- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Sixth

Tencent's Q3 financial report is about to be released. Is the predicted net profit expected to soar

Tencent’s Q3 financial report is about to be released. In the past year, Tencent has been advancing in the complex economic tides, facing numerous challenges. Its core businesses, such as gaming, WeChat Channels, fintech, and enterprise services, are like giant ships sailing in the ever-changing sea, showing fluctuations and adjustments to varying degrees. Against this backdrop, the trend of Tencent’s share price and its future profitability have undoubtedly become the key topics hotly debated in the market.

For investors, the release of Tencent’s third-quarter financial report is an important juncture for evaluating the future direction of the share price. Major securities firms predict that Tencent’s gaming business, advertising revenue, and fintech business are like powerful engines driving the company’s performance growth. Especially as the macroeconomic environment gradually warms up, Tencent’s revenue growth rate and profitability are expected to improve significantly.

Whether you are currently a shareholder or planning to invest, understanding the potential changes in the financial report and evaluating their impact on the share price will be a powerful basis for you to seize market opportunities and make rational investment decisions.

Financial Report Preview: What Are the Market Predictions for Core Businesses?

Tencent’s gaming business has always been a major source of the company’s revenue. In the third quarter of 2024, this business segment is expected to continue to boost the overall revenue.

According to the prediction of TF Securities, Tencent’s online game revenue is expected to grow by 13% year-on-year, with the domestic market revenue expected to increase by 12% and the overseas market revenue expected to grow by 15%. Since its launch in May, the game “Dungeon & Fighter: Origin” has shown stable performance. It is expected that its revenue contribution will increase significantly in the third quarter and may become the main driving force for the growth of Tencent’s gaming business revenue.

Moreover, Tencent’s momentum in the overseas market remains unabated. Although the performance of some games like “Brawl Stars” in major markets has tended to stabilize, the overall game revenue flow still maintains a high year-on-year growth rate and is expected to continue this growth trend in the third quarter. Coupled with the gradual launch of new games such as “Pokémon UNITE” and “Honor of Kings: World,” Tencent’s gaming business is expected to reach a new level in the fourth quarter, adding fuel to the growth of the company’s overall performance.

WeChat Channels Advertising: A Stable Revenue Pillar

Tencent’s social media platform, WeChat Channels, has become an important part of the company’s advertising revenue in the past period. According to the prediction of Huatai Hong Kong, Tencent’s WeChat Channels advertising revenue is expected to achieve a year-on-year growth of 16% in the third quarter of 2024. With the joining of content creators and merchants on the platform, the user stickiness and advertising conversion rate of WeChat Channels are expected to be further improved, thus driving the steady growth of advertising revenue.

Analysts believe that the increase in the advertising load of WeChat Channels will become the main driving force for the growth of Tencent’s advertising revenue in the future period. Tencent can not only interact with users through the WeChat Channels platform but also further tap the potential of advertising and e-commerce revenue through in-depth cooperation with e-commerce platforms.

It is expected that by 2025, the compound annual growth rate of WeChat Channels advertising will reach around 25%, promoting the continuous growth of Tencent’s advertising revenue. In the next few quarters, WeChat Channels will further strengthen the integration with other Tencent businesses (such as WeChat Pay, Taobao, etc.), forming a more closely-knit business ecosystem.

Overall, Tencent’s financial report for the third quarter of 2024 is expected to show a stable growth trend. According to the predictions of multiple analysis institutions, Tencent’s overall revenue is expected to grow by about 8% year-on-year. Among them, the value-added service business (including gaming and social services) will still account for the majority of the company’s revenue, and the advertising business and fintech business are also expected to bring considerable growth to the company.

In terms of profitability, Tencent’s Non-IFRS net profit is expected to grow by 18% to 25% year-on-year. This is mainly due to the strong growth of the gaming business, the steady improvement of WeChat Channels advertising, and Tencent’s excellent performance in cost control.

According to the current predictions, Tencent’s net profit in the third quarter of 2024 is expected to reach between 513.41 billion yuan and 570 billion yuan, with a year-on-year growth rate of 14.3% to 26.9%. This means that Tencent can not only achieve revenue growth in the gaming and advertising businesses but also maintain the growth momentum of profitability through cost control and gross margin improvement.

