- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

There is a reason for Amazon's stock price surge! Revenue surges to $158.8 billion. How far is it fr

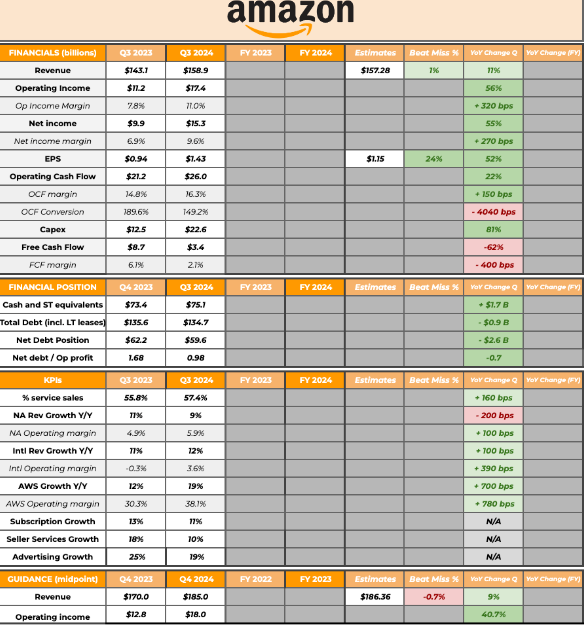

In recent years, Amazon has continuously demonstrated strong growth potential. Especially in the third-quarter financial report, its performance exceeded market expectations. According to the latest financial report, Amazon’s quarterly revenue reached $158.88 billion, and the GAAP earnings per share was $1.43, showing a significant improvement in its profitability. This not only reflects the company’s outstanding performance in the e-commerce and cloud computing fields but also provides reasons for investors to expect future growth in its stock price.

As Amazon continuously optimizes its operations, especially in terms of investments in logistics and AWS (Amazon Web Services), its goal of achieving an annualized revenue of $1 trillion seems to be getting closer.

As the business environment becomes more inclusive for enterprises, I believe that Amazon will continue to create value for shareholders, which will bring further capital appreciation. I wouldn’t be surprised if the stock price breaks through $210 by the end of the year, as Amazon has exceeded a market capitalization of $2 trillion. When I examine the “Magnificent Seven,” Amazon may be the best positioned for long-term growth because the road to an annualized revenue of $1 trillion is getting closer every quarter.

Amazon’s top-notch profitability

Amazon’s revenue performance is remarkable. The company has achieved double-digit growth for six consecutive quarters, and its revenue has reached $620 billion.

Management expects revenue growth in the next quarter to remain between 7% and 11%, which is likely to be the seventh consecutive quarter of double-digit growth. Although many people often take the growth of MegaCap Tech for granted, in fact, this is not a matter of course. After analysis, Amazon is found to be the only company among similar enterprises that is growing at such a speed. Currently, only four companies, Alphabet, Amazon, Berkshire, and McKesson Corporation, have achieved double-digit growth with a revenue scale of over $300 billion.

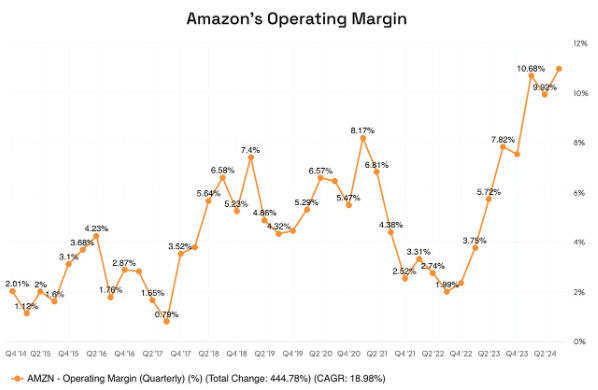

Amazon has once again achieved excellent results in profitability this quarter. The market has been paying attention to its profitability for some time. Amazon has also demonstrated its excellent operational leverage. The operating profit margin has steadily risen and reached a new high of nearly 11% this quarter. Since hitting bottom in the third quarter of 2022, the operating profit margin has increased by 900 basis points. As Andy Jassy said, the profit margin during the epidemic should not be regarded as Amazon’s upper limit. Time has proved that his view is correct.

