- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Nvidia's Q3 Earnings Forecast: Potentially a Record Sixth Consecutive Quarter of Growth. How High Ca

After the market closes on November 20th, US Eastern Time, Nvidia (NVDA), the giant in AI chips, will release its earnings report for the third fiscal quarter of fiscal year 2025. Since OpenAI launched ChatGPT in November 2022, Nvidia’s stock price has been soaring. Since then, Nvidia’s stock price has risen by more than 800%, and its market capitalization has exceeded $3.5 trillion, successfully surpassing Apple and firmly ranking first in global market capitalization. It has also become an important member of the NASDAQ 100 Index.

In the upcoming earnings report, the market generally expects that Nvidia will achieve revenue of $33.028 billion in the third fiscal quarter, a year-on-year increase of 82.27%; earnings per share are expected to be $0.7, a year-on-year increase of 88.11%. This means that Nvidia may achieve record revenues and profits for the sixth consecutive quarter, further consolidating its leading position in the global AI and data center markets.

Third Quarter Earnings Forecast: Performance Exceeding Expectations

Nvidia’s (NVDA) upcoming performance in the third fiscal quarter of fiscal year 2025 is attracting much attention. As a leader in the AI field, Nvidia’s performance is not only related to the trend of its stock price but also serves as a bellwether for the entire technology sector. The market generally expects that Nvidia’s third fiscal quarter will continue the strong growth momentum, and its revenue and earnings per share are expected to exceed analysts’ expectations once again.

Analysts expect Nvidia’s revenue in this quarter to reach $33.028 billion, with a year-on-year increase of more than 82%; earnings per share are expected to be $0.7, a year-on-year increase of 88.11%. This achievement not only means that Nvidia will set new historical highs for six consecutive quarters but also demonstrates the strong demand dynamics for its AI chips and in the data center field.

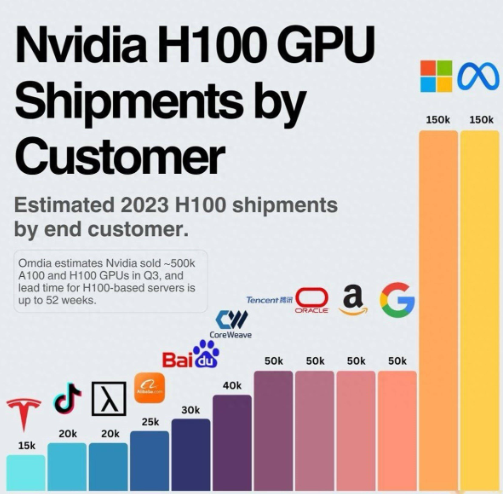

Moreover, Nvidia’s performance growth will be mainly driven by its dominant position in the AI market. As enterprises and institutions increase their investments in artificial intelligence technology, Nvidia, as a core supplier of AI hardware, is obtaining a huge market share from this wave of technological trends. The continuous demand for Nvidia’s products from major customers such as Meta, Microsoft, and Amazon has become a key factor in driving the company’s revenue growth.

In addition, Nvidia is also accelerating the release of a new generation of GPU architectures. In particular, the upcoming Blackwell GPU is regarded as the “catalyst” for the company’s growth in the next stage. The Blackwell architecture is expected to further promote the popularization of AI computing in 2025 and bring considerable revenue to Nvidia. Morgan Stanley predicts that the launch of Blackwell will bring quarterly revenues of $5 billion to $6 billion to Nvidia, thus helping the company achieve further revenue growth in the short term.

Nevertheless, Nvidia may face some challenges in this quarter. Although its AI and data center businesses continue to grow, the slowdown in demand in some industries may put certain pressure on its overall growth. In addition, as the company’s stock price continues to rise, its valuation has become more sensitive, and the market may be cautious about future earnings expectations.

Although some factors may affect the company’s short-term performance, in the long run, Nvidia is still in a very advantageous position. Especially driven by the explosive growth of AI technology, the company’s future growth potential is still promising. For those who want to enter the market early, it is recommended to use the multi-asset wallet BiyaPay to buy this asset as soon as possible. The current price indicates that investors still have the opportunity to enter at a low price. BiyaPay also supports trading in US and Hong Kong stocks as well as digital currencies, facilitating users to regularly check price trends and quickly complete deposit and withdrawal operations at critical moments.

