- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Supermicro appoints new auditor, stock price soars 58% in two days, can AI "former demon stock" make

Supermicro Computer (NASDAQ: SMCI), a company specializing in high-performance computing solutions, has recently received widespread attention from the market due to its audit issues and delayed financial reporting. Faced with challenges, the company hired a new independent auditor, BDO USA, P.C. (BDO), and submitted a compliance plan to the NASDAQ exchange. As a result of this news, on November 19th, Supermicro Computer continued its rebound momentum, rising more than 30% at one point. It has risen more than 58% in two days this week, and its decline for the year has narrowed to around 2%.

These developments not only demonstrate Supermicro’s determination to solve its financial problems, but also reflect the market’s reassessment of the company’s long-term growth potential.

Audit change and risk adjustment

With the addition of the globally renowned accounting internet company BDO USA, Supermicro is facing a new turning point to address audit issues and financial reporting delays. This change is an important strategic move for the company to address reputational challenges and ensure audit resources after the high-profile resignation of former auditor Ernst & Young. BDO’s intervention not only conducted threat and risk assessments in advance, showing that the company’s financial situation may be controllable, but also significantly changed the company’s risk of delisting. Although this risk has not been completely eliminated, for investors who can bear certain risks, this marks a potential upward space for Supermicro’s positioning in the AI market.

BDO changes the risk profile of ultracomputers

Supermicro recently took a key step in responding to the financial and governance crisis caused by the resignation of its auditor: appointing BDO as the new independent auditor.

Supermicro Computer announced that its Board of Directors Audit Committee has hired BDO USA, PC (“BDO”) as its independent auditor, effective immediately.

BDO is a member firm of BDO International, one of the world’s top five accounting firm networks, with a global network of over 115,000 professionals and recognized as a leader in the field of auditing and assurance.

Supermicro President and CEO Charles Liang said, “We are pleased to welcome BDO as Supermicro’s independent auditor. BDO is a highly respected accounting firm with global business capabilities.”

This is an important next step in keeping our financial statements up to date, and we are working diligently and urgently to achieve this goal. "

This replacement is not only a direct response to governance, internal control, and management integrity issues, but also reflects the company’s active efforts in maintaining its listing status. At the same time, Supermicro has submitted a compliance plan to NASDAQ, hoping to obtain an extension of the deadline for submitting financial reports. As one of the top five accounting firms in the world, BDO’s technical capabilities and credibility provide solid support for the company’s handling of financial and compliance issues. The company’s current short-term focus is on processing and submitting the annual report for fiscal year 2024 and the quarterly report for fiscal year 2025 Quarter 1, which is expected to significantly reduce the risk of NASDAQ delisting due to failure to meet financial reporting requirements.

Nasdaq compliance and potential delisting risks

According to NASDAQ regulations, Supermicro must submit overdue financial reports to re-comply with Listing Rule 5250 © (1), which requires the company to submit periodic reports to the US Securities and Exchange Commission (SEC) in a timely manner. Specifically, the company failed to submit its annual report on Form 10-K for the fiscal year ended June 30, 2024 and its quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2024.

After receiving a non-compliance notice, the company usually has 60 days to submit a compliance plan. For Supermicro, if the plan is accepted, Nasdaq can extend the deadline by up to 180 days after the original deadline. In theory, this could push the final deadline to February 2025.

If the company fails to submit these reports within the extended deadline, it will be considered a violation of NASDAQ’s listing rules and may face delisting. Delisting will lead to reduced liquidity of the company’s stock, weakened investor confidence, and further increase the challenges for the company to enter Capital Markets.

After hiring BDO and submitting a compliance plan to NASDAQ, Supermicro has made significant progress in correcting its financial reporting issues. Whether the company can continue to be listed on NASDAQ and restore investor confidence will depend on its ability to submit necessary annual and quarterly reports within the extended period of time.

Valuation and investment prospects

After experiencing a series of audit challenges and financial compliance issues, the Market Positioning and investment prospects of SMCI have significantly changed. By deeply analyzing the company’s current valuation and future profit potential, we can comprehensively evaluate its investment value.

Current valuation analysis

The valuation of Supermicro is influenced by various factors, including the company’s financial health, market position, and the addition of new auditor BDO. Despite the risk of NASDAQ delisting, the company has demonstrated its determination to address financial and governance issues by submitting a compliance plan and hiring reputable audit firms. These measures may help alleviate investor concerns and support the company’s market valuation. In addition, the company’s active layout in the artificial intelligence field provides support for its long-term growth.

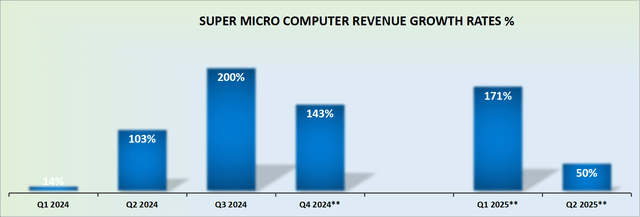

In the 2025 fiscal year, Supermicro expects its revenue growth rate to increase by about 50% year-on-year, indicating the company’s strong momentum and market acceptance in the industry. However, the sustainability of revenue growth is uncertain in the second half of the 2025 fiscal year, partly due to the company’s failure to submit financial reports in a timely manner, which may affect its Customer relationships and market reputation.

