- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Will the US Stocks Plunge Due to the Interest Rate Hike of the Japanese Yen? How Should Ordinary Inv

After a 16-year bull market, people’s expectations for the Federal Reserve’s interest rate cut have been growing higher and higher. After the release of the CPI data previously, the expectation of an interest rate cut heated up and US technology stocks began to correct. This time, also with the strengthened expectation of an interest rate cut, US technology stocks rebounded after falling for a week and a half. Essentially, this can be understood as a style rotation under the trading based on the expectation of an interest rate cut. However, there is a more important factor behind it - the Japanese yen.

Yesterday, the Bank of Japan confirmed a 15 basis point interest rate hike.

The main impact of the yen’s interest rate hike on the global market: The US dollar assets invested overseas by Japan began to flow back to Japan.

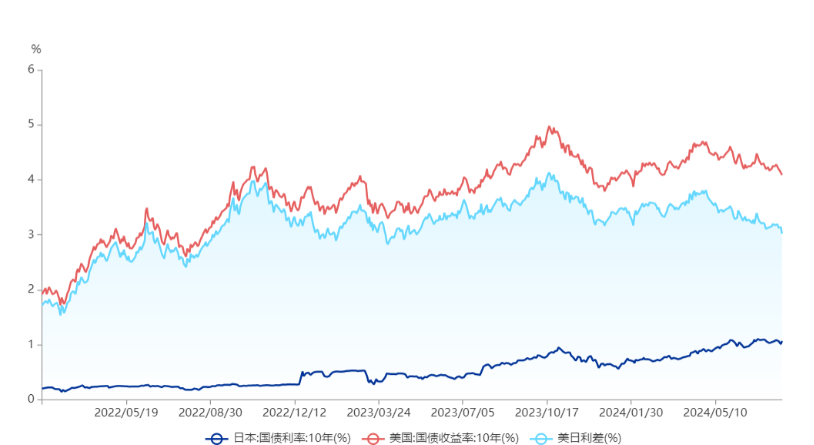

As for the impact of the yen on US stocks, after all, they are the markets of two countries. In fact, we didn’t pay much attention to their correlation before. It was not until recently that we discovered how powerful the yen could be. First, let’s look at a picture.

【Yen exchange rate vs. NASDAQ】

So, my previous logic was:

The US cuts interest rates --> Currencies of other countries appreciate --> Currencies flow back + US stocks correct after expectations are fully priced in.

Until later, when US stocks plunged inexplicably and then soared yesterday. Apart from corporate financial reports, there didn’t seem to be any major news in the US. The impact of economic data and the strengthened expectation of the Federal Reserve’s interest rate cut shouldn’t have been that significant.

Suddenly, there was a rumor in the market that the Bank of Japan would raise interest rates by an unexpected 25 basis points, which immediately led to the appreciation of the yen. To avoid margin calls, short positions on the yen rushed to unwind, resulting in a sharp decline in US stocks. Why does the yen affect US stocks? This has to start with the carry trade of the yen. What is carry trade? Briefly speaking, it means borrowing money at a low interest rate and using it to buy high-yield assets. To put it simply, if I were a Japanese citizen, and the interest rate for borrowing money was only 1%, but I could get at least 5% return by buying US bonds and stocks, then I would consider borrowing yen to buy US assets. Moreover, if the yen depreciated at the same time, it would be like winning twice.

Why did US stocks continue to rise in the first half of the year despite being so overvalued, and why did the rally gradually narrow from a wide range of technology stocks to big stocks like NVIDIA? The core reason is that Japan exempted investment income tax at the beginning of the year, which boosted people’s enthusiasm for investment. Looking globally, where was the best place to invest? - The US stocks. When the S&P 500 didn’t perform well, people turned to the top 100. When the top 100 didn’t do well, they focused on the Magnificent Seven. When the Magnificent Seven stopped rising, they simply bet on NVIDIA. Whoever performed well was where the money went.

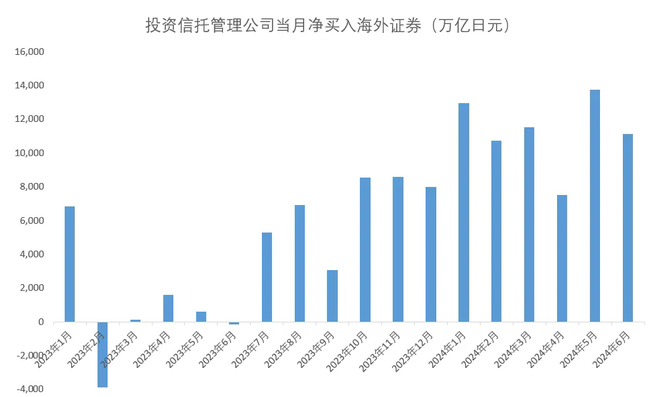

In addition, Japan’s financing cost was low and the yen was depreciating, so investors used leverage to buy US stocks. The key point was that due to the extremely low cost of the yen, it was almost like having unlimited bullets and funds. As much as you wanted for loan financing, you could get it. According to statistics, in the first six months, overseas investments from Japan bought more than 6.7 trillion.

