- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Fed's interest rate cut has changed, the "Trump trade" has cooled down, but the potential for th

With the end of the 2024 US election, the market has high expectations for the loose Fiscal Policy and deregulatory measures that the Trump administration may continue to implement. Driven by such expectations, the US stock market experienced a significant rise, especially in technology stocks. The stock prices of companies such as Tesla soared, driving the Nasdaq 100 index to a new historical high.

After the US stock market soared, it began to pull back, and the three major indexes fell

However, the sustainability of this growth is being tested by the market. Last Friday, the US stock market suffered its largest decline since Election Day, with the three major indexes falling sharply and the US stock market beginning to correct. This market correction is mainly influenced by three factors.

Firstly, the momentum of the “Trump trade” is gradually weakening, and at the same time, the market’s concerns about inflation are clearly increasing. Especially the recently released October CPI and PPI data show that the stickiness of inflation is high, and cost pressures are beginning to emerge from the upstream. This situation strengthens the market’s expectation that the Federal Reserve may maintain a high interest rate environment for a long time. Although these economic indicators reflect certain economic resilience, they also expose potential inflation risks, thereby suppressing investors’ risk appetite.

Secondly, the Fed’s policy stance leans towards hawkishness, increasing market uncertainty. Fed Chairperson Powell’s remarks on Thursday indicated that the Fed is not in a hurry to cut interest rates, highlighting the strong momentum of economic growth providing flexibility for policy adjustments. This stance has extinguished market expectations for possible short-term loose policy adjustments. The rise in 10-year and two-year US Treasury yields further confirms market concerns about higher funding costs and indirectly raises the investment threshold for the stock market, further suppressing market sentiment.

Finally, negative news from important individual stocks and sectors has directly impacted market sentiment. The information technology sector has been particularly impacted, such as Microsoft, whose stock price has been hit hard due to the Anti-Trust investigation, affecting the performance of the entire technology sector. At the same time, Amazon’s stock price has also fallen sharply due to the large-scale reduction of Anchor’s holdings. These events directly affect the market’s view of these tech giants and the future growth prospects of the entire sector.

Can the US stock market continue to reach new highs in the future?

Against this backdrop, many investors are worried about how long the US stock market can continue to rise. Can the current US stock market still be on board? In order to gain a deeper understanding of the future direction of the US stock market, we need to evaluate the sustained effects of the Trump administration’s policies and the possible future interest rate cuts by the Federal Reserve.

The Federal Reserve’s policy is flexible

Firstly, although recent remarks by Federal Reserve Chairperson Powell and other Fed officials have hinted at the possibility of maintaining stable interest rates in the current economic situation, the Fed has always shown flexibility in adjusting policies when necessary. Key economic indicators, such as inflation rates and employment data, will be important references for future policy decisions. If there are signs of slowing economic growth or significant changes in global economic conditions, even in a hawkish background, the Fed may consider cutting interest rates to support the economy.

How does the election affect the sustainability of the US stock market?

Trump advocates significant tax cuts, reducing the corporate tax rate from 21% to 15%, extending personal income tax reductions, and providing tax incentives for US domestic manufacturing, which is expected to enhance the profitability of US companies, which is generally good for the US stock market.

In addition, Trump tends to relax financial and energy regulations, especially in the traditional energy sector, which will promote the outbreak of financial and energy stocks in the short term. The surge in the US stock market is not surprising.

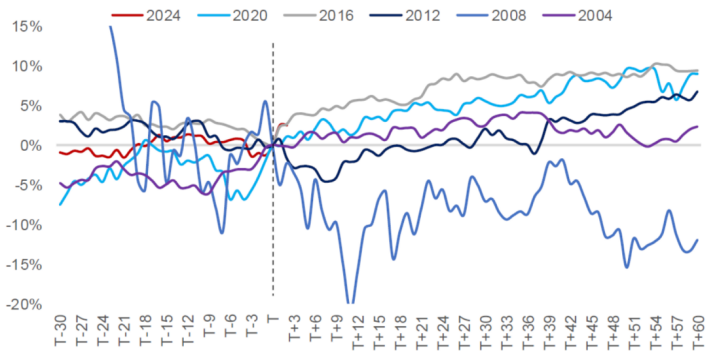

Since it has already risen so much, can it continue in the future? Let’s first look at the performance of the US stock market in previous elections. Except for the 2008 financial crisis, even though the US stock market showed fluctuations before the election, as the results were determined, it usually adjusted towards the expected direction and showed a stable upward trend in the following one to two months.

