- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Exchange USDT for USD and HKD to trade US and Hong Kong stocks

2024 US presidential election

The 2024 US election will be held on Tuesday, November 5, 2024, and the winner will enter the White House in January 2025 to begin a four-year presidential term.

If Kamala Harris is elected, she will become the first female president and the first president of Asian descent.

If Trump is elected, he will become the second president to win a non-consecutive term. In 1892, the first president to win a non-consecutive term was Grover Cleveland, the 22nd and 24th presidents of the US. He will also become the oldest president in US history to take office.

Latest US election predictions

Currently, according to the average data from major polling agencies, Trump’s national approval rating has surpassed Harris’, and Trump’s approval rating in the seven key “swing states” is also leading. According to market-oriented pricing analysis tools, Trump’s probability of winning is about 66%, far exceeding Harris.

The eve of the US election: “Trump 2.0” vs “Harris Surprise”

Trump and Harris have both similarities and differences in their policy proposals. The current poll results show that Trump is temporarily ahead, and the market is widely betting on a “Trump deal”. However, the election is extremely tight, and the poll results may not necessarily mean the final result. Therefore, we should also pay attention to the “Harris surprise” caused by the reversal of the election.

一、Comparison of Trump and Harris’ policy proposals

(1) similarities

Tax cuts. The core of both sides’ economic policies is to stimulate the economy through tax cuts. According to CRFB calculations, Trump and Harris’ tax cuts will result in a maximum tax cut of $11.90 trillion and $5 trillion respectively in the next decade (2026-2035 fiscal year).

Promote the return of manufacturing industry. Trump plans to promote the return of manufacturing industry to the US by bringing key supply chains back to the US, prohibiting companies that outsource work from doing business with the federal government, and other measures. Harris will formulate a “US Forward” strategy, invest in emerging technologies, and achieve modernization and transformation of traditional industries.

Expand housing supply. Trump plans to open up some federal land for new housing construction, and Harris will establish new tax credits to support new housing construction and restoration.

Control illegal immigration. Trump has always adopted a “zero tolerance” attitude towards illegal immigration, and Harris recently emphasized the need to control illegal immigration.

Take restrictive measures against China in the fields of technology and economy. Trump is committed to promoting “decoupling and breaking the chain” with China, imposing tariffs on Chinese goods, and initiating restrictions on semiconductor exports to China. Harris also proposed that “in key industries in the future, the US cannot stand idly by and hand over leadership to China.”

(2) Differences

Regarding foreign trade, Trump will promote a more aggressive tariff policy, while Harris’ tariff policy is relatively mild. Trump’s foreign trade policy mainly includes: imposing a 10% benchmark tariff on imported goods, canceling China’s Most Favored Nation, and imposing a 60% tariff on Chinese goods. Harris opposes Trump’s policy of imposing comprehensive tariffs, but has not proposed a new trade policy, which may maintain the status quo or provide trade protection for some industries.

Regarding tax reduction policies, Trump has made large-scale tax cuts domestically, including making the Tax Cuts and Jobs Act permanent, further reducing taxes for businesses, and imposing tariffs on foreign countries; Harris focuses on reducing taxes for low- and middle-income groups and increasing taxes on the wealthy and large corporations.

Regarding the implementation path of energy independence, Trump values the development of traditional fossil fuels, while Harris continues Biden’s policy and increases support for clean energy.

Regarding immigration policy, Trump is more hardline while Harris is more moderate. Trump plans to carry out the largest illegal immigration deportation operation in US history.

二、The market is betting on the “Trump deal”, but should still be wary of the “Harris accident”.

Recently, Capital Markets has widely bet on the “Trump trade”, with the US dollar and Bitcoin strengthening and US Treasury bonds under pressure. From October 1st to November 1st, the US dollar index rose by 3.1%, and real-time quotes can be viewed through the global multi-asset trading wallet BiyaPay App. Among them, Bitcoin, Ethereum, and Dogecoin had the highest increases of 20.5%, 16.9%, and 68.2% respectively, and the yield of US 10-year Treasury bonds rose by 63bp.

