- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Times Have Changed! Nvidia Replaces Intel in the Dow Jones Index. What Does It Mean for Investors?

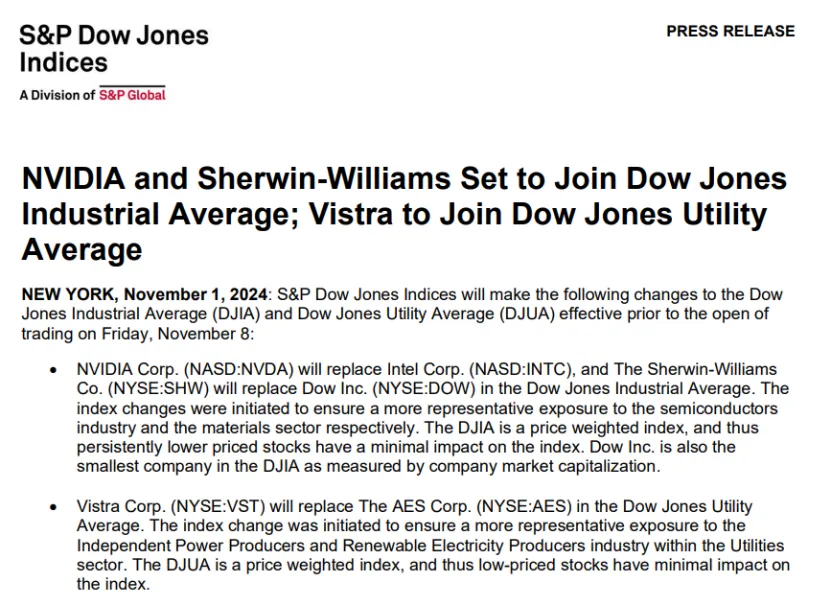

On November 1st, Eastern Time, S&P Global released an important statement, announcing that S&P Dow Jones was making an adjustment to the Dow Jones Industrial Average (DJIA). Nvidia (NVDA.US) will formally replace Intel (INTC.US) as a new component stock of this index, and this change will take effect on November 8th. This news quickly caught the market’s wide attention and marked an important restructuring and adjustment of the Dow Jones Industrial Average. After the news was released, Nvidia’s stock price rose by 2.9%, Intel’s stock price dropped by 1.85%, and the Dow Jones Index fell by 0.9%.

In addition, Sherwin - Williams is also about to join the Dow Jones Index, replacing Dow Chemical.

What does it mean that Nvidia is replacing Intel in the Dow Jones Index this time? How will this adjustment impact the U.S. stock market? How will the chip field develop in the future? Can Nvidia continue to maintain its advantages?

Next, we will interpret this change of the Dow Jones component stocks from multiple perspectives, hoping to bring more references for investment decisions.

01 Dow Jones Index Adjustment: The New King Is Crowned

The Dow Jones Industrial Average (DJIA) can be regarded as the “barometer” of the U.S. economy and one of the most influential stock market indicators globally. However, the event that Nvidia was included in the Dow Jones Index this time has drawn wide attention in the financial and technological fields. The replacement of two traditional large companies, Intel and Dow Chemical, also surprised many investors.

Especially, Nvidia replacing Intel marks a significant transformation in the semiconductor industry. Intel has been a component stock of the Dow Jones Industrial Average since 1999. However, this year, Intel has encountered difficulties and its stock price has dropped by 50%. Dow Chemical was once a typical representative of high - dividend stocks, but now it can’t compete with more growth - oriented companies.

In contrast, Nvidia’s performance has been extremely remarkable, with its stock price rising more than 180%. Tech giants have been scrambling to purchase Nvidia’s powerful but expensive processors to boost the development of generative artificial intelligence. Artificial intelligence technology has been widely regarded as the next stage of innovation, and as the leading supplier of AI GPU, Nvidia undoubtedly occupies an important position in this technological revolution.

The Dow Jones Industrial Average was founded by Charles Dow in 1896 and is often used as a vane to measure the status of the U.S. stock market, the largest in the world. This index adopts the price - weighted method, which means that the higher the stock price, the greater the impact on the index trend. The addition of Nvidia this time also highlights the importance of artificial intelligence in the U.S. economy.

