- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Meta continues to lead the advertising market, but capital expenditures are surging! Does the short-

Meta achieved solid earnings in the third quarter of fiscal year 2024, but its stock price still experienced a correction of about 5%. As the company enters the stage of normalized growth, investors may show caution towards the increase in future capital expenditures. Especially in the case of a gradual decline in advertising business, META needs to increase capital expenditures, especially to enhance its artificial intelligence (AI) capabilities to ensure continuous revenue growth.

However, maintaining year-on-year growth of more than 20% may face some challenges in the current market environment.

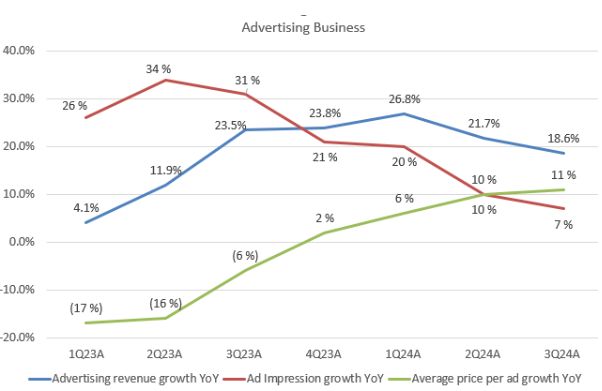

In previous analyses, I maintained a “buy” rating for META and specifically pointed out META’s strategy of increasing capital expenditures when advertising revenue growth slows. Since then, META’s stock price has risen by 24% and outperformed the S&P 500 index by 14 percentage points. The increase in advertising prices is the main reason for this growth. Although the growth rate of advertising impressions has slowed down, advertiser demand remains strong. The guidance for the fourth quarter indicates that although growth is entering a normalized stage, META shows no obvious signs of slowdown.

But can growth continue in the next few years? How will META’s operating cash flow and earnings be affected as infrastructure spending increases?

Although infrastructure spending in fiscal year 2025 is expected to increase significantly, especially with the rise in capital investment depreciation and other operating costs, I believe META’s operating cash flow will remain robust and may put some pressure on earnings in the short term. Considering the company’s growth momentum exceeding market trends, the current price-earnings ratio premium is still reasonable. I still maintain a “buy” rating for META.

Meta: The king of social platforms, leading in advertising revenue

Meta platform is currently undoubtedly one of the global social media hegemons. As a social platform with the largest user base in the world, Meta’s three major platforms, Facebook, Instagram, and WhatsApp, have a huge number of users worldwide, further consolidating its leadership position in the social media industry.

As of April 2024, the number of monthly active users of Facebook has exceeded 3 billion, and Instagram and WhatsApp also have nearly 2 billion and 2 billion monthly active users respectively. Against the background of a global population of about 8.18 billion, this means that Meta’s social platforms have covered almost half of the population - this is an incomparable scale advantage in any industry.

In contrast to Meta’s strong global user base, competitors are constantly catching up. The rising of TikTok and the continuous development of platforms such as YouTube have made the competition in the social media field more intense. However, with its large user group and deep user engagement, Meta still occupies an irreplaceable position in the advertising market.

In recent years, TikTok has faced increasing regulatory pressure in the United States and other countries, especially the potential ban on TikTok by the US government and similar measures in other countries. This political uncertainty undoubtedly provides a huge market opportunity for Meta. The shutdown or restriction of TikTok in some markets may mean that more users and advertising budgets will flow to Meta.

Dominant position in advertising revenue

Meta occupies an important market share in the global digital advertising market. Although YouTube has a higher market share in this field (27.7%), Meta’s 22.8% is still a strong competitive position. Meta continuously optimizes advertising algorithms and advertising products, enabling advertisers to reach target audiences more accurately and thus improving advertising effectiveness and return on investment.

According to data from the third quarter of 2024, Meta’s advertising revenue reached 3.988 billion US dollars, a year-on-year increase of 18.5%. This growth is mainly due to the increase in advertising prices. Although the growth of advertising impressions has slowed slightly, advertiser demand remains strong, indicating that Meta’s advertising platform still has extremely strong attraction.

