- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

As the U.S. presidential election is about to be unveiled, how should we deal with market fluctuatio

The U.S. presidential election is about to be revealed. Policy uncertainties may further exacerbate market fluctuations, and the performance of various assets will also be affected. In such an environment, is there a fund that can not only hedge market risks but also have growth potential?

The AIRR to be introduced today is precisely such a fund. It can not only diversify risks but also achieve years of exceeding expectations in returns. It is a good investment choice. AIRR has outperformed the Nasdaq 100 in the past 1 year, 3 years, and 5 years. It can be called a “dark horse” with outstanding performance in recent years!

Next, let’s deeply analyze this fund and see what charm it has!

What is AIRR?

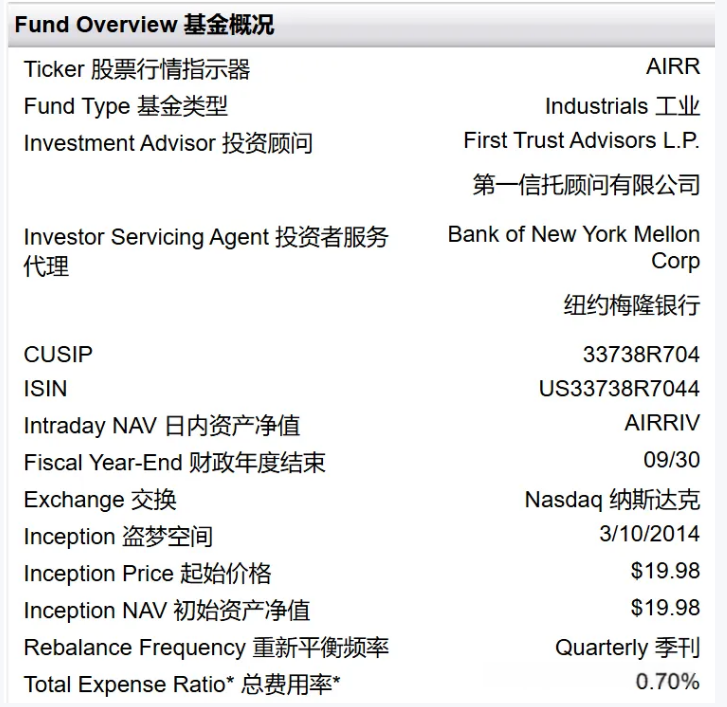

AIRR, namely First Trust RBA American Industrial Renaissance ETF, was launched by First Trust in 2014. This fund tracks the American Industrial Renaissance Index and focuses on investing in companies that can drive economic growth through domestic production and innovation. Its strategy is locked in the industrial and financial sectors, aiming to capture the growth potential of domestic small and medium-sized enterprises.

How does AIRR operate?