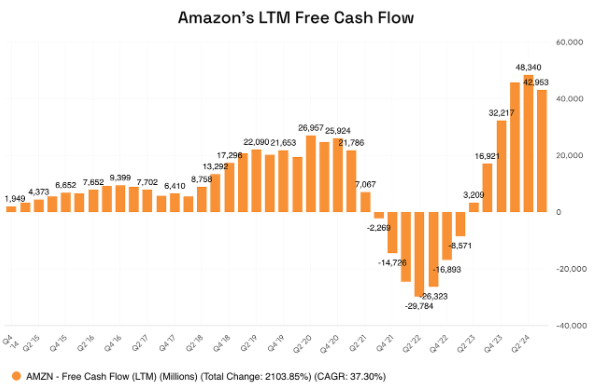

However, the significant decline in cash conversion rate has led to the growth rate of cash flow lagging behind accounting profit. The reduction in cash conversion rate is related to changes in working capital and the accounting adjustment related to the service life of AVWS servers in 2024, which makes the comparison of accounting profit margins somewhat misleading.

Although cash flow may fluctuate each quarter, the data for the past twelve months (LTM) shows that Amazon has started a strong cash flow engine. LTM’s operating cash flow has increased by 57% to $111.2 billion, and the OCF profit margin is 18%.

However, operating cash flow is not the whole story of Amazon. The company continues to make substantial investments in capital expenditures, so free cash flow has declined this quarter. However, LTM data shows that free cash flow is still trending in the right direction. While expanding capacity, Amazon has begun to generate positive free cash flow.

Last quarter, I said that although I can’t give an exact number, I believe that it is not unrealistic for Amazon to generate free cash flow of more than $100 billion in a normalized state (this will be a 17% FCF profit margin). But it is expected that this result will take time to achieve, especially considering management’s comments on capital expenditure investments.

Strong financial report data lays the foundation for future growth

Amazon performed strongly in the third quarter, laying the foundation for becoming the first company to achieve an annualized revenue of $1 trillion.

In this quarter, Amazon’s revenue reached $158.9 billion and its net profit was $15.3 billion, which means the company generated about $5.1 billion in net income per month. Facing such performance, management is full of confidence in the upcoming fourth quarter and expects revenue to be between $181.5 billion and $188.5 billion, with a year-on-year growth rate of between 7% and 11%. If this goal is achieved, Amazon is expected to exceed Wall Street’s expectations and generate an additional $2 billion in revenue.

Amazon’s capital expenditures drive the future and enhance competitive advantages

In the past 12 months, Amazon’s investment in capital expenditures has reached $64.96 billion, a record high.

These huge investments have laid a solid foundation for the company’s future development. Through these expenditures, Amazon can launch new basic models in AWS to support its growing artificial intelligence infrastructure. In addition, based on its self-developed Graviton4 processor, Amazon has launched optimized EC2 instances, enabling AWS to provide 75% additional memory bandwidth and 30% stronger computing power. These technological innovations not only improve the service quality of AWS but also enable customers to control costs more effectively and enhance their user experience.

From the perspective of specific business performance, the results of the third quarter are inspiring. The revenue of the North American market increased by $7.65 billion (8.7%) year-on-year, and operating profit also rose significantly by 31.48% ($1.36 billion) to reach $5.66 billion. After challenges in previous quarters, the profitability of the North American market is gradually recovering. At the same time, after experiencing losses for multiple quarters, the international market has finally achieved profitability. The revenue has increased by $3.75 billion year-on-year and brought in $1.4 billion in operating profit, which shows the effectiveness of Amazon’s global market expansion strategy.

AWS continues to be Amazon’s growth engine.

In the third quarter, AWS’s revenue reached $27.45 billion, a year-on-year increase of 19.05%, and operating profit increased by 49.76% year-on-year to reach $10.45 billion. This quarter’s success not only stems from the double-digit growth in both revenue and profit but also reflects Amazon’s efforts to improve operational efficiency in all aspects of business.

Amazon’s operating profit margin reached 10.96% this quarter, the highest level since the epidemic, and its operating cash flow performance also set a new record. Compared with the sluggish state in the fourth quarter of 2022, Amazon’s operating cash flow has increased by 57% to $111.21 billion, and the OCF profit margin is 18%.

Amazon has created record operating profit and net profit on a trailing twelve-month basis, which will make the bullish case very strong in the future. For friends who want to seize this opportunity early, it is recommended to use the multi-asset wallet BiyaPay. BiyaPay supports US and Hong Kong stocks and digital currency transactions, making it convenient for users to regularly check price trends and quickly complete deposit and withdrawal operations at critical moments.

If you encounter problems with capital inflow and outflow, BiyaPay provides an efficient and safe solution without freezing cards. Whether it is recharging digital currency and exchanging it for US dollars or Hong Kong dollars, or withdrawing to a bank account, it can quickly and flexibly meet capital needs and ensure that investors do not miss any market opportunities.

Why believe Amazon will continue to grow and expand margins

Because the macroeconomic environment is very favorable for Amazon (AMZN). The continuous growth of GDP and the decline in commodity prices and interest rates are currently working together.