Financial health plus share buybacks, double return expectations for shareholders

While Meta’s advertising revenue continues to grow, its financial health also shows strong strength. According to the latest data, Meta’s advertising revenue reached 3.988 billion US dollars in the third quarter of 2024, a year-on-year increase of 18.5%. This growth not only reflects the company’s advantages in the market but also shows its success in advertising pricing strategies.

For example, the main driving force for advertising revenue growth comes from the increase in advertising prices. Although the growth of advertising impressions has slowed down. Data shows that Meta’s advertising impression growth was 31% in the second quarter of 2023 and dropped to 11% in the third quarter of 2024. Although this situation indicates increased competition, Meta can still meet advertiser demand by continuously optimizing advertising algorithms and improving advertising placement effects, thus maintaining strong revenue growth.

In addition, Meta’s free cash flow performance is also very excellent. In the past few quarters, the annual growth rate of free cash flow has reached 38.1%, an increase of 145.6% compared to 2019. This strong growth in cash flow enables Meta to continuously conduct research and development and technology investment, providing strong support for its future development.

Shareholder return strategy

As of now, META has shown a fairly friendly attitude towards shareholders. Based on an annual dividend of 2 US dollars per share and 1.5% of floating funds retired in the last 12 months, the shares retired since fiscal year 2019 have also reached 9.4%.

This shows its excellent utilization of LTM free cash flow. LTM free cash flow generation reached 52.1 billion US dollars, a year-on-year increase of 38.1%, an increase of 145.6% compared to the level in fiscal year 2019. And enhance shareholder returns through stock buyback plans. This approach not only shows Meta’s strong cash flow ability but also reflects its commitment to shareholders.

The effectiveness of this shareholder return policy is reflected in that Meta can rationally allocate capital and enhance investor confidence while maintaining continuous growth. With the enhancement of shareholder returns, Meta not only consolidates its position in the market but also lays a good foundation for future development.

Due to the double expected return, we maintain a buy rating for META stocks. For friends who want to seize this opportunity, it is recommended to use the multi-asset wallet BiyaPay. BiyaPay supports US and Hong Kong stocks and digital currency transactions, making it convenient for users to regularly check price trends and quickly complete deposit and withdrawal operations at critical moments.

If you encounter problems with capital inflow and outflow, BiyaPay provides an efficient, safe, and non-freezing solution. Whether it is recharging digital currency and converting it into US dollars or Hong Kong dollars, or withdrawing to a bank account, it can quickly and flexibly meet capital needs and ensure that investors do not miss any market opportunities.

AI and the advertising market, how does Meta seize the initiative?

Meta is significantly increasing capital expenditures, especially investment in AI technology. The purpose is to increase user engagement and reduce the cost per conversion for advertisers by expanding AI infrastructure and enhancing computing power.

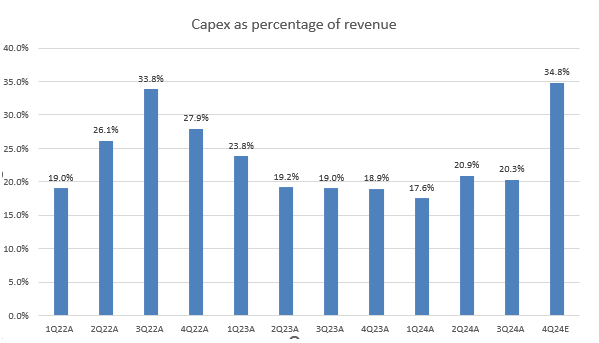

META has been raising its capital expenditure expectations. Starting from the fourth quarter of fiscal year 2024, we expect that the “proportion of capital expenditures to revenue” will increase significantly. The company has slightly raised the guidance for capital expenditures in fiscal year 2024. The lower limit is set between 38 billion and 40 billion US dollars. Taking 39 billion US dollars as the median value, this means that in the fourth quarter, capital expenditures will surge by 120% year-on-year and account for about 34.8% of total revenue, significantly higher than 20.3% in the previous quarter.

