- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Microsoft under the AI wave: Can Azure and Copilot help the next growth peak?

Microsoft had a strong performance at the beginning of the 2025 fiscal year. The steady growth of Azure and the widespread adoption of Copilot demonstrated the company’s strong strength in the AI and Cloud Services fields. Despite the high investment in AI bringing profit pressure, these investments also drove the increase in market share. Faced with fierce market competition and global economic uncertainty, Microsoft continues to consolidate its leadership position in the technology industry through innovative technology and stable financial performance.

From Microsoft’s financial performance, growth drivers to latent risks, we take a comprehensive look at the tech giant’s opportunities and challenges ahead and what it means for investors.

Financial overview

In fiscal year 2025 Quarter 1, Microsoft demonstrated its financial strength and business growth vitality. The company reported revenue of $6.559 billion, a year-on-year increase of 16%, which not only exceeded analysts’ expectations of $103 million, but also demonstrated the strength and Sustainability of its business model. Earnings per share (EPS) increased by 10.4% year-on-year to $3.30, exceeding market expectations by $0.20.

In terms of operating profit margin, although it decreased by 1% year-on-year, the adjusted operating profit margin actually increased to 47%. This change is mainly due to the net effect of the Activision acquisition. Excluding this transaction, the adjusted profit margin indicates that Microsoft can effectively promote efficiency and profit growth while expanding AI-driven capital expenditures.

For the second quarter, Microsoft expects revenue to be between $6.81 billion and $6.91 billion, slightly lower than analysts’ previous forecast of $6.99 billion. This expectation reflects the company’s confidence in its business growth despite supply chain challenges. Azure’s revenue is expected to grow by 31% to 32% on a constant currency basis, demonstrating strong momentum in its cloud business. In addition, costs and operating expenses (COGS) for the second quarter are expected to be between $2.19 billion and $2.21 billion, with operating expenses expected to be $1.64 billion to $1.65 billion and other income and expenses expected to be about negative $1.50 billion. The company expects the effective tax rate to remain around 19%.

Azure Rises, AI Drives Accelerated Growth

In the past few quarters, Microsoft’s Azure has experienced a relatively slow growth period, but by the 2025 fiscal year Quarter 1, this trend has been significantly reversed. Azure’s revenue achieved an annual growth of 34% on a constant currency basis, which not only far exceeded the company’s own expectations, but also significantly exceeded market analysts’ predictions. In addition, artificial intelligence (AI) played an important role in driving this growth, and the direct contribution of AI technology to Azure’s growth increased from 8% in the previous quarter to 12%. This significant increase indicates that AI’s key role in improving the efficiency and functionality of Cloud as a Service is increasingly prominent.

More importantly, the integration of AI is not only limited to increasing Azure’s revenue, but also greatly optimizing User Experience and enterprise Operational Efficiency. The application case of Microsoft Copilot is a typical example. This Azure-based AI tool has been widely used in enterprise daily operations, helping enterprise customers improve productivity through automated functions and intelligent decision support. In addition, the promotion of Microsoft 365 Copilot has also led to an increase in the usage of the platform, with daily usage doubling within a quarter, highlighting the penetration of AI in work and collaboration tools.

Despite Azure’s strong performance in Quarter 1, the outlook for the second quarter is relatively conservative, with growth expected to fall back to the early 30%. This conservative forecast is mainly due to supply chain issues, especially the delay in the supply of key components needed in the AI field. Chief Financial Officer Amy Hood clearly pointed out in the earnings call that this slowdown is expected to be short-lived. With the gradual resolution of supply chain issues, growth is expected to accelerate again in the second half of the year.

The management also announced that the entire company’s AI business is expected to exceed an annual revenue run rate of $10 billion in the next quarter, becoming the fastest growing business unit in the company’s history. From increasing market share to significant growth in the number of Copilot enterprise customers, to the widespread adoption of Microsoft 365 Copilot, these are clear signals that AI investment is beginning to bring significant returns to Microsoft.

The recovery of Azure and the deep integration of AI technology not only demonstrate Microsoft’s strength in technological innovation, but also lay a solid foundation for the company’s future growth in the Cloud Service market. With the continuous advancement of AI technology and the continuous expansion of market applications, it is expected that Microsoft will continue to maintain its leadership position in the fierce competition of Cloud Services, while providing sustained growth momentum for investors.

