- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Fivefold increase in free cash flow! Micron's target price in 2025 is expected to rise by 30%. Is it

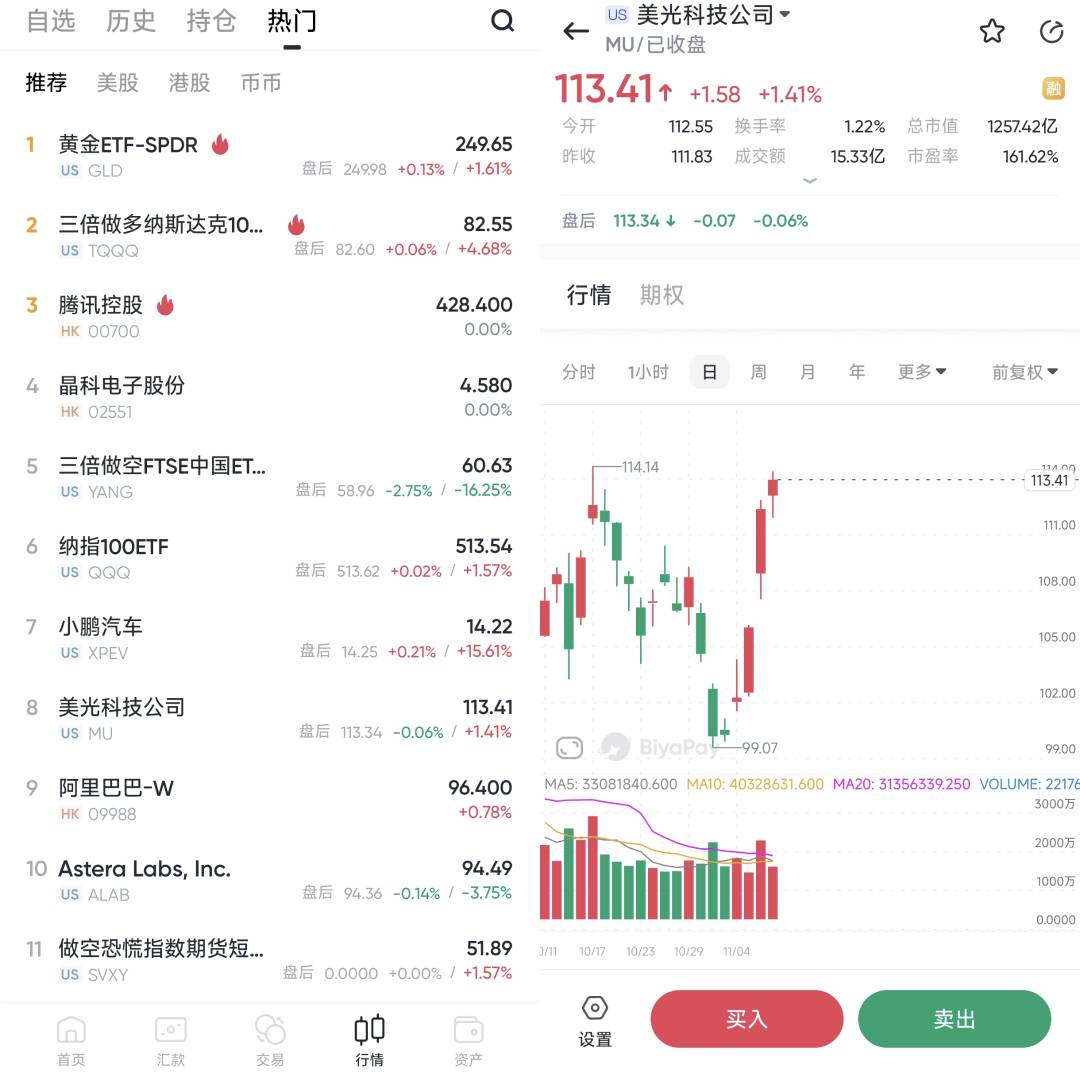

Driven by the AI and data center markets, Micron Technology (MU) is embracing a new wave of growth opportunities. With the recent rapid development of cloud data centers, the prices of Micron’s NAND and DRAM products have finally reversed the years-long downward trend. In the company’s optimistic guidance for the first quarter of 2025 released recently, the expected revenue and non-GAAP profit will exceed the initial expectations, further enhancing the market’s confidence in its future performance.