This indicates that although the market is influenced by various political and economic factors in the short term, fundamental factors such as economic growth and changes in Federal Reserve policies will still be the main driving force supporting the market trend in the long run.

Future outlook for US stocks: new highs or adjustments

Looking back at Trump’s first term from 2017 to 2020, the performance of the US stock market has gone through several significant stages, emerging from a sustained bull market.

Initially, after Trump’s election, the market was full of expectations for his proposed fiscal stimulus and regulatory relaxation policies, and this optimistic sentiment drove the rapid rise of the stock market. Even during the subsequent interest rate hike by the Federal Reserve, due to the strong fundamentals of the US economy, the market still maintained an upward trend.

Especially in 2019, when the Federal Reserve began to shift towards a looser Monetary Policy and stimulate the economy by cutting interest rates, this policy shift provided further support for the stock market. During the COVID-19 pandemic, the Federal Reserve adopted unprecedented Quantitative Easing policies, which helped the market and economy withstand the impact of the epidemic and further pushed up the stock market.

Currently, despite a slight pullback in the US stock market, considering the strong fundamentals and profit growth of technology stocks, as well as the stimulus that government policies may continue to provide, the market may continue to explore new highs. However, investors still need to be vigilant about the rise in inflation expectations, the uncertainty of policy changes, and the challenges of the global economic situation, all of which may affect the stability and growth potential of the market.

The benefits accumulated by the US stock market and the risks faced

What positive factors have accumulated in the current US stock market?

Despite the recent market uncertainties, the US stock market has accumulated many positive factors, driving the market’s continued performance. The resilience shown by the US economy, especially in the third quarter, still provides support for the market.

Interest Rate Cuts and Monetary Policy Outlook

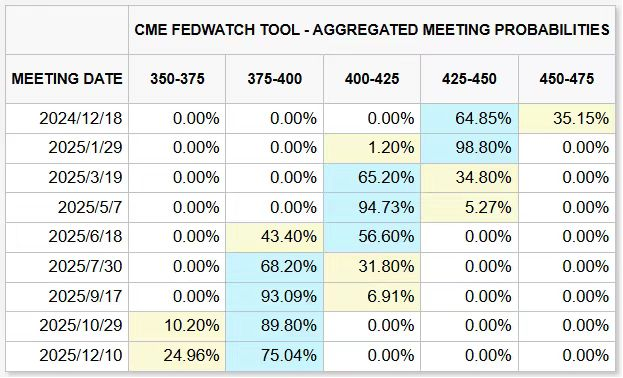

At the November interest rate meeting, the Federal Reserve cut interest rates again by 25bp to a rate range of 4.5-4%, which is in line with market expectations. The latest interest rate futures show that the market still expects a 70% chance of a 25bp rate cut in December. It is expected that there will be three rate cuts by the end of next year, which has been significantly reduced compared to the expected rate cuts after the September interest rate meeting, but overall, there is still a high possibility of future rate cuts.

Federal Reserve Chairperson Powell also made it clear that the current Monetary Policy is still in the “restrictive range”, which means that interest rate policy may continue to adjust, and the expectation of interest rate cuts is still possible in the coming months. Despite the possible fiscal pressure brought by the Trump administration, Powell emphasized that the Federal Reserve will maintain a high degree of independence and continue to pay attention to the sustainability of US debt. This statement has raised market expectations for the transparency and independence of Federal Reserve policies, which has a positive effect on maintaining market stability and boosting investor confidence.

The job market is stable

The performance of the job market is also a positive factor for the US stock market. The statement from the Federal Reserve confirmed that the supply and demand gap in the labor market has continued to narrow, especially with the easing of labor market tensions. Although the job market has been overheated this year, current employment data shows that the supply and demand contradiction has eased, and the unemployment rate is at a low level. Such an employment environment supports consumer spending and corporate profits, helps support economic growth, and has a positive impact on the stock market.

What other risks need to be noted?

Although the US stock market has accumulated positive news in multiple aspects, the future direction of the market is still full of uncertainty. The following latent risks are worth investors’ attention:

Hawkish remarks from the Federal Reserve

Despite the Fed’s interest rate cut, hawkish rhetoric remains a latent risk in the market. If Fed officials continue to emphasize that strong economic growth may not require excessive rate cuts, or suggest that a strong economy may mean a slowdown in the pace of rate cuts, market expectations may change again, causing short-term market uncertainty. In particular, investors need to closely monitor the more signals that the Fed’s December meeting may release to adjust their investment strategies.

