- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The U.S. presidential election has entered the final stage. U.S. stocks and the global market are on

The U.S. presidential election has entered the final countdown. At this moment, the market is filled with a tense atmosphere, like the calm before the storm. Overnight, the three major U.S. stock indexes closed lower in an uneasy atmosphere. The Dow Jones Industrial Average fell 0.61%, the Nasdaq Composite Index dipped slightly by 0.33%, and the S&P 500 Index slipped 0.28%. The seven giants of U.S. stocks were not spared either, all turning green. Only Nvidia closed slightly up after a sharp rally during the session. The VIX panic index approached the 23 mark during Monday’s trading session, hitting a new high since the August non-farm payroll data came as a surprise negative.

At this moment, Wall Street is on high alert and making full preparations for the upcoming U.S. presidential election and the Federal Reserve’s interest rate meeting. After all, not only is Wall Street closely watching who will ultimately enter the White House, but the whole world is also waiting to see. Because the birth of a new president will set the direction for the U.S. economy in the next few years, and its impact will spread like ripples to the vast ocean of the global economy.

So, what kind of impact will the results of the presidential race between Harris and Trump have on the market respectively?

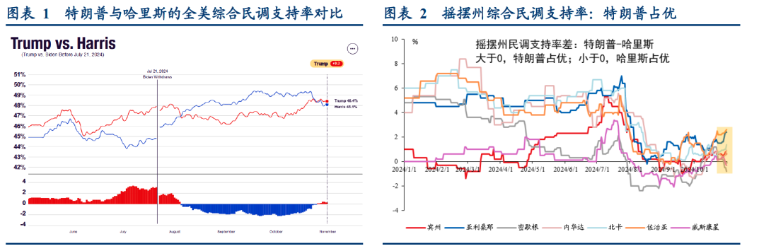

Election analysis: Currently, Trump and the Republicans have the upper hand, but the election is still intense.

At present, Trump’s support rate in comprehensive polls across the United States has exceeded Harris for the first time since August. In five of the seven swing states, Trump also maintains a polling advantage. According to RCP comprehensive polling data, in the past week, Trump’s support rate at the national level has exceeded Harris for the first time since August this year. And in the polls of the seven swing states, except for Michigan and Wisconsin, Trump is also in the lead.

The implied probability of Trump winning the presidential election in the betting market is higher. Currently, Trump’s winning rate is 18.9 percentage points higher than Harris (Trump 59.5% VS Harris 40.6%).

Policy comparison: Differences and commonalities between Trump and Harris’s policy positions.

I. Tax policy

Similarities: Both have focused on tax adjustments for specific groups. For example, both have mentioned canceling the taxation of tips.

Differences: Trump has significantly reduced taxes on enterprises, planning to reduce the corporate tax rate from 21% to 15% and make the 2017 Tax Cuts and Jobs Act permanent. At the same time, he cancels the taxation of overtime income, social security, etc. Harris has increased taxes on enterprises and the rich, raising the corporate tax rate to 28% and imposing a minimum tax of 25% on the rich with assets of more than $100 million. At the same time, she has reduced taxes on middle- and low-income groups and expanded child tax credits.

II. Trade policy

Similarities: At present, Harris has no specific trade policy position. This is in contrast to Trump’s “active actions” in trade policy.

Differences: Trump plans to significantly increase tariffs, announcing a 10% baseline tariff on imported goods, imposing high tariffs on China and stopping the import of necessities from China, etc. Harris is expected to maintain the existing trade policy and has criticized Trump’s approach of increasing tariffs.

III. Industrial policy

Similarities: Both have expressed support for the return of manufacturing and infrastructure investment. In terms of digital currency, both support the technological development of digital currency.

Differences: There is a big disagreement in the energy industry. Trump supports fossil energy and opposes the new green energy policy. Harris advocates vigorously developing clean energy and canceling subsidies for the oil and gas industry. In terms of artificial intelligence, Trump supports reducing regulation on the AI industry. Harris advocates establishing a balanced regulatory framework.

IV. Policy to cut living costs

Similarities: Both agree to reduce prices and cut family living costs and support reducing energy costs.

Differences: In terms of housing costs, Trump has proposed reducing mortgage interest rates by cutting inflation and allowing new housing construction on federal land, but there are no specific details. Harris’s proposal is specific, including building housing and providing down payment support for first-time homebuyers. In terms of medical costs, Trump advocates expanding healthcare choices through competition and canceling the Affordable Care Act. Harris advocates strengthening federal subsidies for the Affordable Care Act and expanding healthcare coverage. In terms of daily costs, Harris advocates using administrative means to prohibit “price gouging” of food and groceries.

