- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Heavy bets on AI! Azure AI leads growth, will Microsoft's stock price rebound strongly?

With the increasing global demand for artificial intelligence and Cloud Services, Microsoft (NASDAQ: MSFT) is rapidly driving growth with Azure AI and intelligent cloud business. Through the expansion of global Data centers and continuous technological innovation, Microsoft has consolidated its leadership position in the AI field and met the needs of enterprise digital transformation.

Although the huge capital expenditure brings short-term pressure, the solid financial foundation and forward-looking investment have laid the foundation for the company’s long-term growth. For investors, Microsoft’s stock presents new entry opportunities after a brief adjustment, and is expected to usher in a strong rebound, bringing rich investment return potential for the future.

Azure AI continues to expand, driving growth

With the rapid growth of global demand for artificial intelligence solutions, Microsoft’s Azure AI is demonstrating its increasing technological advantages and wide range of applications in the market, driving significant growth in the intelligent cloud sector.

Satya Nadella, Chairperson and CEO of Microsoft, pointed out that it is expected that by the second quarter of 2025, the annual revenue of Microsoft’s artificial intelligence business will exceed $10 billion. This growth is partly due to the tripling of customer usage of Azure OpenAI services, especially as enterprises move applications from the testing phase to production environments, Microsoft’s market expansion plan has been substantially promoted.

Microsoft has data centers in over 60 regions worldwide, and recently expanded to emerging markets such as Brazil, Italy, Mexico, and Sweden. These strategic deployments not only strengthen Microsoft’s global service capabilities, but also significantly improve User Experience by reducing data transmission latency.

In addition, Azure AI pays special attention to providing end-to-end solutions, which is particularly valuable for enterprises seeking seamless integration of AI functions to drive business innovation. Microsoft has promoted the widespread application of services by integrating more industry-specific models to help customers meet their artificial intelligence development needs. According to reports, Microsoft Fabric currently has over 16,000 paying customers and has successfully attracted over 70% of Fortune 500 companies, highlighting its market influence and brand trust.

Azure AI not only strengthens Microsoft’s position in existing markets, but also lays a solid foundation for further exploring future technological potential and emerging market opportunities. As more enterprises and organizations rely on AI-driven digital transformation, Microsoft’s Azure AI is expected to continue to lead the market, providing innovative solutions to meet complex and changing global demands.

Investing heavily in the future of AI: Microsoft’s approach to capital investment and innovation

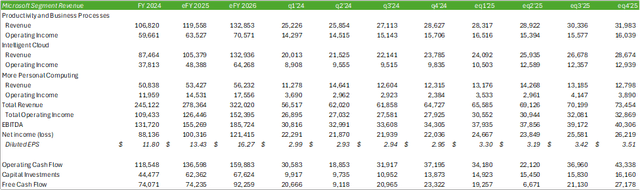

Microsoft’s determination to maintain its leading position in the global Cloud Services and artificial intelligence markets is reflected in its huge capital investment. In Quarter 1 of 2025, the company announced a significant increase in capital investment in the second quarter, with a particular focus on AI servers, CPUs, and GPU resources. These investments respond to the demand for existing and future technological advancements.

Although Microsoft has invested $49 billion in the past 12 months, due to ongoing capacity constraints, the company expects to invest an additional $10 billion in renting CoreWeave’s server facilities between 2023 and 2030. With support from Nvidia, CoreWeave leases GPUs through its 14 data centers, expanding Microsoft’s competitiveness in the cloud infrastructure field.

According to the 2025 Quarter 1 financial report, Microsoft’s capital expenditure plan includes $14.90 billion for financing leases for data center construction, with overall capital expenditures reaching $20 billion. This heavyweight investment aims to enhance the processing and storage capabilities of global data centers, especially to meet the growing demand for AI and Machine Learning applications. About 50% of Microsoft’s cloud and AI-related investments are used for long-term assets with a monetization period of more than 15 years, and the remaining funds are allocated to CPUs and GPUs to meet customers’ demand for computing resources.

Despite an 11% year-over-year increase in operating cash flow in Quarter 1 2025, free cash flow decreased by 6% due to a 50% increase in capital investment. Looking ahead to the second quarter of 2025, Microsoft expects to continue to increase investment to support the growth demand of cloud and AI, expected to generate $22 billion in operating cash flow, while planning to invest over $15 billion in capital, resulting in $6.66 billion in free cash flow.

In addition to capital investment, Microsoft is also constantly breaking through in technological innovation. Microsoft has become the world’s first Cloud as a Service provider to deploy NVIDIA’s latest Grace Blackwell GB200 GPU. This high-performance AI processor is designed for complex Machine Learning and Deep Learning tasks, greatly improving data processing speed and efficiency.

In addition, Microsoft has introduced multiple new features in its Azure AI platform, including automated AI power builder and customized AI solutions, simplifying the development and deployment process of AI applications for enterprise customers. These innovations not only demonstrate Microsoft’s forward-looking investment in hardware, but also reflect its continued promotion of software and service innovation, further consolidating its dominant position in the Cloud as a Service market.