However, the swing state election is tight, and Harris still has a chance to win. Attention should be paid to the risk of market correction. The two candidates have wins and losses in the swing state, and the difference in poll support rates is within a statistical error range of 2-3 percentage points.

(1) Trump trade: good news for the US dollar, US stocks, Bitcoin, US bonds under pressure

Trump’s economic plan will trigger a “re-inflation risk” in the US, supporting the strengthening of the US dollar and putting pressure on US debt. If Trump’s economic plan is fully implemented, it will trigger a large-scale fiscal deficit. At the same time, domestic tax cuts, tightened immigration policies, and increased tariffs will further amplify the supply-demand contradiction in the US, leading to an increase in the risk of US “re-inflation”. Inflation fluctuations may slow down the pace of interest rate cuts by the Federal Reserve, or even tighten Monetary Policy, which is good for the US dollar and bad for US debt.

One is that Trump’s tax cut plan will lead to a large fiscal deficit and increase the upside risk of inflation. According to CRFB calculations, if all of Trump’s economic policy proposals can ultimately be implemented, it will lead to an increase of 7.50 trillion US dollar deficit in the next decade (2026-2035 fiscal year).

The second is to control illegal immigration, which leads to a decrease in labor supply or boosts wage inflation. The surge in illegal immigration effectively alleviates the shortage of labor supply in the US. According to the calculation of the US financial website Zerohedge, in the 2024 fiscal year, half of the average monthly increase in non-farm employment (231,000) comes from illegal immigrants (109,000). Once the immigration policy is tightened, it will amplify the labor supply gap in industries such as agriculture, construction, and low-end services, and boost wage inflation.

The third is that imposing tariffs will increase the cost of living for US residents. According to the Peterson Institute for International Economics (PIIE), Trump’s expulsion of illegal immigrants and the imposition of a 10% tariff on imported goods will lead to a 0.35 and 0.6 percentage point increase in US inflation compared to the benchmark level in 2025, respectively.

Trump advocates tax cuts for companies, which will support the US stock market. Trump’s fiscal stimulus is greater and may drive higher economic growth. In addition, Trump plans to further reduce the corporate income tax rate from 21% to 15%, which will increase corporate profitability and benefit the performance of the US stock market.

From the perspective of sector performance, it is favorable for the fossil energy, cryptocurrency, manufacturing, and artificial intelligence sectors. Regarding fossil energy, Trump plans to increase its production and achieve energy independence. In the previous term, Trump promoted the “US Priority Energy Plan” to lift regulations on energy production and related employment, approve the construction of pipelines for the Keystone XL project and the Dakota pipeline project, and open up more federal land for energy development to increase traditional energy supply. According to the US Energy Information Administration (EIA), from 2016 to 2019, US oil and gas production increased by 39.0% and 27.8%, respectively.

Regarding cryptocurrency, Trump has repeatedly publicly supported it and relaxed financial regulation. On July 27th, in his speech at the 2024 Bitcoin Conference, Trump promised to maintain the “national strategic Bitcoin reserve” and “never sell” government-seized Bitcoin. Regarding the manufacturing industry, Trump advocates promoting the return of manufacturing, bringing key supply chains back to the US, prohibiting companies that outsource work from conducting business with the federal government, reducing taxes for local enterprises, imposing tariffs on imported goods, and supporting local manufacturing enterprises. Regarding artificial intelligence, Trump plans to abolish AI restrictions, which is beneficial for the development of the artificial intelligence industry.

(2) Harris Surprise: US dollar, US stocks, Bitcoin pullback, good news for US bonds and new energy

Compared to Trump, the risk of re-inflation caused by Harris’ policy is smaller, providing an operational window for the Fed to cut interest rates, benefiting US bonds and putting pressure on the US dollar. Harris’ policy focuses more on reducing the cost of living for low- and middle-income families, including reducing food and grocery prices, expanding medical insurance subsidies, reducing prescription drug costs, lowering housing costs, and protecting consumers from fraud. According to CRFB calculations, if all of Harris’ economic policy proposals can be implemented, the deficit will increase by 3.50 trillion dollars in the next decade (2026-2035 fiscal year), less than 50% of Trump’s. At the same time, Harris’s fiscal expansion policy may be offset by raising taxes on the rich and large corporations, and due to its more moderate tariff and immigration policies, there is less supply-side inflationary pressure.

