- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

In the turmoil of the U.S. presidential election, how can the pyramid rule help you easily manage in

In the upcoming U.S. presidential election, the market changes are like a dramatic play full of ups and downs. As the election day approaches, the support rates of candidates keep fluctuating, and the emotions of investors are also changing all the time. According to the latest poll data, the gap in support rates between candidates is not obvious, and the market’s expectations for the final result are full of uncertainties.

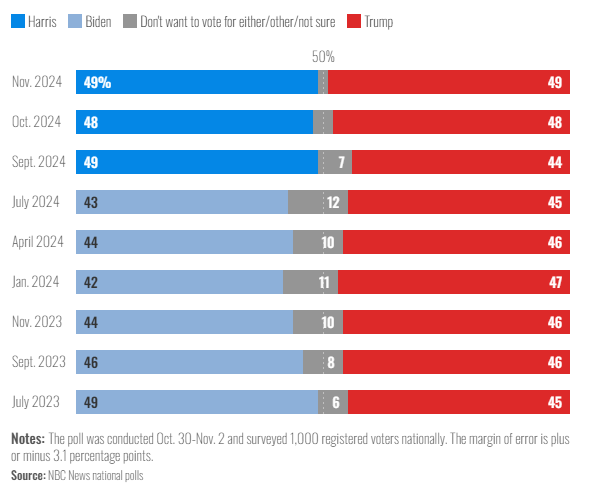

According to the results of a poll conducted by NBC just before the election, the support rates of Harris and Trump are currently tied at 49%. Two percent of voters said they are still undecided.

Just a few days ago, on October 31 local time, according to Forbes in the United States, the results of a poll showed that the vice president of the United States and Democratic presidential candidate Harris is only leading former U.S. president and Republican presidential candidate Trump by a narrow margin of 1%, but 10% of voters may change their minds before the election.

The uniqueness of this round of elections lies in not only the different policy positions of candidates but also the influence of many external factors, including changes in economic indicators, turmoil in the international situation, and the guidance of public opinion.

These factors have caused the market to experience severe fluctuations in the weeks before the voting day, and the performance of the stock market and other assets is difficult to predict. Investors’ decisions may be affected by breaking news. In this uncertain environment, investors must carefully assess risks to avoid losses caused by market sentiment fluctuations. At this time, adopting the pyramid rule for investment strategy adjustments will provide investors with an effective risk management tool.

The core of the pyramid rule lies in establishing positions in stages and reducing holding costs by gradually adding positions. At the same time, it can respond flexibly when the market trend is unclear. As the election day approaches, using the strategy of the pyramid rule can help investors better manage risks in a volatile market and provide greater security for their investments.

What is the pyramid rule?

When it comes to “pyramid”, what’s your first reaction? I believe many people think of the pyramids in ancient Egypt. Egyptians have a famous proverb, “Humans fear time, but time fears the pyramid.” This refers to the sturdiness of the pyramid, which has stood firm for more than four thousand years despite the erosion of wind and sand.

And this stable structure was later applied to position management, forming a unique position management strategy: “the pyramid rule”, also known as “the pyramid adding and reducing position method”.

The basic concept of the pyramid rule is to optimize investment returns and reduce risks through phased position building and reduction. The name of this method comes from its shape: investors gradually add positions when prices are low, forming a positive pyramid structure, and gradually reduce positions when prices rise, forming an inverted pyramid shape. Such a strategy enables investors to respond flexibly in a volatile market and ensure the stability of investments.

Where is the advantage of the pyramid rule?

The pyramid rule emphasizes the strategy of “buying low and selling high”. By gradually adding positions in a positive triangle way, it reflects the flexible response ability of investors in the market. When prices fall, investors can increase their holdings proportionally to form a pyramid shape and reduce the overall holding cost. Conversely, when the market rebounds, profits are realized by gradually reducing positions. The key to this rule is that investors can take corresponding actions at the appropriate time instead of blindly following the trend.

Principles of adding positions

The pyramid rule needs to follow three basic principles when adding positions:

- Profit condition: Before each addition of positions, the previous opening and adding positions must be profitable. This can ensure that investors will not suffer losses due to premature addition of positions when the market pulls back.