This strategy could lead to winning twice when the yen was depreciating. However, once the yen appreciated rapidly, leveraged investors had to sell US stocks to avoid margin calls, and funds flowed back to Japan, resulting in a sharp decline in US stocks represented by NVIDIA.

Let’s see what the actual situation was like.

Earlier this year, just after Warren Buffett significantly reduced his holdings of US stocks and cashed out nearly $100 billion, the Nikkei Index fell by more than 12% the next day after the news spread, hitting its biggest historical decline, surpassing the Black Monday in 1987. On the same day, in the pre-market trading of US stocks, there were also huge fluctuations, and the index almost hit the circuit breaker.

Have you noticed why most global markets were basically calm? Only the US and Japanese markets experienced significant fluctuations?

The second question is even more worthy of discussion: On the day when US stocks fluctuated wildly, why did the NASDAQ Golden Dragon China Index (representing leading Chinese companies listed in the US) rise instead of falling? Over the course of a week, while the NASDAQ fluctuated significantly, the Golden Dragon China Index rose over the week, far outperforming the NASDAQ. Why was there such a completely opposite performance?

It all started a few years ago.

After 2020, Warren Buffett successively invested in several Japanese trading companies. His approach was quite special: He borrowed a large amount of long-term yen loans in Japan at an almost zero interest rate. Since Buffett was reluctant to bear exchange rate risks, he didn’t transfer the money to the US but invested in Japan with the borrowed money. At that time, those trading companies had a dividend yield of 3 - 5%, which meant Buffett earned dividends for free. Due to Buffett’s actions, there was a huge imitation effect. Many people liked to follow Buffett’s investment moves.

After he invested in Japan, it made people realize that Japan was actually the last place where one could borrow money for free. Especially after 2021, when the US continuously raised interest rates, being able to borrow yen at a zero interest rate had a huge advantage compared to the costly US dollar. As a result, global speculative funds began to borrow money for free from Japan. They were bold and not afraid of exchange rate fluctuations. They borrowed yen and then invested in US stocks.

For example, in 2020, assuming 1 US dollar was equivalent to 100 yen at that time, if Wall Street borrowed 100 yen for free from Japan and then exchanged it for 1 US dollar to speculate on US stocks. As more and more people did this, the S&P 500 was continuously pushed up. 1 US dollar became 1.6 US dollars. According to the current exchange rate of 1 US dollar to 147 yen, 1.6 US dollars became 235 yen. After paying off the borrowed 100 yen, they finally made a profit of 135 yen for free. In the whole process, overseas funds earned three speculative gains:

First, the interest rate spread from the zero interest rate of the yen;

Second, the valuation bubble of US stocks;

Third, the profit from the depreciation of the yen.

The above process greatly encouraged speculative funds to continuously borrow money from Japan and then pour it into US stocks for speculation. This explains why the yen depreciated while the US dollar appreciated relative to the yen; it also explains why the US and Japanese markets were highly correlated; and it also explains why the valuations of the Magnificent Seven in US stocks were so high, yet there was still a continuous inflow of funds. Moreover, the US dollar interest rate had already reached 5%, and funds were very expensive. Why was the liquidity of US stocks still so abundant? Where did the money come from?

Let’s look at another piece of evidence, and the answer will be clearer: On July 31, the Bank of Japan announced an interest rate hike, and the world’s last zero-interest-rate currency gradually withdrew from the historical stage. Almost at the same time when the Bank of Japan announced the interest rate hike, the S&P 500 Index fell continuously for three weeks, and the Nikkei 225 Index replicated almost the exact same downward performance. This evidence powerfully explains that there might be a considerable amount of marginal funds in the US stock market coming from zero-interest-rate Japan. When Japan raises interest rates and the cost of the yen increases, the US and Japanese markets will then experience significant fluctuations simultaneously. When the continuous “free water pipe” is shut off, the extremely high valuations of US stocks may no longer be sustainable. Many people say that US stocks have a bubble, but they have been overvalued for quite some time. Why did Buffett choose to reduce his holdings of US stocks at this time? Perhaps it was precisely because he saw this point that he chose to significantly reduce his holdings of US stocks at this moment.

The combination of the US dollar’s interest rate cut and the yen’s interest rate hike may bring an important liquidity inflection point to the global market, and the global capital flow is likely to experience a phased directional change.

So, how can ordinary US stock investors gain insights into the market and seize the opportunity in such an investment environment? You can consider compliant platforms such as Tiger Brokers, Futu Securities, and BiyaPay. BiyaPay can help investors directly deposit funds into various overseas securities firms, and there is no freezing of cards for deposit and withdrawal, relieving investors of their worries.

In this financial environment full of opportunities and challenges, investors should maintain a sharp market insight and a calm mind. Closely monitor international political and economic developments, timely grasp the latest policy information and market data, and flexibly adjust investment strategies to achieve the preservation and appreciation of assets. Meanwhile, by leveraging the wisdom of professional financial institutions and investment advisors and combining it with their own risk tolerance and investment goals, investors can formulate scientific and reasonable investment plans, so as to move forward steadily amid the fluctuations of the yen exchange rate and seize the opportunities for wealth growth.