- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Nvidia's Q3 Earnings Report Approaching: SoftBank Collaboration and Blackwell Chip Boost Share Price

After the market closes on November 20, Eastern Time, the release of Nvidia’s fiscal 2025 third-quarter earnings report will undoubtedly be a major event in the current technology investment field, attracting the attention of countless investors.

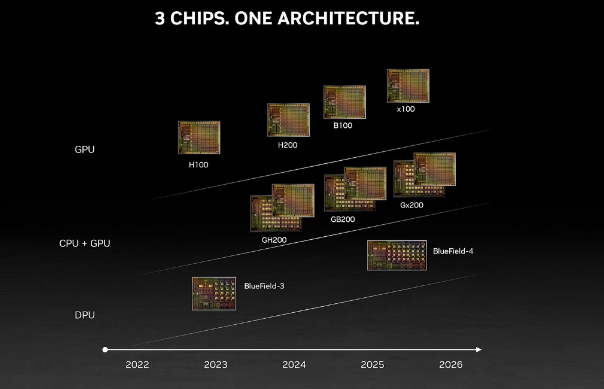

This earnings report is highly anticipated because the key information it reveals may have a profound impact on the company’s future development and market expectations. From the perspective of technological innovation, Nvidia’s new-generation AI chip - Blackwell - has attracted much attention. Morgan Stanley predicts that in fiscal 2025 alone, Blackwell is expected to bring considerable revenue to the company. It is expected that the chip will start shipping in the fourth quarter, so its supply situation and Nvidia’s guidance on sales in 2025 will be important highlights in the earnings report.

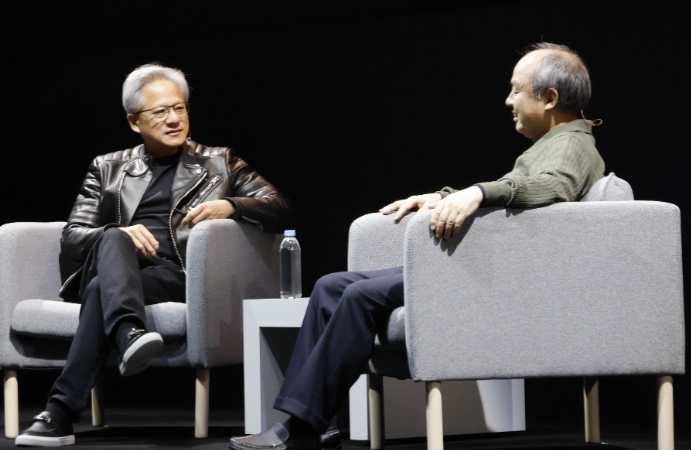

In addition, Nvidia has also made new breakthroughs in business cooperation. At the AI Summit Japan 2024, Nvidia reached a deepened cooperation with SoftBank, and the latter became the first company in the world to receive the official version of the DGX B200 system, aiming to build a new generation of supercomputers with this system. This cooperation not only promotes SoftBank’s development in the field of generative AI but also lays a solid foundation for Nvidia’s expansion in the global AI market, indicating that it will further consolidate its position in the international market.

These factors intertwined make Nvidia’s third-quarter earnings report a maze full of opportunities and challenges. How to evaluate the impact of this earnings report on the company’s future valuation and its potential in the technology investment field are all important topics worthy of attention.

Target Price Significantly Raised: Analysts Optimistic about Nvidia’s Future Potential

Revenue, Profit, and Earnings per Share: Analysis of Key Indicators

According to Bloomberg’s comprehensive expectations, Nvidia’s Q3 revenue will reach $33.08 billion, an 83% increase year-on-year, which demonstrates its strong growth momentum. The adjusted net profit is expected to be $18.46 billion, an 84% increase year-on-year, indicating the continuous improvement of the company’s profitability. Earnings per share are $0.72, a 94% increase year-on-year, reflecting the company’s positive performance in terms of shareholder returns.

Looking back at the past eight fiscal quarters, Nvidia’s earnings per share exceeded market expectations seven times, which is quite an achievement. The average share price change on the earnings day is ±9.32%, with the largest increase reaching +24.4% and the largest decrease being -6.39%. The probability of a share price increase is 62.5%, indicating that its share price fluctuates relatively actively and there are more opportunities for an increase. This series of data has made investors full of expectations for this earnings report.

Analysts’ Views: Company Prospects from Multiple Perspectives

Mizuho raised Nvidia’s target price from $140 to $165 and reiterated its “Outperform” rating.

The basis is that the artificial intelligence accelerator market has continued to strengthen before the quarterly report was announced. Analysts believe that Nvidia’s upcoming January quarter guidance will lay the foundation for its development in 2025. Meanwhile, the growth of GB200 NVL72 and GB300 will benefit the company in the second half of the year. Sovereign market opportunities will start to increase next year, and sales are expected to reach $10 billion, accounting for about 9% - 11% of data center revenue. Moreover, the artificial intelligence server market has huge potential, with a scale of over $400 billion and is expected to grow by more than 60% from 2023 to 2027.

