- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Trump's election victory ignites US stocks, Musk's investment returns crush Buffett! Tesla soars, ma

In the 2024 US presidential election, after Trump won the presidential election, the US stock market opened a new round of bull market feast. Tesla CEO Musk, as the “strongest assistant”, invested hundreds of millions of dollars in the campaign, attracting global attention. Some investors believe that Trump’s return to power may benefit Tesla.

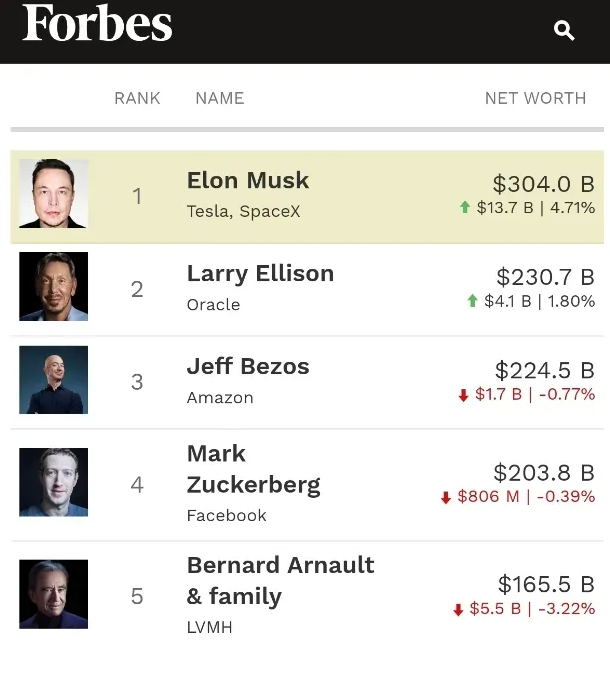

Tesla’s stock price rose more than 29% during the election week, and its market value quickly returned to above $1 trillion. At present, the world’s richest man Musk’s net worth has exceeded $300 billion, firmly occupying the throne of the world’s richest man, with an investment return of up to 192 times, beating the stock god Buffett.

Trump wins, US stocks soar

Trump’s tax cut proposal helps US economic growth and corporate profits, which is the main logic for the rise of US stocks.

On November 6th local time, with Trump defeating Harris to win the election, the three major US stock indexes hit a new historical high. Among them, the Dow Jones Industrial Average rose more than 1500 points or 3.57%, setting the largest single-day increase since November 2022, while the S & P 500 index set the largest increase since December 2022.

In the following two trading days, the US stock market further rose slightly. As of the close on November 8th, the Dow Jones Industrial Average rose 0.59% to 43,988.99 points; the Nasdaq rose 0.09% to 19,286.78 points; and the S & P 500 index rose 0.38% to 5,995.54 points. All three major indexes set new highs for closing and intraday trading, with the S & P 500 index breaking through the 6,000-point mark.

Overall, Trump’s policy proposals are positive for the US stock market. His proposed policies include large-scale tax cuts, reducing the corporate tax rate from 21% to 15%, extending personal income tax reductions, and providing tax incentives for local manufacturing, which are expected to enhance the profitability of US companies.

In addition, he also advocates imposing tariffs of at least 10% on all imported goods, which is expected to promote the development of US industrial manufacturing. Moreover, Trump tends to relax financial and energy regulations, especially in the traditional energy sector, which is expected to promote the outbreak of financial and energy stocks in the short term.

Tesla’s stock price soared, and its market value exceeded one trillion again

As a member of the US stock market, Tesla’s stock price performance is particularly outstanding. As of the close of November 8th, Tesla’s stock price still rose by 8% to $321.22 per share, reaching a new high of more than two years. The market value once again broke through the $1 trillion mark, reaching $1.03 trillion.

Wind data shows that Tesla’s stock price has risen by a cumulative 29.01% in a single week, the largest weekly increase since January 2023. Investors are betting that Trump’s return to the White House may have a positive impact on Musk’s company.

