- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

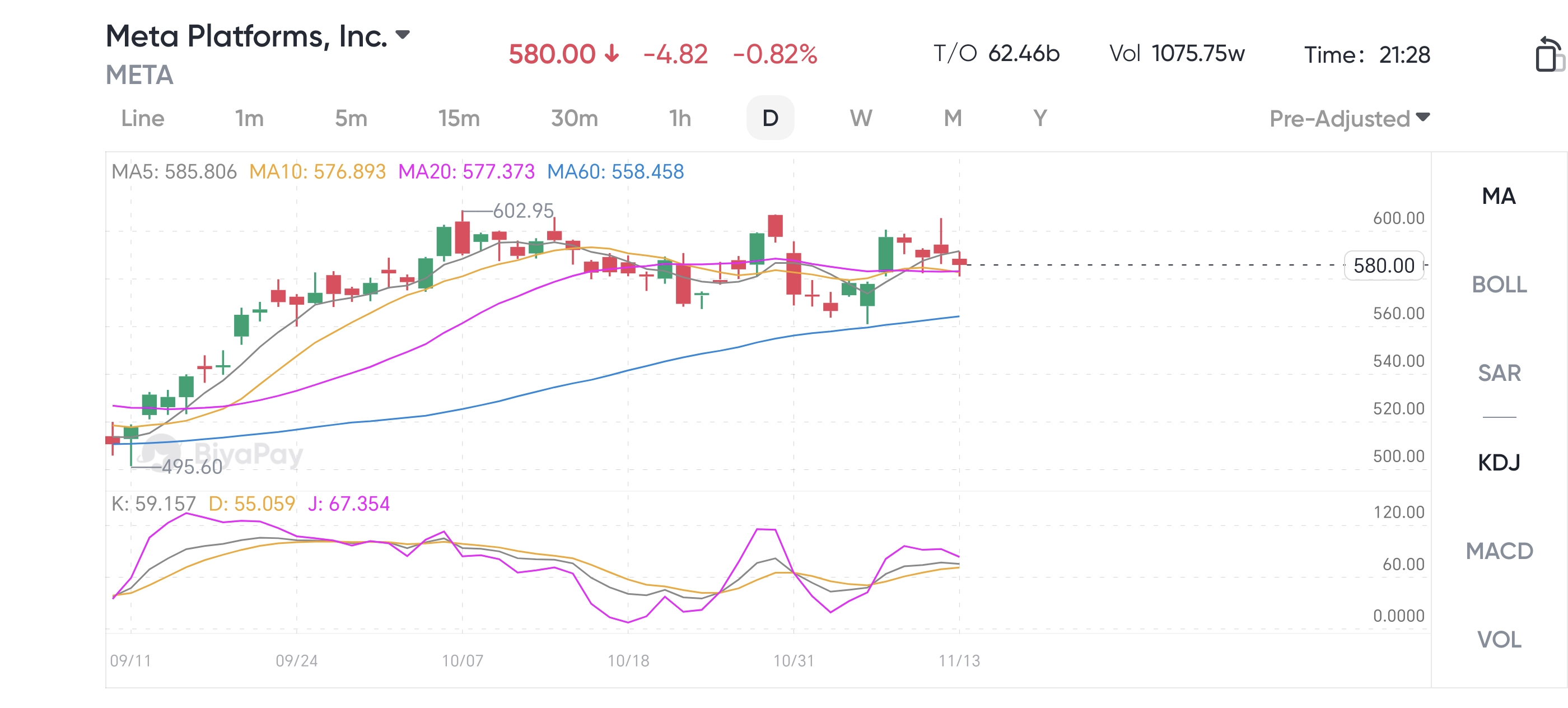

Can Meta up the ante AI investment trigger a new wave of profit growth and stock price leaps? How sh

Meta is a leading global social media company with popular application platforms such as Facebook, Instagram, and WhatsApp. In recent years, as market competition intensifies and user growth slows down, Meta has increased its investment in the field of artificial intelligence (AI), striving to drive the company’s future development through technological innovation.

Meta’s AI strategy has become the core of its transformation, especially its investment in AI recommendation engine and generative AI tools. Through these technologies, Meta hopes to improve customer engagement and provide more monetization opportunities for advertisers. However, the core issue that investors are concerned about is whether Meta’s large-scale AI investment can translate into stable and sustainable returns, especially in the case of significant growth in capital expenditures. Can the company maintain good financial performance?

In the following analysis, we will explore how Meta drives company growth through its AI strategy and deeply evaluate the impact of capital expenditure growth on company profitability. At the same time, we will also combine valuation analysis to help investors better understand the investment value and future potential of Meta stocks.

Meta’s AI strategy: a core driver of long-term growth

Meta’s investment in artificial intelligence, especially in the development of recommendation engines, generative AI tools, and Meta AI, has become a key strategy for the company’s development. The application of these technologies not only helps Meta improve customer engagement, but also provides advertisers with new monetization opportunities, driving the company’s growth in advertising revenue.