02 Impact on the U.S. Stock Market

- Index Effect: Surge in Demand and Selling Pressure

The adjustment of the Dow Jones Index is not only a replacement of component stocks but also triggers a wide - ranging index effect. Many ETFs and funds strictly track the Dow Jones Index for allocation. Therefore, when Nvidia and Sherwin - Williams are added to the Dow Jones Index, the relevant funds and ETFs will be forced to increase their holdings of these two stocks, leading to a sharp increase in demand. On the other hand, Intel and Dow Chemical, due to being removed from the Dow Jones Index, face selling pressure and may lead to a short - term decline in their stock prices.

According to market statistics, historically, after each adjustment of the Dow Jones Index’s component stocks, the newly - added companies usually gain a 2% - 5% increase within a few weeks, while the removed companies may decline by 3% - 7% before the adjustment takes effect. This phenomenon provides a market opportunity for short - term investors. For example, Nvidia’s stock price rose by more than 3% in after - hours trading after the news was announced, showing the market’s high recognition of its addition to the Dow Jones Index, which directly affected investor sentiment.

- Nvidia’s Entry: A Boost to Tech Stocks

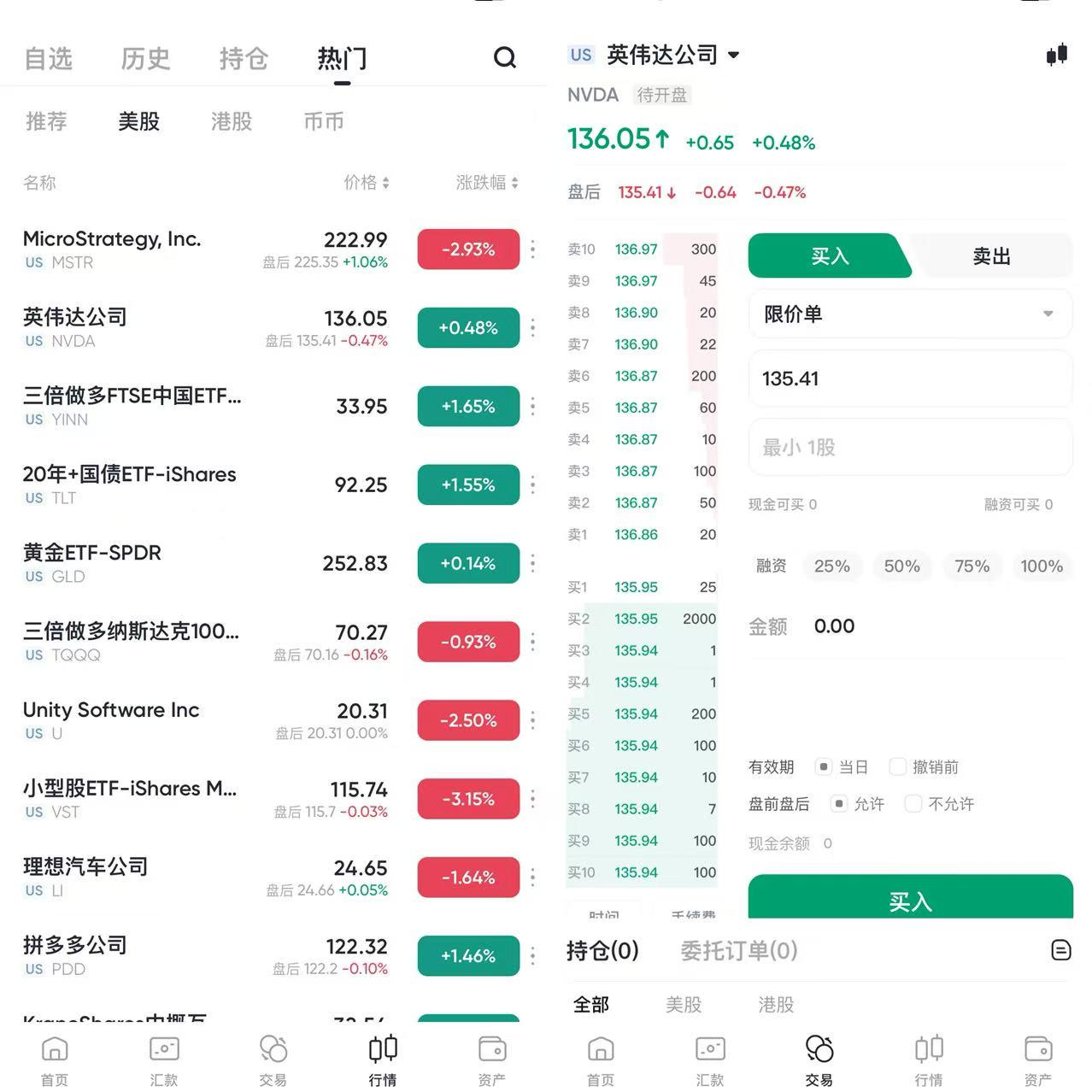

As the world - leading artificial intelligence (AI) and high - performance computing company, Nvidia’s entry into the Dow Jones Index undoubtedly conveys the market’s strong confidence in the technology industry, especially in the AI field. Since the news of Nvidia’s entry into the Dow Jones Index was announced, its stock price has been strong, rising more than 3% after - hours. This change not only boosts Nvidia’s stock price but may also have a positive driving effect on the entire tech - stock sector.

Especially in the fields of AI and high - performance computing, with Nvidia’s entry into the Dow Jones Index, the market’s interest in these high - growth areas may deepen further, attracting more capital inflows. Nvidia’s market capitalization has exceeded $3.5 trillion, showing the market’s high recognition of this adjustment and an optimistic attitude towards the prospects of tech stocks. It is expected that as capital flows into the technology sector, especially AI - related companies, the performance of this area may further drive the market up.

- Capital Flow: Tech Stocks Welcome Capital Influx

