- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Micron's stock price is undervalued, but the potential is huge! Is now the best time to enter the ma

Micron Technology’s recent stock performance has attracted a lot of attention. Since August, although the stock price has retreated slightly, with a slightly lower increase than the S & P 500 index, it still achieved a return of about 6%. During this period, Micron’s fundamentals have also been continuously improving, especially driven by demand in the data center, mobile device, and automotive markets, and the future growth potential is still promising.

With the company’s continued investment in research and development and technological innovation, especially the launch of a series of new products in the memory and storage fields, Micron is expected to seize growth opportunities in multiple industry sectors and further improve its performance.

Next, we will analyze Micron’s business performance, financial situation, and future investment opportunities in depth to help everyone understand its prospects and potential in detail, so as to make wise investment choices.

Micron’s core competitiveness: Can its technological advantages support future growth?

Micron’s core competitiveness lies in its memory and storage solutions, which are widely used in multiple industries such as data centers, mobile devices, and automobiles. With the advancement of global digitization, the demand for data processing continues to grow, bringing huge market opportunities to Micron. The company has consolidated its leading position in the storage industry through continuous technological innovation and strategic layout.

New products and technological innovation

Micron is continuously launching innovative products, consolidating its market advantage in the memory and storage fields. Recently, the company launched the world’s fastest and most energy-efficient 60TB SSD storage product, which is considered an ideal choice for supercomputing data centers. According to Micron’s description, this product has significant advantages in energy efficiency and can provide up to 67% density improvement per rack, especially suitable for enterprise applications that require large-scale data storage.

In addition, Micron has introduced the new Crucial DDR5 Pro Overclocking gaming memory. With transfer speeds of 6.40 quadrillion per second, this memory can significantly improve gaming performance, accelerate multitasking, and enhance productivity. With the continuous expansion of the global gaming PC market, this product is expected to bring considerable growth to the company in the coming years.

Research and development and capital expenditures

Micron’s investment in technological innovation and research and development has always remained strong. In the 2024 fiscal year, the company’s R & D expenditure is expected to continue to increase, further promoting the development of new products and market penetration. The company’s R & D expenditure has significantly increased in the past few years, indicating that Micron maintains a high level of investment and attention to future technological evolution.

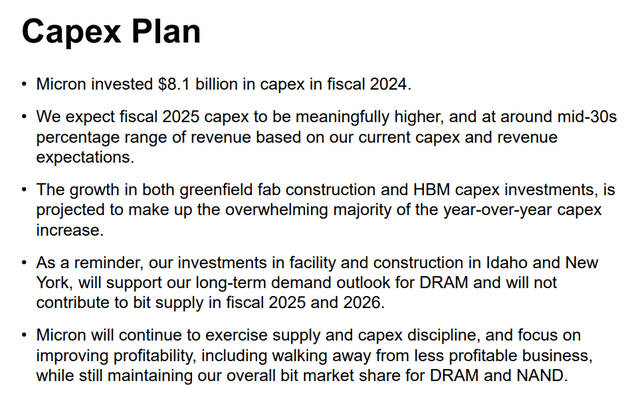

Meanwhile, as the company continues to follow market demand, capital expenditures (CapEx) are also increasing year by year. Micron expects capital expenditures to increase by about 61% in fiscal year 2025 compared to fiscal year 2024. This growth will help the company expand in key technology areas and further consolidate its market share.

Market trends and growth drivers

The growth in demand for data centers is an important driving force for Micron’s future development. With the popularity of AI technology, the global demand for data storage and processing has also shown explosive growth. Micron has already occupied the high-end market of data centers through technological breakthroughs in high-bandwidth memory (HBM). According to reports, the company has reserved all HBM production capacity until 2025, indicating its strong technical reserves and market demand in this field.

In addition, the recovery of the global smartphone market and the automotive industry has also brought growth opportunities to Micron. With the recovery of global smartphone shipments, especially the demand for high-end smartphones, the demand for memory and storage products has grown synchronously. At the same time, with the advancement of electrification and intelligence in the automotive industry, the demand for high-performance memory has also significantly increased. Micron’s layout in this field will provide more growth momentum for the company.

Micron Investment Opportunities: Is Now the Best Time to Invest?