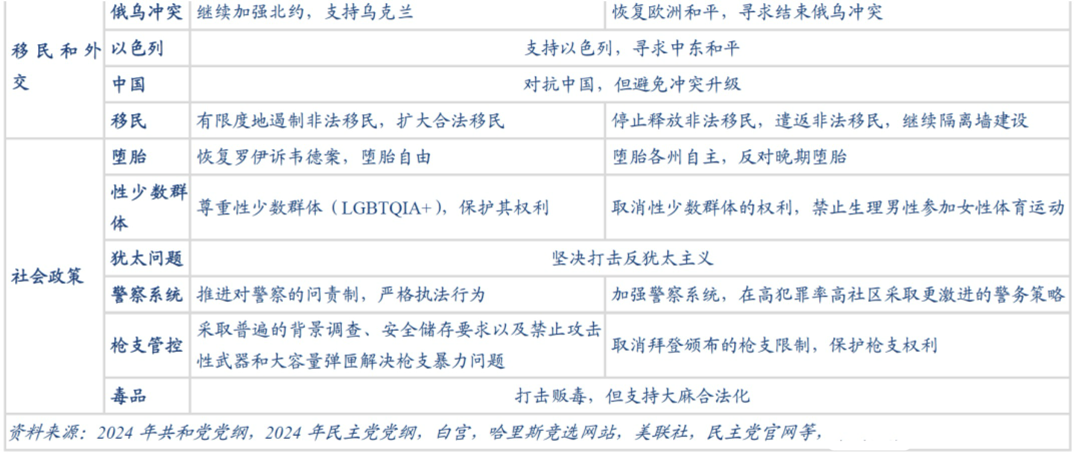

V. Immigration and foreign policy

Similarities: Both support Israel and advocate confronting China but avoiding an escalation of conflicts.

Differences: In immigration policy, Trump opposes and advocates large-scale deportation of illegal immigrants, strengthening border management, and continuing to build the border wall. Harris advocates expanding legal immigration, reforming the asylum system, and curbing illegal immigration to a limited extent. In foreign policy, Trump seeks to end the conflict in Ukraine. Harris supports Ukraine.

VI. Social policy

Similarities: They are consistent in combating anti-Semitism and supporting the legalization of marijuana.

Differences: In terms of abortion, Trump advocates that abortion be decided by each state and opposes late-term abortion. Harris calls for freedom of abortion. In terms of sexual minorities, Trump advocates canceling protection and rights for them. Harris respects and protects their rights. In terms of police law enforcement, Trump advocates strengthening police law enforcement powers. Harris advocates promoting accountability and strictly regulating police law enforcement behavior. In terms of gun control, Trump protects the right to own guns. Harris strengthens gun control and addresses the problem of gun violence.

The impact of different election results on the U.S. market and major asset classes

I. Trump’s election scenario

“Red sweep” (Trump has full power):

Impact on economic growth is uncertain. Tariff increases and deportation of illegal immigrants are unfavorable for growth, while tax cuts are beneficial for growth. After comprehensive consideration, it is uncertain. There is a greater upward risk of inflation due to the combined effects of tariff increases, tax cuts, and restrictive immigration policies.

Impact on major asset classes: The probability of U.S. bond yields rising is high. The huge deficit pushes up the term premium and there is a large upward risk of inflation. Factors such as trade conflicts push the U.S. dollar to strengthen. U.S. stocks benefit from tax cuts in terms of earnings, but the upward trend in U.S. bond yields brings valuation pressure. The impact is difficult to determine and volatility increases. Crude oil may be negatively affected due to expanded fossil energy production and trade uncertainties. Regulatory relaxation is beneficial for Bitcoin. Increased global trade disputes are beneficial for gold.

“Red lame duck” (Trump faces a divided Congress):

There is a negative impact on economic growth. Tax cut policies are difficult to implement. Tariff increases and restrictive immigration policies bring negative growth impacts and upward inflation risks, and there is a risk of “stagflation.”