If you encounter problems with fund deposits and withdrawals, BiyaPay provides efficient, secure, and non-freezing solutions. Whether it is recharging digital currencies and converting them into US dollars or Hong Kong dollars, or withdrawing to bank accounts, it can quickly and flexibly meet fund needs and ensure that investors do not miss any market opportunities.

The Support of Nvidia’s Major Customers

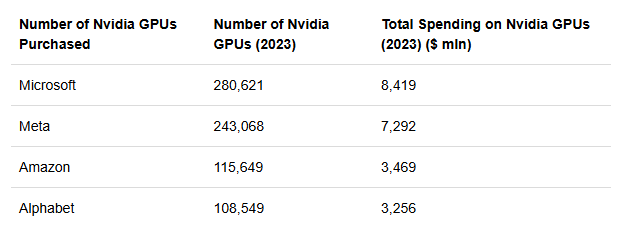

Nvidia’s performance in recent years is inseparable from its leading position in the AI hardware market. In particular, the continuous purchases from top major customers have provided solid support for its revenue growth.

Although Nvidia has not disclosed its revenue composition by customer, according to UBS data, its largest customer is believed to be Microsoft.

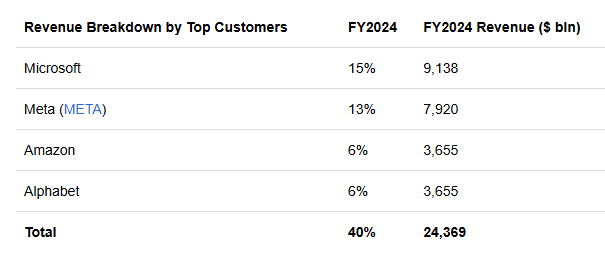

The four technology giants, Microsoft, Meta, Amazon, and Alphabet, contributed 40% of Nvidia’s revenue in fiscal year 2024, with a total amount as high as $24.369 billion. This highly concentrated revenue structure also indicates that the capital expenditure plans of these customers are crucial for Nvidia’s future performance.

Among these major customers, the capital expenditures of Meta, Microsoft, and Amazon are particularly noticeable.

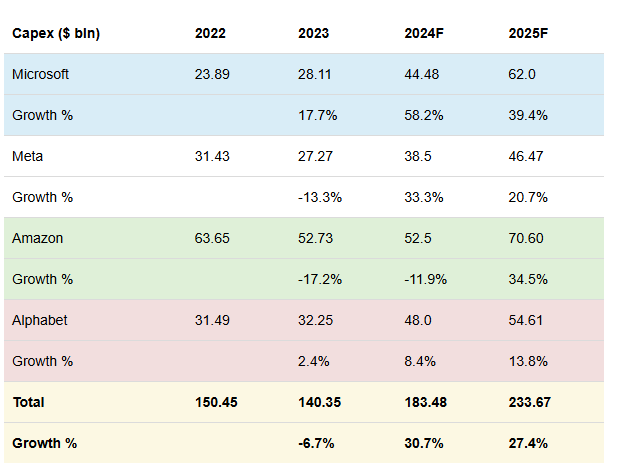

It can be seen from the data that the growth rates of the capital expenditures of these technology giants in 2024 have significantly increased, and this trend is expected to continue in 2025. Analysts unanimously believe that the growth rates of capital expenditures in these two years will reach 30.7% and 27.4% respectively, showing the huge momentum of investment in AI infrastructure. Among them, Microsoft’s capital expenditure increase in 2024 is particularly significant, reaching 58.2%, while Meta follows closely with a growth of 33.3%.

This high emphasis on AI infrastructure is not accidental. Google mentioned in its earnings conference call that the company prefers to make advanced investments in data center construction. The CEO specifically pointed out that “for us, the risk of underinvestment is far greater than the risk of overinvestment.” This strategy indicates that Google regards data centers as the core guarantee of its future competitiveness. Meta’s CEO also expressed a similar view, emphasizing that if the opportunity for AI infrastructure construction is missed, it may lose its technological leadership position in the next 10 to 15 years.

In addition, Nvidia’s newly launched Blackwell architecture GPU has brought new growth momentum to the company. According to the latest data, the performance of the Blackwell chip in AI training workloads has improved by 2.2 times compared to the previous-generation Hopper chip, making this chip a core component of AI applications.