Understanding Micron’s current stock price valuation is crucial when evaluating investment opportunities. As one of the world’s leading semiconductor companies, Micron’s business covers multiple fields such as data centers, high-performance computing, AI, large enterprise storage, and mobile devices. Due to the rapid growth in these fields, Micron’s financial performance and stock price potential are widely favored by the market in the coming years.

Micron’s valuation

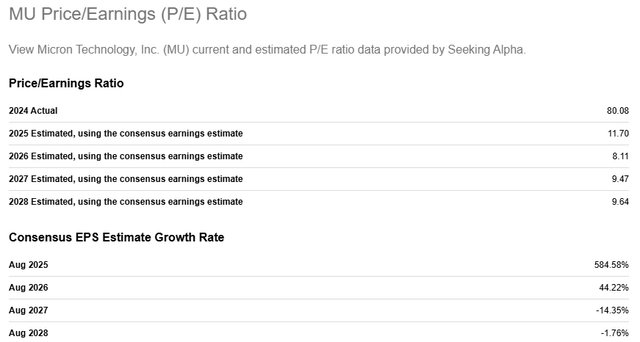

Micron’s stock price currently has relative attractiveness in the semiconductor industry. According to the latest valuation analysis, Micron’s Price-To-Earnings Ratio (P/E) is expected to rapidly contract in the next five years. Although the Price-To-Earnings Ratio for 2024 is high, this expectation is reasonable in the long run. Specifically, the forward-looking Price-To-Earnings Ratio for fiscal year 2025 is expected to be 11.7 times, which is still a low valuation for a company benefiting from emerging fields such as artificial intelligence (AI) and data centers.

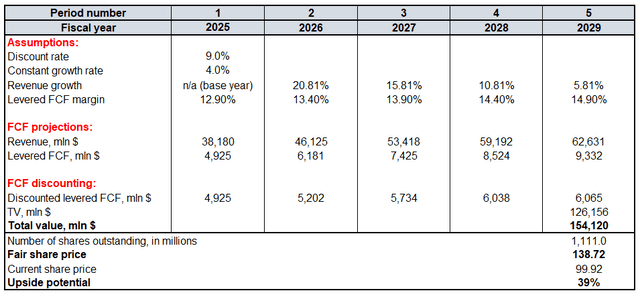

Further analysis of Micron’s stock price growth potential can be verified through the Discounted Cash Flow (DCF) model. The model uses a weighted average cost of capital (WACC) of 9% for discounted cash flow and references revenue forecasts from over 30 Wall Street analysts.

Based on this broad market consensus, Micron’s revenue growth is expected to be relatively stable in the next two years. However, starting from fiscal year 2027, annual revenue growth is expected to slow down by 5%. Nevertheless, considering Micron’s strong performance in the AI and Data center fields, it is expected to maintain a stable growth rate of 4% in the future, which is used to calculate the company’s final value.

Although Micron’s current leveraged free cash flow (FCF) profit margin is 1.45%, based on the forecast of adjusted earnings per share (EPS) of $8.9 for the 2025 fiscal year, this number is expected to increase by 585% compared to 2024. This is similar to Micron’s performance in the 2018 fiscal year, when the company’s leveraged free cash flow profit margin was 12.9%. Therefore, the profit margin is expected to rebound in the 2025 fiscal year. To balance this more aggressive assumption, the growth rate of future free cash flow is expected to increase by 0.5 percentage points per year.

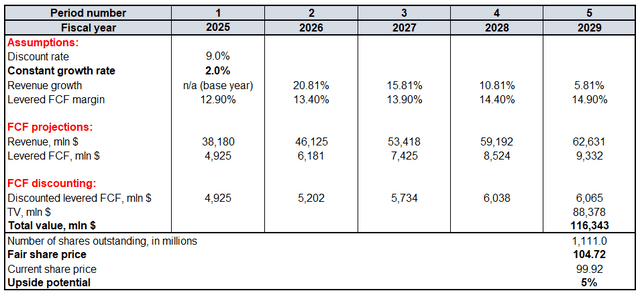

Based on these assumptions, the DCF model estimates Micron’s fair stock price to be $138.72, which is about 39% higher than the current stock price. Even under the pessimistic assumption of a constant growth rate of 2%, the fair value is still significantly higher than the current stock price, indicating that Micron’s stock price may be undervalued and has strong upward potential.