Harris increases taxes on enterprises, raises capital gains tax, and is bearish for US stocks. For the enterprise side, Harris plans to raise the corporate income tax rate from 21% to 28%, which will increase the burden on enterprises and affect their profit performance. For the investment side, Harris advocates imposing a long-term capital gains tax of 28% on households with an annual income of $1 million or more, which may affect the investment willingness of high-income groups.

Judging from the performance of the sector, Harris’ victory is good news for new energy, which may trigger a cryptocurrency correction. Harris supports increasing investment in new energy industries such as electric vehicles, photovoltaics, and energy storage, and increasing tax credits, which is good for the development of the new energy industry. As for cryptocurrency, Harris’ victory may trigger a high-level correction risk. Currently, Harris has not expressed a clear position on cryptocurrency, predicting that it will continue the policies during the Biden administration, hold a cautious attitude towards cryptocurrency, and strengthen regulation through the establishment of taxes and rules.

How will the US election result drive the market to surge? How to invest in the election to achieve wealth growth?

For investors, besides the election results, policies, market conditions and other situations at any time, it is also important to choose a suitable investment platform. Here, we need to choose a relatively trustworthy securities firm for investment - BiyaPay, a global multi-asset trading wallet.

Advantages of using USDT to invest in US stocks at BiyaPay

- Account opening 0 threshold

The entire registration process is conducted online, taking only 1 minute at the fastest. There is no need for a complicated overseas bank account opening application process, only identity authentication is required.

- No offshore account required

After registration, there is no need to apply for a separate overseas bank account. You can recharge USDT to exchange for US dollars and participate in US stock trading, truly realizing “one account to invest in high-quality global stocks”.

- Real-time deposit and withdrawal

No need to wait for the bank to deposit, no need to make cumbersome fund transfers, deposit at any time according to the market situation, and withdraw immediately after making a profit, making your assets more free.

- Significant rate savings

Experience more cost-effective deposit and withdrawal, BiyaPay saves you up to 90% on transaction fees.

Traditional securities firms incur tens of dollars in fee losses at every step (buying U, recharging U, issuing fiat currency, withdrawing to the bank, depositing to the securities firm).

Why choose BiyaPay? The most trusted investment trading platform

BiyaPay: The best choice for trading cryptocurrencies and stocks

As a trading wallet, BiyaPay can not only trade US stocks in real time, but also digital currencies such as BTC and ETH in real time.

Among them, USDT can also be exchanged for US dollars at a 1:1 ratio. You can easily exchange USDT with US dollars and trade US stocks directly without offshore accounts.

BiyaPay: Professional deposit and withdrawal tool

At the same time, it is also a professional deposit and withdrawal tool. You can recharge USDT on BiyaPay to exchange for US dollars and Hong Kong dollars, and then deposit funds to major securities firms. It is fast and convenient, with no limit on the amount, and can be transferred on the same day. It solves the problem of difficult deposits for investors.

BiyaPay: Cryptocurrency withdrawal does not freeze cards

For cryptocurrency users, BiyaPay provides a safe and convenient B2C withdrawal solution, effectively solving card freezing and fund issues in OTC or C2C transactions. Users can deposit funds to the remittance platform through USDT, easily convert to US dollars and withdraw funds. The platform is subject to financial regulation in multiple countries, ensuring the safety of funds and winning trust with its good reputation. With the development of the industry, the B2C model is expected to become the mainstream of cryptocurrency withdrawals, and BiyaPay is the weapon of this trend.

BiyaPay Account Opening Guide

1. What materials are required to open an account at BiyaPay?

You only need to download the BiyaPay App, click “Register”, enter your email address, verify your email, and set a password. It’s completely zero threshold.

2. After successful registration, how to proceed with identity authentication?

In the upper right corner of the app homepage, select “Identity Authentication”, upload your ID card or passport as required, then perform facial recognition to complete the identity authentication.

