the time to re-examine the long-term potential of this tech giant. Just like many opportunities in the past, some things, once missed, may be hard to come by again.