Copilot’s Market Breakthrough: Enterprise Acceptance and Strategic Impact

Microsoft Copilot has become the core driver of enterprise digital transformation. As a cutting-edge product of the company’s artificial intelligence strategy, Copilot has been integrated into the Microsoft 365 suite, greatly improving the productivity and decision-making quality of enterprise users. Whether it is document writing or data analysis, the extensive application of Copilot demonstrates how artificial intelligence can actually affect and optimize daily business processes.

Since its launch, Copilot’s market acceptance has rapidly increased. Enterprise customers particularly appreciate its real-time intelligent support, especially its performance in complex data processing and automated task execution. According to reports, the number of enterprise users of Quarter 1 Copilot has increased by 55% compared to the previous quarter, which not only reflects the increasing demand for advanced AI tools, but also highlights Microsoft’s ability to provide industry-leading solutions.

Copilot has significantly improved work efficiency and strategic execution speed by simplifying many tedious processes and making decision-making more Data-driven through its advanced analytics capabilities in enterprise operations. Currently, nearly 70% of Fortune 500 companies have adopted Microsoft 365 Copilot, and its application in Microsoft’s CRM and ERP networks has also led to a 60% quarter-on-quarter increase in monthly active users, further demonstrating its profound impact on enterprise operations.

Microsoft continues to innovate in Copilot, such as the recent addition of support for complex Excel formulas such as XLOOKUP and SUMIF, as well as the introduction of narrative building tools in PowerPoint. These enhancements not only improve User Experience, but also enhance the product’s market competitiveness. By continuously expanding its functionality, Copilot is becoming an indispensable tool for enterprises, helping users stay competitive in a rapidly changing market environment.

With the further maturity of AI technology and the increase in market recognition, Copilot and its integration into the Microsoft product ecosystem are expected to continue to drive the growth of the company’s revenue and market share. These measures not only deepen the penetration of Microsoft’s products in existing markets, but also lay the foundation for its expansion in Emerging Markets. Overall, the successful implementation of Copilot not only marks Microsoft’s leadership position in AI-driven enterprise application areas, but also provides significant business value to customers, demonstrating the transformational potential of AI in modern enterprises.

Valuation analysis: Enter now or wait and see?

With the successful implementation of Microsoft Copilot and its widespread acceptance in the market, as well as the continued strong performance of Azure Cloud as a Service, Microsoft’s market valuation and stock investment value have become the focus of investors’ attention.

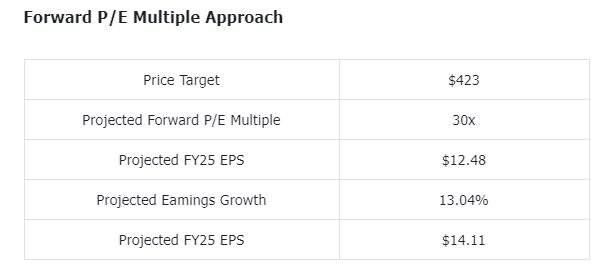

According to the latest financial report and market trends, Microsoft’s current forward Price-To-Earnings Ratio (P/E) is about 30 times, which is at a high level in the technology industry. This high valuation reflects the market’s optimistic expectations for Microsoft’s future growth potential, especially the strong growth momentum in the AI and Cloud Service fields.

Although high valuations usually indicate high market expectations for future performance, they also bring corresponding investment risks, especially in the context of increasing global economic uncertainty. Microsoft’s stock price has experienced significant fluctuations in the past few quarters, partly due to the market’s re-evaluation of its financial performance and future growth prospects. Nevertheless, Microsoft’s performance continues to exceed analyst expectations, especially strong performance in key product lines such as Azure and Copilot, supporting its high Price-To-Earnings Ratio level.