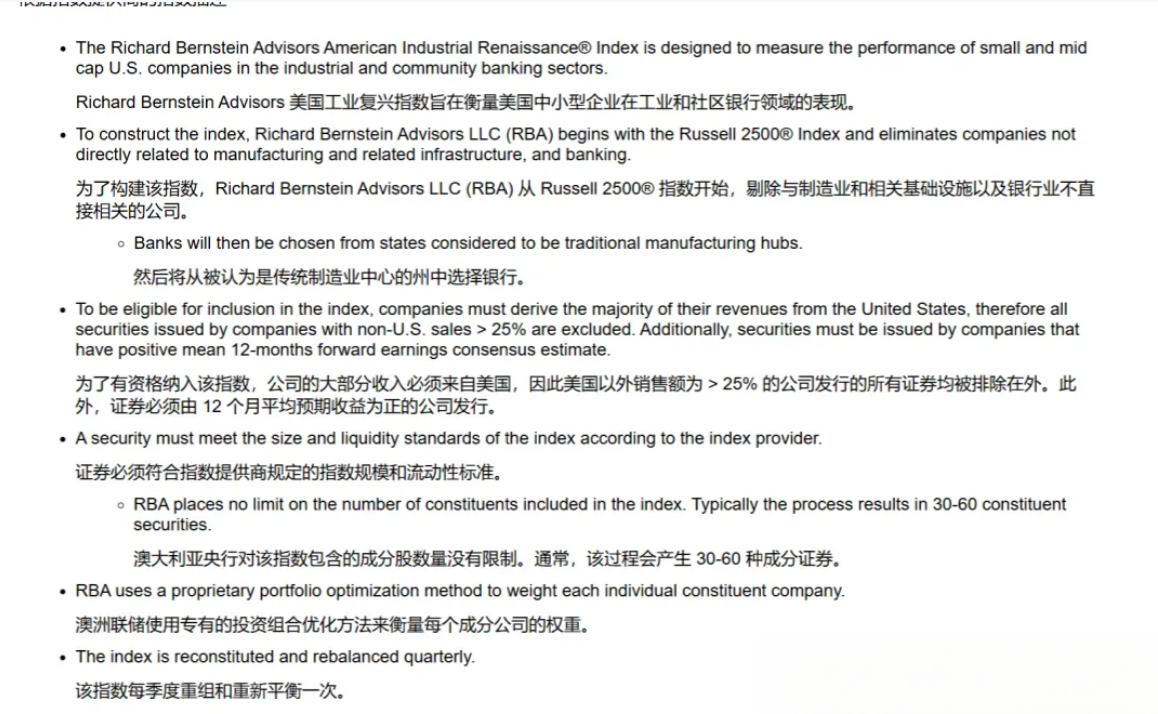

Let’s first take a look at the investment strategy of the index tracked by AIRR. There are several key points as follows:

① Select small and medium-sized enterprises concentrated in industry and finance from the Russell 2000 index, and exclude companies unrelated to manufacturing and infrastructure. Banks need to be selected from states in traditional manufacturing centers.

② Qualified companies must have more than 75% of their revenue coming from the United States, and the 12-month earnings forecast must be positive.

③ The index has no limit on the number of constituent stocks. Usually, there are 30-60 stocks, and it is readjusted and rebalanced quarterly.

