- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA Earnings Preview: Challenges and Opportunities in AI as the $140 Resistance Looms

NVIDIA (NVDA), a leading name in the AI industry, has become one of the most prominent tech companies in the market today. Its dominant position in the AI GPU sector and the broad adoption of its technology and products worldwide have solidified NVIDIA’s reputation as a driver of the AI revolution. The latest Blackwell series of chips, widely adopted by tech giants like Microsoft (MSFT) and Google (GOOGL), further underscores NVIDIA’s innovation and its ability to meet market demand.

Additionally, NVIDIA is set to release its latest earnings report in November, which will offer clearer guidance on the company’s future performance. Investors may wonder whether this implies NVIDIA’s growth story will continue.

In the AI space, NVIDIA is not only a technology leader but also a key player within the industry’s ecosystem. With the growing demand in the AI market, investments in AI infrastructure are expected to surge, benefiting NVIDIA in the process. Giants like Microsoft and Google have deeply integrated NVIDIA products into their data centers and AI infrastructure, establishing a solid “financial moat” for the company.

AI Market Leadership

NVIDIA CEO Jensen Huang has described demand for Blackwell as “insane.” Following this, both Microsoft and Google announced their intentions to deploy NVIDIA’s latest Blackwell-series server GPUs in their data centers. This move reinforces NVIDIA’s leadership in the AI GPU market, and with companies expected to invest $160 billion in AI infrastructure in 2024, a substantial portion of these funds will likely flow to NVIDIA, driving its performance this year.

Moreover, NVIDIA has recently seen multiple price target upgrades, affirming its growth potential. Major investment banks like Citigroup ©, Morgan Stanley (MS), Wells Fargo (WFC), and Bank of America (BAC) have each raised their price targets for NVIDIA to $150, $150, $165, and $190, respectively.

NVIDIA’s supply chain is also showing signs of growth. Several suppliers, competitors, and customers have released third-quarter earnings reports, clearly indicating that the generative AI wave is far from slowing; rather, it is gathering momentum. Short-term investments in AI chips show no signs of waning either.

Recently, NVIDIA’s chip manufacturer, TSMC (TSM), reported a 36% year-over-year increase in third-quarter revenue, reaching $25.5 billion, surpassing market expectations.

TSMC CEO C.C. Wei emphasized, “The demand is real, and I believe this is only the beginning. One major client described the demand as insane. This is part of engineering, a form of science, and it will continue for many years.”

Another significant NVIDIA supplier, SK Hynix (OTCPK), also reported record earnings in the third quarter, driven by strong demand for high-bandwidth memory chips for AI servers.

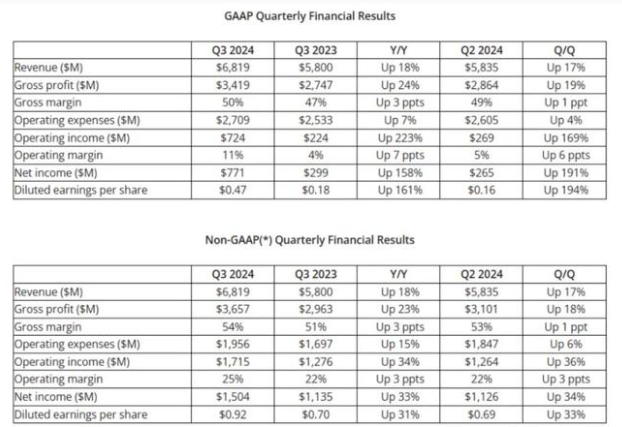

At the same time, NVIDIA’s competitor AMD (Advanced Micro Devices) released its third-quarter earnings report with impressive results. The company’s data center revenue grew 122% year-over-year to $3.5 billion, also driven by strong demand for its AI chips.

For NVIDIA’s customers, it’s evident that they will continue purchasing NVIDIA GPUs in the foreseeable future. Reports earlier this year indicated that Tesla (TSLA) alone might spend $3-4 billion on NVIDIA chips in 2024. Tesla’s management also mentioned in its latest earnings call that AI spending continues to rise, despite efforts to cut costs. Tesla plans to deploy 50,000 GPUs in Texas by the end of October, indicating that a significant portion of its third-quarter spending was on NVIDIA products. Similarly, Google highlighted its $13 billion in capital expenditures in the third quarter, mainly on servers and data center equipment, and noted its strong partnership with NVIDIA.

All these indicators suggest NVIDIA is likely to exceed market expectations again, possibly revising its growth targets upward.For those looking to enter early and hold this growth opportunity, the multi-asset wallet BiyaPay offers an ideal choice.