- Position control: The position added each time should not be greater than the previous opening position. It is especially emphasized that the position of the first opening must be greater than the position of the first addition. This can ensure that investors still have enough flexibility to adjust their strategies when prices fluctuate.

- Number of additions: On a contract, the number of consecutive additions generally does not exceed three times. This can avoid the risk concentration caused by excessive additions.

Strategy of reducing positions

Reducing positions is also an important link in the pyramid rule. By reducing positions in an inverted triangle way, investors can gradually lock in profits when the market turns for the better. The strategy of reducing positions should complement the principle of adding positions to ensure that part of the positions are exited at the right time to maximize profits.

The benefit of positive pyramid opening and adding positions lies in effectively avoiding losses.

For example, if it is found that the market reverses after the first addition of positions, it is required to clear all positions before the middle price between the first opening price and the first addition price at the latest. Due to the positive pyramid addition of positions, such operations are always profitable.

For another example, if it is found that the market reverses after the third addition of positions, in the same way, all the orders added for the second and third times can be cut off before the middle price between the second addition and the third addition. At least these two orders will not lose money. The first opening order and the first addition order can be temporarily retained so that the market development can be continued to be observed for further reduction or addition of positions.

In the current uncertain market environment, the advantages of the pyramid rule are becoming more and more obvious. Investors can flexibly adjust investment strategies according to the policy trends of candidates and market reactions as the election approaches, and then grasp potential investment opportunities.

Practical application of the pyramid rule

In a turbulent market environment, the pyramid rule provides investors with a flexible and effective risk management strategy. Through specific methods of adding and reducing positions, investors can achieve stable returns in an uncertain market.

Pyramid adding position method

The pyramid adding position method is a commonly used strategy when chasing rallies. To illustrate with a simple example: Suppose 50,000 yuan is invested for the first time to buy a certain variety. The second investment is 40,000 yuan, and the third investment is 30,000 yuan. The amount invested each time is less than the previous time, forming a pyramid shape with a larger bottom and a smaller top. This method is usually used for chasing rallies. The price of each addition is higher than the previous one, so the quantity purchased gradually decreases.

Why do many investors choose the pyramid adding position method?

Because in a rising market, no investment variety can rise infinitely. Especially in a non-one-sided bull market, after a moderate rise, adjustments are very normal. In this trend, every time the price rises, the probability of approaching the top increases, which means a decrease in future potential gains. Based on this, reducing the scale of subsequent additions helps reduce risks.

Taking an investor with 100,000 yuan of funds as an example, using the equal amount chasing method, 25,000 yuan is bought when the stock price is 5 yuan, 6 yuan, 7 yuan, and 8 yuan respectively, and the average cost is 6.5 yuan. When the stock price reaches 8 yuan and then falls back to 7 yuan, the return is 7.7%. However, if the pyramid adding position method is used, 40,000 yuan, 30,000 yuan, 20,000 yuan, and 10,000 yuan are bought respectively when the price is 5 yuan, 6 yuan, 7 yuan, and 8 yuan. The average cost is reduced to 6 yuan, and the return rate can be increased to 16.7%. This method effectively improves the profitability of investors.

Inverted pyramid method can bottom-fish

Opposite to building positions and adding positions when chasing rallies, the inverted pyramid adding position method is suitable for bottom-fishing. Especially for value investors, they often add positions when stocks fall, believing that good stocks are more worth buying when they fall. The inverted pyramid adding position method refers to gradually increasing the quantity of each addition. Because in a volatile market, the possibility of price declines will not increase indefinitely. After each decline, the probability of continued decline gradually decreases.

When the stock price is falling, investors can invest 10,000 yuan in the first round of adding positions, 20,000 yuan in the second round, and 40,000 yuan in the third round. As the price declines, investors gradually increase their investments. This can better grasp the rebound opportunity and ensure that the addition amount increases as the probability of decline decreases. Through such a strategy, investors can achieve higher returns when the stock price rebounds.

This is mainly used for value stocks in the low-level layout period. The principle is “buy more when it falls”, spreading the investment cost. When the fund falls, gradually increase the position of each addition as the net value declines.

For example, Xiao A is optimistic about the future potential of Fund C. The current net value of the fund is 1 yuan. Then we set the addition range as adding 1,000 yuan when the fund net value falls by 5% (fund net value is 0.95 yuan), adding 2,000 yuan when it falls by 10% (fund net value is 0.9 yuan), and adding 3,000 yuan when it falls by 15% (fund net value is 0.85 yuan)… If the net value continues to fall later, continue to increase the addition ratio until the net value stabilizes and shows an increase.

