- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Why is Google still the "hardcore" choice in the eyes of investors as AI competition intensifies?

In the era of fierce competition among global tech giants, Google has continuously consolidated its leading advantages in digital advertising, Cloud Services, and artificial intelligence with its unshakable market position and continuous innovative technological strength. The strong financial performance in the third quarter of 2024 demonstrates Google’s resilience and growth potential in the face of competitive pressure and external challenges.

Meanwhile, the market volatility brought by the US election year, increasingly strict data privacy regulations, and the rise of AI competitors do not seem to have weakened Google’s investment attractiveness. Through a comprehensive analysis of Google’s market performance, technology trends, and future growth potential, we will reveal why Google is still the long-term “hardcore” choice in the eyes of investors.

Strong performance in the third quarter of 2024, with a leap in profits

As the dominant global search engine and digital advertising giant, Google continues to demonstrate its dominance in the global market. On October 29th, 2024, Alphabet, the parent company of Google, released its Q3 financial report. The report shows that the company’s overall performance is strong, with revenue reaching $88.27 billion, a year-on-year increase of 15%. This growth is mainly due to the outstanding performance of business units such as Google Services, YouTube, and Google Cloud.

Google Services revenue reached $76.50 billion in the quarter, up 13% year-over-year; Google Cloud revenue was $11.4 billion, up 35% year-over-year; YouTube advertising revenue also reached $8.90 billion, up 12% year-over-year. These figures not only reflect Google’s strong position in the advertising and Cloud Services markets, but also demonstrate the diversity of its business model and continued market demand.

In terms of profitability, the company’s performance is also impressive. Operating income increased by 34% to $28.50 billion, while Net Income also increased by 34% to $26.30 billion. This profit growth is mainly attributed to Google’s effective strategies in artificial intelligence integration and cost management. Google CEO Sundar Pichai pointed out that by using a combination of TPUs and GPUs, LG AI Research reduced the inference processing time of its MultiModal Machine Learning model by more than 50% and reduced operating costs by 72%. In addition, the company’s enterprise AI platform Vertex has played an important role in establishing and customizing basic models in the industry.

From these data, it can be seen that Google’s user base is large and stable. As of the third quarter of 2024, Google’s monthly active users are about 2 billion, accounting for 25% of the global population. The global adult population (aged 18 and above) is 5.80 billion, which means that more than 34% of the global adult population are monthly users of Google. This broad user base is a solid foundation for Google’s long-term growth.

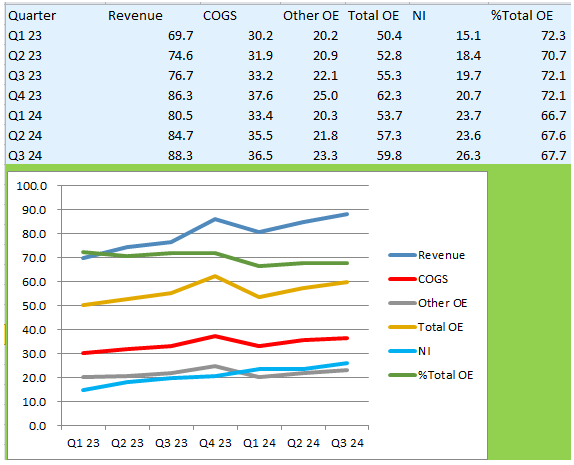

By reviewing the revenue, expense, and Net Income trends of the past seven quarters, we can observe the strong growth momentum of Google’s revenue. Although the revenue in Quarter 1 of 2024 has declined, this is mainly due to seasonal factors, and it still achieved a year-on-year growth of 15%.

Google has performed well in terms of cost management. Despite continued revenue growth, its cost of goods sold (COGS) and other operating expenses (OE) have remained relatively stable. In particular, the increase in research and development expenses, from $1.126 billion in Q3 2023 to $1.245 billion in Q3 2024, shows the company’s continued investment in innovation and growth.