Through BiyaPay, you can conveniently monitor stock prices regularly and trade at opportune moments. BiyaPay allows direct trading of U.S. and Hong Kong stocks, and you can recharge USDT and withdraw as USD or HKD to a bank account for further investment in other securities. The entire process is efficient, quick, and free from funding limits, providing you with an easy way to stay on top of market dynamics and seize every investment opportunity.

Future Profitability: Divergence and Uncertainty

Despite NVIDIA’s remarkable performance in AI, there are uncertainties surrounding its future profitability.

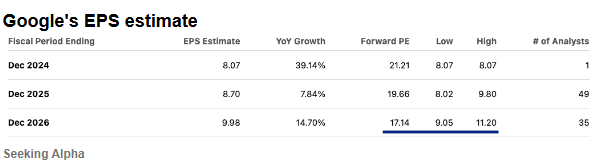

Market analysts have varied projections regarding the company’s future earnings, reflecting differences in views on NVIDIA’s future market share and profit levels.

Regarding NVIDIA’s projected EPS for the 2027 fiscal year, estimates from 28 analysts range widely, from a high of $7.29 to a low of $1.81—a difference of fourfold. Such a disparity in estimates highlights market divisions on the company’s future trajectory and suggests potential volatility for NVIDIA’s stock.

By comparison, other large tech companies, like AMD and Google, have narrower earnings estimate ranges, typically fluctuating between 20% and 60%.

This reflects greater market confidence in these companies’ future performance, viewing their earnings as relatively stable. Conversely, NVIDIA, amid intensifying competition and efforts to optimize AI investments, may face greater challenges ahead.

Furthermore, NVIDIA’s current valuation prompts caution. With a P/E ratio of around 30, higher than comparable tech giants like Google, some investors question its future earnings growth potential. Much of NVIDIA’s current stock price appreciation is based on highly optimistic expectations for future growth. If earnings do not meet these high expectations, the stock could face downside risk.

On the other hand, NVIDIA has consistently exceeded market expectations in recent quarters, boosting investor confidence. In the past five quarters, the company has surpassed revenue estimates by over $1 billion each time and raised future guidance. This has certainly fueled investor optimism, though it also means that NVIDIA’s stock is now close to “priced for perfection,” where any below-expectation news could cause significant volatility.

Overall, NVIDIA’s future is filled with both opportunities and challenges.

On one hand, the continued expansion of the AI market and NVIDIA’s leadership position offer substantial growth potential. On the other, uncertainties about the company’s future profitability, coupled with an increasingly competitive environment, cast a shadow over its growth story. For investors, understanding these expectations and divergences is key to making wise investment decisions: “Amid such uncertainty, is holding NVIDIA stock worthwhile?” This is the central question each investor must weigh and decide for themselves.

Intensifying Competition: Threats from AMD and Intel

Despite NVIDIA’s lead in the AI market, competition is intensifying. Competitors like AMD and Intel are actively launching competitive AI chips, often willing to compete at lower margins, thereby pressuring industry prices. Maintaining high profitability is becoming increasingly complex for NVIDIA.

AMD’s recent moves are particularly noteworthy. In the third quarter, AMD’s data center revenue grew 122% year-over-year to $3.5 billion, primarily due to strong demand for its AI chips.

AMD has gained a foothold in the AI market not only by enhancing product performance but also by attracting customers with flexible pricing strategies. Intel, too, aims to capture market share with its Gaudi 3 series AI chips. Though its current market share is smaller than NVIDIA’s, Intel has drawn some customers with lower pricing strategies. This competitive environment poses greater challenges for NVIDIA.

Additionally, besides traditional competitors like AMD and Intel, several large tech companies are developing their own AI chips to reduce reliance on NVIDIA. For instance, Amazon has developed in-house AI chips, claiming a 50% lower cost-performance ratio compared to NVIDIA’s chips. As chip costs represent a major expense in cloud computing and AI services, these companies are highly motivated to pursue in-house development.

Amidst this competition, NVIDIA is leveraging its ecosystem and continuous technology upgrades to fortify its position. NVIDIA’s robust CUDA platform supports developers building deep learning applications on its hardware—a significant ecosystem advantage not easily replicated by competitors.

This has led many companies to prefer NVIDIA products for better software and hardware synergy.

However, NVIDIA cannot afford to be complacent. The AI market competition is growing, with companies like AMD and Intel advancing quickly. Against this backdrop, NVIDIA must continue innovating and staying technologically ahead to maintain its leadership. Investors should monitor NVIDIA’s market share trends and its responses to competitors’ challenges in the coming quarters to assess its sustained competitiveness in the AI market.