Other major banks also have their own views: Many major banks such as Melius collectively raised Nvidia’s target price before the performance. The current average target price on Wall Street is $157.8, with an upside potential of 6.43%, and the highest target price reaching $200 per share.

Piper Sandler listed Nvidia as a preferred stock considering its dominant position in the artificial intelligence accelerator field and the upcoming Blackwell architecture. Morgan Stanley believes that the Q3 gross margin will increase and is optimistic about the revenue in the January quarter. It is expected that Blackwell’s sales can reach nearly $5 billion to $6 billion.

Goldman Sachs reiterated its “Buy” rating and included it in the “Conviction Buy” list. It is expected that the performance in the first fiscal quarter of April next year will bring a positive adjustment to earnings per share due to the progress of Blackwell and the improvement of supply. These views, combined, highlight the market’s optimistic expectations for Nvidia.

Breakthrough or Obstacle: The Impact of Blackwell and the Share Repurchase Plan on Share Price

Blackwell, as the core innovation achievement of Nvidia in the AI chip field, bears the high hopes for the company’s future performance growth.

According to the plan, this new-generation AI chip is expected to start shipping in the fourth quarter, and its 2025 sales guidance has attracted much attention. From the perspective of market development, the current AI application is still in the early stage of vigorous development. Wall Street analysts generally believe that the Blackwell cycle will become a key force to promote the continuous upward trend of Nvidia’s performance.

Morgan Stanley’s revelation has made the market full of expectations for it. According to its information, the supply of Blackwell for the next year has been snapped up, which fully demonstrates the strong market demand for this product. This demand stems from the solid capital expenditure plans of technology giants. For example, the data center capital expenditures of companies such as Microsoft, Amazon, and Meta are expected to increase by 24% to $282 billion by 2025, which will undoubtedly provide solid support for Blackwell’s sales.

However, there are also challenges under the bright prospects. Nvidia had a close relationship with Supermicro in the past, but Supermicro has been in constant turmoil recently. First, it was accused of accounting violations by Hindenburg Research’s short-selling report, and then its auditing firm, Ernst & Young, resigned. During this period, Nvidia canceled Supermicro’s Blackwell orders. In the short term, although this decision was made out of prudence, it will inevitably have a certain impact on the company’s growth rate.

Share Repurchase Plan: Impact on Share Price and Valuation

Nvidia’s $50 billion share repurchase plan is another focus of the market.

In the first two quarters of fiscal 2025, the company has already repurchased 162.1 million common shares, involving $15.1 billion in funds, and there is currently still an authorized repurchase quota of $7.5 billion remaining. Share repurchase is usually a positive signal for investors, meaning that the company’s management believes that the stock value is undervalued.

Judging from Nvidia’s current financial indicators, its price-to-earnings ratio (P/E) and price-to-free-cash-flow ratio (P/FCF) are lower than the average levels of the past two years. With the launch of the Blackwell chip, the market generally expects that the company’s share price may usher in a breakthrough upward trend. In this case, if the company can reasonably utilize the repurchase plan before the share price rises to repurchase stocks at a more reasonable valuation, it will be beneficial to enhance the company’s value and investor confidence.

Conversely, if Nvidia fails to grasp the repurchase timing, for example, if it fails to reasonably promote the repurchase plan in the third fiscal quarter before the Blackwell drives the share price to rise significantly, the market may question the motivation of this $50 billion repurchase plan and even think that it has the suspicion of being a public relations stunt.

This will not only affect the company’s image in the eyes of investors but also may have a negative impact on the share price, leading to increased share price fluctuations and affecting the stability of the company’s valuation. Therefore, the implementation progress and timing of the repurchase plan have a crucial impact on Nvidia’s share price and the company’s overall value.

Nvidia and SoftBank’s Deep Cooperation: Promoting the Global Layout of AI Technology

At the AI Summit Japan 2024, Nvidia reached a deep strategic cooperation with SoftBank. The first DGX B200 system received by SoftBank is exactly the core of the new-generation NVIDIA DGX SuperPOD supercomputer. The appearance of this system is not only a hardware upgrade but also a powerful boost to the global AI industry.

The DGX B200 is equipped with the most advanced Quantum-2 InfiniBand network, providing powerful computing power and data transmission capabilities for supercomputing. In the future, this supercomputer will become a leader in the AI field in Japan, helping SoftBank accelerate its research and development and business expansion in generative AI.

In addition, SoftBank also plans to open it to Japanese universities, research institutions, and enterprises to jointly promote the development and application of AI technology. This open cooperation is not only part of SoftBank’s strategy but will also bring a positive promoting effect to Nvidia’s layout in the global AI field.

What’s more remarkable is that SoftBank’s next-generation supercomputer is expected to adopt Nvidia’s Grace Blackwell platform, which is undoubtedly a sign that the cooperation between Nvidia and SoftBank is moving to a deeper level. Nvidia’s leading position in the AI supercomputing field has been consolidated again, and this cooperation model not only provides strong technical support for Nvidia but also provides potential growth momentum for its share price as the cooperation projects progress and results emerge.