Nvidia’s entry, in addition to driving up stock prices, may also lead more capital to flow into tech stocks, especially those companies in the fields of artificial intelligence and high - performance computing. Investors’ focus will be more inclined to these high - growth areas with bright prospects. Therefore, the performance of tech stocks, especially AI enterprises, may be further enhanced. At the same time, Nvidia’s successful selection also strengthens the representativeness of tech stocks in the Dow Jones Index, making it a more attractive investment choice.

This will also affect other technology companies, especially those companies with technological advantages in emerging technology fields such as artificial intelligence, autonomous driving, and cloud computing. As investors are confident in the future growth potential of these fields, the relevant tech stocks are expected to attract more capital, thus driving the entire sector up.

- Short - Term and Long - Term Outlook

In the short - term, Nvidia’s entry will undoubtedly bring a rising trend to the entire U.S. stock market. Especially for tech stocks, especially companies in the fields of AI and high - performance computing, they may experience rapid growth driven by capital inflows. The Nasdaq 100 Index may hit a new historical high, and the Dow Jones Index and S&P 500 Index are also expected to follow suit.

In the long - term, Nvidia’s entry is not only a short - term phenomenon of stock price fluctuations but also the market’s high recognition of technological innovation, especially AI technology. With the continuous progress of technology and the rapid development of the AI industry, tech stocks, especially Nvidia, will continue to play a crucial role in the next few years.

Therefore, as an investor, in the face of this adjustment of the Dow Jones Index, you can follow these strategies to grasp market opportunities and cope with possible risks.

03 How Can Investors Seize Market Opportunities?

- Pay Attention to the Index Effect: Timely Adjust the Investment Portfolio

The index effect brought about by the Dow Jones Index adjustment means that the demand for Nvidia and Sherwin - Williams will increase significantly, while Intel and Dow Chemical may face selling pressure. If you currently have removed companies such as Intel in your investment portfolio, you may need to assess whether to adjust your positions in the short - term to avoid possible downward pressure. On the contrary, if you don’t hold Nvidia or Sherwin - Williams, this may be a buying opportunity, especially if your investment portfolio is biased towards tech stocks or you are optimistic about the future growth of the AI field.

