- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Dell's Q3 financial report is expected to improve, and the setback of Supermicro brings unexpected b

Dell, a leading global provider of technology hardware and solutions, has long held an important position in enterprise infrastructure, storage solutions, and personal computers. In recent years, Dell’s strong financial performance, especially in high-growth areas such as Cloud Services and AI, has enabled it to stand out in the fierce market competition.

With Dell about to release its Q3 2025 financial report on November 26th, analysts generally expect it to continue to perform well and further consolidate its market position. Dell’s stock price is still undervalued, especially compared to competitors such as SMCI. Dell’s financial stability and leading layout in the AI field give it a more advantageous position in the future market share competition.

Next, we will explore why Dell is a worthy investment opportunity, analyze its financial performance, market prospects, and future stock price potential.

Dell Q2 financial report highlights and Q3 financial report outlook

Despite the rapid changes and economic uncertainties in the technology industry, Dell still demonstrated strong financial performance, especially in the growth of data center and network hardware. Despite facing challenges in the global PC market, the company still brought steady returns to shareholders by optimizing business structure, innovating products, and expanding into new markets. Next, we will analyze Dell’s financial performance in the second quarter of 2025 in detail, interpret its growth drivers, and look forward to the financial prospects for the next few quarters.

2025 Q2 Financial Report Review

Dell’s financial performance in the second quarter of 2025 once again demonstrated its strong profitability and market adaptability. In the quarter, Dell’s non-GAAP earnings per share (EPS) were $1.89, exceeding analysts’ expectations of $1.71, demonstrating its excellent performance in different business segments. Overall revenue reached $25 billion, a year-on-year increase of 9%. This growth not only reflects the steady development of Dell’s core business, but also demonstrates its continued seizing of opportunities in a changing market environment.

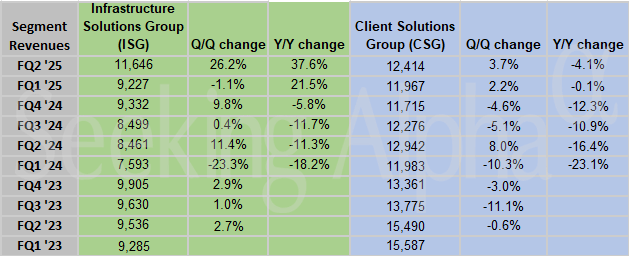

From the perspective of business segmentation, Dell’s Infrastructure Solutions Group (ISG) performed outstandingly, with revenue increasing by 38% year-on-year. Especially driven by the demand in the fields of Data center, Cloud Service, and artificial intelligence (AI), Dell’s network business revenue surged by 80%. These increases are mainly due to Dell’s deep accumulation in data storage, virtualization technology, and high-performance computing equipment. Dell’s advantage in providing advanced technology support to global enterprises enables the company to continue to attract large enterprise customers, especially in the process of promoting digital transformation and cloud migration.

However, despite the strong overall performance, Dell’s Customer Solutions Group (CSG) faced some challenges in the second quarter of 2025. CSG is responsible for the PC and end point hardware business, and its revenue decreased by 4% year-on-year due to the weak global PC market. Nevertheless, Dell maintained a strong response ability in the face of market contraction. With the support of enterprise customer demand and its stable IT hardware product line, it successfully offset some of the pressure brought by the decline in PC sales.

2025 Q3 Financial Report Outlook

Looking ahead to the third quarter of 2025 financial report, Dell still maintains a positive growth expectation. The company expects non-GAAP earnings per share to increase by 9% year-on-year to $2.04, while total revenue is expected to increase by 11% to $24.70 billion. Regarding the outlook for the third quarter, Dell’s management emphasized that the company will continue to maintain its leading position in enterprise solutions and data infrastructure, especially driven by Cloud Services and AI-driven demand.