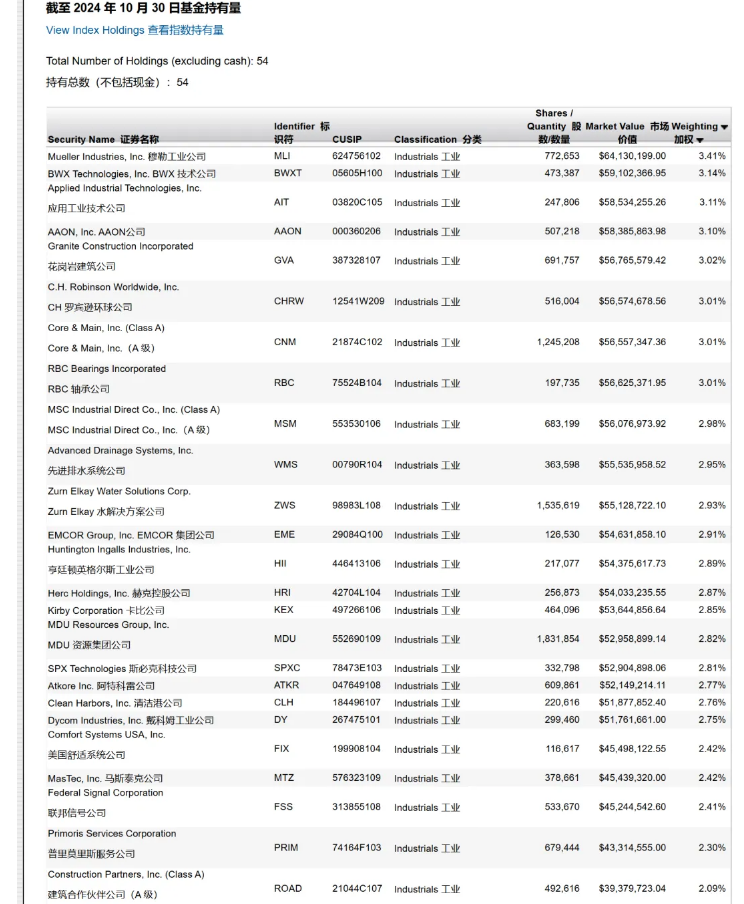

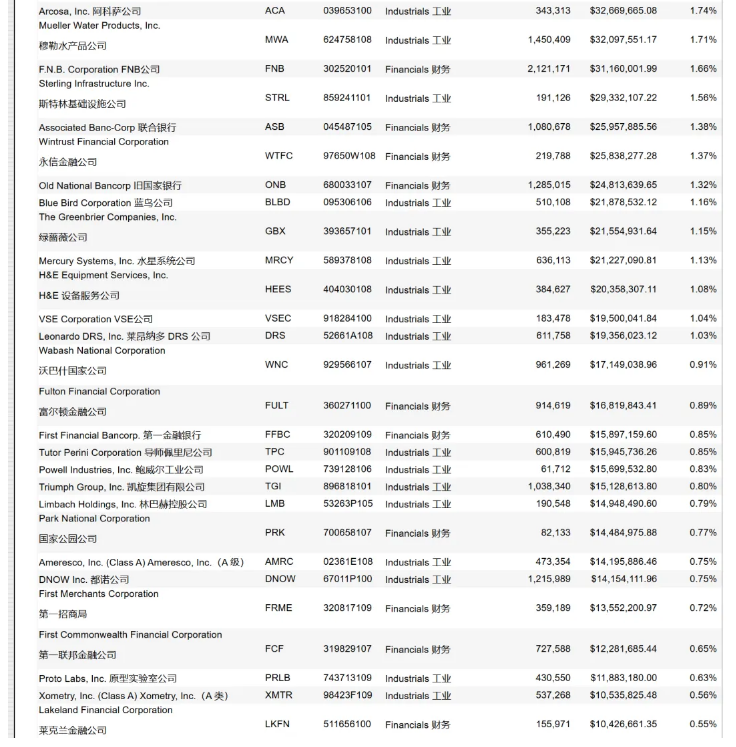

Next, let’s analyze the holdings. The following is the latest holdings and holding valuations of AIRR as of October 30.

Latest specific holdings:

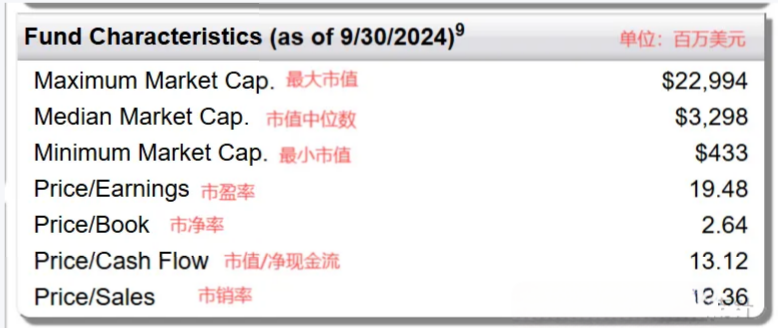

Holding valuations:

As can be seen from the figure, its holding characteristics basically conform to the investment strategy mentioned above:

Concentrated in the industrial field and configured with a small amount of supporting finance

This ETF is mainly concentrated in the industrial field, especially industrial equipment, infrastructure, and materials companies, such as Mueller Industries, BWX Technologies, and Applied Industrial Technologies, occupying more than 90% of the weight.

AIRR also has companies in the financial field configured, such as regional banks and financial services companies, mainly providing financial services for the above industrial areas.

Fewer holdings but relatively balanced positions

More than 99.5% of the positions are stocks. It only holds 54 stocks, which is a relatively small number among ETFs. However, the shareholding ratio of each company is relatively balanced, and the largest shareholding ratio is only 3.41%.

Holdings are concentrated in small and mid-cap stocks with a relatively low valuation level

Most of the enterprises in the holdings are probably not known to everyone. The median market value is only about 3.2 billion U.S. dollars, mainly small and mid-cap stocks.

The price-earnings ratio is 19.48 times, the price-to-book ratio is 2.63 times, the price-to-cash flow ratio is 13.12 times, and the price-to-sales ratio is 1.36 times. The overall valuation level is lower than the average level of the market.