Investment opportunities and return potential

From the perspective of investment opportunities, Micron clearly has strong potential for returns. It is expected that Micron will benefit from the popularity of technologies such as AI, Big Data, and autonomous driving, further expanding its market share. Especially in the field of data centers, global enterprises’ demand for storage and computing capabilities continues to increase. Micron will be able to occupy more market share by leveraging its technological advantages and market strategies.

In addition, the rapid development of AI provides more growth opportunities for Micron. With the increasing demand for storage and computing resources in artificial intelligence, especially Micron’s innovation in products such as high-bandwidth memory (HBM) and PCIe Gen5 SSD, its market share in the AI field is expected to further increase. These technological innovations will make Micron’s products more competitive, thereby driving the company’s revenue and profit growth.

Compared with other semiconductor companies, Micron’s valuation is more attractive, and the company’s layout in multiple key growth areas gives it strong growth potential in the next few years. In the current market environment, with the continuous increase in technology demand, Micron is expected to achieve relatively stable growth and bring sustained returns to investors.

If you are attracted by the investment returns that Micron may bring and consider investing in its stocks, you can operate through the BiyaPay platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience.

Through BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With the advantages of fast deposit speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

Risk management: What potential challenges do investors need to pay attention to?

Micron is in a stage of rapid growth, but the risks and challenges it faces cannot be ignored. As an investor, it is crucial to understand these potential challenges and conduct effective threat and risk assessments. Especially in the increasingly competitive semiconductor industry, how to manage these risks and maintain steady growth is the focus we need to pay attention to.

Analysis of major competitors

One of Micron’s main competitors in the field of storage chips is Samsung Electronics. Samsung, with its technological advantages and market share in the high-end memory and chip market, has formed a strong pressure on Micron. Although Samsung’s market performance is still strong, especially in memory technology, Micron has gradually formed a unique competitive advantage in multiple technology segments, especially in products such as high-bandwidth memory (HBM) and data center SSD, through continuous research and development investment. Micron focuses on innovation, continuously improves the energy efficiency and performance of its products, and strives to maintain its leading position in fierce competition.

However, changes in the competitive environment mean that Micron cannot take it lightly. Especially in rapidly developing fields such as AI and data centers, the continuous innovation of Samsung and other competitors will affect Micron’s market share. Investors should pay attention to how Micron continues to make breakthroughs in technology and market strategies to ensure that it is not left behind in competition.

Industry trends and market risks

The rapid development of technology in the semiconductor industry has brought huge opportunities, but also accompanied by equally huge challenges. Especially in emerging fields such as AI, 5G, and autonomous driving, the demand for high-performance storage chips has surged, providing Micron with a good opportunity to expand the market. However, this also means that the speed of technological updates is extremely fast, and industry competition is becoming increasingly fierce. Micron needs to maintain technological leadership while constantly innovating to cope with the pressure of continuous technological innovation.

In addition to the challenges brought by technological progress, the uncertainty of the global economy is also an important risk. The volatility of current market demand and the continued tension of global supply chains may cause Micron to encounter difficulties in production and delivery. For example, any interruption in raw material supply or production delays may have an adverse impact on Micron’s overall performance. Investors need to pay attention to these external factors and evaluate their potential impact on Micron’s financial condition and market performance.

In addition, changes in market demand, especially fluctuations in demand in the consumer electronics and traditional computing fields, may also affect Micron’s revenue growth. Even technology-leading companies find it difficult to completely avoid the financial pressure brought about by shrinking demand. With the recovery of the global economy and changes in policies in various countries, market turmoil in the coming years may have an impact on Micron’s profitability.

Combining Micron’s financial prospects, technological advantages, and market potential, the current situation is undoubtedly a time worth investors’ attention. Micron’s layout in multiple growth areas, especially technological innovation in industries such as data center, AI, and automotive, has significant room for the company’s stock price to rise in the coming years. Despite facing pressure from competitors and market risks, Micron remains an attractive investment target with its strong technological accumulation and continuous research and development investment.