Technical Analysis: Weekly Trend Overview

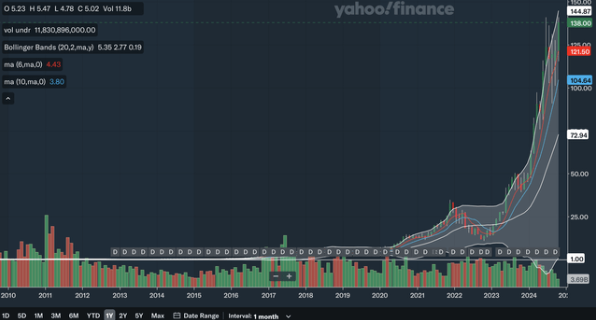

To analyze NVIDIA’s (NVDA) technical aspects, we examine different timeframes to evaluate price trends. A weekly timeframe is chosen here to capture NVIDIA’s medium-term trends and support and resistance levels.

Weekly Trend and Support/Resistance Levels

As shown, NVIDIA faces minimal medium-term resistance. The only potential resistance is the upper channel line, which is rising swiftly. Even if the price doesn’t break through, it could still provide solid returns. The nearest support is on the lower channel line, which dates back to 2022 and has frequently held against price declines.

Further down, the significant psychological support level around $100 was a resistance level in early 2024 and later became a support level mid-year. Despite the distance between support levels on this logarithmic chart, the $40-$50 region is another area of support, as it was a significant trading range in 2023.

Overall, NVIDIA is currently in a strong medium-term upward channel with relatively low resistance overhead.

Moving Averages Analysis

Since late 2022, the 13-week and 26-week SMAs have shown a bullish crossover, and there have been no further crossovers since. Following this signal, NVIDIA’s price saw explosive growth. Although the moving averages are close, the 13-week SMA appears to be regaining upward momentum, suggesting the bullish trend is ongoing.

Currently, the price is significantly above these moving averages. As for Bollinger Bands, the price is near the upper band, potentially indicating an overbought condition in the medium term. However, NVIDIA has previously maintained its position above the upper band during strong rallies, so a similar scenario is not unexpected.

Additionally, the 20-week Bollinger Band middle line, around $120, could serve as NVIDIA’s recent moving average support.

Overall, with the 13-week SMA accelerating upward, NVIDIA’s uptrend remains robust and healthy.

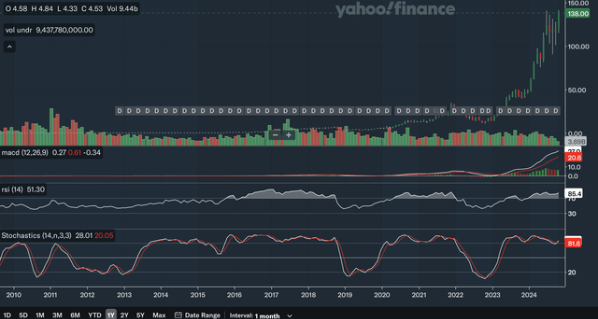

Technical Indicators

MACD has just crossed above the signal line, delivering a bullish signal. This is the first bullish crossover since mid-year. The current MACD reading is well below mid-year levels, even though the price has returned to historical highs, showing some negative divergence.

The RSI (Relative Strength Index) mirrors the MACD. The current RSI reading is below early-year levels, indicating the price is not yet in overbought territory. Currently around 60, RSI suggests a relatively healthy market.

Lastly, the Stochastic indicator shows the %K line clearly above the %D line, and the gap is widening, reflecting strong upward momentum. Overall, both medium-term and short-term technical indicators show bullish signals, albeit with some long-term negative divergence that warrants caution.

Investment Recommendations

From a technical perspective, NVIDIA’s weekly trend remains in a healthy upward channel. A breakthrough of current resistance could open up further upside potential in the short term.

However, given the slight overbought signal from the Bollinger Bands, investors should exercise caution when chasing the price, especially near the critical $140 resistance level.

For investors, it may be wise to hold positions and wait for a breakout signal. Short-term investors may look for buy opportunities near support levels or await a confirmed breakout above resistance. In summary, technical analysis indicates NVIDIA’s uptrend remains strong, though short-term fluctuations are possible, making a flexible market strategy advisable.

For long-term investors, NVIDIA’s technological advantage and partnerships with major tech companies offer strong growth potential. In an expanding AI market, NVIDIA’s technological solutions will continue to permeate various industries, boosting the company’s future performance. Thus, for those with patience and tolerance for some volatility, NVIDIA remains a compelling long-term holding.

Currently trading near historical highs and with a high P/E ratio, NVIDIA’s stock price reflects the market’s high expectations. Although NVIDIA’s growth outlook is promising, investors should remain cautious in their investment decisions, particularly amid potential short-term price swings.