- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Can Google start a new round of growth with impressive financial reports and potential positive news

Since July 2024, Google’s stock price has been fluctuating and continuously affected by the Anti-Trust investigation. However, as the dust settles on the results of the 2024 US election, the subsequent change of government may bring changes to the regulatory environment, providing new opportunities for Google and other large technology companies. The regulatory pressure on Google may be eased, which will help its long-term development and survival. At the same time, Google’s financial report released in the third quarter of 2024 showed strong performance, and the market is generally optimistic about its future prospects. Relevant analysts believe that Google is the most undervalued company among the seven major tech giants, and many favorable factors in the future may push its stock price further up.

Q3 2024 Financial Review: Strong Growth and Diversified Breakthrough

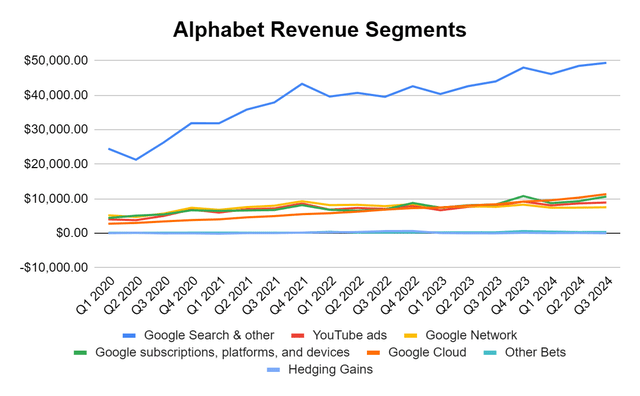

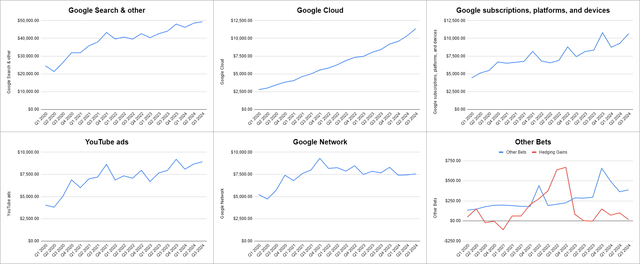

In the third quarter of 2024, Google’s financial performance exceeded market expectations, demonstrating its strong profitability and potential for continued growth. The company reported total revenue of $84.74 billion, a year-on-year increase of 15%. Among them, advertising business is still Google’s main source of revenue, especially search ads and YouTube ads, which contribute greatly to the overall revenue. Google’s total revenue increased by 34% compared to last year, and the operating profit margin also increased from 29% in the previous quarter to 32%, bringing in $28.52 billion in revenue. In the third quarter, there were 13 weeks where Google’s weekly revenue was $6.79 billion and Net Profit was $2.02 billion. This achievement shows that Google has not only successfully improved its Operational Efficiency, but also made significant progress in improving profitability.

From the perspective of segmented businesses, Google’s search business still performs strongly. In the third quarter, the revenue of Google’s search and other advertising products was $49.39 billion, a year-on-year increase of 12.17%. This indicates that despite competition from AI technologies such as ChatGPT, Google can still maintain its leadership position in the global search engine market. YouTube’s advertising revenue also steadily increased, reaching $8.92 billion, a year-on-year increase of 12.19%. This growth not only comes from the strong demand of advertisers for the platform, but also closely related to YouTube’s continuous optimization in improving the content creator ecosystem and advertising targeting technology.

In the field of Cloud as a Service, Google Cloud continues to show strong growth, with revenue in Q3 increasing by 30.64% YoY to over $10 billion. Although Amazon’s AWS and Microsoft’s Azure still dominate the global Cloud Service market, Google Cloud is gradually expanding its market share with its advantages in artificial intelligence, Big data processing, and enterprise-level solutions. The strong performance of Google Cloud indicates that Google’s investment in this field is paying off, especially in providing innovative services and technical support to enterprise customers, demonstrating its sustained market appeal.

In addition, Google’s hardware products and subscription services have also performed well, especially in smart devices and platform services. The revenue in the third quarter reached $10.66 billion, a year-on-year increase of 27.79%. This growth mainly comes from Google’s continued expansion in smartphones (such as the Pixel series), smart home devices (such as Nest), and related subscription services (such as YouTube Premium and Google One). This not only shows Google’s success in the hardware field, but also its diversified development in digital platforms and services.