Operational Efficiency and Strategic Expansion: How Can Microsoft Further Enhance Its Competitiveness?

While pursuing technological innovation and market expansion, Microsoft’s commitment to Operational Efficiency and sustainable development is equally important. The company has taken multiple energy efficiency and environmental responsibility measures in global Data center operations, which not only reduce operating costs but also enhance the company’s social responsibility image. Microsoft has widely implemented Renewable Energy strategies such as wind and solar energy in its Data centers, and plans to achieve 100% Renewable Energy power supply by 2030.

In addition, Microsoft has signed an agreement with Constellation Energy to restart the remaining reactors at the Three Mile Island nuclear power plant, and is partnering with Helion Energy to provide nuclear fusion power generation by 2020. The company is also forming a small team to develop a Small Modularization Reactor (SMR) technology integration plan to provide more efficient and environmentally friendly power supply. These measures not only help Microsoft cope with the high power demand brought by the growing data center space, but also demonstrate its positive attitude towards promoting energy transformation.

Through these strategic capital investments and emphasis on Operational Efficiency and sustainable development, Microsoft has not only increased the market appeal of its products, but also significantly enhanced the overall value of its services, bringing sustained revenue growth and profitability to the company. At the same time, these efforts have also strengthened Microsoft’s social responsibility image among global tech giants, winning further trust and support from customers and investors.

Financial outlook and investment return: Is the stock price about to experience a strong rebound?

According to the latest financial report, the company’s total revenue reached $69 billion, a year-on-year increase of 12%. The revenue growth of the intelligent cloud department was particularly significant, reaching 20.5%. The growth of this department is mainly due to the strong demand for Azure AI and Cloud as a Service, reflecting the urgent need for efficient cloud solutions among global enterprises.

Furthermore, Microsoft’s capital investment in AI and cloud infrastructure has significantly increased. It is expected that the company’s capital expenditure will exceed $15 billion in the second quarter of 2025. This strategic investment is mainly used to expand the computing power of its global data centers to meet the growing demand for data processing. Although these investments have led to a 6% decrease in free cash flow in the short term, in the long run, these forward-looking investments will greatly enhance the company’s market competitiveness and financial performance.

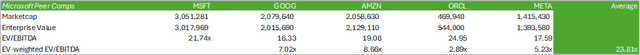

From a valuation perspective, Microsoft’s current valuation is lower than the average level of other large-scale enterprises, which means that Microsoft’s stock has a certain price advantage compared to its peers. For investors, the relative undervaluation of Microsoft’s stock provides a good opportunity to rebalance or increase holdings, especially when the company’s future growth expectations are good.

In addition, after the release of the Quarter 1 financial report in 2025, Microsoft’s stock experienced a round of selling, which provided potential for future stock price rebound. According to the analysis of the stock price trend chart, Microsoft’s stock price may continue to fall to the support level of about $401/share, and then it is expected to re-enter the upward channel and usher in a new round of growth.

If you are optimistic about the future development of Microsoft and considering investing in its stocks, you can operate through the BiyaPay platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience. With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

Investor threat and risk assessment: challenges and tests ahead for Microsoft

It is crucial for investors to understand the key risks faced by Microsoft, which may directly affect the company’s financial performance and stock price trends. As a leader in the technology industry, Microsoft must continue to innovate to remain competitive, especially in key technology areas such as artificial intelligence and Cloud Services. If Microsoft’s technological innovation in these areas lags behind Amazon’s AWS or Google Cloud, its market share and profitability may be affected.

In addition, Microsoft’s global operations have brought challenges in compliance and data privacy. Microsoft’s extensive presence in the global market means that the company must strictly comply with regulatory requirements in various countries, especially laws and regulations related to data privacy and internet security. Any compliance errors may result in huge fines or legal proceedings, which in turn affect the company’s reputation and market performance.

Competitive pressure is another major concern for Microsoft. The competition in the technology industry is becoming increasingly fierce, with emerging technology companies and innovative technologies constantly emerging, which may impact Microsoft’s existing market position. To address these challenges, Microsoft continuously optimizes its products and services, while increasing research and development investment to ensure technological and market leadership.

Investors should closely monitor how Microsoft adjusts its business strategy under fierce competition and regulatory pressure to ensure sustained growth. These factors are crucial for evaluating Microsoft’s long-term investment value.

Overall, Microsoft has firmly stood at the forefront of artificial intelligence and cloud services with its outstanding performance in Azure AI and intelligent cloud business. The company’s global capital investment, data center expansion, and continuous innovation in technology all indicate that it is determined to succeed in future technology. Although huge capital expenditures and market competition may bring some pressure in the short term, Microsoft’s forward-looking investment and stable financial situation have laid a solid foundation for its long-term development. The stock price adjustment after the release of Quarter 1 financial report actually gave investors a good opportunity to enter the market. Microsoft’s current valuation is low and its growth prospects are clear. This adjustment makes it more attractive to increase holdings or reposition. With the increasing demand for Cloud Services and AI, Microsoft is expected to usher in a new growth period, bringing long-term returns to investors.