- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

This year's surge is nearly 50%! Can Broadcom create a future growth path with AI and strategic tran

Since the beginning of this year, Broadcom’s (NASDAQ: AVGO) stock price has risen by nearly 50%, demonstrating the market’s high recognition of its growth potential. As a leader in the global semiconductor industry, Broadcom has continuously expanded its boundaries in the fields of artificial intelligence (AI) and high-performance hardware infrastructure with technological innovation and market performance. At the same time, through major transactions such as the acquisition of VMware, the company has successfully transformed from a traditional hardware manufacturer to a diversified technology solution provider, consolidating its leading position in future technology trends such as AI and Cloud Services.

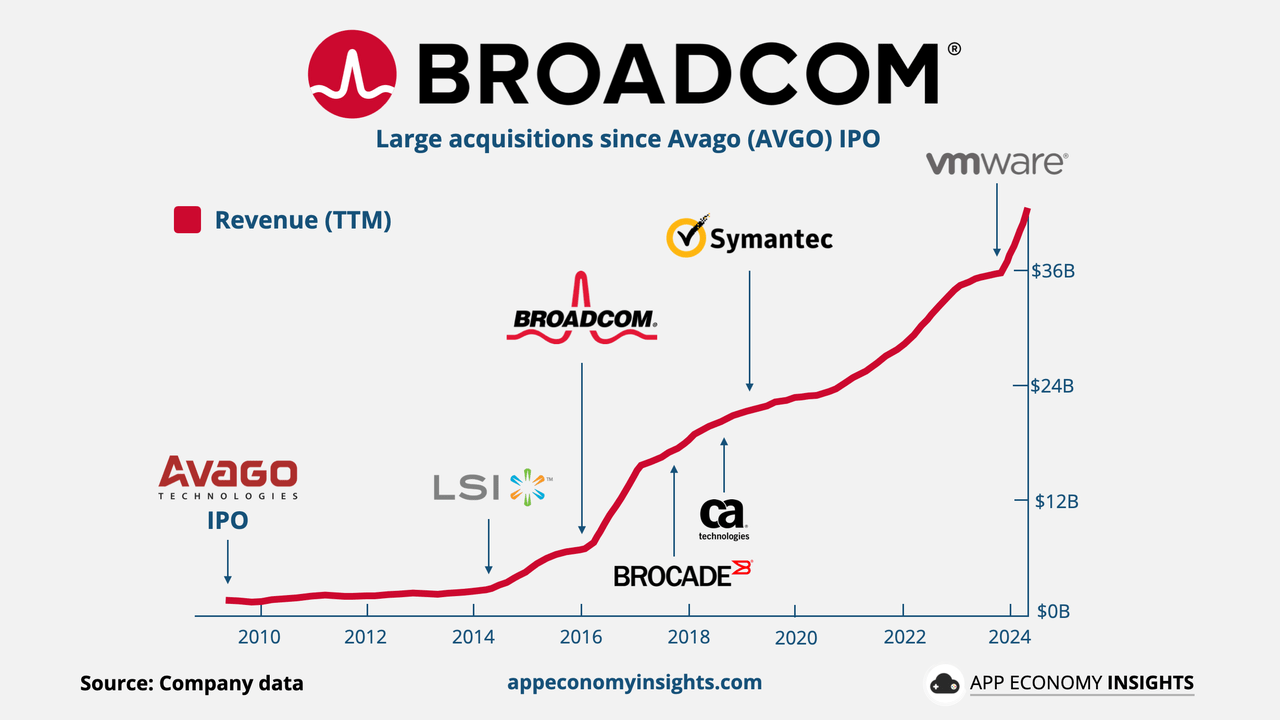

Open a new chapter of growth through strategic transformation

With the rapid changes in the technology field, especially the significant growth in Cloud Services and artificial intelligence (AI), Broadcom recognizes the urgency of transforming from a traditional hardware manufacturer to a diversified technology solution provider. This market insight led Broadcom to strategically acquire VMware, which is part of the company’s growth strategy through mergers and acquisitions over the years. As a leader in cloud infrastructure and enterprise mobility management, VMware has brought software-defined data center (SDDC) technology to Broadcom, which not only strengthens Broadcom’s competitiveness in the global data center market, but also greatly expands its footprint in the enterprise software market.

