- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Intel and TSMC Deepen Partnership Amid High-End Chip Demand Surge: Should Investors Continue to Buy?

With the rapid advancement of artificial intelligence (AI) technology, global demand for high-end chips has surged. From autonomous driving and cloud computing to smart devices, nearly every frontier of technology relies on high-performance chip support. TSMC, the world’s largest semiconductor foundry, has become indispensable in the AI supply chain by virtually dominating the high-end AI chip manufacturing sector.

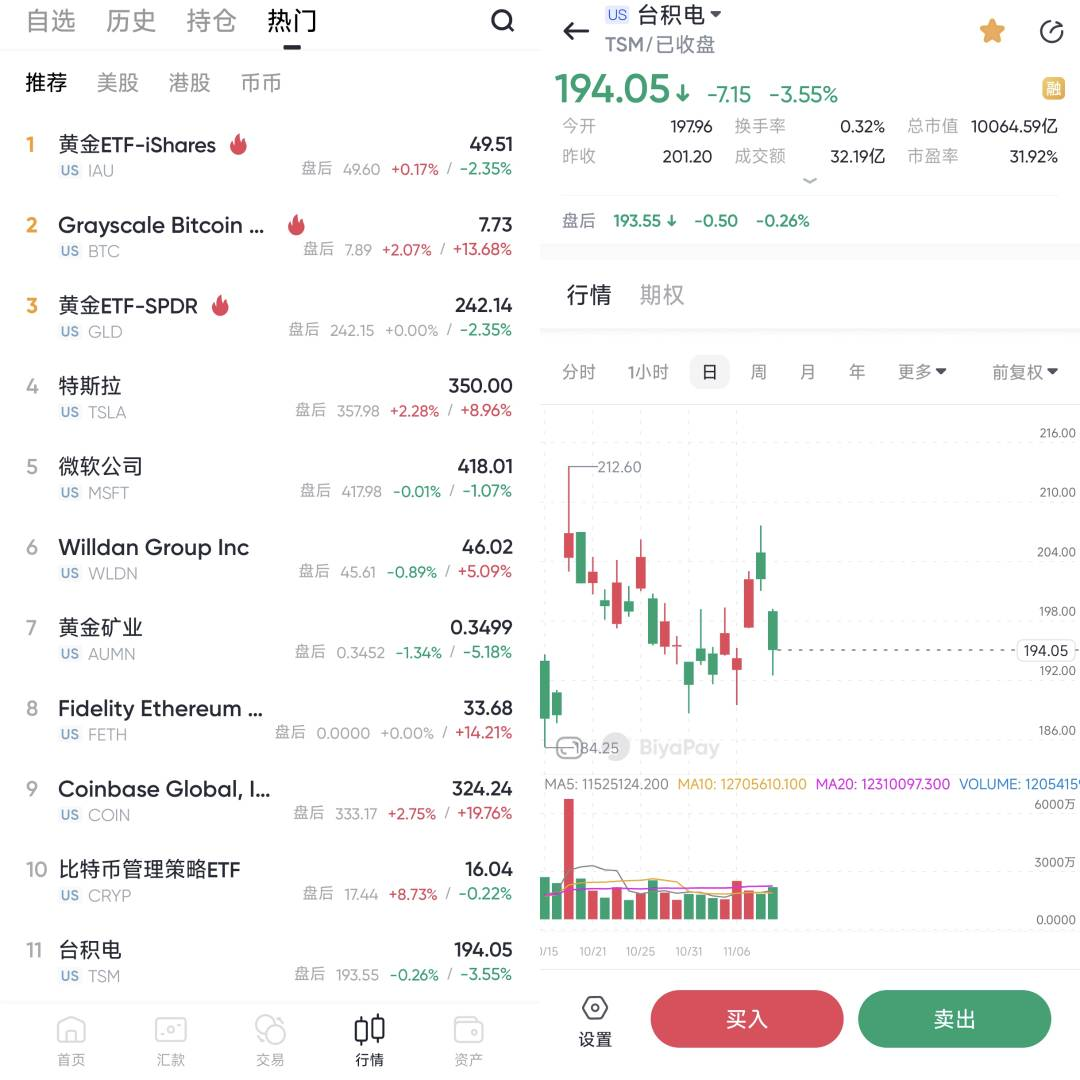

Since the start of 2024, TSMC’s stock price has risen over 90%, pushing its market cap to $1.04 trillion, making it Asia’s first trillion-dollar tech company.