Tencent Fintech and Enterprise Services Preview

Fintech: Growth Slows Down but with Huge Potential

Tencent’s fintech business, including services such as WeChat Pay and Licaitong, has always been an important pillar for the company’s revenue diversification.

Although the revenue growth rate may slow down in the third quarter of 2024, this field still has huge growth potential. According to the Bloomberg consensus estimate, the revenue of fintech and enterprise services is expected to reach 540.55 billion yuan, with a year-on-year growth rate of about 3.86%.

The growth rate of the payment business may be affected by macroeconomic fluctuations. However, the in-depth integration of WeChat Pay with Taobao and Tmall is expected to further increase its market share. Especially in lower-tier cities, there is still much room for the penetration rate of WeChat Pay to increase, which brings new growth opportunities for Tencent’s payment business. As the consumer market gradually recovers, Tencent’s payment business is expected to maintain its growth momentum in the next few months.

You may wonder how Tencent maintains its leading position in the highly competitive payment market. In fact, through its huge user base and in-depth integration with e-commerce platforms, WeChat Pay has established a solid market position. The increase in penetration rate in lower-tier cities also brings new growth potential for Tencent and supports its stable growth in the next few months.

Enterprise Services: Cloud Computing and Technical Services Drive Growth

Tencent Cloud, as an important strategic business of the company, has gradually shown an upward trend in its performance in both domestic and overseas markets in recent years.

With the increasing demand for enterprise digital transformation, cloud computing and technical services will become an important driving force for Tencent’s future growth. Tencent Cloud’s performance in the third quarter of 2024 is expected to continue to strengthen. According to the prediction of TF Securities, Tencent Cloud’s revenue in Q3 is expected to grow by about 15% year-on-year, and the demand for enterprise cloud services will be the key factor driving growth.

Tencent Cloud’s overall market share is also gradually increasing. According to the latest market data, Tencent Cloud’s share in China’s public cloud market has approached 20% and ranks among the top three in the domestic market. This increase in share is due to Tencent Cloud’s continuous breakthroughs in technical fields such as AI, big data, and SaaS (Software as a Service). In addition, Tencent Cloud is stepping up its layout in the global market, especially in Southeast Asia and European and American markets, through acquisitions and localization strategies to further expand its market share.

The steady growth of Tencent Cloud in the domestic market, coupled with its globalization strategy, enables Tencent to continue to consolidate its position in the cloud computing market in the next few years. As enterprises’ demand for digital services surges, Tencent Cloud is expected to benefit from it and become a new engine for future growth.

Another highlight in the enterprise services field is Tencent’s WeChat Work and Tencent Meeting. These two products provide small and medium-sized enterprises with efficient communication and collaboration tools. According to Tencent’s latest data, the monthly active users of WeChat Work have exceeded 150 million, and its market penetration rate among small and medium-sized enterprises is constantly increasing.

With the wide application of these products, Tencent Cloud can provide more customized services for enterprises, further promoting its business growth.

Gross Margin and Cost Control: Tencent’s Profitability

In the third quarter of 2024, Tencent’s overall gross margin is expected to reach 53.3%, a year-on-year increase of 3.9 percentage points. This growth is mainly due to the strong performance of high-gross-margin businesses (such as gaming and advertising businesses). Compared with the second quarter, Tencent’s gross margin has increased by 16%, and this change has had a positive impact on its overall profitability. With the continuous expansion of gaming, advertising and other businesses, Tencent can further enhance its profit level.

With the optimization of the gross margin, Tencent’s financial situation becomes more stable, investors’ confidence is enhanced, which may drive the share price to rise. The continuous improvement of the gross margin will also directly enhance Tencent’s profitability and then bring higher returns to shareholders.

