- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Can Intel turn the tables? Three reasons reveal hope for recovery! Is now a good time to bet?

The recent stock price fluctuations of Intel (NASDAQ: INTC) have attracted attention from investors and market analysts. From the disappointing financial report released in the second quarter of last year to the cancellation of dividend payments, the market value of this Silicon Valley giant has shrunk by a quarter. However, with the release of the third quarter financial report a few weeks ago, the market began to rekindle hope for Intel’s future, and Intel’s stock price has also risen. Although its stock price has not fully recovered to its previous level, investors are beginning to see signs of Intel’s possible recovery.

Intel’s Transformation: Core Strategy and Future Opportunities

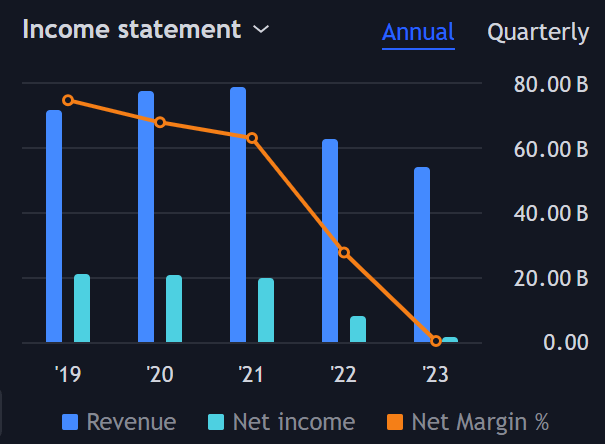

Intel used to be a leader in the global semiconductor industry, but in recent years, with the intensification of competition in core markets and changes in the technological landscape, especially the rise of non-traditional fields such as artificial intelligence computing, Intel has faced unprecedented challenges. Since 2021, the company’s financial pressure has increased, and shareholders have experienced a series of upheavals.

Against this backdrop, Intel is engaged in a critical transformation battle to reshape its market position and seek new growth drivers. Here are three core reasons to be optimistic about Intel’s path to recovery.

Reason 1: Deep cost reduction and corporate restructuring

Faced with intensified market competition, especially pressure from competitors such as Nvidia, Intel’s cost structure appears too bloated. In the past year, Intel’s operating expenses reached $22.50 billion, while Nvidia’s operating expenses were $13.60 billion, and the latter’s gross profit margin was as high as 76%, far higher than Intel’s 40%. This intuitive financial comparison highlights the significant gap between Intel’s Operational Efficiency and cost control.

In order to address this challenge and improve financial health, Intel has launched a comprehensive corporate restructuring plan. The core of the plan is to reduce financial burden and improve market competitiveness by significantly reducing expenses and optimizing resource allocation. Specific measures include cutting more than 15% of employees and cutting 20% of capital expenditures. These decisions not only demonstrate the determination of Intel’s management, but also the difficult steps the company must take to achieve long-term improvement in financial condition and market position.

This restructuring plan is expected to save Intel over $10 billion in expenses by 2025. Through these savings, Intel will be able to reallocate resources and focus on innovative projects and market opportunities that are most likely to bring high investment returns. For example, Intel will be able to increase investment in artificial intelligence, data center technology, and high-performance computing, which are expected to be the main drivers of future growth.

Although there are opinions in the market that business growth cannot be achieved solely by cutting costs, for Intel, this strategy is a key component of its transformation plan. By reducing operating costs and improving capital efficiency, Intel can ensure flexibility in a fiercely competitive market and respond quickly to market changes. In addition, it is expected that through these measures, Intel will be able to achieve positive adjusted free cash flow by 2025, which will provide the necessary financial stability for the company to support its continued technological innovation and market expansion.

This strategic cost control and corporate restructuring will enable Intel to focus more on its core competitiveness and re-establish its leadership position in the global semiconductor market. This is not only a direct response to current financial pressures, but also an active preparation for future market opportunities, marking a strategic transformation for Intel in the global technology competition.

Reason 2: Investment in Next Generation Computing Technology

Despite fierce market competition, Intel still insists on making in-depth investments in the field of next-generation computing technology. The company continues to promote technological innovation and capital investment in four key areas: Client computing, Data center and AI, network and edge technology, and foundry services. In today’s increasingly competitive global semiconductor market, breakthroughs in these areas are crucial to Intel’s future growth.

Especially in the field of data center and AI, Intel’s new generation of AI processors such as Gaudi AI accelerator, although facing the challenge of not reaching the revenue target in 2024, is expected to achieve a strong market rebound in 2025. With its high cost-effectiveness, Gaudi accelerator has demonstrated a significant competitive advantage in cost-sensitive markets. Although there is a certain performance gap compared to competitors, its price advantage makes the product more attractive to customers with limited budgets, especially in enterprises that need to deploy AI solutions on a large scale.

Intel has also made significant progress in the field of Client computing. The recently launched Intel Core Ultra 200V series processors have set a new industry standard in mobile AI performance, significantly surpassing competitors’ products. The launch of this series of processors not only consolidates Intel’s leadership position in the high-performance mobile processor market, but also indicates the company’s strong competitiveness in the AI integrated chip field. Intel plans to ship more than 100 million AI PCs by 2025, which will significantly drive the company’s growth in the global consumer electronics market.

