- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Dell “Takes Over” the Declining Market of SuperMicro and Accelerates the Layout of AI Infrastructure

Dell Technologies (DELL) was once one of the well-known brands, but in recent years its performance has lagged behind software and chip counterparts. However, with the wave-like development of the artificial intelligence revolution, the narrative around Dell Technologies is changing. The rise of artificial intelligence stocks started from generative artificial intelligence software application stocks like Adobe Inc. (ADBE), shifted to chips that power these applications, and is now about to reach artificial intelligence server manufacturers.

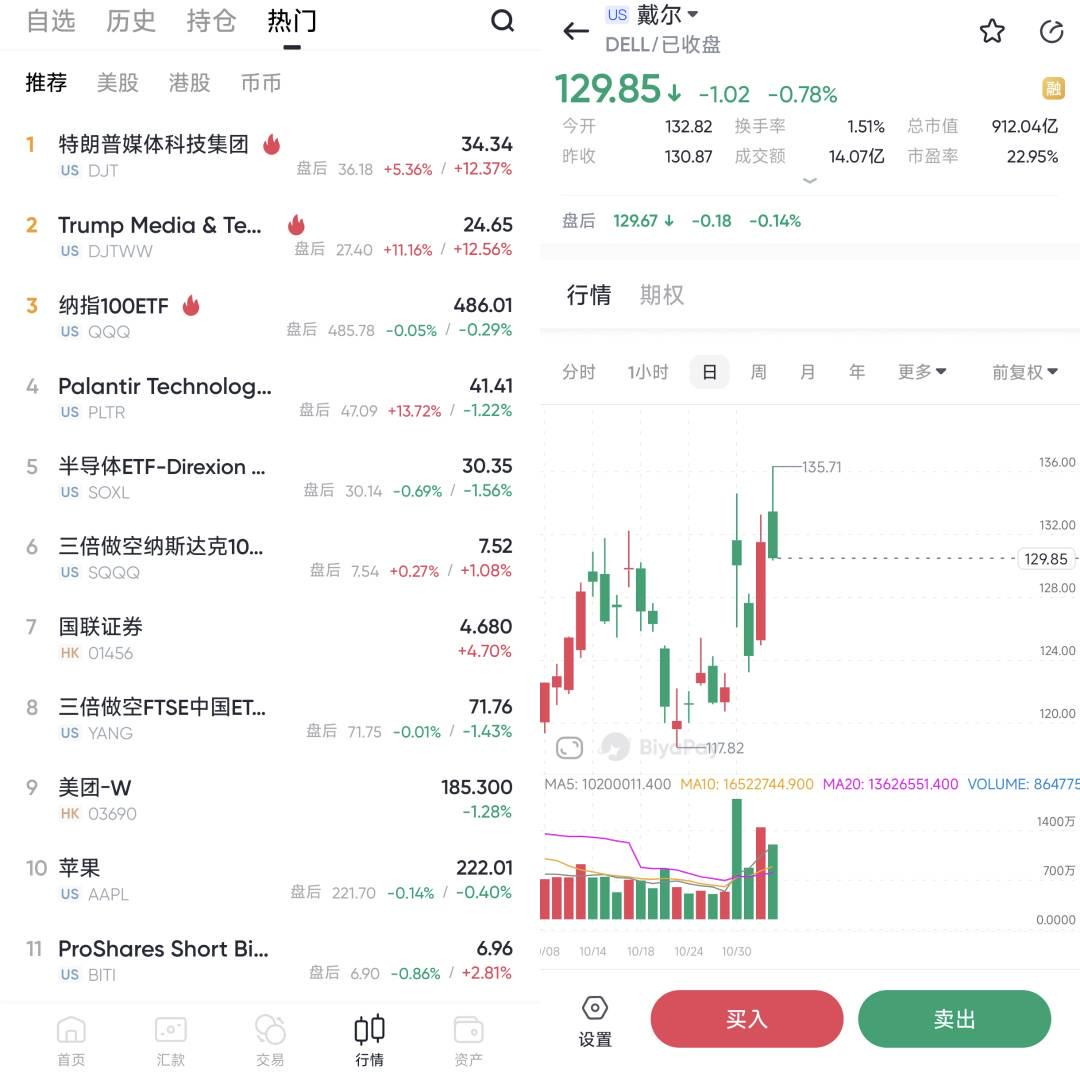

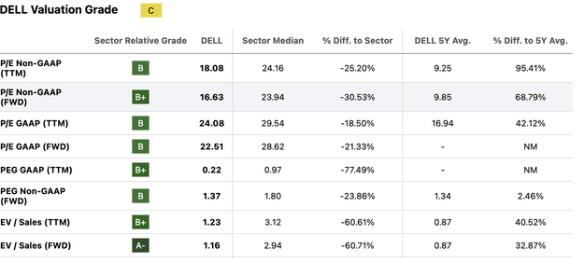

The sales of Dell’s artificial intelligence data center servers have been booming for a year, completely changing the narrative of the stock’s fundamentals. The stock’s expected price-earnings ratio is less than 17 times, and the stock price has risen 75% so far this year, half of which was achieved in the third quarter, which may imply an acceleration in the stock price increase.

To maintain the growth of the stock price, Dell needs to significantly restructure and revitalize its declining PC business or shift its business model away from the PC business that drags down performance. Therefore, the stock is currently rated as “buy.”

At the same time, no other data center provider is more capable than Dell (DELL) of benefiting from the recent difficulties of SuperMicro (SMCI). As Super Micro Computer gets mired in difficulties, Dell can continue to move forward and win project backlogs from its competitors. Dell’s management team is determined to seize this opportunity and has pointed out that revenue will accelerate growth in the rest of this year, making it a strong candidate for investors’ portfolios.

The Rise of the AI Market: How Dell Seizes Market Share

Recently, Super Micro Computer (SMCI) is facing a series of serious financial and corporate governance crises. The unexpected resignation of its auditing firm Ernst & Young has led to great doubts about the company’s financial transparency. SuperMicro’s stock price plummeted by more than 32% in just one day and has fallen by more than 60% in the past three months. In addition, SuperMicro has also received a delisting risk warning from Nasdaq. The market is full of uncertainties about whether its future financial statements can be submitted on time. Some analysts even believe that the company may not be able to submit its fiscal year 2024 statements in time.

