- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

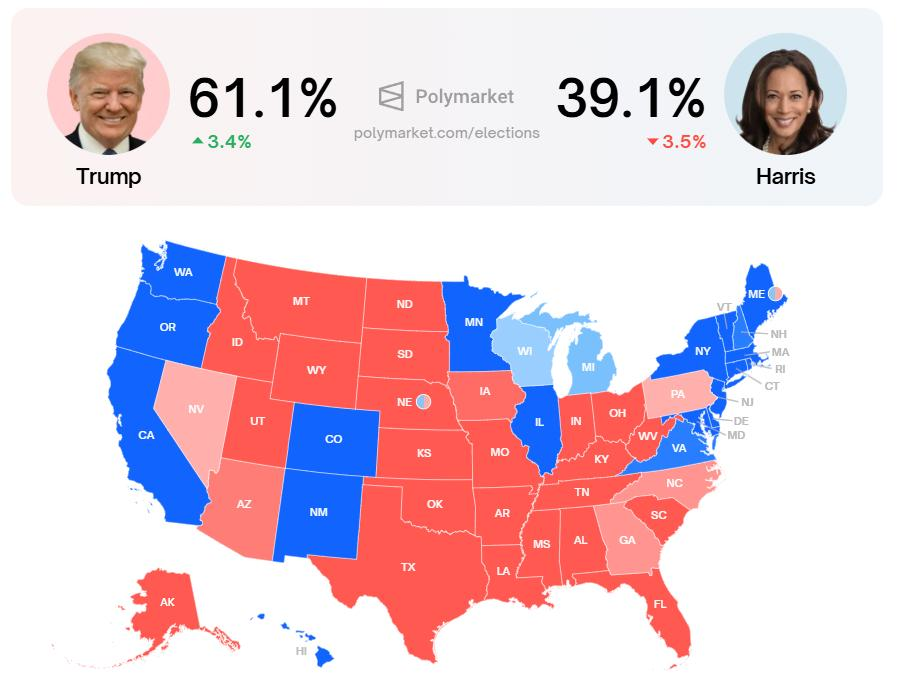

The biggest winner no matter Trump or Harris takes office in the 2024 U.S. presidential election.

Recently, the 2024 U.S. presidential election has captured the attention of many investors. Different from previous elections, in addition to polls in various U.S. states, analysts have an important new data source. It is the prediction website Polymarket.

What is a prediction market?

A prediction market is a trading market. Compared with general betting platforms, prediction markets mainly focus on “events”. Users can buy and sell “contracts” for the “results of future events” on it. Winners obtain benefits from the betting amounts of losers according to the proportion, while losers lose all their principal.

Why Polymarket?

The rise of Polymarket is inseparable from some favorable timing and geographical advantages, such as:

1.Enough high-quality events: In 2024, there are always continuous topics, from Bitcoin and Ethereum ETFs to the U.S. presidential election, Olympics, etc.

2.The crypto market is more closely related to policies, regulations, and the economy: In the past one or two years, the factors that have caused the largest price fluctuations in the crypto market are often not the development status of crypto itself, but changes in external macro factors. This also leads more Crypto Native users and funds to pay attention to macro changes and prediction markets, because prediction markets provide simple “conclusions” for many macro factor topics.

3.More complete infrastructure: When the concept of prediction markets was very popular in 2019, custodial wallets, deposit and withdrawal services, and public chains were not perfect, restricting users from entering. At that time, many prediction markets were built on Ethereum, and problems such as difficult recharge and inability to place bets often occurred.

In addition to favorable timing and geographical advantages, Polymarket has also made many optimizations on the product level compared to prediction markets in previous cycles.

In the past, prediction markets usually had the following pain points:

1.The entry threshold is too high and the infrastructure is not perfect. Concepts such as the use of wallets need to be understood.

2.The product is complex and difficult to understand. The prediction market is a combination of casino, options and other models, and it is easy to design it too complex.