Morgan Stanley predicts that the Blackwell new product line will contribute sales of $5 billion to $6 billion to Nvidia’s revenue in the first quarter of 2024, further promoting the growth of Nvidia’s performance.

However, although the demand for Nvidia’s products from major customers is strong, the initial production of Blackwell architecture chips and the stability of high gross margins remain the focus of investors. According to analysis, although the increase in initial production capacity may lead to a lower gross margin, as the production of Blackwell increases and technological optimizations are made, Nvidia’s overall gross margin is expected to recover. This change is expected to gradually appear in the first quarter of 2024, bringing more profit margins to the company.

The Balance between Technology and Valuation: How High Can Nvidia Go?

In the context driven by the current AI wave, the company’s stock price has risen significantly in the past year. However, the high valuation has also made some investors doubtful.

The current market has mixed views on Nvidia’s high valuation, but institutional analysts are still fully confident in its future growth. Melius Research has raised its target price to $185, believing that Nvidia is about to usher in its “iPhone moment” and that the application potential of its AI chips in various fields will push the company into a new stage. Piper Sandler analyst Harsh Kumar has raised the target price to $175, emphasizing the company’s absolute dominant position in the AI accelerator market. HSBC is even more optimistic and has directly raised the target price to $200, believing that future Blackwell architecture products will bring higher gross margins and continuous revenue growth.

However, from the data perspective, Nvidia’s valuation is obviously at a high level. As of the fiscal year ending in January 2025, the company’s expected price-to-earnings ratio is 49.75, while the industry average level is only 24.25 times, which means that Nvidia’s price-to-earnings ratio is more than twice the industry average. In terms of the price-to-sales ratio, the company’s expected price-to-sales ratio is 27.60 times, while the industry median value is only 3.00 times, with a premium as high as 820.16%. Such a valuation reflects the market’s high confidence in Nvidia’s future growth potential, but it also makes the company’s stock price more sensitive to news of performance falling short of expectations.

Technical Analysis

Technical analysis cannot tell you “what to buy” or “what to sell”, but it can help you determine “when” to buy or sell.

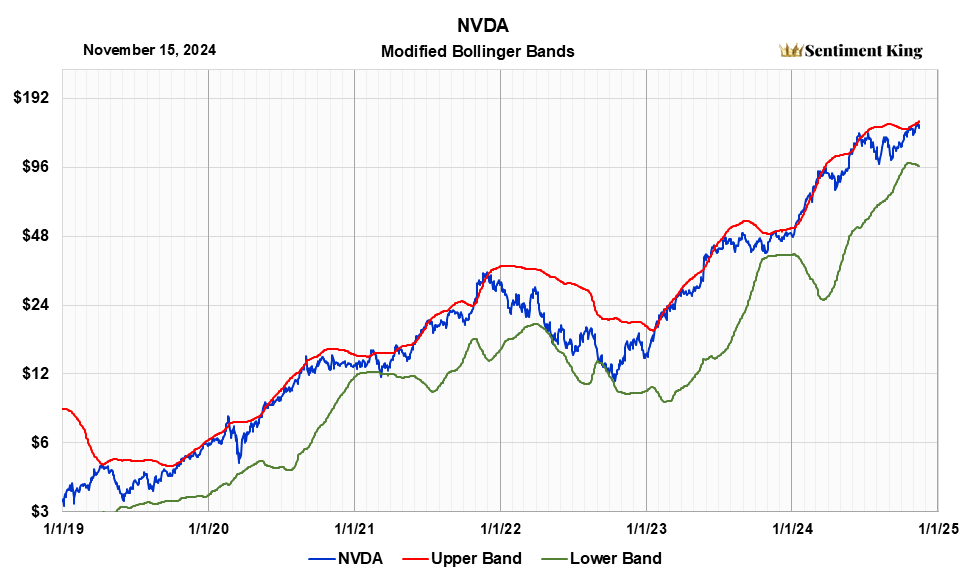

The Bollinger Bands analysis shows that Nvidia’s current stock price is close to the upper band (2.25 standard deviations), indicating that the short-term price may be somewhat restricted.

However, from a historical performance perspective, touching the upper band of the Bollinger Bands did not lead to a significant pullback in the stock price but instead showed a gradual upward trend. This means that although the room for gains is limited, the risk of a significant decline in the short term is relatively low.