The industrial-dominated configuration of AIRR fully reflects its core investment concept of focusing on promoting domestic economic growth. By focusing on the industrial and financial fields, this fund provides growth support for domestic industrial enterprises and also adds stability to the portfolio.

The dominant position of the industrial sector not only reflects AIRR’s high attention to the revival of American manufacturing but also provides a win-win situation for supporting the domestic industrial chain and supporting financial services. In the current economic environment, this configuration makes AIRR more independent of fluctuations in the international market, thus effectively capturing the potential of domestic economic development and opportunities brought by policies.

How is AIRR’s return and risk resistance?

Earning ability:

Comparison of growth curves of AIRR vs QQQ vs SPY:

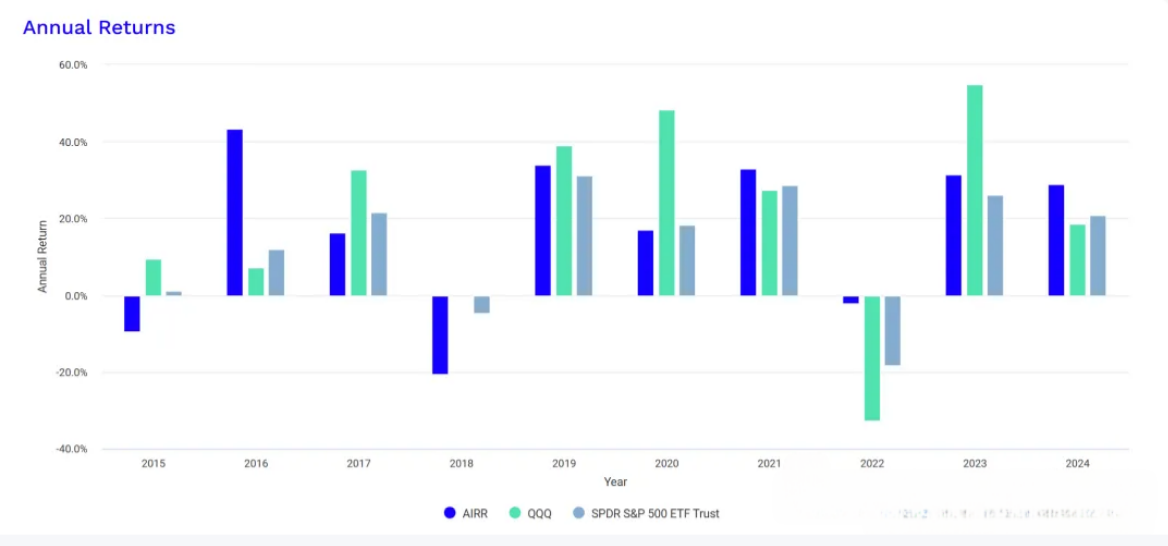

Comparison of annual returns of AIRR vs QQQ vs SPY:

Annualized returns of AIRR vs QQQ vs SPY:

Correlation:

By comparing the growth curves, annual returns, annualized returns, and correlation tests of AIRR, QQQ, and SPY, the following points can be found:

Overall earning ability

AIRR is one of the few ETFs that can compete with the Nasdaq QQQ in terms of returns. The 1-year, 3-year, and 5-year returns are all ahead of QQQ and SPY. Although the long-term performance is slightly inferior to QQQ, it is still better than SPY, showing strong earning ability.

Performance in downtimes

During market downturns, AIRR shows some fluctuations. For example, in 2018, its performance was relatively poor, but in 2022, it was outstanding. This fluctuation shows that AIRR’s performance has advantages and disadvantages in different market environments and is suitable for adding return elasticity to longer-term portfolios.

Correlation

The correlation between AIRR and QQQ is 0.67, showing a certain positive correlation but not very strong, indicating that its return fluctuations are not completely synchronized with the Nasdaq. At the same time, the correlation with SPY is 0.81, indicating that the performance of AIRR small and mid-cap stocks is more in line with the trend of the broader market. This moderate correlation means that AIRR can effectively balance the fluctuations of the broader market and the Nasdaq in the portfolio and provide investors with more diverse sources of returns.