Growth prospects: technological innovation and policy dividend dual-wheel drive

Despite the impressive financial results in the third quarter of 2024, Google’s future growth potential is also worth paying attention to. The rapid development of AI technology, especially Google Gemini and Deep learning models, will bring new business growth space to Google. As Google’s next-generation AI platform, Google Gemini aims to improve the accuracy of search results through more efficient natural language processing technology, optimize advertising strategies, and further increase advertising revenue. The application of AI technology can not only improve the performance of search engines and advertising systems, but also open up growth opportunities for Google in multiple emerging areas such as intelligent hardware, Cloud as a Service, and subscription business.

YouTube remains one of the key drivers of Google’s growth. Despite challenges from Short Video Platforms like TikTok, YouTube has shown strong growth in both advertising revenue and subscription services with its large user base and content ecosystem. Paid services such as YouTube Premium and YouTube TV are expanding, driving the platform’s continued profitability. In addition, as global video consumption continues to grow, YouTube will continue to play an important role as a source of revenue in the coming years.

In the field of Cloud Services, Google Cloud is growing at a faster rate. Despite AWS and Microsoft Azure’s leading position in the enterprise market, Google Cloud has gradually attracted a large number of enterprise customers with its technological advantages in AI and Big data. With the further expansion of the Cloud Service market, Google Cloud is expected to continue to maintain strong growth and become a key growth point in the future.

In addition to technological innovation and market expansion, changes in government policies and market environment will also profoundly affect Google’s growth prospects. The dust has settled on the 2024 US election, and the subsequent new government may bring regulatory changes to large technology companies, which is both a challenge and an opportunity for Google. In the past few years, Google and other tech giants have been facing Anti-Trust investigations from the US government and multiple countries around the world, especially the Federal Trade Commission’s (FTC) investigation into Google’s advertising business, which has been the focus of market attention. New government policies and regulatory environments may affect the progress of these investigations and may ease some regulatory pressure on Google, thereby bringing a more relaxed operating environment for the company.

In addition, the Fed’s interest rate cut policy has created a more relaxed capital environment for the market. This is a positive signal for Google, especially in promoting innovation and increasing capital expenditures. Interest rate cuts usually lower corporate borrowing costs, thereby encouraging companies to increase research and development investment and global expansion. As a well-funded company, Google will be able to better seize this opportunity and accelerate technological innovation and business expansion.

Valuation and share buyback drive: Google’s long-term investment appeal

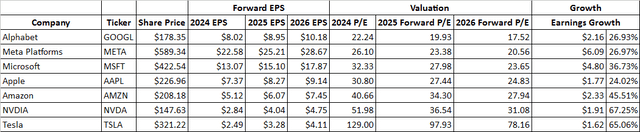

Google’s financial performance and business growth potential have laid a solid foundation for the future trend of its stock. However, to fully evaluate Google’s investment value, we also need to carefully analyze its current valuation and stock buyback strategy. Based on the current market situation, Google’s valuation is relatively low, especially when compared with peer companies, the potential for its future stock price to rise is particularly obvious.

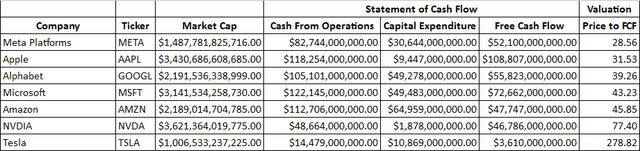

Google’s current Price-To-Earnings Ratio (PE) is 22.24 times the expected earnings per share in 2024, which is relatively undervalued among tech giants. Compared to companies like Apple and Microsoft, Google’s Price-To-Earnings Ratio is significantly lower than their expected levels. Apple’s Price-To-Earnings Ratio is expected to be 30.8 times in 2024, while Microsoft’s Price-To-Earnings Ratio is 28.3 times, which means investors can gain more growth potential by investing in Google at the same Price-To-Earnings Ratio level. Google’s current trading price is almost half of the expected Price-To-Earnings Ratio for 2026. In these years, Google’s profits are expected to steadily increase, further enhancing shareholder returns. Therefore, Google’s stock price growth potential in the coming years is still huge, especially with its low valuation, attracting more attention from value investors.