- Track the Capital Flow of Tech Stocks

Nvidia’s entry not only boosts its own stock price but may also lead more capital to flow into tech stocks, especially companies related to artificial intelligence and high - performance computing. If you are optimistic about the long - term prospects of these fields, you can consider increasing your holdings of some high - quality tech stocks.

Besides Nvidia, other competitive companies in the fields of AI, semiconductors, and autonomous driving, such as AMD, Google’s parent company Alphabet, and Meta, may benefit from the market’s enthusiasm for tech stocks. If you are unsure about specific stock selection, you can also consider using ETFs in the technology sector to diversify investment risks.

There are now many safe and convenient investment channels in the market. For example, BiyaPay, a global multi - asset trading wallet, can not only trade U.S. stocks in real - time but also easily exchange USDT for U.S. dollars and directly trade U.S. stocks without an offshore account. At the same time, it is also a professional deposit and withdrawal tool. You can recharge USDT on BiyaPay to exchange for U.S. dollars and Hong Kong dollars, and then deposit funds into various brokerage firms. It’s fast, convenient, without quota limits, and can achieve same - day transfer and arrival, solving the problem of difficult deposit for investors at one stroke.

- Short - Term Operation: Utilize Volatility

The adjustment of the Dow Jones Index may bring significant market volatility in the short - term, especially the rise of new component stocks and the fall of removed stocks. This provides an arbitrage opportunity for short - term investors. According to the statistics of the rise and fall after the Dow Jones Index adjustment, the newly - added companies usually rise by 2% - 5% within a few weeks, while the removed companies may decline by 3% - 7%.

If you are a short - term investor, you can take advantage of this volatility to profit from the short - term rise of new component stocks such as Nvidia. Through technical analysis and changes in market sentiment, accurately grasp the timing of buying and selling.

For removed companies such as Intel, if the stock price drops significantly, it may provide a short - term buying opportunity, especially when there is no significant change in its fundamentals, waiting for its stock price to recover.

- Focus on Industry and Market Trends: Invest in Future Growth

As an investor, you can think from a long - term perspective. In the next few years, these fields will bring huge growth opportunities. Nvidia’s successful selection is not only a change in index component stocks but also a symbol of technological innovation and the AI revolution.

Look at the investment from a long - term perspective. Don’t just focus on the short - term index effect, but also grasp the long - term growth opportunities brought by technological innovations such as AI, semiconductors, autonomous driving, and cloud computing. Other competitive companies in the frontier technology fields, such as Tesla, Microsoft, Amazon, and Apple, are all potential long - term investment objects.

- Examine the Overall Market Environment: Do a Good Job in Risk Management

Investors should be cautious about short - term market fluctuations and make corresponding asset allocations and risk management according to their own risk - tolerance capabilities.

Diversify Investments: Ensure that your investment portfolio covers multiple industries and asset classes to avoid over - concentration in a certain sector.

Set Stop - Loss Points: In a volatile market environment, setting reasonable stop - loss points can help you control losses when the market is down.

Regularly Evaluate: Continuously pay attention to the fundamental changes of Nvidia, Intel, and other related technology companies to ensure that your investment decisions are in line with market trends.

04 Nvidia’s Road to the Top

- The Leading AI GPU Supplier

According to the latest data, Nvidia’s market share in the global artificial intelligence chip market has soared to 90%, hitting a new historical high. This achievement is mainly due to the explosive growth of the demand for generative AI. Nvidia’s A100/H100 series AI GPU has become the market favorite. Research institutions predict that Nvidia’s AI GPU sales in 2024 will reach 1.5 million to 2 million units, nearly tripling compared with 2023.

In terms of AI model training, Nvidia’s GPU can significantly shorten the training time. For example, in the field of natural language processing, H100 and H800 make it possible to train large - language models such as GPT and BERT, which have shown excellent performance in understanding and generating natural language. At the same time, Nvidia’s CUDA technology provides powerful parallel - computing support for AI frameworks such as TensorFlow and PyTorch, enabling AI developers to conduct model training and inference more efficiently.