Through this acquisition, Broadcom not only combines its existing hardware product line with VMware’s software and service capabilities, but also expects to provide more comprehensive end-to-end solutions through new services, covering cyber security, Cloud as a Service, and enterprise-level applications. This integration will enable Broadcom to more effectively serve the growing needs of global enterprises in digital transformation, especially in processing and analyzing Big data.

In addition, Broadcom has significantly reduced its reliance on any single customer (such as Apple) through this acquisition, which has been a key factor in the company’s revenue fluctuations in the past. VMware’s customer base is broad and diverse, including enterprises in almost all industry sectors, which brings Broadcom a more stable and predictable revenue stream.

Another key component of this transformation strategy is investment in the AI field. As the commercial application of AI technology continues to expand, Broadcom is gradually increasing its R & D investment in AI hardware and software solutions. The company uses its deep accumulation in silicon wafer manufacturing and network technology to develop a new generation of semiconductor products optimized for AI and Machine Learning. The development of these products and technologies enables Broadcom to maintain competitiveness in the AI-driven market while increasing its market share in the high-performance computing field.

Accelerating the Leading AI Race: Broadcom’s Layout Strategy

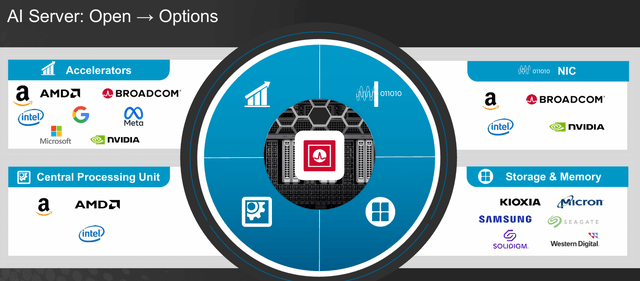

Broadcom has made significant progress in the field of artificial intelligence hardware and software solutions, especially demonstrating strong competitiveness in key technologies such as AI servers, high-performance PCIe switches, and network accelerator NICs. Broadcom’s AI server technology focuses on providing high-performance and low-power computing capabilities to meet increasingly complex Data Analysis and Machine Learning tasks. These servers integrate advanced semiconductor technology to optimize the computing speed and processing power of the Data Center, thereby supporting the extensive AI needs of enterprise-level applications.

In order to meet the high-speed requirements of AI data transmission and processing, Broadcom’s PCIe switch product provides high-bandwidth and low-latency data channels for AI servers. These technologies have become the key to building an efficient AI computing environment, which can significantly improve the speed and efficiency of data processing. At the same time, Broadcom’s Network Interface Card (NIC) accelerator technology provides a high-speed and reliable network connection solution in the Ethernet field, optimizing data flow and reducing network congestion, supporting the fast transmission and real-time analysis of large amounts of data in AI applications.

Broadcom is constantly seeking strategic partnerships with industry leaders in expanding its AI business. By establishing partnerships with companies such as OpenAI and TSMC, Broadcom has accelerated its own technology development in the AI field, while providing extensive practical scenarios and verification platforms for its products in the market. These partnerships enable Broadcom to deeply participate in the development of cutting-edge AI models and algorithms, while ensuring that its semiconductor products can utilize the most advanced manufacturing technologies.

This technological innovation and strategic collaboration has enabled Broadcom not only to consolidate its leadership position in the traditional semiconductor market, but also to successfully enter the rapidly growing AI market, opening up new growth channels and adding strong momentum to the company’s long-term development.