Impact on major asset classes: The probability of U.S. bond yields rising is high, but the magnitude is weaker than in the “red sweep” scenario. The U.S. dollar strengthens due to factors such as trade conflicts. The increased risk of stagflation may have a negative impact on U.S. stocks. Crude oil may be negatively affected due to expanded fossil energy production and trade uncertainties. Regulatory relaxation is beneficial for Bitcoin. Increased global trade disputes are beneficial for gold.

II. Harris’s election scenario

“Blue sweep” (Harris has full power):

There is a negative impact on economic growth. The combination of tax increases on the rich and enterprises and tax cuts for middle- and low-income groups may affect short- and medium-term economic growth and corporate earnings. The impact on inflation is uncertain. The drag on economic growth brings downward pressure on prices, but down payment subsidies for homebuyers may stimulate housing prices to rise and thus boost inflation.

Impact on major asset classes: The direction of U.S. bond yields is uncertain but volatility increases. The deficit pushes up the term premium and the impact on growth is negative. The U.S. dollar may weaken due to the negative impact on growth and the expanded deficit. Tax increases may have a negative impact on U.S. stocks.

“Blue lame duck” (Harris faces a divided Congress):

Maintain the status quo and have no additional impact on growth and inflation.

There may be no obvious additional impact on major asset classes. The medium-term asset trend depends on the evolution of the prospects for a soft landing of the U.S. economy.

How should investors respond to different market situations?

So, in the face of the possible market changes brought about by different election results of Trump and Harris, what should investors do? Here are some suggestions for investors:

(1) Diversify asset allocation

Investors should avoid putting all their eggs in one basket and reduce risks by reasonably allocating different asset classes. In terms of stock investment, they can adjust the allocation ratio to different industries according to different election results. For example, if Trump is elected, they can appropriately increase investment in industries such as energy and finance that benefit from tax cuts and regulatory relaxation. If Harris is elected, they can pay attention to industries such as healthcare and environmental protection that may benefit from her policies. At the same time, increase the allocation of safe-haven assets such as bonds and gold to deal with market uncertainties.

(2) Focus on fundamental analysis

Regardless of the election results, investors should deeply study the fundamentals of enterprises and choose enterprises with stable performance and healthy finances for investment. Pay attention to financial indicators such as enterprise operating income, net profit, and gross profit margin, as well as factors such as industry status and competitive advantages. Avoid blindly following the trend and speculating, but make investment decisions based on the intrinsic value of enterprises.

(3) Closely follow policy dynamics

Investors need to closely follow the policy trends after the U.S. presidential election and adjust investment strategies in a timely manner. If Trump is elected, they need to pay attention to the impact of his trade policy, tax policy, etc. on the market. If Harris is elected, they need to pay attention to the implementation of her tax increase policy, environmental protection policy, etc. At the same time, pay attention to the monetary policy trends of the Federal Reserve and changes in the global economic situation in order to make more accurate investment decisions.

(4) Maintain rationality and patience

In the case of increased market volatility, investors should maintain rationality and patience and avoid being influenced by emotions. Do not blindly buy and sell stocks due to short-term market fluctuations, but formulate a reasonable investment plan based on a long-term investment perspective. At the same time, learn to diversify investment risks and do not concentrate all funds on a single investment variety.

(5) Choose a suitable platform and invest in U.S. stocks and the global market with USDT.

As an investor, in addition to paying close attention to the impact of the election situation on the global market in real time, choosing a suitable investment platform is also very important. Here, we need to choose a more reliable brokerage for investment. For example, Charles Schwab is a globally renowned investment brokerage. By opening an account with Charles Schwab, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay and then withdraw fiat currency to invest in U.S. stocks at Charles Schwab Securities.

Of course, users can also directly search for U.S. stock codes on BiyaPay and make purchases by recharging USDT. In addition to U.S. stocks, as a multi-asset trading wallet, BiyaPay also supports the trading of digital currency and other major asset classes. It can be said that with this one wallet account, you can invest globally.

Summary

In short, currently, the U.S. presidential election has entered the final stage and is attracting global attention. Trump currently has the upper hand in polls and the betting market, but the election is still intense. Trump and Harris have obvious differences in policy positions in many aspects such as taxation, trade, and industry. Different election results have different impacts on the U.S. market and major asset classes. Trump’s election may bring uncertain economic growth, upward inflation, and complex changes in different assets. Harris’s election has a negative impact on economic growth, uncertain impact on inflation, and specific impacts on major asset classes. Investors should diversify asset allocation, pay attention to fundamentals, closely follow policy dynamics, and maintain rationality and patience to deal with market changes.