In addition, Nvidia also cooperates with universities to explore new application fields of GPU, continuously enhancing its technical strength and innovation ability in the field of AI computing. This enables Nvidia to attract more investors’ attention to emerging technologies and bring higher returns to investors.

- Driving the High - Performance Computing Revolution

Nvidia is irreplaceable in the high - performance computing field. It provides users with stronger computing power, faster transmission, and better solutions through acceleration.

In terms of computing power, Nvidia’s GPU has powerful parallel - processing capabilities. For example, the NVIDIA H100 and H800 GPU are based on the new Hopper GPU architecture, providing higher parallel - processing capabilities and improved memory efficiency. Especially when dealing with complex AI algorithms and large - scale data sets, this architecture can significantly improve the computing speed and accuracy.

In terms of transmission, Nvidia has launched the NVIDIA HGX accelerated server platform for the AI and high - performance computing fields, integrating the powerful core computing power of NVIDIA A100 80GB PCIe GPU, the NVIDIA NDR 400G InfiniBand network system, and the NVIDIA Magnum IO GPUDirect Storage software, enabling more industries to make full use of the power of high - performance computing. With its faster memory bandwidth, researchers can obtain higher throughput and faster results, maximizing the value of IT investment.

In terms of solutions, Nvidia not only plays an important role in industries such as medical care, finance, and manufacturing but also provides powerful support for the digital linkage of medicine, pharmacy, and insurance. For example, with the help of the NVIDIA A100 Tensor Core GPU and NVIDIA TensorRT, knowledge vision has greatly shortened the algorithm research and development time, and the data - processing speed has increased ten - fold compared with the original, enabling efficient processing of the explosively - growing medical and insurance data. At the same time, the platform can train tens of millions of data, helping to process the massive unstructured image data in the medical and insurance industries.

05 Nvidia’s Moat and Future Challenges

Nvidia’s inclusion in the Dow Jones Index is undoubtedly a high recognition of its position in the AI and high - performance computing fields and also marks the increasing importance of these two fields. However, Nvidia’s development path in the future is not all smooth sailing and still faces many challenges.

On the one hand, the competition pressure is constantly increasing. Traditional chip giants such as Intel and AMD are striving to catch up with Nvidia and have launched competitive products. For example, Intel’s Gaudi 3 AI accelerator is 50% faster than Nvidia’s H100 in training and 30% faster in inference; AMD’s MI300X accelerator can also keep up with Nvidia’s upcoming B100 and has a lower cost. In addition, Nvidia’s customers are also developing competitive AI chips to bypass Nvidia. For example, Amazon has created the AWS Inferentia and Trainium AI accelerators, Meta and Microsoft have also demonstrated their internal hardware, and Tesla has also demonstrated its 25 - chip Dojo Training Tile. These will all pose a threat to Nvidia’s market share.

On the other hand, the risk of technological substitution cannot be ignored. The current AI accelerator hardware is based on the architecture used by GPU, but alternative architectures such as analog computing, neuromorphic computing, and quantum computing may prove to be more efficient than CPU, just as GPU is more efficient than CPU. Although quantum computing is still far from realization, analog processors for AI applications are currently in the research stage. Once these technologies achieve breakthroughs, they may have a significant impact on Nvidia’s business.

Despite the challenges, Nvidia’s potential is still huge. First of all, the growth prospects of the artificial intelligence market are broad. According to the prediction of Grand View Research, by 2030, the annual compound growth rate of the AI market will reach 37%, and the market size will exceed $1 trillion. This provides a huge market space for Nvidia. Even in the face of competition, Nvidia also has enough opportunities to continue to maintain its dominant position in the AI field.

In conclusion, Nvidia’s inclusion in the Dow Jones Index marks the increasing importance of AI and high - performance computing. Although it faces challenges, its potential is huge and is worthy of continuous attention. For investors, this change reminds us to respond to the changing market in a more flexible way. Whether it’s using any strategy to increase cash flow or choosing a combination of growth stocks and derivatives, the key is to find a strategy that suits you.