In this context, TSMC not only needs to meet current demand but also faces competitive pressure from Intel, Samsung, and others. The U.S. CHIPS Act has further complicated the global semiconductor landscape, pushing TSMC to expand its global footprint, strengthen capacity planning, and seek deeper international partnerships. Despite these challenges, TSMC has continued to deliver robust market performance.

Revenue Growth Deceleration: Can TSMC Maintain Its Momentum?

According to the company’s data, TSMC’s consolidated revenue in October reached NT$314.24 billion, up 29.2% year-over-year and 24.8% month-over-month, marking another record high for monthly revenue and reflecting strong global demand. However, compared to the 39.6% year-over-year growth rate in September, October’s slower growth has raised questions about the sustainability of AI chip demand.

Overall, TSMC’s cumulative revenue from January to October 2024 has reached NT$2.34 trillion, a 31.5% increase year-over-year. This steady growth has solidified TSMC’s significant competitive edge amidst the global chip demand surge. Although TSMC has not disclosed specific growth sources, the market widely attributes the rise to increased orders from Apple and the booming demand for AI chips.

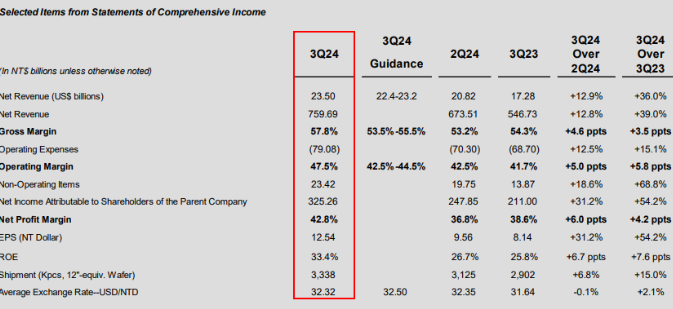

Additionally, TSMC’s third-quarter financial report impressed. The company posted revenue of NT$759.69 billion, up 39% year-over-year, with net profit reaching NT$325.26 billion, a 54.2% increase, and a gross margin as high as 57.8%. TSMC projects fourth-quarter revenue between $26.1 billion and $26.9 billion, with a gross margin ranging from 57% to 59% and an operating profit margin between 46.5% and 48.5%. This strong performance has significantly bolstered confidence in TSMC’s ability to sustain growth amid the AI demand wave.

Nevertheless, the October slowdown has drawn some investor attention.

TSMC’s latest sales data may indicate a slight deceleration in AI chip demand, signaling that AI demand may not be endless, though the slowdown remains modest.

Bloomberg analyst Charles Shum notes:

Despite ASML reporting that its third-quarter orders were only half of expectations, indicating a potential slowdown in global chip manufacturing capacity growth, TSMC’s short- to mid-term revenue outlook remains solid.

Strong demand for TSMC’s 2nm and 3nm technologies from Nvidia, AMD, Apple, and Qualcomm offsets any shortfall. TSMC’s high yield rates, increasing EUV production efficiency, and leadership in 2.5D and 3D packaging add further support for sales.

Overall, TSMC continues to leverage its dominance in high-end AI chips and efficient capacity management, but future growth prospects remain cautiously optimistic.

Intel and TSMC’s Enhanced Partnership

Amid fierce competition from AMD and NVIDIA, Intel is strengthening its market position through a partnership with TSMC. According to ITBEAR, Intel has reached an agreement with TSMC to expand collaboration, planning to use TSMC’s 3nm process to produce key future chips—Lunar Lake and Arrow Lake—by 2025. Through this partnership, Intel aims to improve chip performance and maintain a leading position in the AI PC sector.

The Arrow Lake chip, in particular, is viewed as Intel’s “secret weapon” in the AI PC market, aimed at delivering high performance while significantly reducing power consumption. This design meets the current market’s demand for efficient, low-power chips, enabling Intel to secure a place in the growing AI-driven tech sector.

Although Intel’s third-quarter financial report showed a loss of $16.6 billion, the company is still heavily investing in its foundry business. Intel even dropped its original 20A process plans for Arrow Lake, opting instead for TSMC’s foundry support. This move demonstrates Intel’s flexibility and pragmatic approach to process selection.

By utilizing TSMC’s 3nm process, Intel’s chip configurations are set to achieve substantial optimization. For instance, the new 3nm chips will significantly reduce core area compared to the 13th and 14th generation Core chips and will integrate NPU (Neural Processing Unit), enhancing chip performance and diverse functionality.