3. How long does it take to open an account?

After submitting the account opening application, generally, the account can be opened within the same day. In some cases, it may be extended. If you have any questions, please contact customer service for confirmation.

How to deposit and trade US/Hong Kong stocks through BiyaPay?

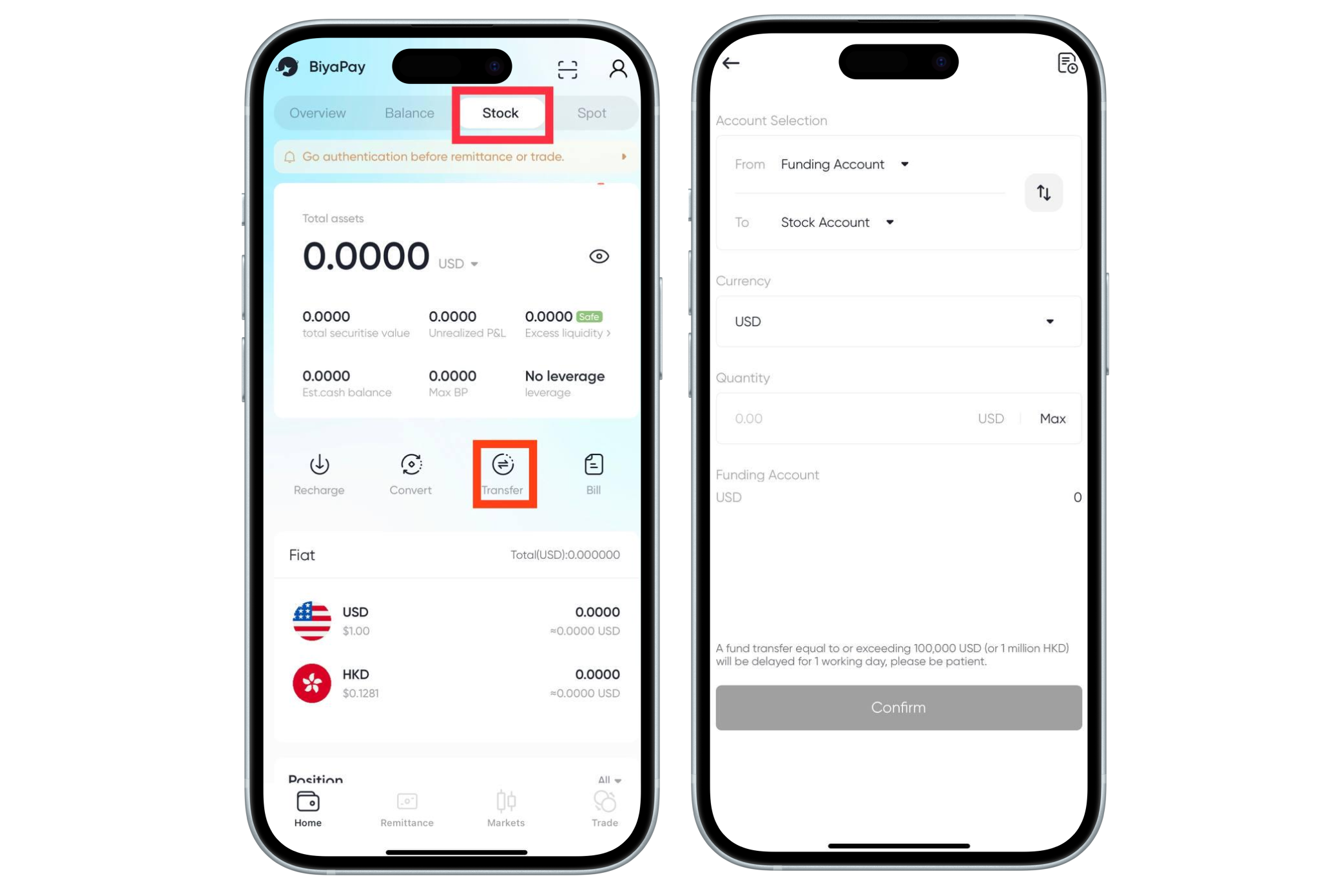