In addition, Intel’s investment in network and edge technology is accelerating the development of the Internet of Things and smart devices. The advancement of these technologies not only improves the efficiency of data processing and transmission, but also opens up new market opportunities for Intel, especially in future technology fields such as smart cities and autonomous cars.

Reason 3: Strategic advantages of contract manufacturing and policy partnerships

Intel’s foundry business occupies an important position in global semiconductor manufacturing. Despite the huge challenges in this business field, Intel’s technology and manufacturing capabilities make it a key player in global advanced semiconductor production. In addition, the company recently announced that it has received $3 billion direct funding support from the US government under the “Secure Enclave” program, which not only enhances its competitiveness in the domestic market, but also demonstrates the government’s high recognition of Intel’s technology and manufacturing capabilities.

This cooperation between the government and enterprises is a major victory for Intel, as it not only provides direct financial support to the company, but also helps strengthen Intel’s strategic position in the global semiconductor supply chain. As the company makes progress on the 18A technology node, Intel has received important orders from major customers such as Amazon AWS, further verifying its competitiveness in the high-end market.

Based on these three reasons, it can be seen that Intel is comprehensively promoting the transformation of its business and technology. Through in-depth cost control, strategic Technology Investment, and close cooperation with the government, Intel can not only cope with current market challenges, but also lay a solid foundation for future growth and success. For investors who are optimistic about Intel’s future, now may be a good time to participate in its growth story.

For investors who hope to seize this opportunity by investing in Intel stocks, BiyaPay provides a convenient platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience.

With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With the advantages of fast deposit speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

Potential challenges on Intel’s road to recovery

As Intel actively seeks transformation and market recovery, the company faces a series of key challenges and latent risks. The main risks include the intensity of market competition and the challenges of technical execution, which may affect the company’s performance and stock price performance.

Market competition risk

In the semiconductor industry, competition is particularly fierce. Although Intel has a leading position in multiple fields, Nvidia, AMD, and other emerging competitors are rapidly eroding Intel’s market share in specific technology fields, especially in the high-performance computing and artificial intelligence processor markets. These companies have performed well in technology innovation, product launch speed, and Performance optimization, posing a severe challenge to Intel. If Intel cannot effectively respond to these competitive pressures or its new products cannot meet market demand, the company’s market share and revenue growth may be negatively affected.

In addition, the fluctuation of demand in the global semiconductor market is also an important risk factor. The demand for semiconductor products is affected by macroeconomic conditions, industry cycles, and the speed of technological innovation. Any global economic slowdown or reduced demand in specific industries may affect Intel’s performance.

Technology implementation risk

Intel’s future development depends on its success in advanced manufacturing technology and new product development. However, the development and monetization of technology is a complex and uncertain process with execution risks. For example, Intel has encountered multiple delays in advancing its 7nm and 5nm technology processes, which has affected the market competitiveness of its products and customer trust. If future technology iterations or new product development continue to face delays or failures, Intel’s market position may be further damaged.

The risks of technology implementation are not limited to process technology. As companies increasingly rely on software and services to drive growth, the complexity and security of software development have also become important considerations. Any significant security bugs or performance issues could damage Intel’s brand reputation and customer loyalty.

Intel’s Future: Is It Worth Entering Now?

Intel’s current transformation efforts and strategic adjustments are showing their positive impact on the company’s future development. Deep cost reduction, investment in next-generation computing technology, and strengthening of foundry business and policy partnerships, these three core reasons jointly support Intel’s attractiveness as an investment choice.

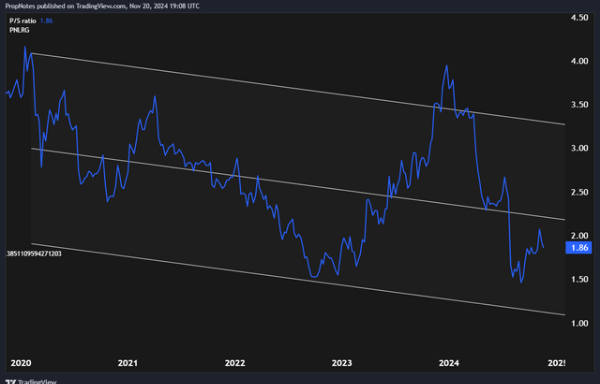

Currently, Intel’s trading price is at the historical low end of the past five years, with a Price-To-Earnings Ratio of less than 2 times forward sales.

This valuation level, combined with the company’s continuous progress in key technology areas and strategic cost control measures, indicates that Intel provides investors with an attractive investment opportunity. Especially for investors seeking long-term growth and being able to withstand industry fluctuations, Intel has demonstrated its potential value-added opportunities.

However, investors should also keep a close eye on the global economic situation, changes in the market competition landscape, and the progress of technological development within the company to ensure that investment strategies can be adjusted in a timely manner to cope with potential market fluctuations.

Overall, Intel has demonstrated its potential as a long-term investment, especially in the context of its strategic adjustments beginning to produce actual results. You can continue to pay attention to Intel’s dynamics and adjust your investment strategy in a timely manner.