- Risk resistance ability:

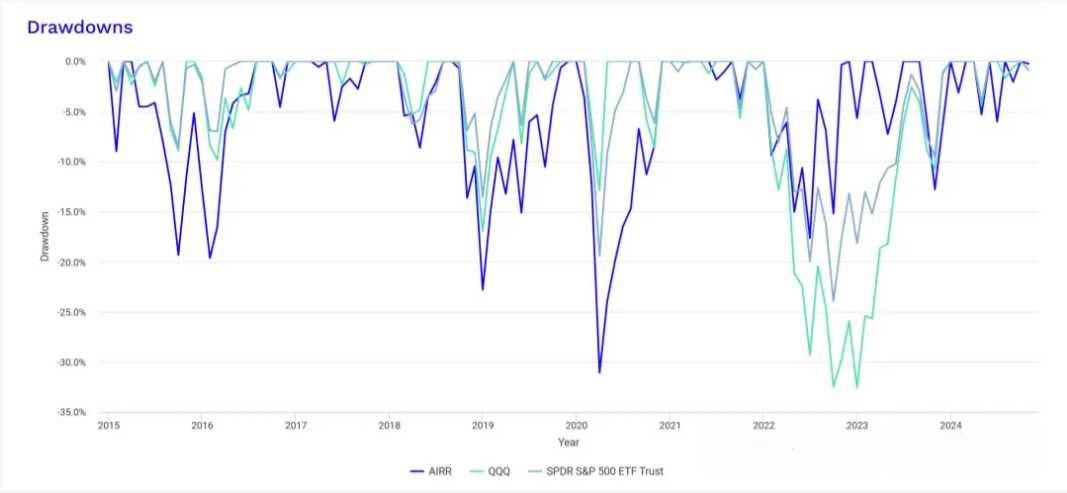

Drawdown curves of AIRR vs QQQ vs SPY:

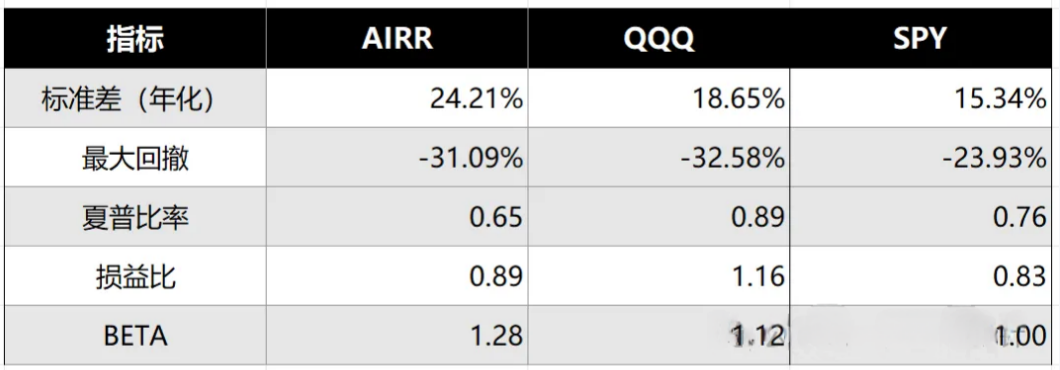

Major risk-return indicators of AIRR vs QQQ vs SPY:

By comparing the drawdown curves, standard deviation, maximum drawdown, Sharpe ratio, profit-loss ratio, and Beta of AIRR, QQQ, and SPY, it can be seen that:

AIRR has the largest annualized standard deviation and Beta value, showing high volatility. In terms of maximum drawdown, AIRR is slightly lower than QQQ but higher than SPY, indicating that AIRR’s risk resistance performance in market downturns is in the middle.

In terms of the Sharpe ratio, AIRR is relatively the lowest, while the profit-loss ratio is higher than SPY but lower than QQQ, showing that its return-risk balance is slightly inferior but still better than SPY.

In general, although AIRR has higher volatility and risks, it shows relatively higher return potential in the comparison with the broader market. For investors with a certain risk tolerance, it still has strong attractiveness.