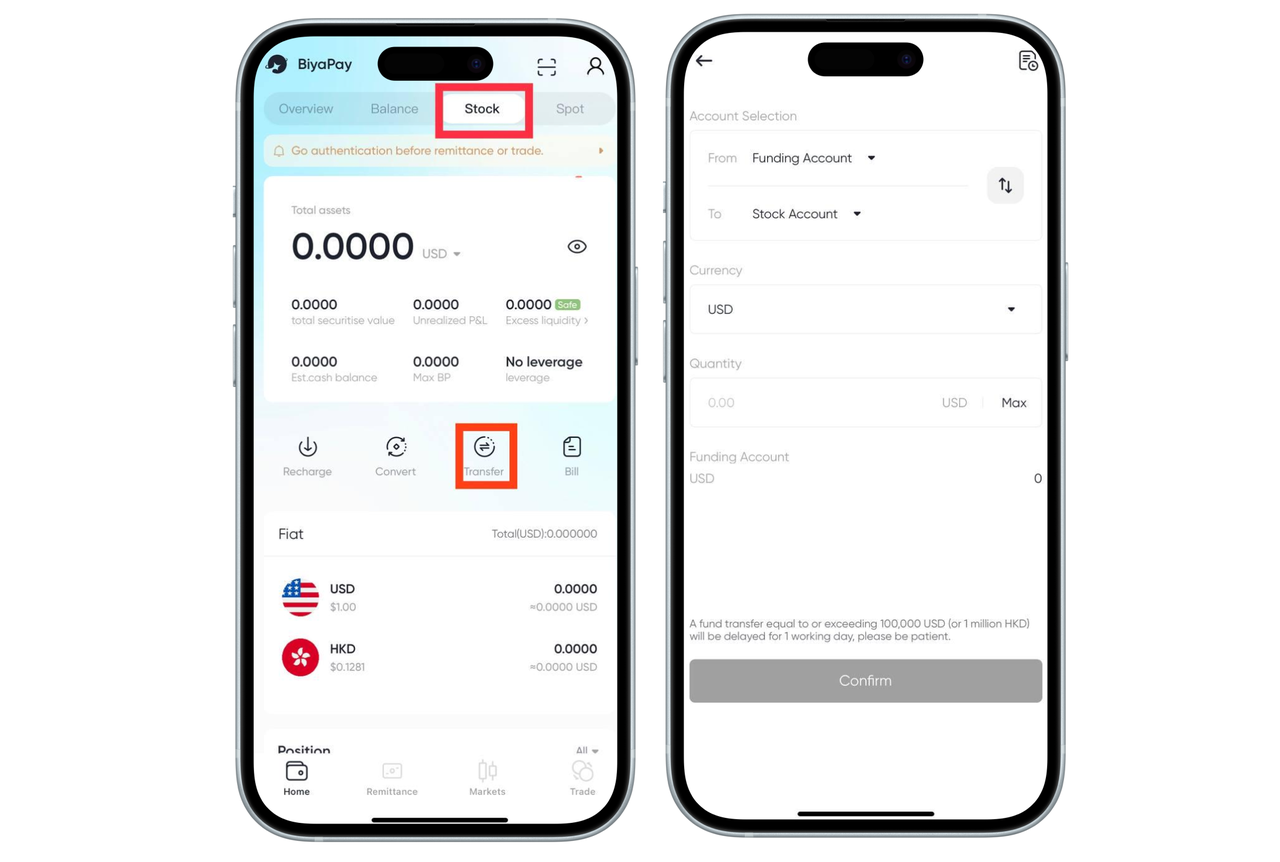

1.Transfer the fiat currency in the fund account to the US and Hong Kong stock accounts

After the recharge of fiat currency is credited to your account, you can click “Transfer” on the “Stock” page. On the “Transfer” page, you can directly transfer fiat currency from your fund account to your stock account.