Intel CEO Pat Gelsinger stated that Intel is both a customer and competitor to TSMC, working together on industry standards. Gelsinger emphasized the importance of Intel providing TSMC with advanced equipment like IMS Nanofabrication’s multi-electron beam lithography tools, which are crucial in the EUV era.

This collaboration reinforces TSMC’s position in advanced processing technologies, while Intel’s flexible foundry cooperation strategy helps it navigate a complex market landscape. This “win-win” arrangement allows Intel greater adaptability in the competition, while TSMC cements its leading position in high-end manufacturing.

For those looking to enter early, using the multi-asset wallet BiyaPay to invest in this stock is recommended. Current prices indicate there’s still an opportunity for investors to enter at a lower cost. BiyaPay supports both U.S. and Hong Kong stock and digital currency trading, allowing users to check price trends regularly and execute deposits and withdrawals quickly at crucial moments.

If you encounter issues with fund transfers, BiyaPay offers an efficient, secure solution that avoids account freezes. Whether converting digital currencies to USD or HKD or withdrawing to a bank account, BiyaPay flexibly meets funding needs, ensuring investors never miss a market opportunity.

U.S. Policy Support: The CHIPS Act

TSMC’s Arizona plant is seen as a cornerstone of its “U.S. expansion plan.”

Recent data shows that the Arizona plant’s chip yield rate leads similar facilities in Taiwan by about 4 percentage points. This indicates the plant not only has stable production capabilities but also excels in quality and efficiency, further reinforcing TSMC’s competitiveness in the global market.

The Biden administration’s CHIPS Act aims to enhance U.S. semiconductor manufacturing capacity through financial support, and TSMC’s Arizona plant is one of its beneficiaries.

Currently, the Biden administration is accelerating the CHIPS Act’s fund distribution process. TSMC stands to receive approximately $6.6 billion in subsidies and $5 billion in loan support. This funding will significantly ease TSMC’s capital expenditure burden, facilitating the smooth progress of its U.S. plant project.

However, TSMC’s U.S. expansion plan also faces policy uncertainties, especially with potential changes if Trump is re-elected.

Trump has previously criticized the CHIPS Act, arguing that it has limited impact on promoting U.S.-based manufacturing. He also suggested tariffs to encourage the semiconductor industry’s reshoring. If Trump wins, TSMC’s subsidies could face reductions or delays. Analysts expect the Biden administration to finalize subsidy agreements with TSMC and others before its term ends to mitigate policy risks.

For TSMC, continued U.S. policy support will be a crucial element of its global expansion strategy. These policies could not only bolster TSMC’s capital backing but also open more doors in the U.S. market.

Market Valuation and Investment Appeal

Driven by AI and high-end chip demand, TSMC has exhibited strong market performance, consolidating its position in the global semiconductor industry. Its third-quarter 2024 financial report showed NT$759.69 billion (approximately $23.5 billion) in revenue, a 39% increase year-over-year, with a gross margin of 57.8%, significantly surpassing market expectations. This growth mainly stems from the 3nm process’s maturity and scaling.

TSMC’s P/E ratio (TTM) stands at approximately 31.05, with a P/B ratio of 8.18, and a total market cap of around $1.01 trillion.

Future Think Tank’s report suggests TSMC’s reasonable market cap for 2024 should be $782.2 billion, indicating potential upside.

Analysts project TSMC ADR’s 2024 target price at $240, with an optimistic target of $295, reflecting market confidence in its long-term growth potential.

Moreover, TSMC’s forward P/E ratio is 28.35, slightly above the industry median, but its relatively low PEG ratio indicates a balanced growth-valuation alignment. TSMC’s earnings growth matches its valuation, making it appealing.

TSMC’s dominance in the global semiconductor market and technological edge provide a solid foundation amid the AI-driven growth wave. With leading processing technology and capacity planning, TSMC meets the demand for high-end chips and strengthens its core industry position through partnerships like that with Intel.

Despite fierce market competition and policy uncertainties, TSMC’s U.S. expansion plan and strong financial performance add a new growth driver. Its financial metrics, valuation, and analyst forecasts suggest TSMC has significant growth potential. Persistent AI and high-performance computing demand, alongside the mass production of 3nm technology, are expected to further boost the company’s performance.

For investors, TSMC’s unique role in the semiconductor supply chain, robust financial health, and long-term technological advantage make it an ideal investment candidate in the AI-driven landscape.