With the rise in memory prices, especially the continuous growth in demand for AI-related solutions, Micron is expected to achieve strong sales and profit growth in 2025.

It is worth mentioning that since hitting a historical high in June this year, Micron’s stock price has corrected by more than 30%. The current valuation level is relatively healthy. The company is also taking this opportunity to accelerate its transformation and focus on high-profit products such as DDR5, LP5, and HBM to ensure its competitiveness in the fields of AI and data centers.

On this basis, Micron’s progress in HBM technology is particularly worthy of attention. Its product power consumption is 20% lower than that of competitors and it plans to achieve mass production in 2025.

According to the latest financial report, Micron’s free cash flow has returned to positive and shows double-digit revenue growth, marking a recovery in profitability. Although facing risks of rising inventory and policy adjustments, compared with its peers, Micron’s valuation is still attractive. Does this mean it is now an opportunity worthy of buying a long position for “bottom-fishing”?

Shifting to high-profit products: Market opportunities driven by AI

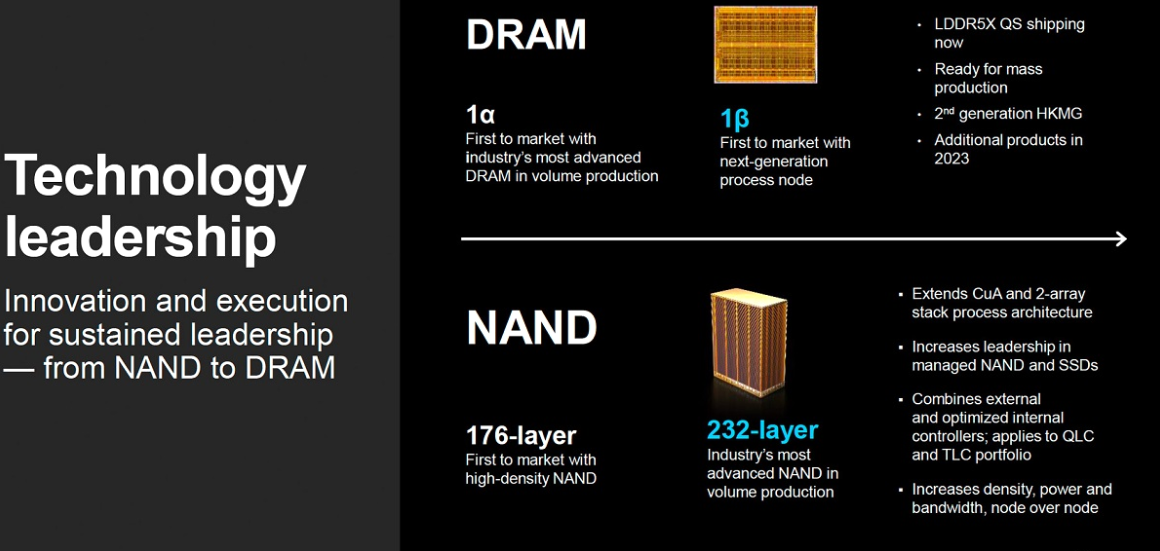

In view of the surge in demand for AI and high-performance computing, Micron Technology is fully shifting its production focus to high-profit products such as DDR5, LP5, and high-bandwidth memory (HBM). Management pointed out in the recent earnings conference call that the company is currently upgrading some old production lines to the latest 1-beta technology node.

Speaking of 1-beta, it is a cutting-edge technology for manufacturing high-speed DRAM and is mainly used in storage chips for devices such as computers, servers, and smartphones. The total system bandwidth of the 1-beta node exceeds 1.5 TB/s, and the data rate is as high as 32 Gb/s, which means it is faster and has higher performance.