Averaging down (left-side trading, contrarian trading)

Even if you make a mistake in judging the market direction, you can adopt the strategy of “averaging down”.

This strategy complements the pyramid rule and provides another flexible investment method. The positive pyramid strategy means buying more when the price is lower, while the inverted pyramid means buying more when the price is higher. These two methods reflect different mentalities of investors.

“Averaging down” is a contrarian trading strategy. When the market falls, investors can gradually increase their holdings. The more the price falls, the more they buy. Just like many ETFs and regular fund investments now, it is the same concept. The more the price falls, the more they buy.

When the price rises back, they can make money. So as long as this commodity has an upward long-term direction, it will be a good way to make profits. Such a strategy is especially suitable for those assets with long-term positive prospects, such as stocks of some competitive companies or index ETFs.

In this strategy, choosing the right tool to regularly check market prices and quickly manage funds is crucial. Through BiyaPay, you can easily check stock prices regularly and make transactions at the right time. For example, pay attention to the operation of stock prices on the upper rail of the Bollinger Bands and the defense strength of the $120 support level.

BiyaPay supports direct trading of U.S. stocks and Hong Kong stocks. At the same time, it allows USDT to be recharged and withdrawn as U.S. dollars or Hong Kong dollars to bank accounts and then further used for investment in other securities. The whole process is efficient and fast, without any quota restrictions, completely solving the trouble of deposit and withdrawal, allowing you to easily grasp market dynamics and seize every investment opportunity.

For spread speculators who engage in left-side trading, it means bottom-fishing and guessing the bottom. For value investors, in the long run, it means entering the market when prices are low. Suppose a good company is suddenly hit by negative news. When its value emerges and the stock price is low, you can go in and bottom-fish. These two types of investors will enter the market at this time.

In this strategy, choosing the right tool to regularly check market prices and quickly manage funds is crucial. Through BiyaPay, you can easily check stock prices regularly and make transactions at the right time. BiyaPay supports direct trading of U.S. stocks and Hong Kong stocks. At the same time, it allows USDT to be recharged and withdrawn as U.S. dollars or Hong Kong dollars to bank accounts and then further used for investment in other securities. The whole process is efficient and fast, without any quota restrictions, completely solving the trouble of deposit and withdrawal, allowing you to easily grasp market dynamics and seize every investment opportunity.

And the commodities suitable for this method are those that will rise after you buy them, that is, “stocks with a long-term upward trend” or “index ETFs”. Stocks with a long-term upward trend are competitive companies, or enterprises in a monopolistic position in the industry, leading stocks, such as Nvidia. When it makes more money, the stock price will naturally be higher and the dividends will also be higher. You can bottom-fish when the price falls.

For example, Boeing. In the summer of 2022, due to the negative factors such as the epidemic and malfunctions, the stock price once fell to $113.02. But there is no doubt that Boeing is a company with long-term positive prospects. One year has passed, and the stock price has rebounded and hit a new high of $223.91.

“Inverted pyramid reduction method”

The inverted pyramid reduction method is opposite to the pyramid addition method and is mainly used to lock in profits. It emphasizes gradually reducing positions in the process of rising investment net value.

For example, if the net value of a fund held by an investor is rising. Suppose the current net value is 2 yuan, and the investor thinks it’s time to take profits. The reduction range can be set. For example, reduce 1,000 yuan when the net value rises by 5% (reaching 2.1 yuan), reduce 2,000 yuan when it rises by 10% (2.2 yuan), and reduce 3,000 yuan when it continues to rise by 15% (2.3 yuan)… If the net value continues to rise later, the reduction ratio should also gradually increase until all are redeemed.

Such a strategy can ensure that investors lock in profits during the rising process and take profits in time.

Through the pyramid addition method, the inverted pyramid rule, and the averaging down strategy, investors can flexibly respond to market changes. Combined with the current market environment and the upcoming U.S. presidential election, these strategies provide investors with practical risk management methods and keep their chances of making profits in uncertainty. By using these methods, investors can find better investment opportunities in a complex market environment.