Considering the market opportunities of Supermicro in the fields of artificial intelligence and data center technology, the future earnings expectations are optimistic. Despite the challenges, analysts generally expect Supermicro’s profitability to gradually improve as the company’s governance structure improves. Currently, Supermicro’s stock valuation is about 8 times the expected earnings per share, reflecting the market’s conservative expectations for the company’s future profitability. The company’s Balance Sheet shows that it is expected to report net debt of about $2.50 billion, which accounts for about 20% of the market value, indicating that the company’s financial structure in capital-intensive industries, although not overly tight, also limits its expansion ability.

Get on the bus or wait and see

The valuation of Supermicro computers is influenced by various internal and external factors. Internal factors include the company’s financial performance, stability of governance structure, and uncertainty of compliance and audit results. External factors include fluctuations in market demand for AI and high-performance computing, competitive pressure, and macroeconomic conditions. In addition, changes in the global political and economic environment may also have a significant impact on the company’s business operations and market performance.

Considering the current market performance, financial health, and industry position of Supermicro, although the company faces many challenges in the short term, in the long run, if the management can effectively address these issues, the investment prospects of Supermicro are still attractive. However, in the short term, as the company continues to advance its financial and governance reform measures, closely monitoring these changes, especially their impact on stock prices, is crucial for making wise investment decisions.

During this process, using BiyaPay for operations can bring great convenience to investors. BiyaPay supports trading in US and Hong Kong stocks, and can monitor the market trends of Supermicro computers at any time, making it convenient for you to grasp the market and make investment choices. In addition, it can also serve as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience.

With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With the advantages of fast deposit speed and unlimited transfer limit, BiyaPay can help you seize investment opportunities.

Market opportunities for ultracomputers

As a leading provider of high-performance computing solutions, Supermicro’s technology foundation in the fields of artificial intelligence (AI) and data center remains solid despite current financial reporting issues. The company focuses on developing innovative solutions that support advanced workloads, such as large-scale storage systems and optimized server architectures for AI computing. These technologies not only strengthen Supermicro’s market position in providing critical Data Analysis and Machine Learning solutions for enterprises and governments, but also meet the growing demand for efficient and scalable computing resources.

In terms of technological innovation, Supermicro continues to introduce industry-leading technologies, such as direct liquid cooling (DLC) systems and GPU-optimized servers. These technological innovations not only improve computing efficiency and reduce energy consumption, but also directly respond to the market’s strict requirements for data center energy efficiency and environmental sustainability. Through these continuous technological advancements, Supermicro can effectively respond to the energy efficiency challenges faced by global data centers and maintain its competitiveness in the market. Even facing short-term financial reporting challenges, the company’s core technological strength and rapid response to market demand have laid a solid foundation for its long-term growth.

In addition, Microcomputer is actively expanding its influence in the global market, especially in rapidly growing economies such as Asia and Europe. The company not only establishes strategic alliances with local partners, but also meets the demand for data center infrastructure upgrades in these regions by providing targeted solutions. This globalization strategy not only helps the company reduce its dependence on any single market, but also enhances its competitiveness and brand influence in key markets. Through this approach, Microcomputer can more effectively utilize global growth opportunities, enhance the company’s market share and profit potential.

Other risks to be aware of

Supermicro has a large number of retail investors, and this investor structure makes its stock market performance extremely volatile. Retail investors are usually extremely sensitive to market news and react quickly to any major company announcements. In this case, any positive news may quickly push up the stock price, while negative news or overall market downturn can also quickly pull down the stock price. This high volatility may pose significant risks for long-term institutional investors who pursue stable returns.

Although the current financial indicators of Supermicro may make its stock valuation look attractive, the actual performance of the stock price largely depends on investors’ trust in the company’s financial reports. Continued market uncertainty and potential information opacity will continue to cause stock price fluctuations until the company’s financial records are not thoroughly audited and widely recognized. In this case, even if the valuation is low, it may be difficult to attract investment from large institutions due to a lack of confidence from institutional investors.

Understanding the risks faced by Supermicro computers is crucial for potential investors. The significant impact of retail investors may cause sharp fluctuations in stock prices in the short term, which may be good news for short-term traders and provide them with opportunities to profit from market fluctuations.

After comprehensive consideration of the challenges and opportunities of supermicrocomputers, although the company is currently facing difficulties in auditing and financial reporting, its solid foundation in the high-performance computing and data center markets still provides support for its long-term growth. With the entry of new audit partner BDO and the strategic expansion of the global market, the company has demonstrated the potential to overcome challenges. However, the significant impact of high volatility and retail investors has increased market uncertainty. For investors, it is crucial to closely monitor changes in financial transparency, corporate governance progress, and market dynamics of supermicrocomputers. Continued attention will help investors grasp the company’s ability to respond to internal and external challenges and make wiser investment decisions. On this basis, if ultracomputers can effectively solve these challenges, their long-term investment prospects in the technology frontier market will be worth looking forward to.