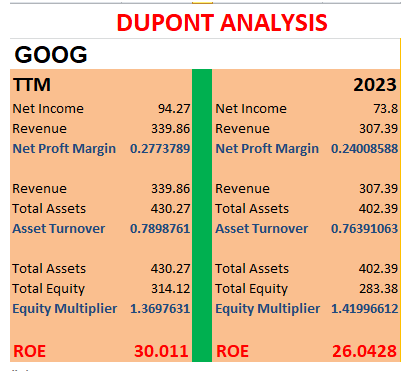

This effective cost control and improved profitability are supported by DuPont Analytics, which shows that the company’s return on equity (ROE) has increased from 26% in 2023 to 30% in the past twelve months (TTM). In addition, the company’s asset turnover ratio has increased from 0.76 to 0.79, and the Net Profit ratio has also increased, indicating that Google’s profitability and cost management capabilities are continuously improving.

Through these detailed financial analyses, we can not only see Google’s performance within a quarter, but also grasp its financial trends and stable market position over a longer period of time. These data and analyses provide strong evidence for investors, proving that Google is not only a company worth investing in at present, but also that its market position and financial performance will continue to lead in the foreseeable future.

If you are optimistic about Google’s future development and considering investing in its stocks, you can operate through the BiyaPay platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience. With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

How Google maintains growth in the competition of open AI

In the past few quarters, Alphabet has shown impressive growth. However, some investors are concerned that with the rise of open AI models like ChatGPT, Google’s core business - search engine - may be significantly affected. Despite these challenges, I believe Google will continue to achieve growth through its diversified business model.

Google not only dominates the search engine field, but its Google Cloud service and YouTube advertising business have also shown significant growth. For example, Google Cloud achieved an annual growth rate of 35% in the most recent quarter, while YouTube advertising business also achieved a growth rate of about 12%. In addition, Alphabet has invested heavily in its autonomous car department Waymo, including a recent $5.60 billion funding to expand its robot taxi service. Waymo has made significant progress and now offers over 150,000 paid rides per week, showing sustained growth potential.

From the perspective of the global Cloud Service market, it is expected to grow at a compound annual growth rate of 21.2% by 2030. This provides huge growth space for Google Cloud business. In addition, the US autonomous driving market is expected to grow from $22.52 billion in 2023 to $78.63 billion in 2030. As a major player in the market, Waymo will greatly benefit from this growth trend.

Google has also strengthened its competitiveness by integrating AI into its products. For example, Google’s AI model Gemini, including Gemini 1.5 pro, provides intelligent and detailed answers to user questions, surpassing ChatGPT in some aspects. Gemini models support MultiModal Machine Learning data processing and can handle text, images, audio, and video, while ChatGPT is limited to text. In addition, Gemini provides a wide range of customization options within the Google ecosystem, enhancing User Experience, which platforms such as ChatGPT do not have.

Overall, although open AI is seen as a threat to Google’s search business, the diversity of Google’s AI models and other Line of Business enables it to effectively address these challenges. Google’s stable market share and user traffic prove that its market position is far from shaken. In fact, Google and open AI models are more complementary than direct competitors in the market. In addition, due to academic restrictions on AI-generated content, Google’s application advantages in the education field have also maintained a certain market share for it.

Based on the above analysis, it is believed that Google will be able to continue to maintain its growth momentum in the AI competition, not only due to its innovative business model, but also because of its adaptability and resilience in responding to market changes and technological challenges.

Google Technology Outlook: Future Stock Prices and Market Forecasts

In the increasingly fierce technological competition and market changes, Google continues to consolidate and expand its market position with its forward-looking technological innovation and diversified strategy. This is not only reflected in the continuous optimization of products and services, but also in its stock price performance and investor confidence. Current technology trends and future market predictions show Google’s stable performance in terms of financial health and growth potential.