This increase not only greatly increased Tesla’s market value, but also caused Musk’s net worth to skyrocket. According to Forbes’ real-time global rich list, as of last Friday, Musk’s net worth has reached $304 billion, which is more than $70 billion higher than the second-ranked software giant Oracle CEO Ellison (worth $230.70 billion), firmly ranking as the world’s richest person.

The reason why Tesla’s stock price soared and its market value skyrocketed

First, the accumulation of Tesla’s core competitiveness

Since its establishment in 2003, Tesla has gradually established its leadership position in the electric vehicle market with its innovative technology and leading electric vehicle design.

With the global response to climate change and policy support, Tesla has launched multiple popular models such as Model 3 and Model Y through continuous technological research and development and market expansion. The global sales of these models not only demonstrate the increasing acceptance of electric vehicles by consumers, but also drive Tesla’s global capacity expansion and supply chain optimization, bringing sustained growth momentum to the company.

Tesla’s success is also due to investors’ confidence in its long-term strategy, especially under the leadership of Elon Musk. Musk’s vision of “full electrification” and his promotion of “solar + energy storage” solutions not only meet the needs of global climate change countermeasures, but also create new growth opportunities for Tesla.

As a comprehensive enterprise that is not only a car manufacturer but also involved in energy production and storage, Tesla’s diversified business layout enables it to achieve coordinated development in different fields, further consolidating its market position. This enhancement of comprehensive strength, along with its innovation in autonomous driving and battery technology, has provided a solid foundation for the significant growth of Tesla’s stock price and market value.

Second, Trump’s election became an important catalyst

Trump’s victory in the 2024 US presidential election is an important catalyst. According to public reports, Tesla CEO Musk began supporting Trump in July 2024. During the campaign, Musk donated more than $130 million to Trump’s campaign and continuously posted on social media to support the Republican Party and Trump, making him a key ally of Trump.

Trump has repeatedly expressed his support for Musk’s company and promised to take a series of policy measures that are beneficial to its development. He clearly stated that he will review and may adjust his previous plan to slow down the transition to electric vehicles, while expressing firm support for Musk’s SpaceX company and its Mars landing plan. This may bring more cooperation opportunities and development space to Tesla. Therefore, Trump’s victory has made investors full of expectations for Tesla’s future development, thereby driving up its stock price.

Analysts believe that after Trump takes office, Tesla’s competitive advantage in the electric vehicle industry will be further highlighted, especially in the context of the Trump administration’s possible reduction of tax incentives for electric vehicles, giving Tesla an advantage over other manufacturers.

In addition, Musk may even hold important government positions. During the campaign, Trump proposed the establishment of a government efficiency committee responsible for conducting comprehensive financial and performance audits of the entire federal government. He hoped that Musk could serve as the head of the government efficiency committee to fully leverage his outstanding talents in innovation and efficiency improvement. Musk has also previously responded by expressing interest in serving on the committee.

Trump also promised to relax regulations on autonomous cars, which will help Tesla accelerate the development of its autonomous driving technology. Musk said in last month’s earnings call that if appointed as a member of the Trump administration, he would “work hard to achieve this goal.” Tesla’s autonomous driving technology is considered one of the key drivers of the company’s future growth, and it is expected that Tesla will be able to put autonomous cars on the road faster.

Tesla’s growth potential under Trump’s policy expectations

Under the dual drive of policy expectations and loose interest rates after Trump’s election, Tesla is facing great potential growth opportunities. Although Trump’s policies have not yet been officially implemented, his advocated policy direction of tax reduction, tariff protection, and relaxation of environmental protection and energy regulation has brought confidence to the market, especially the expected benefits for US manufacturing and technology stocks. For Tesla, once the policy dividend is implemented, it will inevitably bring substantial support, especially in terms of cost reduction and market competitiveness.