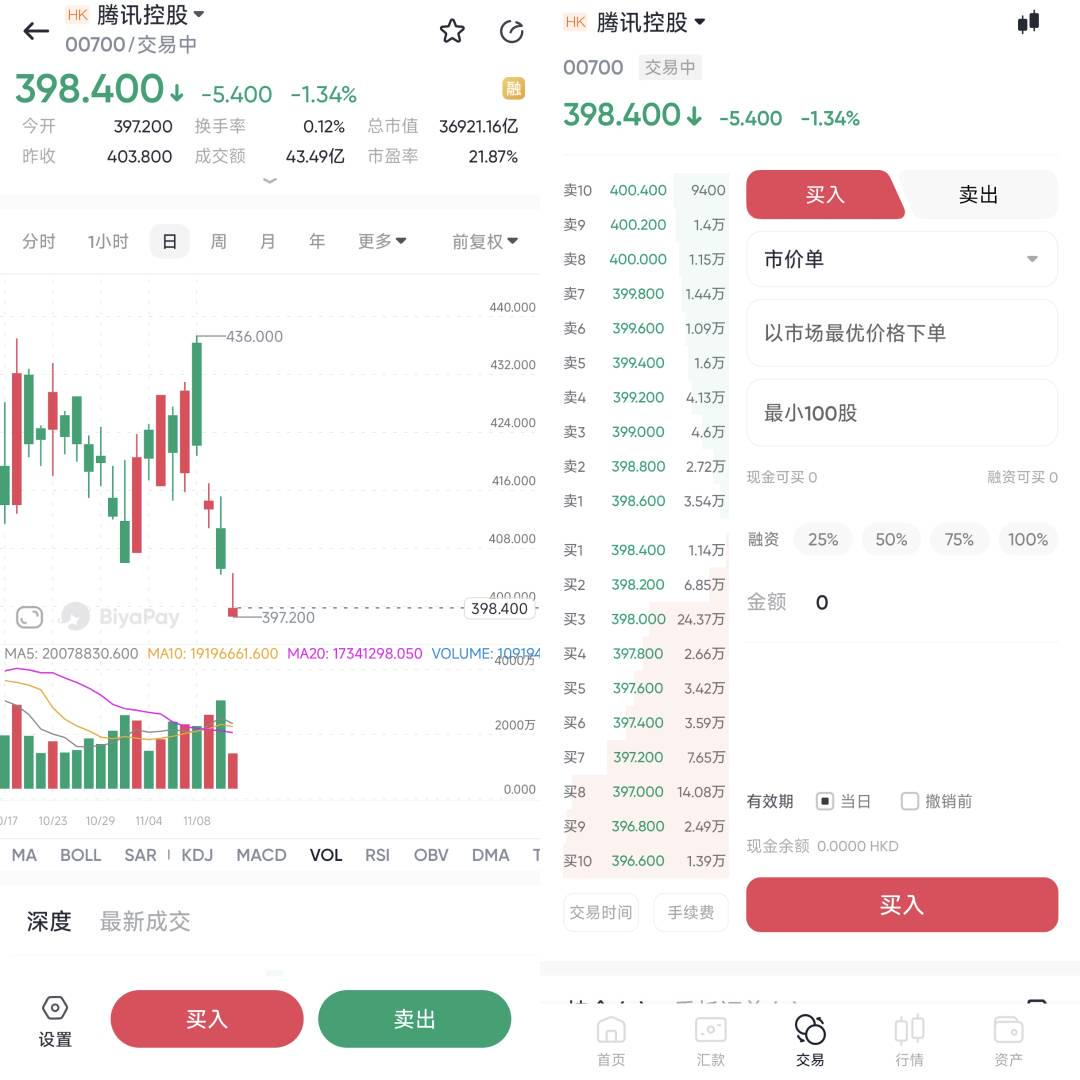

For those who want to enter the market early, it is recommended to use the multi-asset wallet BiyaPay to buy this asset as soon as possible. The current price indicates that investors still have the opportunity to enter at a low price. BiyaPay also supports trading of US and Hong Kong stocks as well as digital currencies, facilitating users to regularly check the price trend and quickly complete deposit and withdrawal operations at critical moments.

If you encounter problems in fund deposit and withdrawal, BiyaPay provides efficient, safe and non-freezing solutions. Whether it is recharging digital currencies and converting them into US dollars or Hong Kong dollars, or withdrawing to bank accounts, it can quickly and flexibly meet the fund needs and ensure that investors do not miss any market opportunities.