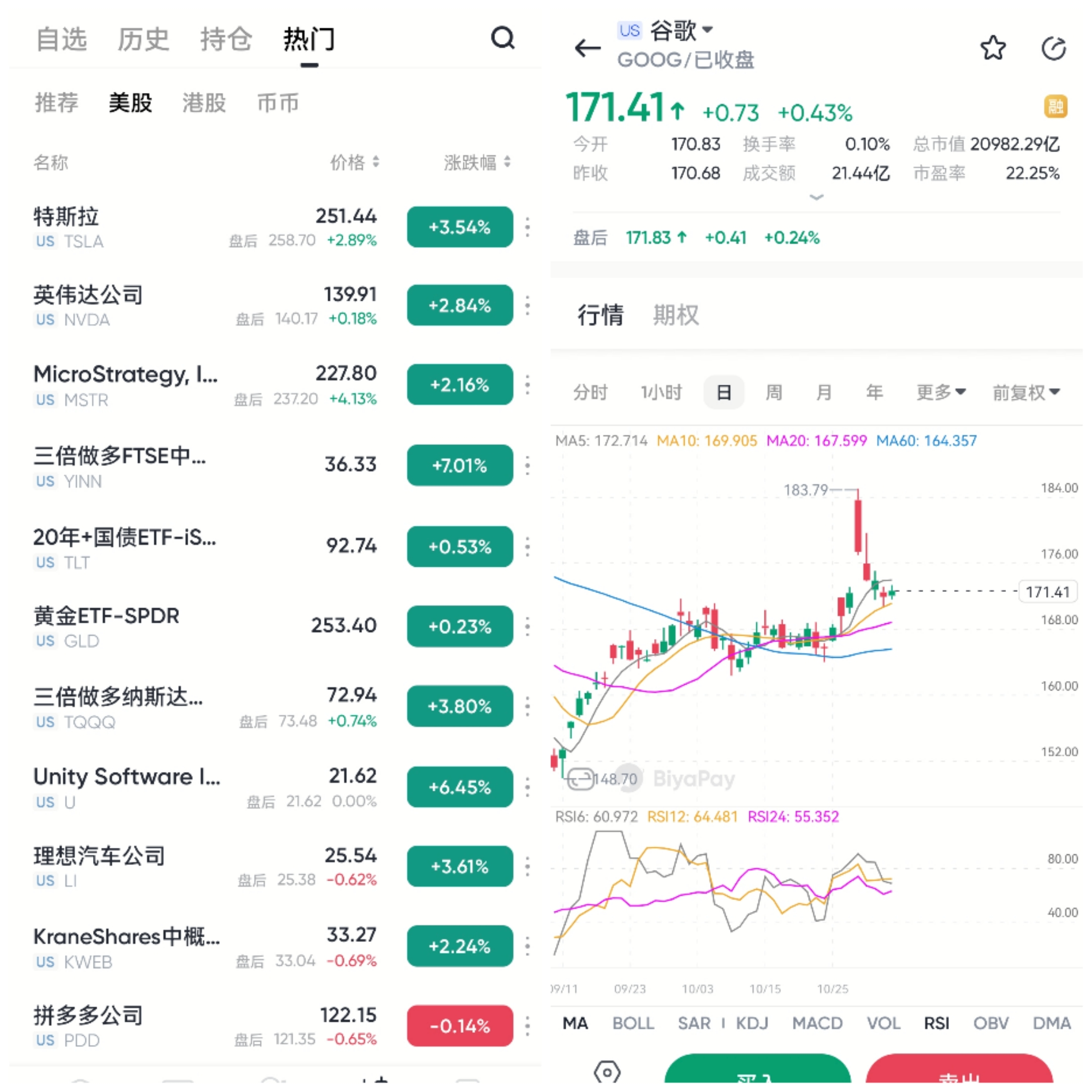

From a technical analysis perspective, Google’s stock price has entered a new bullish trend. Before July 2024, Google’s stock price continued to rise and then experienced a correction, but this correction has ended and the stock price has begun to re-enter an upward trend. A significant sign is that Google’s stock price has formed an inverted head and shoulders bottom pattern, which is a strong bullish signal in the market.

In addition, Google’s stock price has broken through the 50-day, 100-day, and 200-day Moving Average lines, indicating that it is in an upward trend in the short, medium, and long term. Especially in November, the 50-day moving average crossed above the 100-day moving average, forming a “golden cross” signal that confirms the long-term bullish trend.