These negative news have dealt a major blow to SuperMicro, especially having a serious impact on its customer trust in the data center market.

In this case, competitor Dell Technologies (DELL) sees an opportunity to fill the market gap. Especially after SuperMicro loses some market share, Dell rises rapidly and competes for these shaken customer resources.

Dell’s AI data center infrastructure and high-performance computing (HPC) products precisely meet the strong market demand for high-speed data processing and artificial intelligence applications. Dell’s technological reserves in this field enable it to quickly fill the market gap left by SuperMicro and gain more market share in SuperMicro’s predicament, especially in the fields of AI computing and large-scale cloud computing.

Therefore, Dell can not only benefit from SuperMicro’s predicament in the short term but also continue to expand its influence in the data center market in the medium and long term through technological innovation and strategic layout.

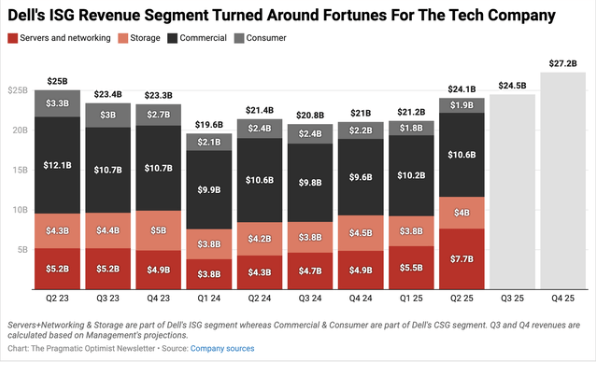

Rapid Growth of ISG Department

Dell’s Infrastructure Solutions Group (ISG) has always been an important part of its revenue. In the past year, the performance growth of the ISG department has been particularly outstanding. With the rapid development of AI technology, the demand for Dell’s AI-optimized data center servers has skyrocketed, driving the department’s revenue to achieve an 80% growth.

This growth rate is not only astonishing but also shows Dell’s strong competitiveness in the AI infrastructure market.

In the second quarter of fiscal year 2024, the revenue of the ISG department accounted for more than half of Dell’s total revenue, indicating that this department has become one of the core driving forces for Dell’s future growth. In particular, the surge in demand for data center infrastructure driven by AI technology further promotes the market penetration of Dell’s products. Dell not only meets the needs of large-scale AI computing but also enhances customer stickiness by continuously optimizing products, making its market share in AI-related fields steadily rise.