3.Insufficient liquidity and counterparties.

4.It is difficult to balance between freedom of event creation and having clear standards.

5.Regulatory risks. Prediction markets have existed since ancient times, but they have always been restricted by centralized power.

Although Polymarket has not completely solved the above problems, it still has carried out a certain degree of innovation or optimization for these pain points.

Do your best to optimize product UIUX and lower the usage threshold.

We can compare the user experience of Polymarket a few years ago and today’s user experience through some collected data charts.

Comparing the beta version and the current version of Polymarket, we will find that the current Polymarket is easier to use and has a smoother path. For example, the current homepage directly lists all the hottest “events” on the platform. Users can place orders directly without entering the secondary page. At the same time, the user’s participation logic revolves around “how much to invest & expected return” instead of the “cost” of each bet. The probability of winning each bet, expected return, the size of the pool and other data that may need to be referred to before placing an order are also fully displayed. The platform also supports completely using Web2 registration and payment methods to create wallets and deposit funds, and there is no need to understand the concepts of blockchain and Gas when using it.

- Abandon mechanism innovation and provide liquidity through incentives.

In a certain sense, prediction trading is very similar to the NFT market. Any event can be traded on any prediction platform. It can be said that liquidity is one of the decisive factors affecting user choice, because sufficient liquidity can not only allow users to profit from correctly predicting the results of events, but also profit from the fluctuations in the market’s judgment of events.

Polymarket uses the order book method as the mainstream settlement method. Market makers can provide liquidity by placing limit orders to obtain rewards. The closer the limit price is to the market price, the more rewards there will be. Does this set of models sound very similar to Blur? In fact, all positions held by Polymarket users are in the form of ERC1155. However, the inspiration for this set of liquidity incentives actually comes from dYdX.

- Improve content supply and decentralized settlement as much as possible.

There is a set of special channels in Polymarket’s community for community members to provide event suggestions, so that the team can always pay attention to various events around the world to ensure the continuity of platform content supply. At the same time, UMA’s oracle is used to decentralizedly solve the settlement problem of events. Rich event supply is the basis for ensuring the long-term survival of the platform, because hot events such as the U.S. presidential election and the Olympics do not occur often, and “events” themselves are “content” rather than “gameplays” and cannot exist for a long time. Therefore, whether it can continuously and quickly provide consumable content will directly affect user retention.

In these aspects, Polymarket has solved some of the problems faced by past Crypto trading markets to a certain extent, laying the foundation for its explosion. In addition to products, Polymarket has also invested a large amount of money in user marketing, including Reddit channels and WallStreetBets.

What is the stock market usually like after the U.S. presidential election?

History shows that the stock market usually rises after a presidential election, but investors need to be prepared for some short-term instability first.

Since 1980, the three major benchmarks in presidential election years have on average risen between election day and the end of the year. However, investors should not expect the market to rise directly after the polls end.

In fact, these three indexes have an average decline in the session and within a week after the voting day. Statistics show that stocks tend to erase most or all of their losses within a month.

Amy Ho, executive director of strategic research at JPMorgan Chase, said: “Elections are now at the center of the next catalyst for financial markets.” “We warn that uncertainties may linger because presidential campaigns may take days and House campaigns may take weeks to prove the timetable for election results.”

This election is held in a strong year for stocks, which has pushed the broader market to new historical highs. According to Bespoke Investment Group, 2024 is the best in the first 10 months before a presidential election since 1936, with a return of about 20%.

If you want to closely follow the changes in the stock market before and after the 2024 U.S. presidential election and invest, you can choose some compliant investment platforms, such as Interactive Brokers, Charles Schwab, BiyaPay, Tiger Brokers, etc. Among them, BiyaPay is more friendly to cryptocurrencies and does not freeze cards for deposit and withdrawal. It is more in line with the favor of digital asset investors because it has solved the pain points that have long plagued these investors.