Strength from data: Broadcom’s financial performance is excellent

Broadcom demonstrated outstanding financial performance in the third quarter of fiscal year 2024, with total revenue reaching $13.10 billion, a year-on-year increase of 47%. This significant growth not only reflects Broadcom’s strong competitiveness in the market, but also benefits from its diversified business layout and precise bets on high-growth areas.

It is worth noting that Broadcom’s performance in the AI chip field is particularly outstanding. With the continuous growth of global demand for artificial intelligence technology, Broadcom’s AI chip revenue is expected to reach $12 billion in 2024, accounting for about 25% of the company’s total revenue. If this growth trend continues, its AI-related revenue may increase to 30-32% in the next year, which means that the AI business is rapidly becoming an important growth engine for Broadcom. In addition, cooperation with OpenAI and TSMC further consolidates Broadcom’s competitive position in the AI market and brings long-term revenue growth potential.

In addition to the rapid growth of revenue, Broadcom has also demonstrated strong profitability. By successfully integrating VMware’s business, the company’s non-GAAP EBITDA profit margin in the software department is expected to reach 64%. The software business now accounts for 46% of total revenue, indicating that Broadcom has achieved significant results in diversifying its business through mergers and acquisitions and effectively reducing its dependence on the hardware business.

At the same time, the synergy effect of AI chips and software businesses has significantly improved the company’s overall Operational Efficiency, driving Broadcom to continue to achieve high levels of cost control.

Broadcom’s financial performance not only demonstrates its strategic success in the AI and software fields, but also demonstrates the company’s ability to seize emerging technology opportunities in the global semiconductor market. Currently, it is a reliable choice for investors seeking long-term growth and stable returns in the technology and semiconductor industries.

If you are optimistic about Broadcom and considering investing in its stocks, you can operate through the BiyaPay platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience.

With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With the advantages of fast deposit speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

Current valuation and future potential: Is Broadcom worth investing in?

Next, let’s specifically analyze Broadcom’s attractiveness as an investment target. In addition to considering the business stability and market position mentioned above, we also need to delve into its financial valuation.

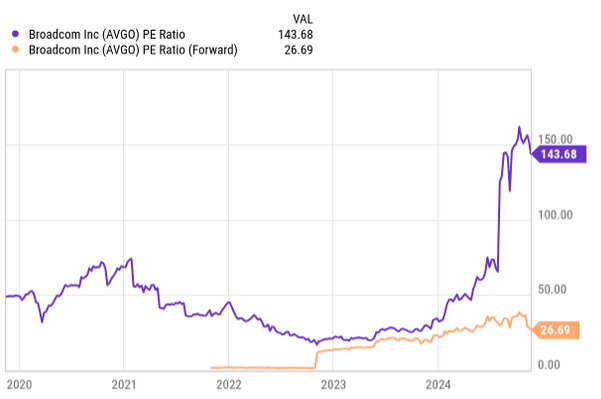

Currently, Broadcom’s Price-To-Earnings Ratio (P/E) is as high as 144 times, which seems significantly higher than the industry average at first glance. However, this number does not fully reflect the company’s value. Considering Broadcom’s expected bottom line expansion, its 12-month forward Price-To-Earnings Ratio is expected to be 26.7 times, significantly lower than the current Price-To-Earnings Ratio, indicating potential for future growth in the current stock price.

Looking at the company’s financial projections, according to FactSet, analysts expect Broadcom’s earnings per share growth over the next three fiscal years to be as follows:

- 2025 fiscal year: 618 million dollars (up 28%)

- 2026 fiscal year: $723 million dollars (up 17%)

- 2027 fiscal year: $823 million dollars (up 14%)

These predictions reflect Broadcom’s expectation of achieving a compound annual growth rate of about 20% over the next three years, indicating an optimistic outlook for the company’s growth. In the past 15 years, Broadcom’s earnings per share have grown at an annual rate of about 25%, mostly through indirect growth. In contrast, the company now expects to achieve organic growth.