At the same time, DDR4 and LP4 products are gradually becoming “supporting roles” in the company’s product portfolio, mainly targeting low-profit and slow-growing markets. Micron has not disclosed the specific revenue of these traditional products, but management said in the conference call that the proportion of DDR4 shipments in total DRAM shipments has been declining and is expected to continue to decrease next year as the company accelerates its transition to DDR5 and LP5, especially in data center applications.

As Micron’s chief commercial officer Sumit Sadana said:

“Last year, the percentage of DDR4 shipments as a percentage of our overall DRAM bit shipments continued to decline. Looking ahead to next year, we will decline again because over time our product portfolio is increasingly shifting to DDR5. It’s shifting to LP5, and we’re now shipping to data centers.”

High-bandwidth memory (HBM)

In my opinion, high-bandwidth memory has significant growth potential due to its wide application in AI and data centers. Micron is accelerating the production of HBM3E and plans to launch a more advanced HBM4 customized for AI and data center applications.

Micron is moving towards more complex memory stacks, such as 12-layer stacks. Compared with competitors’ 8-layer stacks, the power consumption is reduced by 20%. According to the recent earnings conference call, Micron has begun to provide customers with 12-layer HBM samples that meet production standards and is expected to achieve mass production at the beginning of fiscal year 2025.

Micron’s new HBM product has a 20% reduction in power consumption, and the International Energy Agency (IEA) predicts that the power consumption of data centers, AI, and cryptocurrencies will double by 2026. The company is fully prepared for future growth.

Free cash flow and growth potential

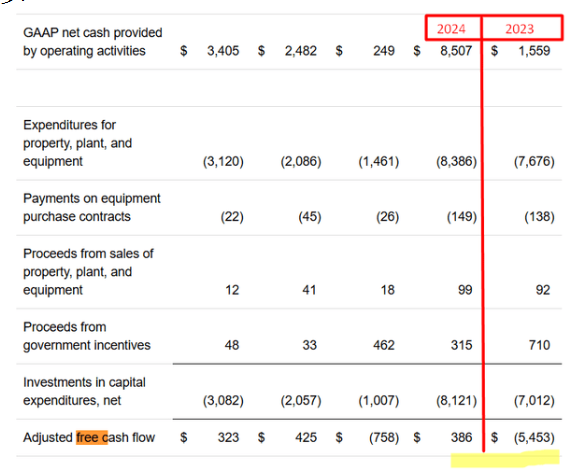

Micron Technology (MU)'s financial situation has improved significantly in recent quarters, especially in terms of cash flow. According to Micron’s fiscal fourth quarter 2024 financial report data: “Micron achieved $8.851 billion in operating cash flow in fiscal year 2024, an increase of about five and a half times compared to $1.559 billion in fiscal year 2023.”

This is a very significant improvement, indicating that the company’s layout in high-profit product lines has initially yielded results.

In particular, the improvement in free cash flow is of concern. Although the company’s capital expenditure in fiscal year 2024 is as high as $8.4 billion, in the fourth quarter, Micron still achieved $323 million in free cash flow, and reached $386 million for the whole year. This is in sharp contrast to fiscal year 2023, when the cash flow was still in a large deficit state during the same period last year.

Through its relatively high free cash flow, Micron not only provides strong financial support for future market expansion but also proves the effectiveness of the company’s successful adjustment of its product portfolio in high-demand markets.

At the same time, Micron’s asset-liability situation also shows financial stability. Although the company’s current net debt level is relatively high, reaching $13.4 billion as of the end of the previous quarter, the company also holds more than $8.1 billion in cash and investments. Micron has relatively sufficient liquidity, and debt pressure has been alleviated to a certain extent. As the financial report says: “The higher cash reserve and solid liquidity give the company greater financial flexibility in future expansion plans.”

Micron’s management plans to further increase capital expenditure in 2025 and expand factories in Idaho and New York to expand the production of high-profit products. This measure is considered a key to supporting the company’s long-term growth.

The current growth of the memory and storage markets further provides support for Micron’s financial stability. According to TrendForce’s forecast, Micron is expected to occupy 25% of the HBM market by 2025, and the average annual growth rate of this market is expected to reach 26.1%. The layout in such high-margin markets not only increases the stability of the company’s revenue sources but also provides support for future market expansion.