In terms of financial data, based on a five-year average compound growth rate (CAGR) of 14.3%, Microsoft’s revenue for FY25 is expected to reach $280.10 billion, although the financial guidance for the second quarter is relatively conservative, and management maintains a stable and optimistic attitude towards full-year growth. If revenue in the second half of the year can reach $141 billion, full-year revenue is expected to be $275.70 billion, with a growth rate of about 12.5%. The company’s current forward-looking Price-To-Earnings Ratio is 30 times, and the PEG ratio is about 2.4, slightly higher than its five-year average, indicating high market recognition of Microsoft’s long-term growth potential in the AI field. The company expects AI-related expenses to gradually decrease starting in FY26, which will help drive profit margins.

For investors considering investing in Microsoft, it is recommended to adopt a cautious strategy. Although the company has shown strong growth momentum, especially in the field of AI and Cloud Services, the current high valuation level also requires future performance to continue to meet or even exceed market expectations. Investors should closely monitor the company’s financial performance in the coming quarters, especially the revenue growth of AI and cloud businesses, as well as the potential impact of the global economic environment on its business.

For long-term investors, Microsoft’s stock remains attractive. The company’s continued investment in the AI and Cloud Service markets has begun to pay off, and these areas are expected to continue to drive the company’s growth in the future. In addition, the company’s investment in Copilot and other AI-driven products will continue to enhance its market competitiveness and profitability. Therefore, for investors who can withstand short-term market fluctuations, Microsoft provides an opportunity to participate in the core changes and long-term growth of the technology industry.

In the current volatile market environment, investors considering high-growth technology stocks such as Microsoft can use multi-asset trading platforms such as BiyaPay to achieve diversified layout. BiyaPay supports various asset transactions including US and Hong Kong stocks, and can also serve as a professional deposit and withdrawal tool with fast arrival speed and no limit on the amount, helping investors seize investment opportunities in the global market and achieve asset allocation balance. Through platforms like BiyaPay, investors can not only participate in high-quality stocks such as Microsoft more easily, but also flexibly allocate assets in the global Financial Marekt and optimize investment strategies.

Although there may be fluctuations in the short term, holding Microsoft stock for the long term is still a worthwhile strategy given its strong performance and solid market position in the AI and Cloud Service fields. If there is a major market adjustment, it will provide more attractive buying opportunities. Investors should make decisions based on their own risk tolerance and investment objectives, while grasping the best balance between risk and return in diversified allocation.

Growth and risk coexist

Microsoft’s investment in artificial intelligence (AI) and Cloud Services has shown strong growth potential, but these high-cost investments also pose challenges to the company’s short-term and long-term profit margins. The research and marketing activities of AI-related technologies not only require huge financial support, but also involve infrastructure expansion and talent cultivation. These factors require Microsoft to find a suitable balance between AI-related expenses and profit margins. In the 2025 fiscal year, the company expects its AI-related expenses to remain high to support further expansion of Azure and Copilot. Although these investments will bring revenue growth in the long term, these high expenses may compress profit margins in the short term. Therefore, how to maintain a healthy profit level while continuing to promote AI innovation has become a key consideration for Microsoft management.

In addition to cost pressure, Microsoft also faces fierce market competition in the AI and Cloud Service fields. Major competitors such as Amazon and Google are also in a leading position in the Cloud Service market, especially Amazon’s AWS and Google Cloud, which have established solid market shares respectively. Amazon, with the extensive layout of AWS in the global market, continues to up the ante AI technology and launches intelligent Cloud as a Service and solutions for enterprises, which has posed a considerable challenge to Microsoft in the process of competing for large enterprise customers. In addition, Google has a deep accumulation in AI research and development, and its open source technologies such as TensorFlow have a strong influence in the technical field, enhancing its competitiveness in the AI and data processing fields.

At the market level, the uncertainty of the global economy has also brought risks to Microsoft’s business growth. In particular, macroeconomic fluctuations may affect enterprise IT budgets, leading to fluctuations in demand for AI and Cloud Service services. Faced with these external risks, Microsoft needs to adopt more flexible strategies in market layout to respond to changes in customer demand in different regions and industries and maintain its competitive advantage in the market.

Overall, Microsoft’s investment in AI and Cloud Services has brought significant market advantages, but high costs and fierce competition pose challenges to its profit margins. In the future, Microsoft needs to find a balance between growth and costs to maintain competitiveness. For investors, its long-term potential in AI and Cloud Services is still worth paying attention to.