Market Opportunities

The rapid development of AI technology, especially in the fields of deep learning, natural language processing (NLP), and big data analysis, has spawned a huge demand for high-performance computing, and traditional computing architectures can no longer meet this demand.

Dell closely follows this demand trend by deeply integrating its artificial intelligence data center server product series. The demand for large-scale parallel computing and data analysis prompts enterprises to turn to more intelligent and flexible hardware solutions. Dell’s AI infrastructure is precisely based on this demand and provides optimized services for AI training and inference computing, so that its products can better serve emerging AI workloads.

Especially for cloud computing service providers and large enterprises, Dell’s AI infrastructure solution provides a powerful technical support, helping them process massive amounts of data and accelerate AI model training while reducing the threshold for hardware investment. This not only promotes Dell’s penetration in the enterprise-level market but also enhances the importance of its products in the global AI industry chain.

Dell takes the lead in the AI data center market by taking advantage of SuperMicro Computer’s market predicament, the rapidly developing ISG department, and the accurate grasp of the demand for AI infrastructure. With the continuous development of the AI market, Dell is expected to achieve more long-term growth in this field. When investors pay attention to Dell’s AI layout, they should notice its strong momentum in this emerging field and the potential returns brought by the continuous evolution of technology in the future.

Dual Acceleration of Free Cash Flow and Shareholder Returns

Driven by the wave of artificial intelligence (AI), Dell Technologies (Dell) not only has made breakthroughs in product innovation and market share expansion but also shows a strong growth momentum in financial performance. In particular, the growth of free cash flow and the improvement of shareholder returns make Dell more attractive for investment in the current highly competitive market.

Growth of Free Cash Flow: A Powerful Financial Engine

Dell’s free cash flow performance in recent years has been extremely excellent. Especially driven by the surge in AI demand, the company’s financial situation is very stable.

Free cash flow is a key indicator to measure a company’s financial health. It represents the cash flow obtained by the company from operations and the funds that can still be freely disposed of after deducting necessary capital expenditures. Dell’s growth in free cash flow reflects the robustness of its business model and the improvement of its profitability.

In the past few years, Dell’s free cash flow has continued to grow, especially driven by the ISG (Infrastructure Solutions Group) department. With the continuous increase in demand for AI and cloud computing, Dell’s sales of servers and storage devices have achieved significant growth, which not only promotes the increase in revenue but also greatly increases the inflow of disposable cash of the company. Dell continuously benefits from this growth by leveraging its strong product portfolio and technological advantages, ensuring the health and stability of its financial situation.

Stock Repurchase and Dividend: Commitment to Returning to Shareholders

In addition to the steady growth of free cash flow, Dell also returns its performance to shareholders through stock repurchase and dividends.

In fiscal year 2024, although the company’s revenue decreased by 14% compared to fiscal year 2023 and earnings per share also decreased by 6%, mainly due to the increase in PC market costs and supply chain disruptions, and the slowdown in consumer economy leading to stagnant hardware demand. However, adjusted free cash flow surged 266% from $1.5 billion to $5.6 billion. This significant growth indicates improved business operational efficiency and a significant reduction in the revenue cost base, as artificial intelligence services have proven to be a more profitable center than Dell’s hardware costs.

The management announced that more than 80% of adjusted free cash flow will be returned to shareholders through stock repurchase and dividends. In addition, Dell Technologies increased its stock repurchase authorization by $5 billion and plans to increase its annual dividend payment by 10% by fiscal year 2028. The dividend payment in 2024 has already increased by 20%, which helps to increase the current dividend yield of 1.3% (under pressure due to the soaring stock price).

Wall Street and Dell’s shareholders have welcomed these shareholder-friendly measures.

The combination of stock repurchase and dividends not only increases investor confidence but also shows the company’s concern for shareholder interests, making Dell Technologies a strong candidate for investors’ portfolios. In the face of market opportunities, flexible scheduling of funds is crucial for seizing appropriate investment opportunities. The multi-asset wallet BiyaPay supports US and Hong Kong stocks and digital currency transactions, making it convenient for users to check price trends regularly and quickly complete deposit and withdrawal operations at critical moments.