Cost Control and Profit Growth: Tencent’s Refined Management

Tencent has performed excellently in cost control and can effectively control operating costs while ensuring business growth. Through refined management and resource optimization, Tencent has maintained a relatively low sales and administrative expense ratio. This strategy enables the company to maintain stable profit levels while maintaining profitable growth. According to the data, through efficient cost control, Tencent can still maintain a strong profitable growth momentum in the third quarter of 2024, with the gross profit growing by 16% year-on-year. It is expected that in the third quarter, Tencent will continue to maintain the continuous improvement of the gross margin based on the incremental business with high gross margin, thus supporting the company’s long-term growth.

How does Tencent promote profitable growth while controlling costs? The answer is that Tencent focuses on high-gross-margin businesses and strictly manages expense expenditures. By optimizing resource allocation and improving operational efficiency, Tencent can maintain stable and profitable growth while controlling costs.

Market Predictions: Will the Share Price Continue to Rise?

Before the release of the financial report, there are different views in the market regarding the expectation of Tencent’s share price. According to the predictions of multiple securities firms, Tencent’s Non-IFRS net profit is expected to be between 513.41 billion yuan and 570 billion yuan, with a year-on-year growth rate of 14.3% to 26.9%. This profit growth expectation reflects Tencent’s strong performance in multiple core businesses, especially the continuous growth in the gaming and advertising fields.

From the predictions of securities firms, the room for Tencent’s share price to rise is likely to be further expanded. Especially on the eve of the release of the financial report, the market sentiment is generally quite optimistic. Investors are full of confidence in Tencent’s long-term development. The rapid development of emerging businesses such as WeChat Channels, cloud computing, and fintech is like adding fuel to the fire for the share price rise and is a powerful potential driving force.

According to the current market sentiment, Tencent’s share price is expected to continue to rise, especially if the financial report data exceeds market expectations. With the release of the financial report, the share price may experience a wave of increase, especially after Tencent announces strong performance data, the market reaction may be more positive.

However, the trend of the share price after the release of the financial report is not completely certain. After all, there are uncertainties in the macroeconomic environment and the global market. But from a long-term perspective, Tencent’s share price will still be affected by the performance of its core businesses and its strategic layout. If Tencent can always maintain strong profitable growth, especially continue to expand in the advertising and fintech fields, the possibility of the share price continuing to rise will be very high.

Moreover, Tencent has established a diversified investment portfolio by investing in multiple industries and technical fields (such as artificial intelligence, cloud computing, e-commerce, and fintech). These investments not only bring new revenue channels for Tencent but also enable Tencent to promote its own business development by leveraging the innovation and market layout of other enterprises. Through foreign investment, Tencent’s technical ability and market competitiveness have become stronger, providing a powerful guarantee for future profit growth. Therefore, Tencent’s diversified investment portfolio is also an important driving force for the long-term rise of its share price.

Although Tencent may face market corrections or adjustments in the short term, from a long-term perspective, its share price still has upward space, especially under the background of the continuous advancement of its innovation and globalization strategies.

The future trend of Tencent’s share price will highly depend on the performance of its core businesses, especially the continuous growth of businesses such as gaming, advertising, and fintech. Tencent has already laid a solid foundation for future growth with its powerful gaming business and the steady growth of advertising revenue. With the continuous development of platforms such as WeChat Channels and Mini Programs, Tencent will continue to enhance its market share in the advertising and e-commerce fields, which will form long-term support for the share price.

With the continuous expansion of core businesses, Tencent can maintain its market leadership position on a global scale and promote the long-term rise of the share price.

Overall, the future trend of Tencent’s share price will depend on the steady growth of its core businesses and the company’s continuous innovation and strategic investment in emerging industries. As Tencent continues to consolidate its market position in various business fields, the share price is expected to maintain a steady growth. However, fluctuations in the market environment and changes in the macroeconomy may have a certain impact on the short-term share price. Therefore, investors should pay attention to how Tencent adjusts its strategies in the complex economic environment to maintain its long-term competitivene