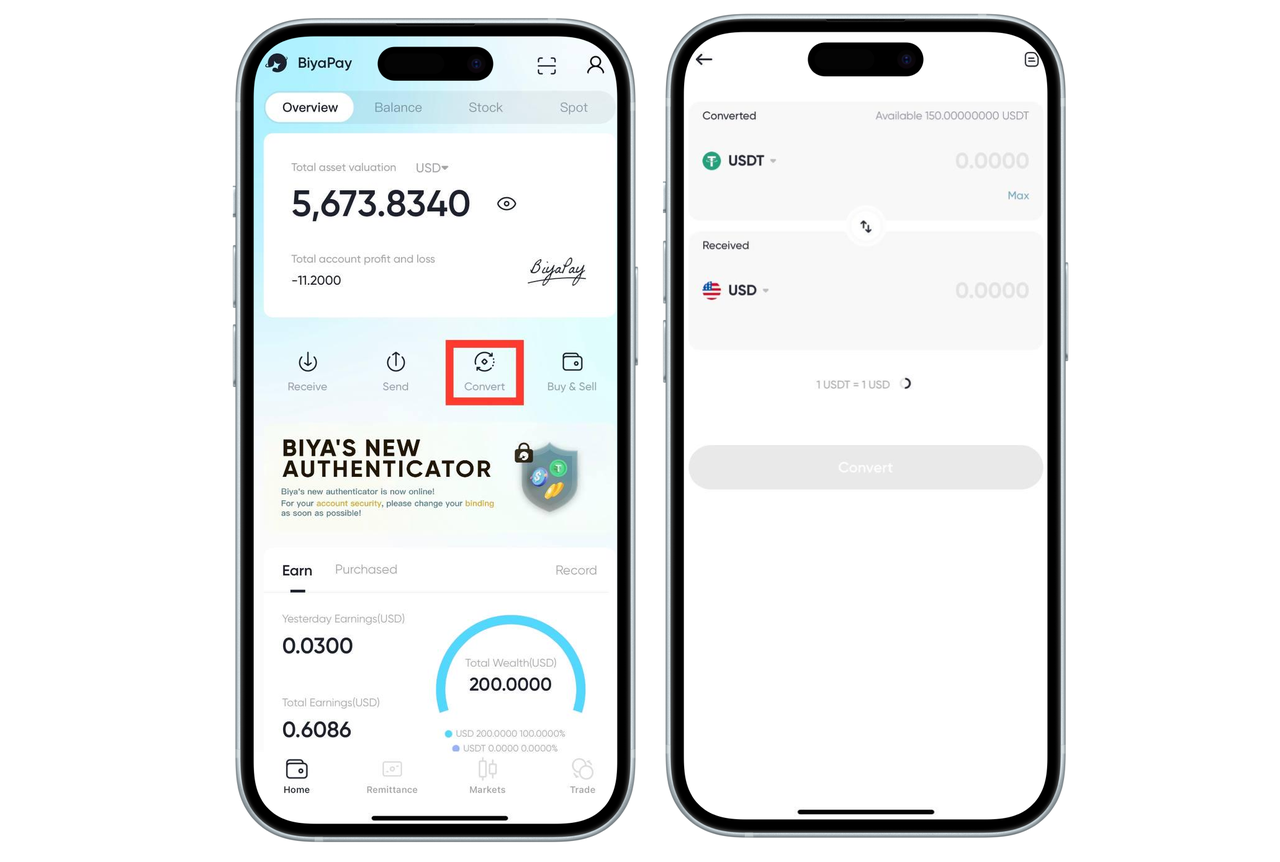

2.Transfer the digital currency in the fund account to the US and Hong Kong stock accounts

After the digital currency recharge is credited to your account, you need to first flash the digital currency into fiat currency US dollars or Hong Kong dollars, and then transfer the fiat currency funds from the fund account to the stock account (the following example shows the flash exchange of digital currency USDT into fiat currency USD).

This article is for reference only and does not constitute any investment advice or invitation.

For users who have questions about registering and opening a BiyaPay account, they can add the contact information of BiyaPay customer service. A dedicated customer service representative will guide and explain the account opening and deposit step by step.

Customer service email: VIP@Biya.club

Telegram: @biyapay001

Customer Service SkypeLive: Live.cid.d53ae2872b464237

Click to enter the official Telegram community:http://t.me/biyapay_ch