If there are problems with fund inflow and outflow, BiyaPay provides an efficient, safe, and non-freezing card solution. Whether it is recharging digital currency and converting it into US dollars or Hong Kong dollars or withdrawing to a bank account, it can quickly and flexibly meet fund needs and ensure that investors do not miss any market opportunities.

Target Price Analysis: Future Investment Potential

Based on Dell’s current financial health and future growth potential, analysts generally believe that Dell’s stock price has a large upside potential.

Dell shows a strong growth momentum in the next few years, especially driven by AI and data center demand. Management expects revenue to reach $97 billion in fiscal year 2025, an increase of about 10%, and the growth rate in fiscal year 2026 may slow down to 9%. However, with the surge in demand for AI data center infrastructure and the capture of project backlogs, Dell’s revenue growth is expected to remain close to 9%.

In terms of profitability, Dell’s operating margin is expected to remain between 5-6%, and the gross margin is 22-23%. Despite facing competitive pressure, management expects that as the market environment improves, the profit margin will increase by about 20 basis points in fiscal years 2025 and 2026, and the GAAP operating margin is expected to increase to 13-14%. This improvement indicates that Dell’s profitability will be further consolidated in the future.

From a valuation perspective, Dell’s current price-earnings ratio is 22.5 times, and the adjusted expected price-earnings ratio is 16.6 times. Compared with the industry average level, this valuation appears relatively low. Dell’s earnings growth rate is expected to be 13-14%, so its price-earnings ratio should exceed 25 times. Although considering the impact of $1.4 billion in interest expenses, the final valuation should be adjusted to 19-20 times, meaning that there is about a 16-17% upside potential for the stock price in the next 12-15 months.

Dell’s free cash flow is expected to reach $7.67 billion by 2025, and earnings per share will increase from $7.13 to $9.38. Although the stock price has risen by 75% this year, the market seems to fail to reflect its fundamental changes in time, and there is still a large room for valuation adjustment. From the perspective of the price-earnings ratio and free cash flow ratio, Dell’s price-earnings ratio is 12 times, far lower than the industry median of 21 times, showing a 44% discount.

In comparison with peers, Dell’s valuation is significantly lower than that of HP Inc. (HPQ) and Hewlett Packard Enterprise (HPE). The price-earnings ratios of the two are 10-11 times respectively, indicating that Dell’s stock price has considerable upside potential. Strictly speaking from valuation indicators, Dell’s stock price is relatively discounted by 30-40%, and the target price should be raised from the current $130 to $170-$180.

To sum up, Dell’s stock price still has a large room for growth. Especially driven by AI technology, its future growth potential cannot be ignored. With the company’s business transformation to artificial intelligence and the improvement of the performance of the ISG department, Dell will likely continue to bring considerable returns to investors.

Risks: Market Competition and Volatility

Although Dell shows a strong growth momentum in the AI infrastructure field, the intensity of market competition and the uncertainty of the external environment still pose potential threats to the company’s future profit prospects. The competition in the data center and AI infrastructure market is extremely fierce. In addition to Super Micro encountering financial difficulties, other players such as HP and Cisco are also competing for market share.

In addition, the development of AI technology is changing with each passing day, and technological breakthroughs by competitors and changes in market dynamics may also put Dell at risk of falling behind in technology. For Dell, how to maintain a leading position in the technology field and meet market demand in a timely manner is the key to whether it can continue to gain market share in the future.

Another important external risk is global economic fluctuations. In particular, uncertainties in interest rates, supply chains, and trade policies may have a negative impact on Dell’s operating costs and market demand. These factors may put additional pressure on the company’s profit margin. Therefore, investors need to closely monitor these key risk points, especially those related to supply chain disruptions and fluctuations in raw material costs.

In general, Dell Technologies’ active layout in the AI infrastructure field and the strong growth of the ISG department give it the potential to achieve continuous growth in the next few years. Although the decline in revenue of the PC department is still a problem that cannot be ignored, the company’s successful transformation in the AI and data center markets and the performance of stabilizing shareholder returns through strategies such as stock repurchase and dividends provide solid support for Dell’s financial health.

For investors, Dell’s valuation is still lower than it should be, especially considering its potential in AI-driven growth and the current discount in valuation. Therefore, Dell is an attractive investment choice, especially suitable for investors who are optimistic about the long-term development potential of AI and data center infrastructure.