In addition, Dell specifically pointed out that with the arrival of the third quarter, the company will further strengthen its cooperation with Cloud as a Service provider and AI technology companies to promote more solutions based on artificial intelligence and Big data. This will not only bring more business opportunities to Dell, but also give it a greater advantage in future competition.

Is Dell’s stock price undervalued? Market opportunities and future growth prospects

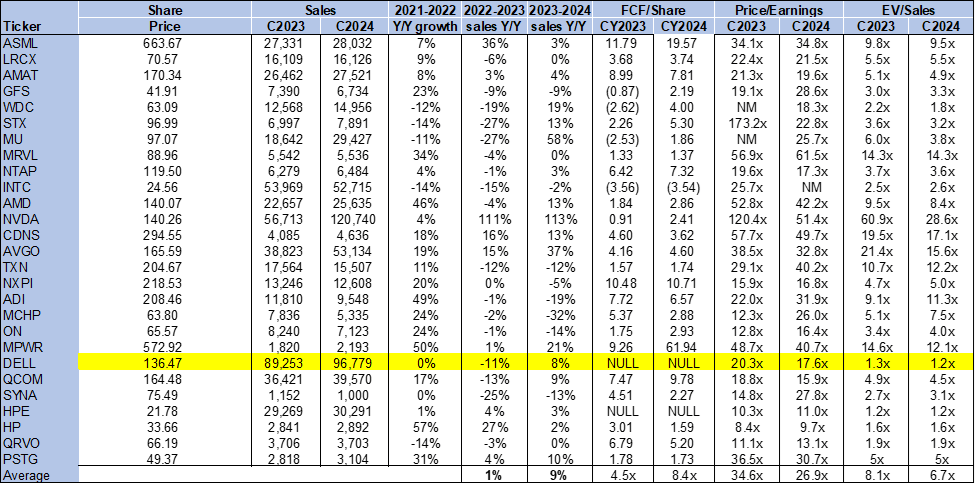

When analyzing Dell’s valuation, it is worth noting that Dell’s current Price-To-Earnings Ratio is 17.6 times, significantly lower than the industry average of 26.9 times. This undervaluation indicates that Dell’s stock may have opportunities to be undervalued, especially in the context of intensified global hardware market competition and gradually recovering enterprise demand. Dell’s deep accumulation in multiple technology fields, especially in the layout of Data center, network solutions, and artificial intelligence (AI), has been widely recognized by the market for its growth potential in the coming quarters.

Compared with its peers, Dell’s valuation obviously has certain attractiveness. For example, compared with Lenovo and HP, which are also hardware manufacturers, Dell has shown stronger performance in financial stability, revenue growth potential, and innovation ability. Especially in enterprise customers and large IT infrastructure projects, Dell’s Market Share is gradually increasing, and all of this is bringing sustainable returns to its shareowners. Even in the global PC market downturn, Dell has maintained market competitiveness through its strong enterprise solutions and innovative product line.

Stock price growth potential

Based on current analysts’ expectations for Dell, its earnings per share will continue to grow in the coming years. Assuming Dell’s earnings per share increase by 20% to $2.4 in fiscal year 2025, and earnings per share are expected to exceed $10 in 2027, based on a 17 times Price-To-Earnings Ratio, Dell’s stock price may reach over $120 in the future, which means that its stock price has some upward potential compared to current levels.

Behind this expectation, it reflects that Dell is laying a solid foundation for future profit growth by continuously strengthening its Technology Investment in Cloud Services, Big Data, and AI. Compared with peers, Dell’s financial stability and layout in the AI market enable it to seize more market share in the future technology wave. The rapid development of AI and Cloud Services has driven the demand for data storage, network infrastructure, and other fields. Dell is in a highly potential market environment through continuous innovation in these areas.

If you are attracted by Dell’s future growth potential and considering investing in its stocks, you can operate through the BiyaPay platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience.