AI recommendation engine: Boost customer engagement and advertising revenue

Meta has greatly improved users’ active level by introducing AI recommendation engines on its core platforms Facebook and Instagram. These engines analyze users’ behavior and interests to recommend content that is more in line with their personal preferences, thereby extending their stay time and interaction frequency. In 2024, the usage time of Facebook and Instagram increased by 8% and 6% respectively, which directly promoted the increase of Meta’s platform’s display capacity and advertising revenue.

In this way, Meta not only increased the number of ad impressions, but also optimized its revenue structure by increasing the price of each ad. In the third quarter of 2024, Meta’s Family of Apps revenue increased by 19% YoY, with Display capacity increasing by 7% and the price of each ad increasing by 11%. This indicates that the AI recommendation engine not only improves customer engagement, but also promotes steady growth in advertising revenue, reflecting the monetization potential of AI investment.

Generative AI Tools: Creating New Opportunities for Advertisers

In addition to the recommendation engine, Meta also actively launches generative AI tools to help advertisers improve the efficiency and effectiveness of advertising creativity. Meta’s generative AI tools can automate the generation of advertising content, and even improve the conversion rate of advertisements through image generation tools. According to the company, advertisers have increased their conversion rate by 7% after using these tools. Moreover, with the advancement of technology, Meta plans to launch more new features in 2025, such as video generation and image animation tools, to further enhance the attractiveness and conversion ability of advertisements.

These generative AI tools have brought more efficient advertising production methods to advertisers and expanded Meta’s competitiveness in the advertising market. As more and more advertisers adopt these tools, Meta’s advertising revenue is expected to continue to grow and bring long-term monetization value to the company.

Meta AI: Expand new markets and enhance user stickiness

Another noteworthy AI innovation is Meta AI, an artificial intelligence assistant for the Meta application family. Although Meta AI is a relatively new product, its monthly active user count has exceeded 500 million, which is a remarkable achievement for a newly released application. With its huge application ecosystem, Meta quickly accumulated a user base for Meta AI, which makes it easier for Meta to promote this product to more client bases.

Meta AI not only helps improve User Experience, but also has the potential to expand to multiple Meta applications. According to analysis, Meta AI may cover 30 to 4 billion users of the Meta application family in the next few years, further increasing the company’s influence and monetization opportunities in the AI market.

Capital expenditures and financial performance: The long-term impact of AI investments

Meta’s AI strategy undoubtedly requires a large amount of capital expenditure as support, especially investment in AI infrastructure building and related technology research and development. In 2023, Meta’s capital expenditure reached $28 billion, and the company expects capital expenditure to be between $37 billion and $40 billion in 2024, showing a clear growth trend. This growth is mainly due to Meta’s continued investment in AI and data centers, and also reflects the company’s ambition for future technology layout.

The growth of capital expenditures: a key support for AI infrastructure

Meta’s capital expenditure growth rate can be described as very significant. In 2024, capital expenditure is expected to increase by 39%, reaching about $39 billion, mainly due to investment in artificial intelligence infrastructure. The rapid development of AI requires the company to continuously improve its hardware facilities and data processing capabilities, which is a crucial strategic investment for Meta. As Meta increases investment in AI technology, it is expected that capital expenditure will further increase by more than 30% by 2025 to support the expansion and upgrade of its AI platform.

This large-scale capital expenditure has shifted investors’ focus to two issues: first, how Meta manages its capital expenditures to ensure investment returns; second, how to balance the spending growth brought by AI strategy with the improvement of profitability.

Financial performance: AI investment returns are beginning to show

Although the growth of capital expenditures has raised concerns about profitability, Meta has begun to demonstrate the return potential of its AI investment. In the third quarter of 2024, Meta’s Family of Apps revenue increased by 19%, with double-digit growth in Display capacity and price per ad. All of this stems from the optimization of the AI recommendation engine. Meta successfully achieved revenue growth by increasing user activity levels and ad impressions.

More importantly, Meta has driven the improvement of its operating profit margin by improving productivity and efficiency. In the third quarter of 2024, the operating profit margin of Meta’s application series increased by 250 basis points, reaching 54%. This improvement reflects Meta’s effectiveness in improving Operational Efficiency, especially with the assistance of artificial intelligence, Meta has achieved more lean operational management, reduced costs, and increased revenue.

Long-term financial prospects: AI’s profit potential and market prospects

Despite the continued growth in capital expenditures in 2024 and 2025, Meta’s overall financial performance shows strong growth momentum. With the continuous deepening of AI applications, Meta is expected to continue to increase advertising revenue in the coming years. Especially through the monetization of new advertising forms such as Reels, Meta is expected to maximize the benefits of its AI recommendation engine and promote further growth in advertising revenue.

Meanwhile, Meta’s generative AI tools and Meta AI have also brought new sources of revenue to the company. Advertisers use these tools to create advertising content, and Meta earns revenue by charging related fees. With the popularity and application of generative AI, Meta’s monetization potential will be further unleashed, bringing long-term profit growth to the company.

Despite the pressure on short-term financial performance from capital expenditures and R & D investments, Meta’s AI investment undoubtedly paves a growth path for the company in the long run. By continuously optimizing technology, improving advertising revenue, and monetizing new products, Meta is expected to continue to expand its profit space in the coming years.