Looking at Micron’s capital allocation strategy again, the company uses part of its profits to repay debts while also maintaining sufficient funds to support innovative research and development.

In the past fiscal year, the company successfully promoted the progress of memory technology by significantly increasing research and development expenditures. The launch of new products such as 1-beta technology, 12-layer HBM stack, and DDR5 is the direct result of this capital allocation strategy, further strengthening the company’s competitive position in the fields of AI and data centers.

For investors, Micron’s financial and cash flow situation makes it highly resilient in the semiconductor market. Does this mean that Micron can more calmly cope with future market fluctuations?

Valuation analysis: Investment opportunity at a discount

In the current market environment, the valuation of Micron Technology (MU) shows certain attractiveness. Especially when the future growth prospects are optimistic, this “discount” in valuation is particularly attractive to investors.

First of all, it is worth noting the company’s optimistic expectations for the first quarter of 2025 - Micron expects revenue in this quarter to be between $8.35 billion and $8.9 billion, and non-GAAP earnings per share will reach $1.74. This expectation exceeds the initial market estimate, and the growth in demand mainly comes from AI servers, data centers, and the promotion of DDR5 products.

Micron further stated that its high-bandwidth memory (HBM) devices have been sold out for shipments in 2024 and 2025, and this part of the revenue has been locked in for the next two years. This shows that Micron’s forward-looking product strategy has been recognized by the market, especially in the high-demand markets in the fields of AI and data centers.

Valuation compared with the industry

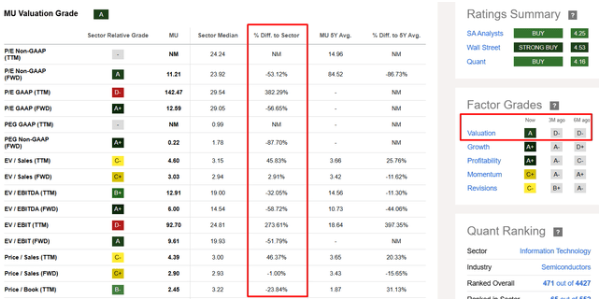

In view of these strong market signals, let’s look at Micron’s valuation level - according to analysis, Micron’s stock price is at a relatively low level compared to similar companies in the industry.

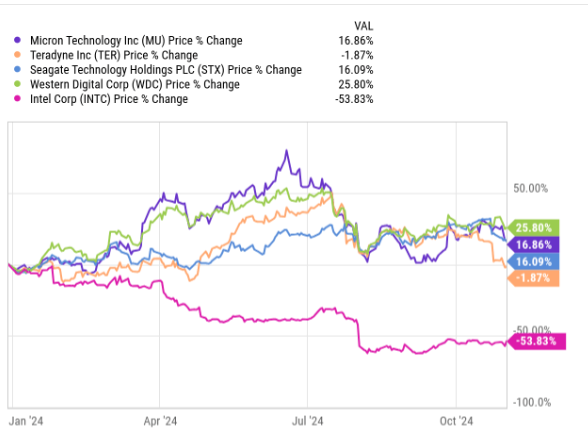

Although Micron’s stock price has increased by 16.86% so far this year, in terms of valuation indicators such as forward price-earnings ratio, it trades at an average price about 24% lower than its major competitors. This valuation discount may partly reflect market concerns about the cyclical fluctuations of the memory industry. However, Micron has alleviated the cyclical impact to a certain extent through the optimization of its product portfolio and the transformation to high-profit products.

According to Argus Research’s analysis, Micron’s “peer indicated value” is about $130. This value means that Micron’s current stock price has a potential upside of 30%. For long-term investors, this is undoubtedly an attractive buying opportunity. If this upside potential can be realized, then Micron’s price-earnings ratio will increase from the current level to about 14.5 times.

It is worth noting that this price-earnings ratio is still at a reasonable level in the industry and is not considered high, so it has a relatively high feasibility.

In terms of other valuation indicators such as P/B and P/CF, Micron’s performance also remains within a reasonable range and is close to historical lows. This valuation attractiveness is partly attributed to market concerns about the cyclicality of the memory and storage industries. However, Micron has offset these cyclical fluctuations through the transformation to high-profit products (such as DDR5 and HBM).