The United States has achieved GDP growth for ten consecutive quarters, which provides strong support for Amazon as it sells goods and services to businesses and individuals across the country. The unemployment rate has dropped to 4.1%, which means more people are employed, and consumers’ disposable income has reached the level when stimulus checks were being distributed during the epidemic.

The Federal Reserve is expected to hold a meeting on Thursday. The CME Group predicts that there is a 98.9% chance that interest rates will be cut by 25 basis points. In addition, oil prices have fallen by 11.87% this year, natural gas prices have declined by 21.23%, and gasoline prices have also dropped by 7.52%. These data indicate that with the reduction in input costs and the expansion of demand for goods and services, it is not surprising that Amazon is achieving revenue growth and improving profit margins.

The decline in interest rates is also crucial for Amazon for two main reasons. First, lower interest rates make debt repayment more affordable, and enterprises are more willing to tap the debt markets to expand. When enterprises expand, they usually need additional goods and services, from cloud computing to office supplies, which creates more revenue opportunities for Amazon. The Federal Reserve is expected to lower interest rates to 3.5% by the end of 2025 and further to around 3% by the end of 2026. This trend may lead to greater business expansion and bring more revenue to Amazon.

Second, lower interest rates will help improve Amazon’s profit margins.

Amazon currently has $60.5 billion in long-term debt. The combined weighted average maturity of its notes is 13.1 years, and some of its debts have an interest rate as high as 5.12%. In the past 12 months, Amazon’s interest expense was $2.55 billion. In the next few years, if Amazon does not reduce its debt by increasing profitability, it may refinance at least half of its debt at a lower interest rate.

In general, Amazon’s revenue and profit are expected to continue to grow in the next few years. The combination of a good business environment and low interest rates will play a key role in improving its profit margins.

Market competition and regulatory risks

Before investing in Amazon, investors need to consider multiple risk factors.

According to data from the past 12 months, Amazon operates a business with low profit margins. Although Amazon’s gross profit margin is 48.41% ($300.18 billion in gross profit / $620.13 billion in revenue), its operating expenses are as high as $239.58 billion, which reduces the operating profit margin to 9.77% ($60.6 billion / $620.13 billion).

If the macroeconomic environment becomes more severe and GDP growth slows down, Amazon’s profitability may be severely affected. As one of the largest companies in the world, Amazon’s profit margins are affected by many factors. For example, a $1 increase in the price per barrel of oil or a 25 basis point increase in interest rates will directly affect its profits. If GDP starts to decline and unemployment rises, then the funds used to purchase Amazon’s goods and services may decrease.

In the retail field, Amazon also faces fierce competition from competitors such as Walmart (WMT) and Target (TGT). In the cloud computing market, Amazon also competes with Microsoft (MSFT) and Alphabet (GOOGL).

In addition, Amazon has also become a regulatory target of the Federal Trade Commission (FTC), especially after Lina Khan published a well-known paper on Amazon’s antitrust issues. Depending on the current political climate and the willingness to file lawsuits against large technology companies, Amazon may face severe challenges in court.

Nevertheless, I am still optimistic about Amazon and, as a long-term shareholder, I believe the company has the potential to overcome these challenges. However, before allocating funds to Amazon stocks, investors must consider these risk factors and other relevant factors to ensure making wise investment decisions.

Should Amazon stock be bought, held, or sold?

Amazon’s (Amazon) recent stock price trend is remarkable. Especially after experiencing a significant decline in August 2024, it successfully overcame this challenge and showed a strong rebound momentum. The rebound in September and the subsequent correction both received effective support on its 50-week moving average (blue line), enhancing market confidence in its bullish prospects. In addition, since the low point in August 2024, Amazon’s performance has continuously outperformed the S&P 500 index, further validating its strong market performance.

This series of higher lows and higher highs price structure enhances investor confidence in its future trend. It is expected that the resistance area slightly below $200 will be broken through, providing a buying opportunity for confident investors. Therefore, maintain a “buy” rating on Amazon stock.

With the improvement of the macroeconomic environment, the support of low interest rates and low commodity prices makes Amazon expected to achieve higher revenue growth in the future. In addition, the strong performance of AWS and technological investments provide important growth drivers for the company. Although Amazon faces pressure from competitors and regulators, its solid financial performance and continuously optimized operating strategies provide good investment opportunities for investors.

Considering these factors comprehensively, Amazon’s strong fundamentals and positive market prospects still make it attractive in future investments. With the continuous progress of technology and the rise in market demand, Amazon is expected to achieve sustainable revenue and profit growth while maintaining its market leadership. For investors, Amazon remains an investment target worthy of attention.