Valuation analysis and investment prospects: Is Meta worth investing in?

After in-depth analysis of Meta’s AI strategy and financial performance, investors’ most concerned questions are often: Does Meta’s stock valuation reflect its future growth potential? Considering the company’s large-scale capital expenditures and Technology Investment, can Meta maintain or increase its current stock price level? We will conduct a detailed analysis from several aspects such as valuation, risk, and future growth potential.

Meta’s current valuation: Price-To-Earnings Ratio analysis

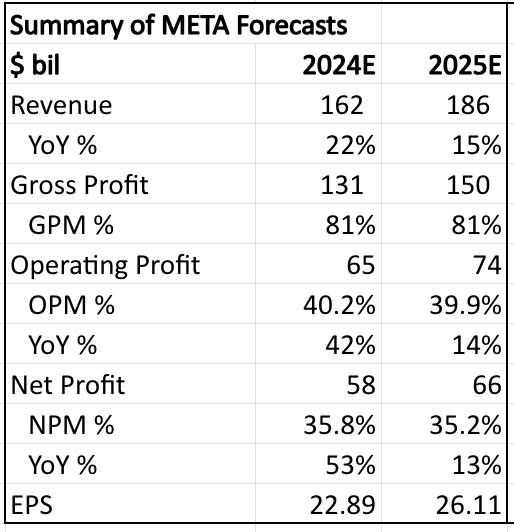

From a valuation perspective, Meta’s current Price-To-Earnings Ratio is relatively conservative compared to peer companies, especially against the backdrop of its AI strategy gradually bringing results. It is expected that revenue will grow by 22% in 2024, but the growth rate will slow down in 2025, mainly due to the increase in revenue base.

Despite this, Meta’s AI investment, advertising revenue growth, and improved customer engagement still support the company’s long-term profitability potential. It is expected that earnings per share will reach $26.11 in 2025. Although operating margins may be compressed in the short term due to increased capital expenditures, Meta has demonstrated its ability to sustainably profit by offsetting some cost pressures by improving efficiency.

Overall, with the further development of its AI strategy, Meta is expected to achieve sustained growth and a reassessment of its valuation in the coming years. If you are optimistic about Meta’s long-term growth potential and considering investing in its stocks, you can do so through the BiyaPay platform.

BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience. With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, BiyaPay will help you seize every investment opportunity.

Risk factors: Capital expenditures and macroeconomic pressures

Although Meta’s long-term growth potential is promising, investors also need to pay attention to some potential risk factors. Firstly, there is pressure on capital expenditures. Although Meta’s AI investment has brought short-term cost increases, capital expenditures will further increase in the coming years, which may affect the company’s short-term profitability. In 2025, Meta is expected to significantly increase capital expenditures again, which means that in the foreseeable future, Meta’s profitability may face some downward pressure.

Secondly, the macroeconomic environment is also a risk factor that cannot be ignored. Meta’s advertising revenue is highly dependent on the global economic environment, especially the US market. If the US economy slows down or advertising spending decreases, Meta may face the risk of slowing revenue growth. Investors need to pay attention to changes in the global economic situation and advertising market, especially in the case of greater economic uncertainty, Meta’s advertising revenue may be affected.

Future Growth Potential: AI-Driven Growth and Diversified Revenue Sources

Despite some short-term risks, Meta’s future growth potential is still worth investors’ attention. Firstly, the application of AI technology is still accelerating. Meta’s investment in generative AI tools, Meta AI, and AI recommendation engine will bring higher customer engagement and advertising revenue to the company. It is expected that with the continuous optimization of Meta’s AI technology, the effectiveness of its advertising system will continue to improve, bringing stable long-term revenue sources to the company.

Secondly, Meta is expanding its revenue streams through multiple new businesses. For example, Threads and Meta’s Llama model have brought new growth opportunities to the company. Threads has accumulated 275 million monthly active users in just a few months, demonstrating the strong ecological effect of the Meta platform. The rapid development of Llama as an open-source AI model may also bring more market share and cooperation opportunities to Meta. As these new businesses gradually mature, Meta’s revenue structure will become more diversified, reducing its reliance on a single advertising revenue source.

Investment advice: Underestimated potential and long-term holding opportunities

From the perspective of valuation, financial performance, and growth potential, Meta is currently in a relatively undervalued state. Although the increase in capital expenditures may put pressure on short-term profits, the company’s AI strategy and the growth potential of its advertising business provide strong long-term support. If Meta can successfully convert its AI investment and further expand the revenue contribution of new businesses, the company is expected to achieve sustainable revenue and profit growth in the next few years.

Overall, Meta’s stock is suitable for long-term investors, especially those who are optimistic about the integration of artificial intelligence and social media platforms. Although there is some market volatility and risk in the short term, in the long run, Meta’s AI investment and diversified business layout will bring appreciation space to its stock. Therefore, investors can consider increasing their investment in Meta during the current relatively low valuation period in order to obtain more returns in the company’s future growth process.