With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With the advantages of fast deposit speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

SMCI’s challenges and Dell’s market opportunities

In sharp contrast to Dell’s good performance in financial stability, SMCI has recently faced a financial crisis. SMCI’s stock price has plummeted by more than 77% since early 2024, mainly due to its layout in the AI hardware field being affected by funding chain issues and failing to meet the growing market demand in a timely manner. This situation has made Dell’s position in the AI market competition more prominent.

Dell’s layout in the AI hardware market is much more stable than SMCI’s. Dell’s long-term investment in Data center, Cloud Service, and AI-related technologies enables it to better seize industry development opportunities, while SMCI’s difficulties have created more market space for Dell. Dell not only leads in technological innovation, but also has a good financial condition and stronger financial support to stand out in future AI competition. Compared with SMCI, Dell’s market opportunities are broader, and its financial stability and technological layout provide investors with a higher safety margin.

Dell’s challenges: What risks must investors be wary of?

Although Dell has obvious advantages in financial performance, technology layout and market opportunities, it still faces certain risks and challenges. Here are several key risk factors that investors need to pay attention to:

Macroeconomic risks

The uncertainty of the global macro economy is an important factor affecting Dell’s revenue. Although Dell’s business growth in enterprise solutions and data center is strong, the global economic slowdown may lead to a slowdown in corporate spending, which in turn affects Dell’s sales. Especially in the face of high inflation, large enterprises may reduce their IT budgets, which may have a negative impact on Dell’s hardware and solution needs. In addition, although Dell operates in multiple regions, global trade tensions and supply chain issues may still have a certain impact on its operations.

Industry competition

The competition in the technology hardware, storage, and peripheral industries is extremely fierce. Although Dell has a large market share in these areas, its competitors are constantly strengthening their technological innovation and market expansion. For example, in the enterprise storage solutions and network equipment fields, traditional competitors such as HP and Lenovo continue to make efforts, while in the AI and Cloud Service fields, giants such as Amazon, Google, and Microsoft also pose competitive pressure on Dell. As the market enters the post-PC era, whether Dell can maintain its technological advantages and continue to provide customized and high-performance solutions for enterprise customers will directly affect its future market position and profitability.

Artificial intelligence risk

Artificial intelligence is an important driving force for Dell’s future growth, especially in the fields of Data center, storage solutions, and enterprise-level IT infrastructure. However, despite the huge market opportunities brought by AI, Dell’s reliance on AI also brings considerable risks. Firstly, the continuous changes and rapid development of AI technology mean that Dell needs to continuously increase its R & D investment to maintain its leading position in technology. Secondly, the competition in the AI market is becoming increasingly fierce. Although Dell has certain advantages in Cloud Service and data storage, it still faces challenges in the fields of dedicated AI chips and Deep learning hardware. If Dell cannot quickly adapt to the changes in AI technology, it may lose market share and affect its long-term growth.

Overall, Dell is a currently undervalued stock with high investment attractiveness. Its Price-To-Earnings Ratio is lower than the industry average, and the expected profit growth in the next few years is very strong. Dell is continuously improving its market competitiveness through strategic layout in areas such as data centers, network solutions, and AI technology, especially in enterprise infrastructure and Cloud Service solutions. Dell has demonstrated strong market adaptability and innovation capabilities.

Dell’s growth expectations for the 2025 fiscal year are very optimistic, especially with broad prospects in the AI and data infrastructure markets. At the same time, Dell’s financial stability and strong cash flow provide good capital support, enabling it to maintain its leadership in technological innovation and market expansion. Despite facing macroeconomic uncertainties, industry competition pressures, and risks brought by rapid changes in AI technology, Dell still has strong market response capabilities and the ability to respond to challenges.

Therefore, when considering Dell’s stock, investors should focus on its undervalued valuation and the potential for stock price growth in the coming quarters. At the same time, investors also need to pay attention to macroeconomic changes, industry competition, and the development of AI technology to more comprehensively evaluate investment risks and returns.