Inclusion in the Dow Jones Index: A New Trend for Technology Stocks

Another event of great significance to Nvidia is that Nvidia has officially replaced Intel as a member of the Dow Jones Industrial Average (Dow). Although on the surface, this change seems to bring only $1 billion to $2 billion in capital inflows, its symbolic significance behind it is huge.

The composition of the Dow is price-weighted. Although Nvidia has the highest market capitalization among US stocks, its weight in the Dow is only about 2.25%. However, Nvidia’s joining will inject strong capital and attention into the technology sector. As a leading enterprise in technology stocks, the performance of Nvidia’s stocks will directly affect the trend of the entire technology sector.

The status of a component stock of the Dow endows it with the potential to become a “weathervane for technology stock investment”, attracting a large number of passive funds to follow and buy, further promoting the growth and market attention of the technology sector.

This move not only enhances Nvidia’s market recognition but also makes it the “focus” of global technology investment. Whether in the capital market or in the hearts of investors, Nvidia’s status is no longer simply that of a hardware company. It is gradually becoming the core force of global AI and technology investment.

However, Nvidia’s current situation is not simply a matter of buying or selling decisions. Judging from historical cases of index inclusions and exclusions, such as Exxon Mobil being removed from the Dow Jones Industrial Average a few years ago and Salesforce replacing it, the subsequent trends were quite different from the market’s initial expectations.

This time, Nvidia’s joining means that Intel is officially “laid off”. Both belong to the semiconductor industry, and the situation is somewhat different from before. Intel is currently facing difficulties and needs to continuously invest a large amount of research and development and capital expenditures to catch up with its peers and develop its capital-intensive foundry business. Although Nvidia is in an advantageous position, the excessive optimism in the market about its share price may put it at risk.

Competition Prospects

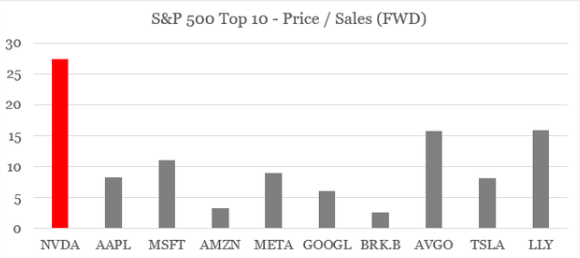

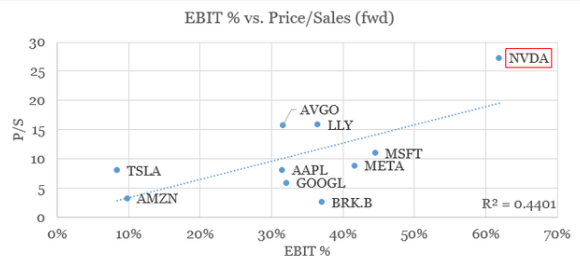

Nvidia has become the company with the highest market capitalization in the world, but it is quite challenging to maintain this position. Currently, its business development momentum is strong, and there seems to be no worry about a share price decline in the short term. However, in the long run, the share price may have approached its limit.

The story of the semiconductor industry continues to heat up, and there are good reasons for this. Chips are hailed as “new oil”, and almost every industry in the economy relies heavily on semiconductors. In addition, for more than a year, the wave of the generative AI revolution has attracted the attention of investors, and the share prices of many large global semiconductor companies have hit record highs. Nvidia is undoubtedly the biggest winner of this trend, with its market capitalization climbing and regaining the title of the world’s most valuable company from Apple.

However, compared with other large listed companies in the top ten, Nvidia faces a unique competitive environment. Companies such as Apple, Microsoft, Google, and Amazon are in more attractive market areas in the long run. From the data perspective, Nvidia’s current operating margin is 62%, but analyzing from its pricing level, the market’s expected operating margin for it is much higher than this, which reflects the high expectations of the market for Nvidia’s profitability.

Although the current growth momentum of semiconductor demand is strong, the competitive advantage of the industry is still full of uncertainties in the long run. For example, AMD’s trough before the launch of the Zen microarchitecture from 2015 to 2016 and Intel’s history of dominating the semiconductor industry for decades both demonstrate the variability of the competitive situation in this industry.

Nvidia’s fiscal 2025 third-quarter earnings report is about to be released, and the market’s expectations have reached their peak. With its technological innovation in the field of artificial intelligence, especially the launch of the new-generation AI chip Blackwell, Nvidia is undoubtedly at the forefront of future technological development. It is expected that with the shipment of Blackwell and the strategic cooperation with SoftBank, Nvidia will occupy a more solid position in the global AI market and further consolidate its market share as a technology giant.

Judging from the financial data, Nvidia’s strong growth momentum cannot be ignored. It is expected that its revenue, profit, and earnings per share will all hit record highs, which further promotes investors’ optimistic sentiment. The market also has high expectations for its future, especially under the dual effects of its leading position in the artificial intelligence accelerator field and the share repurchase plan, Nvidia’s share price may usher in a new breakthrough.