It is worth noting that Google’s shareowner return policy has also brought additional appeal to investors. Google has bought back a large number of shares in the past few years, enhancing the growth potential of earnings per share (EPS). The stock buyback not only reflects the company’s confidence in its own prospects, but also effectively enhances shareowner returns. Buying back shares will reduce the circulating share capital in the market, thereby increasing earnings per share and shareowner value, which is undoubtedly a positive signal for long-term investors.

In the past 12 months, Google has returned nearly $70 billion to shareholders, including stock buybacks and dividend payments. Management stated that they will continue to balance investments in artificial intelligence and other strategic areas to ensure sufficient funds to support future stock buybacks and shareholder returns. After allocating $49.28 billion for capital expenditures in the past 12 months, their trading price is still 39.26 times free cash flow. In the coming years, Google will be able to allocate more funds for its buyback program, which will create more value for long-term shareholders.

Based on valuation analysis, Google’s stock buyback plan further deepens its attractiveness. Analysts are generally optimistic about Google’s long-term prospects, believing that the company will reach a historic high in 2025 and continue to rise.

If you are optimistic about Google’s future development and considering investing in its stocks, you can operate through the BiyaPay platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience. With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

Google’s risks and challenges: seeking breakthroughs in uncertainty

Although Google has demonstrated strong financial performance and technological innovation potential in multiple fields, the company still faces some significant risks and challenges, mainly from market fluctuations, legal litigation, regulatory pressure, and fierce technological competition.

Anti-Trust lawsuits and regulatory pressure are long-term challenges for Google. Due to its dominant position in the global search market, Google has always been the subject of Anti-Trust investigations, especially in the US and Europe. Investigations by the Federal Trade Commission (FTC) and the European Commission focus on Google’s advertising business, search engine, and data privacy. If these investigations lead to stricter regulation, it may affect Google’s operations, especially in advertising and data analysis businesses. Nevertheless, Google still maintains competitiveness through technological innovation and optimization in the face of these pressures.

The rise of AI technology, especially generative AI (such as ChatGPT), has brought new competitive challenges to Google. With the breakthrough of AI in the field of natural language processing, the traditional search engine model may be overturned, and users are increasingly inclined to directly communicate with AI rather than obtain information through search engines. Nevertheless, Google has maintained its technological advantage in this field by launching AI-based products such as Google Gemini, and continues to optimize search quality and advertising effects to address this threat.

The Cloud Service market is also a competitive focus for Google. Although Google Cloud has made breakthroughs in growth rate, AWS and Microsoft Azure still dominate. In order to narrow the gap, Google continuously enhances its competitiveness in the Cloud Service field through acquisitions and product innovation, especially in the fields of AI, Big data, and Machine Learning, which has attracted many enterprise customers. However, to compete with AWS and Azure in the global market, Google still needs to continue its efforts.

In addition, YouTube is facing competitive pressure from Short Video Platforms such as TikTok. Despite its strong performance in advertising revenue, YouTube’s user growth and advertising revenue may be affected as younger clients base prefers Short Video Platforms. Although YouTube is launching more paid subscription services, maintaining user engagement rates and attracting content creators remains a challenge.

Although Google faces challenges from AI technology, fierce market competition, and legal litigation risks, it still has the resilience to respond to challenges with its strong technological accumulation and innovation capabilities. At the same time, future government policy changes may also reduce regulatory pressure on Google and provide more opportunities for its long-term growth. With continuous innovation in fields such as AI and Cloud Services, Google is expected to continue to maintain its market leadership in the future, driving company growth and bringing returns to investors.

Overall, Google’s financial performance and future growth potential in the third quarter of 2024 make it a strong choice for long-term investment. The company has demonstrated strong profitability and competitiveness by optimizing its core business and expanding into emerging areas such as AI, YouTube, and Cloud Services. Despite facing Anti-Trust regulation and market challenges, Google still has significant growth potential with its technological advantages. The favorable environment brought by undervaluation and policy changes makes its stock price expected to continue to rise, and long-term investors seeking stable growth can focus on Google.