Trump advocates for significant tax cuts and relaxation of environmental regulations in the manufacturing industry. This means that once the policy is implemented, Tesla’s corporate tax burden and compliance costs may significantly decrease, allowing it to invest more resources in technology research and development and global expansion. Especially the expectation of tariff protection policies further guarantees Tesla’s domestic market advantage and reduces the competitive pressure on imported electric vehicles. Trump’s plan to increase support for US domestic manufacturing is also expected to help Tesla consolidate its leading position in the US market and provide policy support for its US manufacturing strategy.

Meanwhile, the low interest rate policy after the Fed’s interest rate cut will continue to bring expansion advantages to Tesla. With financing costs remaining low, Tesla can more easily raise funds and increase investment in key technologies, such as the 4680 battery and fully autonomous driving technology. These technologies are key to Tesla’s competitiveness in the market. The 4680 battery not only improves the range and safety of electric vehicles, but also reduces production costs, giving Tesla a stronger pricing advantage in the global market. The advancement of fully autonomous driving technology is expected to completely change the User Experience and enhance brand stickiness.

Tesla has also benefited from the continuous growth of global demand for electric vehicles. Tesla has carried out localization production layout globally through the Gigafactory, and the support of local governments has also created favorable conditions for it. If Trump’s policies are implemented as expected, Tesla’s market expansion and technological breakthroughs will further accelerate, making it continue to lead the global electric vehicle market.

How can investors seize the opportunity of skyrocketing prices?

With the joint promotion of policy expectations, low interest rates, and market demand, Tesla’s growth potential is becoming increasingly clear. This is both a new opportunity and a challenge for investors. Faced with the high market sentiment and the benefits brought by possible future policy support, how can investors seize investment opportunities in the volatility?

First of all, in the short term, Trump’s future tax cuts and support for US companies have indeed provided strong stock price impetus for tech giants such as Tesla, which is expected to further boost stock prices. For investors who are watching, BiyaPay provides an ideal investment service platform that can help you seize opportunities in the US stock market.

With BiyaPay, you can not only easily buy high-growth potential stocks such as Tesla, but also monitor the market trends of the stocks in real time on the platform, effectively avoid risks, and wait for the best time to get on board. In addition, BiyaPay, as a professional tool for depositing funds in and out of US and Hong Kong stocks, also provides a convenient channel for fund flow. You can exchange digital currency for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to complete the investment. BiyaPay has a fast and unlimited arrival speed, which can help you efficiently seize investment opportunities.

However, we need to know that although Tesla’s stock price has performed well, the market is still full of uncertainty, and investors need to be careful.

Although Trump’s policies may have a short-term driving effect on the US stock market, the uncertainty of future policies remains high as policy details are implemented and market reactions are adjusted.

Moreover, Tesla also has areas that need improvement. In terms of technology, Tesla needs to constantly innovate and improve the performance and quality of its products to maintain its leading position in the industry. For example, in terms of autonomous driving technology, Tesla needs to further improve the safety and reliability of the technology to meet consumer demand.

In terms of the market, Tesla needs to continuously expand its market share and strengthen cooperation with other companies. Tesla can jointly promote the development of electric vehicle technology and accelerate the popularization of electric vehicles through cooperation with traditional car manufacturers. At the same time, Tesla can further expand the international market, especially in the development of Emerging Markets, to achieve its strategic goal of global layout.

To effectively deal with the above risks, it is recommended that investors adopt a diversified investment strategy when allocating assets, do not excessively concentrate funds in a single stock or industry, and continuously optimize the investment portfolio.

In summary, Trump’s election has brought new growth opportunities to the US stock market, especially Tesla. The enthusiastic market response has caused Tesla’s stock price to soar and Musk to once again become the world’s richest man. Although policy support and Tesla’s industry position have laid a solid foundation for its future growth, investors still need to be cautious about market fluctuations and potential uncertainties. While seizing opportunities, optimizing fund management through global multi-asset trading wallets like BiyaPay, maintaining flexibility in responding to market changes, and adopting diversified Asset Allocation strategies to better achieve a balance between ROI and risk control.