The Balanced Volume Indicator (OBV) also shows an increase in buying pressure. The rise in OBV means that the trading volume on the rising day of the stock price is higher than that on the falling day, and buyers dominate. In addition, the Relative Strength Index (RSI) value is 56 and showing an upward trend, indicating that the stock price has shifted from the neutral area to the bullish area, and the buying pressure has further increased, indicating that the upward momentum of the stock price is gradually accelerating. These technical indicators clearly provide bullish signals. Combined with Google’s financial performance and market prospects, it is currently a reasonable time for investors to consider buying, especially for long-term holding.

Looking to the future, Google’s expansion into the global Cloud Service market and autonomous driving technology is expected to bring more growth opportunities to the company. The global Cloud Service market is expected to expand at an average annual growth rate of over 20%, and the expansion of the autonomous driving market will also bring considerable economic benefits to Google’s subsidiary Waymo. As Google continues to optimize its services and expand into new business areas, its market competitiveness is expected to further enhance. These positive factors will provide long-term support for its stock price, making Google a potential stock that investors continue to pay attention to.

There is no need to fear the impact of the US election year

During the US presidential election year, some investors may feel uneasy due to political changes, but historical data shows that Google’s (GOOG) stock has achieved stable growth during the past few elections. This performance shows that even in years with volatile political climate, Google can still maintain the stability of its business and stock price.

Looking at history as a mirror, it can be seen that Google’s stock price performed well in election years. For example, in 2016, Google’s stock price rose from about $33 in January to about $39 in December, with a cumulative growth of about 18% for the whole year. This growth trend was confirmed again in the 2020 election year, with the stock price increasing from about $64 in January to about $88 in December, with a full-year growth rate of about 38%. By this year, Google’s stock price has achieved a growth of 22.51% from the beginning of the year to the present, continuing the history of rising stock prices in US presidential election years.

These data emphasize the resilience of Google’s stock to political fluctuations, showing that even during periods of political turmoil that may affect market sentiment, Google’s business model and market strategy can still support its stock price growth. Google’s continuous innovation, market expansion, and investment in emerging technologies such as artificial intelligence and Cloud Services provide growth momentum in an uncertain political environment.

Therefore, for potential investors, Google’s stock is not only an investment in current performance, but also a trust in the company’s future potential. Although the election may bring some market fluctuations, Google’s historical performance in election years and its leading position in the global technology industry are sufficient reasons to invest in this tech giant.

Google’s hidden dangers on the road to becoming a giant

Despite Google’s impressive performance in technology and market, as a global leading tech giant, it also has to deal with enormous pressure from multiple aspects. In the rapidly changing technology industry, Google not only needs to continue investing in research and development to maintain its technological leadership, but also needs to adapt to increasingly stringent regulatory environments and data privacy requirements. Especially as competition in the fields of artificial intelligence and Machine Learning intensifies, maintaining innovation and market share is crucial for Google.

Meanwhile, data privacy and security issues are becoming a thorny challenge for Google. With the global emphasis on data protection and privacy, multiple regions (especially the European Union and the US) are continuously strengthening their regulation of technology companies. This may not only increase Google’s operating costs, but also limit its innovation space in the fields of Personalized Ads and Data Analysis. However, Google is also constantly adjusting its response strategies, actively strengthening its data management system to comply with compliance requirements in different markets, and ensuring market trust in data privacy and security.

In response to the uncertainties brought about by technological and policy changes, Google has adopted diversified business expansion strategies. For example, Google continues to expand its business globally and accelerates the monetization of innovative technologies through acquisitions and partnerships in order to gain more initiative in future markets. This flexible market strategy not only helps Google steadily advance in competition, but also lays the foundation for its further development.

In summary, Google has demonstrated sustainable growth potential with its strong market dominance, continuously innovative technological strength, and stable financial performance. Against the backdrop of competition and external risks, Google has maintained a stable development trend through diversified business layout and effective cost management. Technical analysis shows that its stock price is bullish in the future, coupled with the expansion of emerging fields such as Cloud Services and autonomous driving, which brings long-term profit space to the company. Whether it is responding to short-term market fluctuations or adapting to changes in the election year and global economic environment, Google has shown strong resilience and risk resistance, making it still a highly anticipated high-quality investment target in the future.