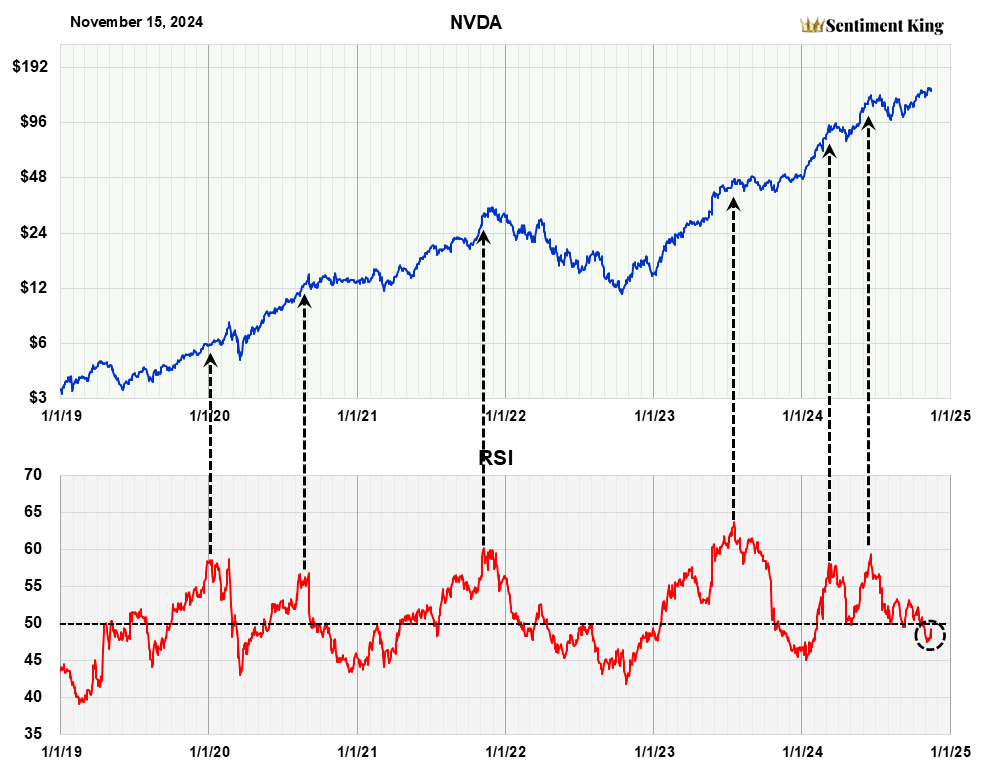

The long-term RSI (Relative Strength Index) shows that the current value is 47.5, close to the historical buy signal area.

Generally, an RSI below 45 is regarded as a strong mid-term buy signal, and price peaks often occur when the RSI reading reaches 58 or higher. This indicates that Nvidia’s stock price still has some room for upward movement, especially in the next few months.

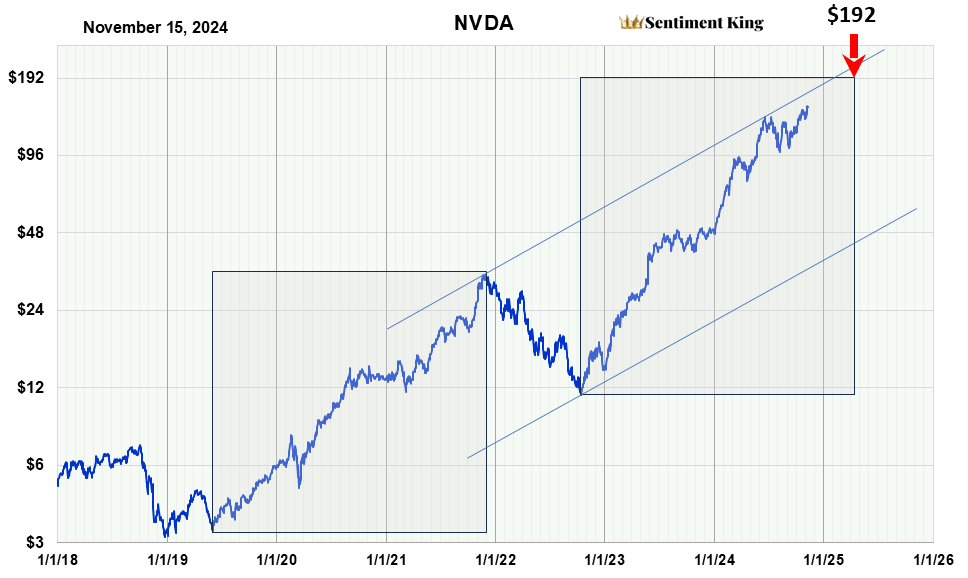

In addition, trend time and channel analysis show that Nvidia’s current stock price is in the middle of a long-term upward channel and still has the potential for further increases.