- Scale, expense ratio, dividends and distribution frequency

The latest scale of AIRR has reached 1.85 billion U.S. dollars, expanding rapidly compared to 600 million U.S. dollars at the beginning of the year, showing investors’ confidence in its growth potential. The expense ratio is 0.70%, which is relatively high among index funds and is a slight disadvantage. The dividend yield is 0.17%. Although it is low, it has a certain dividend income. Dividends are distributed quarterly, and the dividend distribution frequency is at the market average level.

Advantages and disadvantages of AIRR and suitable groups

Advantages:

Scarce theme: AIRR focuses on the theme of American manufacturing revival, which is in line with the direction of policy support and helps the continuous growth of domestic industry. For investors who pay attention to policy dividends, this theme is not common in the market and is therefore quite attractive in the current macro background.

Outstanding return performance: This fund has outperformed the Nasdaq 100 and the S&P 500 on many indicators in the past few years. Especially in terms of returns in the past 1 year, 3 years, and 5 years, it is obviously ahead, showing excellent historical performance.

Low technology dependence: AIRR avoids the highly valued technology sector, which is suitable for investors to diversify risks in the current market environment where technology stocks are highly valued and volatile, while sharing growth opportunities in fields such as industry and infrastructure.

Focus on small and mid-cap stocks: AIRR mainly invests in small and medium-sized enterprises. These companies often benefit more in interest rate cut cycles. Coinciding with the opportunity of sector rotation, this makes AIRR one of the options suitable for periodic allocation.

Disadvantages:

High volatility: AIRR’s annualized volatility reaches 24.21%, higher than the broader market index, meaning that investors may face greater price fluctuations during the holding period, and the investment experience may also be affected.

Industry concentration risk: AIRR’s investment is mainly concentrated in the industrial and financial fields and is greatly affected by the economic cycle. It is suitable for investors with high risk tolerance.

Limited strategy capacity: Since the tracked target companies are mostly small enterprises with limited market capitalization and the number of holdings is limited. With the rapid expansion of the fund size, there may be risks of insufficient investment targets or strategy failure in the future.

Suitable groups:

Risk hedging investors: AIRR is a fund suitable for investors who pay attention to market uncertainties and seek the direction of policy support. Its configuration in the industrial and financial fields gives it certain hedging potential.

Investors seeking high returns: For investors with high tolerance for fluctuations, AIRR shows strong long-term appreciation potential under the support of the theme of American industrial revival. It is suitable for medium and long-term investors seeking return on investment.

Diversified risk allocators: AIRR is suitable as a supplementary allocation in the portfolio to help investors diversify the risks of technology stocks and provide a choice for diversified allocation in the current market environment.

How to invest in AIRR?

For investors with different investment needs, investing in AIRR through the BiyaPay platform can bring a more convenient capital management experience. BiyaPay supports the trading of U.S. stocks and Hong Kong stocks. It is also a professional tool for depositing and withdrawing funds. It is suitable for investors who hedge market risks, pursue high returns and diversify risks. Whether you are optimistic about the high growth potential of the American manufacturing revival or hope to avoid the fluctuation risks of highly valued technology stocks, BiyaPay allows you to recharge digital currency and exchange it for U.S. dollars or Hong Kong dollars, and then conveniently withdraw it to your personal bank account to easily allocate high-quality assets such as AIRR.

Especially for investors who hope to diversify asset allocation and seize every opportunity in the market, the characteristics of fast arrival and unlimited quota of BiyaPay can allow you to flexibly allocate funds at any time, seize the growth opportunity of AIRR in time, and achieve a balance between returns and risks.

In general, AIRR is an ETF with obvious advantages and certain risks. Its return potential is outstanding, especially more attractive under policy support. However, the risks are relatively concentrated, and the overall risk resistance ability is relatively weak. Therefore, AIRR should not be the main force of a single allocation but can be an important part of a diversified portfolio. With its investment direction in the industrial and financial fields, AIRR provides an opportunity to avoid the technology stock bubble in the market where technology stocks are at high risks. At the same time, it is expected to benefit from the macro background of domestic industrial recovery. Making partial allocation at present is a good choice.