High valuation falls back

Currently, the overall valuation of the US stock market is relatively high, especially the Price-To-Earnings Ratio of growth stocks such as technology stocks, which is at a historically high level. If future inflation expectations rebound or the Federal Reserve continues to tighten Monetary Policy, overvalued stocks may face downward pressure. Investors need to be vigilant against adjustments in overvalued stocks, especially in the technology sector. If inflation concerns rise again or the Federal Reserve’s Monetary Policy changes, the pullback of these stocks may have a chain reaction on the overall market sentiment.

US Treasury yields rise

The US debt problem also constitutes a latent risk in the market. If the rise in US government debt raises concerns about debt sustainability, it may lead to an increase in US bond yields. This situation usually triggers safe-haven demand, causing funds to flow out of the stock market and turn to low-risk assets such as the bond market. The rise in US bond yields not only increases Corporate Finance costs, but also may cause funds to flow out of risky assets, suppressing the stock market.

How investors layout US stocks

How to make a reasonable layout in the current market environment is still a problem that every investor needs to think about urgently. The following suggestions are for your reference:

Choosing the right platform is very important

Choosing the right investment platform can not only avoid risks, but also bring you many conveniences and improve investment efficiency. BiyaPay provides a convenient channel for quickly allocating assets. BiyaPay not only allows you to directly purchase US stocks, but also helps you capture the best buying opportunities through its efficient market monitoring tool.

In addition, BiyaPay also plays the role of a deposit and withdrawal tool for US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, and then quickly withdraw it to your bank account or transfer it to another brokerage account for stock purchases. The fast arrival and unlimited characteristics of this platform can ensure that you will not miss any investment opportunities in the dynamic and changing market.

Use market fluctuations for short-term trading

For investors with high risk tolerance, short-term market fluctuations provide opportunities for short-term trading. In the current uncertain context, investors can accurately grasp market sentiment, conduct swing operations, and capture short-term stock price fluctuations. Especially for companies that are greatly affected by policies and economic data, they often experience large price fluctuations in the short term, and investors can use these fluctuations for trading.

However, short-term trading requires investors to have strong market insight and the ability to react quickly, and to pay attention to risk control. The biggest risk of short-term operations lies in market uncertainty and mood swings. Investors need to carefully grasp the opportunity and avoid blindly following the trend.

Adopt flexible strategies to balance growth and risk

In the current volatile US stock market environment, investors should focus on the long-term growth potential of technology stocks, while being vigilant against the risk of a correction due to high valuations. The Trump administration’s possible continued tax cuts and regulatory relaxation policies, especially the potential benefits for the financial and energy industries, may push up the stock prices of these industries in the short term, but investors should be aware of their cyclical risks and be prepared to respond to changes in policies and economic cycles at any time.

In addition, considering the uncertainty and volatility of the market, investors should balance their investment portfolios by investing in undervalued stocks and defensive industries. These industries, such as utilities and healthcare, usually perform relatively stable during market fluctuations, providing stable cash flow and high dividend yields, helping investors maintain the stability of their investment portfolios during economic uncertainties.

Changes in Monetary Policy and the Global Economic Situation

The Monetary Policy of the Federal Reserve and the global economic situation are important factors affecting the trend of the US stock market. Although the Federal Reserve has started to cut interest rates in recent months, the market still needs to be vigilant about the hawkish remarks and policy changes that the Federal Reserve may take. If the Federal Reserve continues to maintain its tightening policy in the future, it may increase market uncertainty and lead to capital outflows from the stock market.

In addition, changes in the global economic situation, especially factors such as trade policies and energy price fluctuations, may also affect the performance of the US stock market. Investors should pay attention to changes in global macroeconomic data and the Monetary Policies of major economies in order to adjust investment strategies in a timely manner.

After considering the policies that the Trump administration may continue to implement and the future direction of the Federal Reserve’s Monetary Policy, investors should remain cautiously optimistic when evaluating potential investment opportunities in the US stock market. Although the market may face fluctuations in the short term due to inflation pressure and policy uncertainty, in the long run, structural reforms and policy incentives may bring new growth opportunities to specific industries. Therefore, it is recommended that investors closely monitor policy changes, choose industries with strong fundamentals for investment, adopt flexible strategies to respond to market changes, and optimize investment portfolios to adapt to rapidly changing market environments.