Based on these technical signals, this upward trend is expected to continue until March 2024, which is consistent with analysts’ expectations for the time when the Blackwell chip will contribute revenue. These technical signals further strengthen the market’s confidence in Nvidia’s target price of $192.

Based on the comprehensive market valuation, technical analysis, and industry trends, although Nvidia’s current valuation has a certain overvaluation risk, its core position in the AI market and strong growth potential still make it a long-term stock worthy of attention. Technical analysis signals, such as the Bollinger Bands, RSI, and trend channels, all indicate that there is still room for Nvidia’s stock price to rise in the next few months.

Investors can be patient in the current market fluctuations and pay attention to the further performance of the next quarter’s earnings report to make wiser investment decisions.

Competition and Risks

AMD and Intel have begun to catch up with Nvidia in the field of high-performance AI chips. AMD’s launched MI300 series AI accelerators are considered direct competitors to H100, and their performance in energy efficiency and computing performance has attracted much attention. Intel has strengthened its layout in the AI accelerator field through the acquisition of Habana Labs. In addition, Nvidia’s monopoly position in the data center and AI accelerator fields is also being challenged by other players in the industry.

What is more worthy of attention is that some technology giants are developing their own AI chips to reduce their dependence on Nvidia. For example, Apple is promoting the development of its own AI chips for use in its future hardware devices. Google, Amazon, and Microsoft are also actively investing in their own AI infrastructure, further dispersing the procurement demand for Nvidia. These measures may weaken Nvidia’s market dominance in the AI hardware field.

In the past two years, many large software enterprises, including Microsoft (MSFT), have invested heavily in AI infrastructure construction. These expenditures were mainly used to support Nvidia’s previous-generation chips, such as H100 and H200. The performance of these chips has been sufficient to meet the current needs of large-scale AI training and inference, making these enterprises seem less urgent to replace them with new-generation chips in the short term.

Although the Blackwell chip has stronger AI capabilities when launched, due to overheating problems in some server configurations, many hyperscale enterprises need to readjust their existing server infrastructure. If they want to fully adopt Blackwell, these enterprises may need to carry out large-scale upgrades or replacements of their existing investments, which will undoubtedly increase costs and complexity. For these enterprises, such a change will be a huge challenge.

At the same time, these enterprises have already experienced the transformation from high-profit software businesses to capital-intensive hardware businesses in their past infrastructure investments, and this change in model has already put pressure on their operations. Therefore, they prefer to extend the service life of existing hardware rather than quickly switch to new-generation chips. This strategy can help them reduce costs and optimize their current return on investment.

Although the Blackwell chip has obvious performance advantages, enterprises may show more caution when adopting it. Different from the market’s expectation of the rapid popularization of new products, this caution may make Nvidia’s short-term growth rate lower than the market’s optimistic estimate. This also reminds us that even though the trend of technological upgrading is inevitable, the actual adoption speed of enterprises will still be restricted by multiple factors.

Nvidia’s strategic position and technological strength in the AI wave are difficult to be shaken in the short term. For investors who focus on long-term potential, it can still be regarded as one of the important configurations in the technology sector. At the same time, treating the short-term fluctuations caused by high valuations with caution and closely monitoring the development trends of the AI market will help to better grasp the rhythm in investment.

For investors with a higher risk tolerance, they can continue to hold or gradually increase their holdings of Nvidia stocks at the current price level, especially in the context of the continuous expansion of demand in the AI market. For more conservative investors, they need to pay attention to Nvidia’s performance in the next few quarters and changes in the market environment to choose a more cost-effective entry time. In the long run, Nvidia’s leading position in AI hardware and the ecosystem is still the manifestation of its core competitiveness.