According to Seeking Alpha’s quantitative rating system, Micron’s valuation rating has been upgraded from “D” three months ago to the current “A”. Micron’s current valuation discount based on future earnings levels is around 20%-30%.

For friends who want to enter the market early, it is recommended to use the multi-asset wallet BiyaPay to buy this target as soon as possible. The current discount indicates that investors still have the opportunity to enter at a low price, and Argus Research’s target price of $130 is also in line with this analysis. BiyaPay also supports US and Hong Kong stocks and digital currency transactions, which is convenient for users to regularly check price trends and quickly complete deposit and withdrawal operations at critical moments.

If you encounter problems in terms of capital inflow and outflow, BiyaPay provides an efficient, safe, and non-freezing card solution. Whether it is recharging digital currency and exchanging it for US dollars or Hong Kong dollars, or withdrawing to a bank account, it can quickly and flexibly meet capital needs and ensure that investors do not miss any market opportunities.

Investment considerations

Why is this valuation discount so important for Micron? Because Micron has considerable earnings growth potential in the next few years.

The company expects to occupy 25% of the HBM market by 2025, and the average annual growth rate of the HBM market is expected to be 26.1%. In other words, Micron’s layout of high-growth high-bandwidth memory products in the memory market will help stabilize revenue growth and provide solid support for its long-term performance.

At the same time, Micron’s capital expenditure in fiscal year 2025 will further expand, especially in the expansion of factories in Idaho and New York to meet the market demand for high-profit products. Although this high capital expenditure will put pressure on short-term earnings, it is undoubtedly a necessary investment for future revenue growth.

For investors who focus on long-term growth and reasonable valuations, Micron’s current discount is undoubtedly an opportunity worthy of attention. You may ask: Is a 30% increase in Micron’s stock price really possible? Judging from Micron’s current financial health and market layout, this goal is not out of reach. Especially in the context of strong and continuous AI demand and rapid expansion of data center construction, Micron’s product and technology advantages will drive its revenue growth and support this upward valuation space.

In short, in the context of Micron’s valuation, perhaps now is a good time to start at a low level and layout for long-term returns.

Risk factors

Although the market outlook is optimistic, the competition in the memory market for Micron is still fierce. Although Micron’s product lineup has a relatively high penetration rate in the automotive and industrial markets, the demand in these industries is highly volatile and may affect the stability of the company’s revenue. Focusing on higher-profit applications (such as artificial intelligence and data center solutions) can bring growth opportunities, but if competitors achieve technological breakthroughs in these fields, Micron’s market share will face pressure.

In addition, the price volatility of the memory chip market is relatively large, especially the prices of DRAM and NAND flash memory are significantly affected by supply and demand and technological progress. Price instability may lead to increased fluctuations in Micron’s revenue and profits. In addition, competitors in the semiconductor field are constantly launching new products, and fierce competition in the market may lead to a reduction in Micron’s market share.

Another risk factor lies in the influence of external economic and geopolitical situations. If the demand in markets such as consumer electronics, data centers, and automobiles decreases due to economic slowdown, it will directly affect the demand for Micron’s products. Geopolitical factors (such as trade wars or technology export restrictions) may limit Micron’s sales channels in specific markets and affect the stability of the company’s global supply chain, making it difficult for it to effectively enter certain regional markets.

In general, although Micron has high growth potential in the memory and data storage markets, these risk factors still require investors to pay attention to in order to more comprehensively evaluate the sustainability of its future growth.

Considering Micron Technology’s growth prospects, financial performance, and valuation status, its layout in high-profit fields such as artificial intelligence and data centers provides strong support for future performance growth. The current valuation is at a discount compared to peers. If the stock price rises by 30%, the price-earnings ratio will only be about 14.5 times, which is still within a reasonable range.

However, investors also need to pay attention to the risks brought by high inventory, price fluctuations, and policy uncertainties. In general, if investors are optimistic about future growth and have a certain risk tolerance, the current stock price may be a good entry opportunity. For investors with lower risk preferences, they can consider waiting for market uncertainties to weaken before entering.