Looking further, Broadcom’s long-term Price-To-Earnings Ratio outlook also appears more optimistic.

- Price-To-Earnings Ratio for fiscal year 2025:26.6 times

- Price-To-Earnings Ratio for fiscal year 2026:22.7 times

- 2027 fiscal year expected Price-To-Earnings Ratio: 20.0 times

In contrast, for example, Nvidia’s expected Price-To-Earnings Ratio for fiscal year 2026 is as high as 34.5 times, while AMD’s expected Price-To-Earnings Ratio for fiscal year 2025 is 26.5 times. This indicates that although Broadcom’s valuation is relatively high, given its long-term development prospects in the field of artificial intelligence and the booming capital expenditures of large Listed Companies at the forefront of innovation, the 12-month forward Price-To-Earnings Ratio of 26.6 times still has relative attractiveness.

Looking to the future, Broadcom’s valuation is expected to remain around 25 times its earnings. If the growth in the next three years is achieved as expected, and an annual growth rate of 12-14% is achieved in the next decade (excluding mergers and acquisitions), investors can expect an annual return of about 12%. This growth potential, combined with Broadcom’s balanced layout in the hardware and software fields, makes it an attractive long-term investment option.

What are the latent risks that investors need to be vigilant about?

In Broadcom’s investment evaluation, the company’s market position in AI, semiconductors, and hardware infrastructure undoubtedly brings long-term return potential to investors, but the current valuation level also comes with certain risks. According to analysts’ predictions, Broadcom is expected to achieve significant growth in earnings per share in the next fiscal year, but as with many high-growth companies, investors must consider potential market volatility and external risks.

Firstly, although Broadcom’s current market position is stable, the pressure of competition cannot be ignored. With the rapid development of artificial intelligence and semiconductor industries, the competitive advantages of technology giants such as NVIDIA and AMD are becoming increasingly apparent, especially in the fields of AI processors and graphics chips. Although Broadcom’s layout in AI infrastructure has gradually made progress, the speed of innovation and capital investment of its competitors in these fields undoubtedly pose a challenge to Broadcom. Broadcom needs to continuously increase its R & D investment to maintain its technological leadership, which puts pressure on its profits and capital expenditures. At the same time, the rapid iteration of technology and the continuous changes in market demand also mean that Broadcom’s product line must always maintain innovation in order to cope with the diversity of market demand.

In addition, Broadcom still faces the risk of customer concentration. Although the company has reduced its reliance on a single large customer through mergers and acquisitions and market diversification, there is still a risk of over-reliance on a few large customers. Apple still accounts for a large share of Broadcom’s revenue, which means that any changes in Apple’s demand will have a direct impact on Broadcom’s financial performance. In a fiercely competitive market environment, fluctuations in large customer demand may lead to uncertainty in Broadcom’s revenue and profit growth, especially in the context of accelerating technological updates.

In addition, as a globally operating company, Broadcom also needs to deal with increasingly strict policy regulations from governments around the world in terms of trade, technology transfer, and data privacy. The uncertainty of the global economy may limit Broadcom’s expansion in certain markets. Coupled with increasingly strict data privacy laws and cyber security regulations, Broadcom may need to invest more resources in compliance, which will undoubtedly increase operating costs and may affect the company’s profitability.

Overall, Broadcom holds a leading position in the global semiconductor and AI technology fields, and its innovative capabilities and strategic layout provide a solid foundation for the company’s sustained growth. However, fierce market competition and macroeconomic uncertainty have also brought many challenges to Broadcom. When investors consider Broadcom as an investment target, they need to comprehensively evaluate these latent risks and growth opportunities. With its solid technological foundation and keen insight into market dynamics, Broadcom has demonstrated its potential to bring stable returns to investors in volatile markets.