Management also revealed that capital expenditures are expected to increase significantly in fiscal year 2025, indicating that there may be an acceleration from the expenditure level in fiscal year 2024. The proportion of capital expenditures to revenue in fiscal year 2024 is expected to increase by 400 basis points year-on-year to 24.2%. Although the company has not given specific revenue expectations for fiscal year 2025, I estimate that this ratio may exceed 28%.

In addition, they pointed out that there will be a “significant acceleration in infrastructure expenses” in fiscal year 2025, mainly due to the increase in capital depreciation and the rise in operating expenses. These higher operating expenses will put pressure on META’s operating margin. At the same time, higher depreciation and amortization (D&A) is expected to have an important impact on earnings growth in 2025. I believe that META’s earnings per share growth will be lower than revenue growth next year. However, since D&A is a non-cash expense, it will not affect the company’s cash flow. Therefore, I expect that META will face greater earnings pressure than operating cash flow pressure in fiscal year 2025.

Advertising market growth forecast

As Meta increases its investment in AI, its advertising business will also benefit. The global advertising market is experiencing rapid growth and is expected to reach 1.23 trillion US dollars by 2026, with an average annual growth rate of 7.2%. As a market leader, Meta will benefit from its strong brand influence and user base. The application of AI technology can not only improve the accuracy and effectiveness of advertising placement but also provide advertisers with better ROI (return on investment).

By using AI technology, Meta can not only enhance the user experience but also maintain an advantage in the increasingly fierce competition. The continuous application of AI will enable Meta to further expand its share in the advertising market and drive revenue growth.

Earnings outlook and challenges

Although Meta faces earnings pressure against the background of increased capital expenditures, especially due to the increase in capital depreciation and operating expenses. It is expected that these higher operating expenses will put pressure on the company’s operating margin. However, since depreciation and amortization (D&A) is a non-cash expense and will not affect cash flow, Meta will face greater earnings pressure than operating cash flow pressure in fiscal year 2025.

According to market analysts’ forecasts, Meta’s revenue is expected to maintain stable growth in the next few years. Especially under the dual promotion of AI and the advertising market, the company’s long-term earnings potential remains strong.

So now, is META worth buying, holding, or selling?

Currently, META has strongly rebounded from its lowest point in July 2024. The stock price has risen by 25% and reached a new high of 590 US dollars, successfully breaking through the 50/100/200-day moving averages.

Recalling that in our previous analysis, we mentioned that META’s fair value estimate is 465.30 US dollars. This is based on the LTM adjusted earnings per share of 19.56 US dollars as of the second quarter of fiscal year 2024 (a quarter-on-quarter increase of 127.9%) and an average one-year price-earnings ratio of 23.79 times. According to the latest data from the third quarter of fiscal year 2024, META’s LTM adjusted earnings per share has increased to 21.23 US dollars (a quarter-on-quarter increase of 87.3%), indicating that its stock price has deviated from our updated fair value estimate of 505.00 US dollars.

Nevertheless, analysts generally expect that by fiscal year 2026, META’s adjusted earnings per share will be revised upward from 27.53 US dollars to 28.58 US dollars. This means that although the stock price has recovered recently, META still has a +19.8% upside potential and is expected to reach our updated long-term target price of 679.90 US dollars.

In addition, META has performed well in treating shareholders, paying an annual dividend of 2 US dollars and retiring 1.5% of outstanding shares through stock buybacks. Since 2019, a total of 9.4% of shares have been retired. This shows that META is very effective in managing its LTM free cash flow. The latest data shows that its free cash flow has reached 52.1 billion US dollars, a quarter-on-quarter increase of 38.1% and an increase of 145.6% compared to the level in 2019.

Based on these good expected returns, we recommend investors to “buy” META stocks.

However, given that the current stock price has not broken through the resistance level of 590 US dollars, we suggest that interested investors can observe for a while before considering entering the market.

Because we expect META’s stock price may pull back to the support range of 500 to 530 US dollars. Such a pullback means that the stock price may fall by 9%, but this is also a better entry opportunity because it is close to our updated fair value estimate.

It is worth noting that the expected correction will not be too aggressive. Therefore, it may be wise to be patient.